HaiKhuu Daily Report - 11/13/2025

Good morning, and happy Thursday! Wow. So the government is reopened. Markets are looking beautiful, and I hope you all are ready for what will hopefully be a wonderful day for the markets. I will warn you about what I believe might happen later today. Still, for now, all that matters is that market conditions are looking strong, tensions are easing, and traders will be more comfortable as uncertainty decreases.

I am a firm believer that one of two scenarios is about to happen:

1) Markets rally and we see new all-time highs

2) Markets don’t rally, and we watch as everything sells off

Ideally, markets do not sell off. I am concerned about the genuine, realistic possibility that they do, but ideally, markets simply recover from this point, and we watch as $SPY displays significantly more confidence here in the short term. If you are attempting to trade or realize some gains today, simply follow the momentum, regardless of your sentiment.

Today is bigger than all of us, so just don't get wiped out trying to fight any trends or momentum. Conditions should be good, and traders should be excited —let’s see where the markets take us from here, and have a fantastic time!

Good luck trading this week, and let’s see where the markets take us!

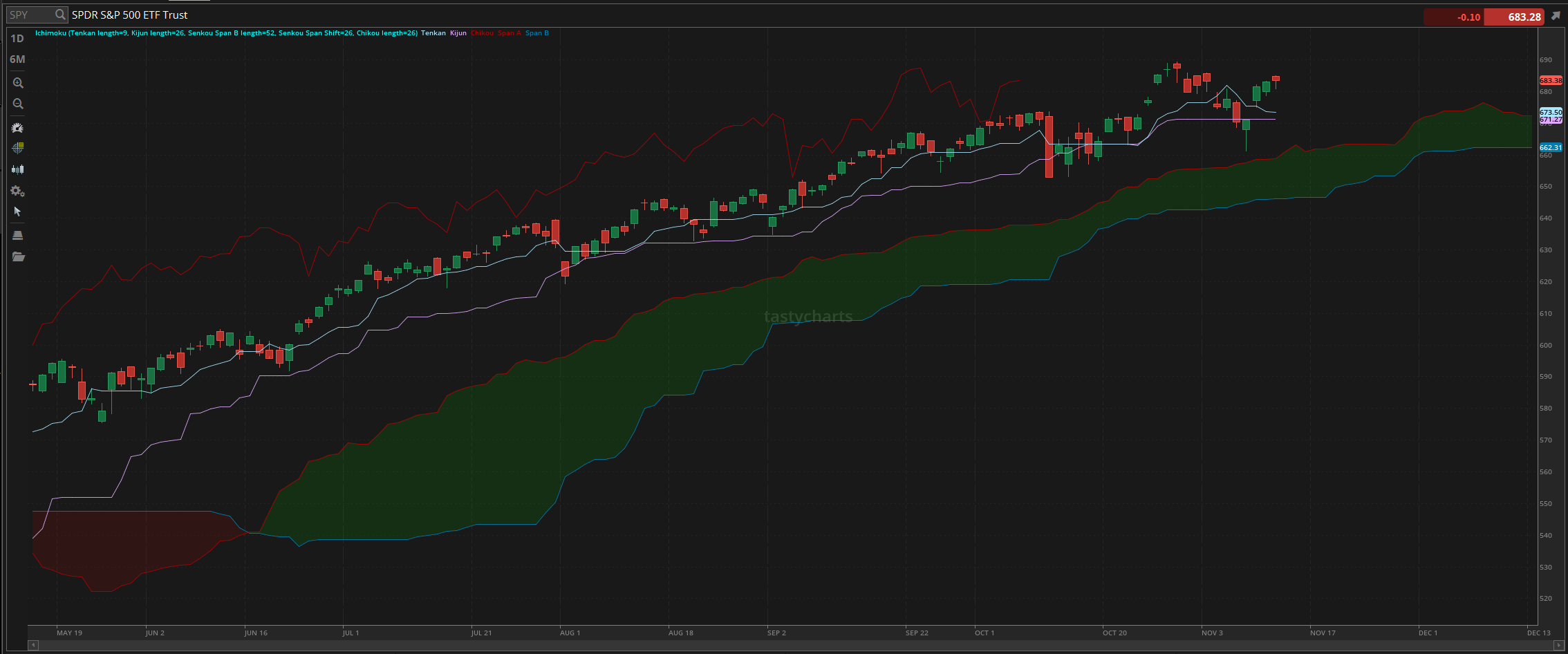

The updated $SPY daily levels are as follows:

Conversion Line Support: $673.50

Baseline Support: $671.27

Psychological Support: $680

Daily Cloud Support: $658.83

Thoughts & Comments from Yesterday 11/12/2025

Yesterday was an absolutely disgusting day to attempt to trade. It was another day full of choppy slow neutrality and many opportunities to get burnt. There was not the insane momentum anyone hoped for, but man was there at least some fun scalping opportuntities as a result. Traders could have realized some gains attempting to scalp yesterday, but I would say the majority of individuals had a difficult time.

