HaiKhuu Daily Report - 11/11/2025

Good morning, and happy Tuesday! Before we get started on our report today, I just want to say on the behalf of HaiKhuu and the Community, if you or a loved one is a Veteran, thank you for your service and dedication to this country.

Wow, wow, wow. I am not saying I told you so. But what a beautiful day, what a beautiful morning, what an absolutely amazing time to be alive. These market conditions are looking beautiful, you are looking beautiful, and I hope you all are ready for another beautiful day for the markets.

We have gotten more news in regards to the Government reopening as soon as Wednesday afternoon! With that said, please go into today with the expectations that market conditions are going to be difficult to navigate but provide us with some absolutely insane opportunities to realize some gains. I hope you all are excited about today, because these conditions over the next couple of weeks are going to be extremely volatile and difficult to navigate.

So, please go into today with the expectation that we are going to see choppier indecision in the markets. We got hype in the air yesterday as a result of no confirmed news, today is going to be the processing and confusion part that will result in traders having a tough time. The easiest way to perform is to simply sit back, relax, and enjoy these conditions to the best of your ability.

Many traders will make the most out of today with relative ease, if this is you. Have fun, make the most of it, because I do not see a reason why we all shouldn’t make the most out of these beautiful conditions. I’ll talk more in regards to my thesis of the markets later on in the report. But for now, sit back, relax, and enjoy these wonderful market conditions!

Good luck trading today, and let’s see where $SPY takes us!

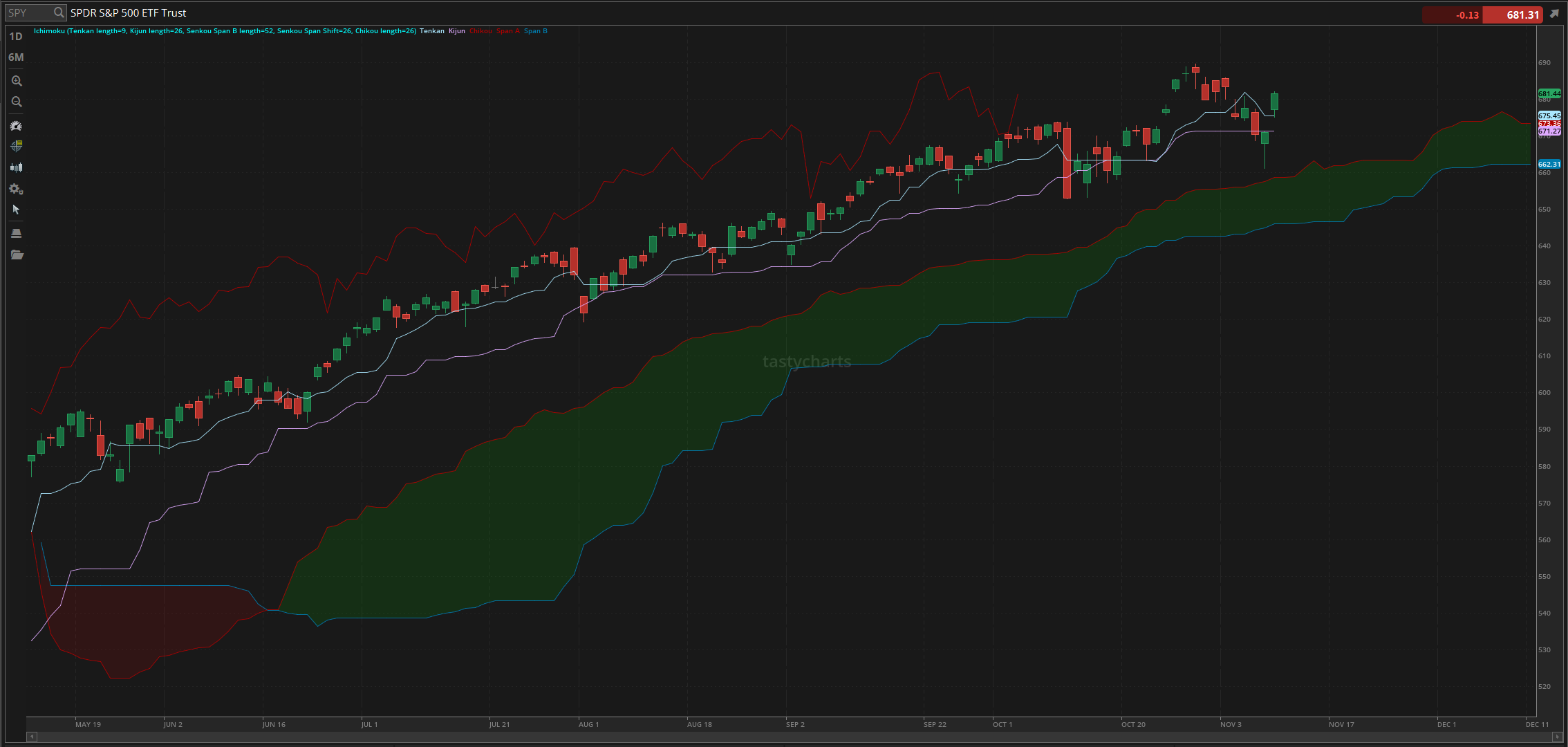

The updated $SPY daily levels are as follows:

Conversion Line Support: $675.45

Baseline Support: $671.27

Psychological Support: $660

Daily Cloud Support: $658.67

Thoughts & Comments from 11/10/2025

Yesterday was an absolutely beautiful and insane time for the overall markets. There was strength and bullish momentum from the get-go, and anyone with general long exposure in the markets should have had an amazing time as the markets kept rallying throughout the day. Everyone had multiple opportunities to go long and realize significant gains; it was just a matter of retaining that bullish exposure and making the most of it in a short period of time.

