HaiKhuu Daily Report - 11/18/2024

Good morning, and happy Monday!!! I hope you all had a wonderful weekend, and are ready for another interesting time for the markets. Conditions are looking tough, traders are having a difficult time, and we’ve watched as $SPY has rejected $600 almost perfectly. Conditions could obviously be significantly better, but we thankfully are in a spot where we can capitalize on these conditions. We do have a lot of economic news and earnings that will bring volatility into the markets, so prepare accordingly as these conditions start to get a little wilder.

The major event that everyone will be watching this week is $NVDA earnings after hours on WEDNESAY. That is going to be significant as this is the earnings from the largest company (by market cap) in the world, so all eyes are on them. But outside of that, some other major events are as follows:

Tuesday - Housing Starts / Building Permits - 8:30 am EST

Earnings: $WMT, $XPEV, $LOW

Thursday - Jobless Claims - 8:30 am EST

Friday - Services PMI / Manufacturing PMI - 9:45 am EST / Consumer Sentiment.

There are obviously significantly more events happening this week, so please check out our WEEKLY PREVIEW to see all of the events to look out for!

Good luck trading this week, and let’s make the most out of these conditions!

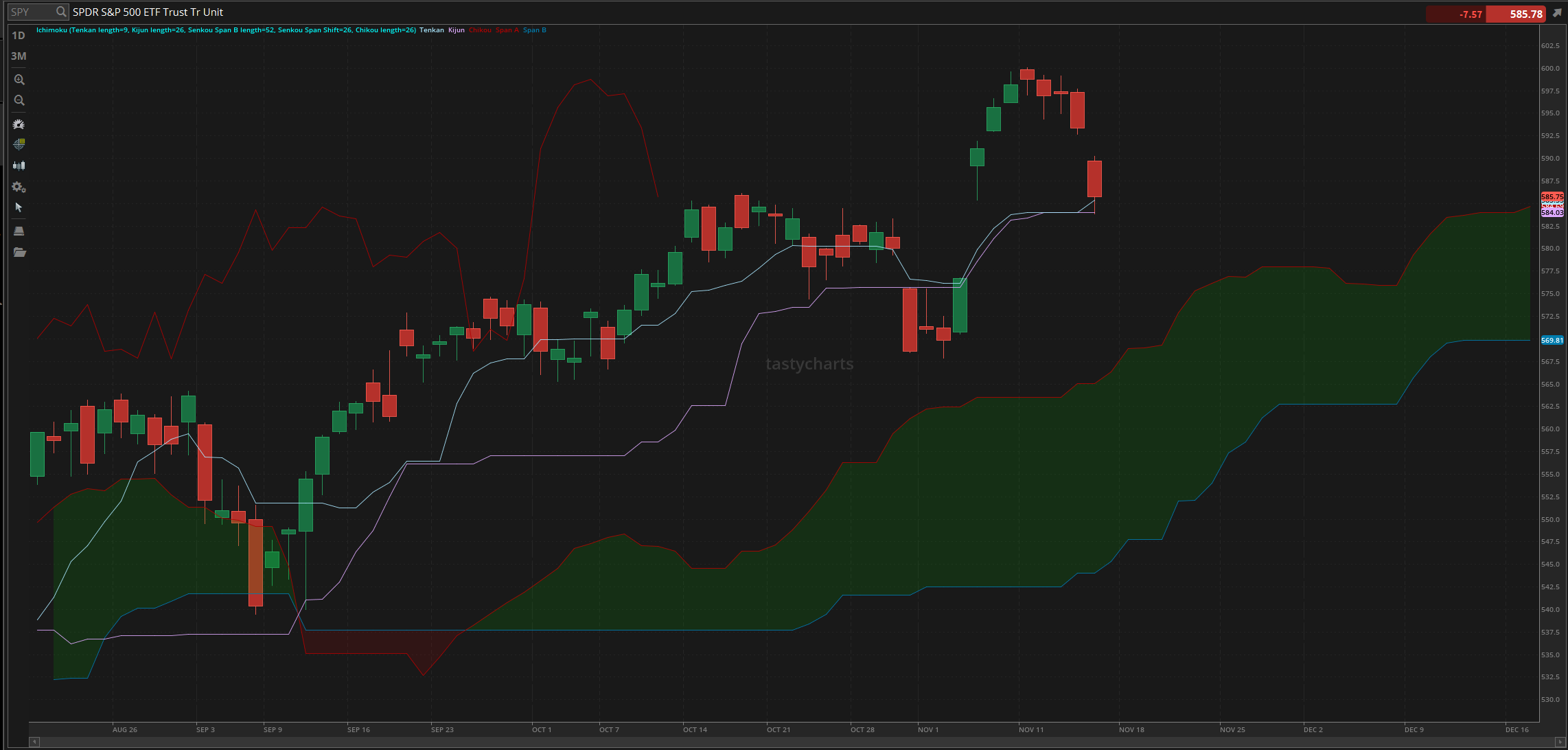

The updated $SPY daily levels are as follows:

Conversion Line Support: $585.35

Baseline Support: $584.03

Psychological Support: $580

Daily Cloud Support: $565.03

Thoughts & Comments from Last Week

Last week was a rather bloody time for the overall markets. Conditions were rough, and many traders consistently realized losses. Many traders got slapped around, but at least it was not as bad as $NFLX’s servers. It's insane that Jake Paul paid $20,000,000 to commit elder abuse in front of the nation but to each their own. If you realized losses last week, do not feel like you are alone. Many traders generated losses, either unrealized gains vanishing or simply realizing losses. C’est la vie; the markets move on, and so do you.