So, we started yesterday with $SPY opening at $684.85. market conditions looked optimistic leading into the day, but that optimism was unfortunately short lived as $SPY only displayed weakness from open, dropping from the get go, and selling all the way until the lunchtime lull where $SPY dropped $4, making the official low of the day at $680.95. Conditions at the bottom were tough but…life.

Thankfully $SPY only dropped $4, and we quickly recovered from the bottom where $SPY went black for the day leading into the afternoon, and essentially hovered around $683 throughout the rest of the day. There were opportunities to scalp and make quick trades, but there really was no great opportunities throughout the rest of the day, where we ultimately ended the day with $SPY trading at $683.38, up $0.38 for the day, or up 0.056%.

I am not saying that yesterday was a wash, as it was not unfortunately for many, but market conditions provided us with opportunities to trade. It was just a matter of catching the right plays at the right time. So hopefully none of you generated any sort of significant loss but if so, such is life. We move on from the tough conditions of yesterday, and make the most out of today!

S&P 500 Heat Map - 11/12/2025

Thoughts & Comments for Today - 11/13/2025

Today SHOULD be a good day for the markets. Conditions are strong, and traders are confident heading into today's reopening. There should be less uncertainty, less fear, and more confidence returning to markets now, as globally, traders no longer have to "fear” a government shutdown. So, if you are attempting to trade today, just remember that these market conditions should be strong and traders are optimistic.

One scenario that I have to warn you all about is the non-zero chance the market has to fall from here. I am not saying that it is going to happen, but there is genuinely a non-zero chance that, as a result of the markets opening the way that they are. Traders are confident as a result of the shutdown not happening, and more traders are “ready” to allocate. My biggest concern today is that we see mild bullish momentum at open, causing traders to FOMO in as they see an insane opportunity to buy some momentum, then that is simply followed by watching as portfolios get erased and traders get deleted in a short period of time.

These conditions are going to be extremely difficult to navigate with genuine confidence, and anyone who is blindly confident in their ability will do what they can in these conditions to maximize their gains. The only issue is that those who do not know how to navigate are the ones who realistically are going to lose the most as a result of overtrading, being overly emotional, and being irrational.

This is unfortunate, but it is simply just a part of life when watching how different traders perform.

Traders are going to have a difficult time remaining consistent with their allocations today as there will be uncertainty with direction, so I am just warning you all again that these conditions “SHOULD” be good, but if they are, it's another question, and if you are going to be able to capitalize on it, it's another question.

My best recommendation for an allocation today is that if you are attempting to allocate long into the markets, or in general, right now, I would advise you to look more towards higher beta allocations that have come down heavily over the previous couple of days, which you believe have a solid shot of moving back up.

$META has taken a nice sized tumble from the top, I am not saying that it is necessarily a good position nor am I advising you to blindly buy into the organization, but with it’s current operations and set up, these market conditions are going to be extremely favorable and if we are extremely bullish, I genuinely believe that $META will be one of the fastest runners from the “bottom” so check it out and put some eyes on it!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $ORCL, $TSM, $TSLA, $NVDA, $PLTR

Speculative: $PTLO, $RIVN, $BUD

Long Dividend: $JEPI

Long Investment: $PTLO, $BUD, $CMG

Short: $BRK/B

Crypto: SOL

Economic News for 11/13/2025 (ET):

Initial Jobless Claims - 8:30 AM

Consumer Price Index - 8:30 AM

Core CPI - 8:30 AM

New York Fed President John Williams speaks - 9:20 AM

Cleveland Fed President Beth Hammack speaks - 12:20 PM

Monthly U.S. Federal Budget - 2:00 PM

Notable Earnings for 11/13/2025:

Pre-Market Earnings:

Bitfarms (BITF)

JD.com (JD)

Walt Disney (DIS)

Bilibili (BILI)

Canadian Solar (CSIQ)

Synergy CHC (SNYR)

Sally Beauty (SBH)

MarineMax (HZO)

After Market Earnings:

Applied Materials (AMAT)

Nu Holdings (NU)

Globant (GLOB)

Beazer Homes (GLOB)

Luminar Technologies (LAZR)

Evolv Technology (EVLV)

STARZ (STRZ)

Wrap up

Hopefully, this confidence in the market continues, and we watch as markets just remain overly bullish and optimistic. It would not surprise me if we went on to make a new all-time high today, but, as bad as this sounds, it would not surprise me if the markets sell off. So please, tread lightly, practice safe risk management. Do not fight any trends, and just make the most out of today!

Good luck trading, and let’s see where this reopening takes us!