So, we started yesterday with $SPY opening at $677.18. Market conditions at open were great, as $SPY only rallied from the open and continued to show strength for the first hour or so before we watched $SPY slow, display weakness, and go on to make the official low of the day at $675.03. Market conditions at the bottom were less than ideal and honestly relatively weak, but they did strengthen, and we watched as $SPY rallied back up from the bottom, showing more confidence in the afternoon.

After lunch, $SPY quickly moved from the day's low to a sustained rally throughout the afternoon, as long as conditions remained strong. $SPY went on to make the official high of the day at $682.17, up $7 from the low of the day, and dropped back down ever so slightly to officially end the day with $SPY trading at $681.44, up $10.50 for the day, or up just shy of 1.6%.

I am not saying that yesterday's market conditions were perfect; I am not saying that everyone made money trading yesterday. Still, yesterday was one of those days when, realistically, traders should have had almost no issues trading, assuming they were retaining bullish exposure or simply following the momentum. Those who generated losses yesterday were either invested in laggards, fighting the momentum, or timing their positions incorrectly. I just want to say congrats again to anyone who was able to capitalize on last week's strong market conditions and enjoy the beautiful opportunities presented to us. Let’s see where the markets take us today and enjoy the process!

S&P 500 Heat Map - 11/10/2025

Thoughts & Comments for Today - 11/11/2025

Today is going to be an interesting time for the overall markets. There is going to be strength, optimism, and confusion. Please go into today expecting traders to be extremely indecisive and to have a difficult time. Markets are strong, people are excited, yet traders are about to lose? This stems from the deep-rooted idea that, regardless of these market conditions, traders are generally going to be more confused and not know how to operate today, nor the direction they want us to head.

We have already seen an extremely large bullish move in the markets after news of the government shutdown, but we are waiting to see what happens tomorrow, meaning today is the confusing day of what happens now. The markets should move up as uncertainty decreases when the government reopens; the issue is getting to that point. We have to survive today.

Going into the day, I do not anticipate being hyperbullish or hyperbearish. Until there is a clear directional move, I expect choppy, lower volatility, and lower volume. Once there is a directional move, please do not fight any trends. I do not know where we are headed from $SPY $680, but I have confidence that once we break out of this consolidation point, there will be a directional move that results in a beautiful and extremely profitable play for everyone. The question is, where do we go from here? We are expecting news that the shutdown will end tomorrow. Will we see a sell-off that tanks the markets? Are we going to see new all-time highs today to price in the shutdown ending tomorrow? I genuinely do not know and I believe in 100% seriousness that your prediction is as valid as mine at this point for where the markets are going to go.

I do believe there is a higher probability that, if we do see a directional move in the markets at this point, it will be bullish, given the decreased uncertainty and easing fears. Again, I may be wrong about the sentiment, so please do NOT blindly purchase based on what I am saying, but I am not saying this to withhold my genuine opinion.

The easiest way to honestly make money in these conditions is simply to hold strong, undervalued positions and capitalize on the strength we are seeing. This is not going to be the fastest money. This won't be the most money, but it is the EASIEST way to make money in these conditions. Simply find an organization that you are comfortable holding at this current price, allocate accordingly, and hope that your position does not go against you. Assuming you are confident in your ability, I do not see any reason why you should not be able to realize significant gains in a very short period of time. So let’s see where the markets take us and have a great time!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $ORCL, $TSM, $TSLA, $NVDA, $PLTR

Speculative: $PTLO, $RIVN, $BUD

Long Dividend: $JEPI

Long Investment: $PTLO, $BUD, $CMG

Short: $BRK/B

Crypto: SOL

Economic News for 11/11/2025 (ET):

NFIB Optimism Index - 6:00 AM

Notable Earnings for 11/11/2025:

Pre-Market Earnings:

Nebius Group (NBIS)

Sea Limited (SE)

Endava (DAVA)

Ceragon Networks (CRNT)

Commercial Vehicle (CVGI)

Consolidated Water (CWCO)

Brainsway (BWAY)

Orla Mining (ORLA)

After Market Earnings:

Beyond Meat (BYND)

Oklo (OKLO)

Evolution Petroleum (EPM)

American Integrity Insurance (AII)

Cae (CAE)

Fathom Holdings (FTHM)

Amdocs (DOX)

Similarweb (SMWB)

Wrap up

Hopefully, market conditions will continue to strengthen and provide all of us with absolutely insane opportunities to realize some gains and trade. It would not surprise me if market conditions weakened short-term, as I am expecting some choppy confusion today until there is a directional move as people prepare for the US Government to reopen. So, regardless of what you attempt to do today, please just tread lightly, practice safe risk management, and mitigate as much volatility and confusion as you can. These conditions are going to be tough, so make the most of this!

Good luck trading, and let’s make the most out of today!