We started the week with $SPY looking relatively strong, testing the $600 resistance but having some slight bearish momentum. We opened Monday at $599.93 and continually slipped through, making new lows in the process. Many traders got caught in the bullish hype, and the markets got a quick check. We quickly rejected $600 and continually slipped as the bearish momentum got faster and faster. Things did slow down around $597 on Wednesday, but Thursday and Friday were bloody.

Thursday, $SPY ended the day at $593.35, down roughly 1.5% from the top, and we gapped down on Friday, making the low of the week at $583.86. We did bounce back slightly, closing the week at $585.75, but that was a rough time. We had five red daily candles on $SPY, dropping $14 or roughly 2.5% in a week, nut checking a lot of traders in the process, myself included.

These market conditions are still amazing, but weeks like last week are the ones that keep you in check while you are feeling confident as a trader. Congratulations to everyone who was able to generate a significant amount of gains on the blood of last week, and congratulations to anyone who was able to realize 30%+ on $RIVN with us. It was a great time, so let’s see what this week has in store for us and make the most of it.

S&P 500 Heat Map - Last Week

Thoughts & Comments for Today - 11/18/2024

Today should be a rather interesting time for the markets. Will $SPY bounce off of this daily support and rally beautifully? Or are we going to see a test of daily support, a rejection, and certain death? Your prediction is as valid as mine, and this is just going to be an interesting time. No one obviously knows where the markets are headed, but if someone does know, please tell us.

I know I’ve been talking about this for a couple of days now, but I believe that the buy-the-dip opportunity is setting up beautifully. Conditions are looking great, traders are confident, and opportunities to allocate are finally amongst us. Equities have come down from the top, but the question from here is, where do we go?

I will say that the markets are more inclined to bounce up from this level as we are testing two levels of daily support. Just because we are showing a level of support does not mean that we cannot break that level and continue to free fall. We can easily break that level of support and continue to free fall, so please tread lightly on allocating in these conditions, but prepare accordingly for an opportunity to buy the dip.

When attempting to allocate, look for organizations that have had a more difficult time over the previous couple of months, that have fundamental strength, and that have opportunities under a Trump presidency. I feel that $RIVN right now is a great organization that has had a difficult time recently, but I will stand by my thesis that $RIVN will have a slightly tougher time under a Trump presidency. That is the primary reason I am not screaming to everyone to allocate into $RIVN on this dip. I still have the same long-term thesis on the organization, but I believe there is going to be pushback over the next couple of years under Trump to put the focus back on internal combustion engines versus allocating resources directly toward electric vehicles. So please tread lightly on $RIVN as an organization. They still have the same long-term outlook, but I believe that the next four years will be sketchier for them.

For my allocations today, I will say that after last week, I anticipate taking on fewer risks in these market conditions. I plan on preparing to allocate long within my portfolio and not actively trading the short-term momentum as much. It is easier allocating long in the markets on a dip, knowing organizations will head back up, versus speculating on where an organization goes over the next 30 seconds - 1 minute. So, watch out for my long allocations. I’ll find some organizations I am interested in, and we will go from there!

Just make sure that, again, you are practicing safe risk management in these conditions. Many traders had difficulty last week, and more will have difficulty navigating with confidence this week!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $SMCI, BTC, XRP, $NVDA, $TSLA, $RIVN, $INTC , $BA

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC / $BA / $RIVN

Economic News for 11/18/2024 (ET):

Home Builder Consumer Confidence - 10:00 AM

Notable Earnings for 11/18/2024

Pre-Market Earnings:

Bit Digital (BTBT)

Bitdeer Technologies (BTDR)

Twist Bioscience (TWST)

After Market Earnings:

Symbotic (SYM)

Trip.com (TCOM)

Tuya (TUYA)

Zenvia (ZENV)

i3 Verticals (IIIV)

BellRing Brands (BRBR)

Wrap up

Hopefully, market conditions improve this week, and we are provided with a great opportunity to trade and realize a significant amount of gains. Last week was tough, but we can put it in the past and move forward. Make sure to practice safe risk management and do what you can to maximize your profit potential at this time. Look to buy this dip, and have some fun in the process!

Good luck trading, and let’s see what this week has in store for us!