HaiKhuu Daily Report - 11/25/2025

Good morning, and happy Tuesday!!!

Just jumping right into things, today is going to be another extremely difficult yet extremely easy day for the markets.

This is day #2 of the Thanksgiving Trading Week, where volume should only continue to decrease as everyone is preparing accordingly for the holidays, so I hope you all are ready for another day of relatively lower volume and choppy indecisiveness.

I think that this again is going to be a more difficult time for newer traders, but as long as you can capitalize on these conditions and remain solvent, you are going to be in a great spot. The difficulties come from when you allocate, and then watch as $SPY just chops in a tight range making it almost impossible for you to realize any gains, while consistently just chopping you out of your plays.

So please, just be smart and safe when you are attempting to allocate into the markets today, and understand that trading lower volume is going to be extremely difficult for many, and stupidly profitable for others.

Good luck trading today, and let’s see a continuation of this breakout!!!

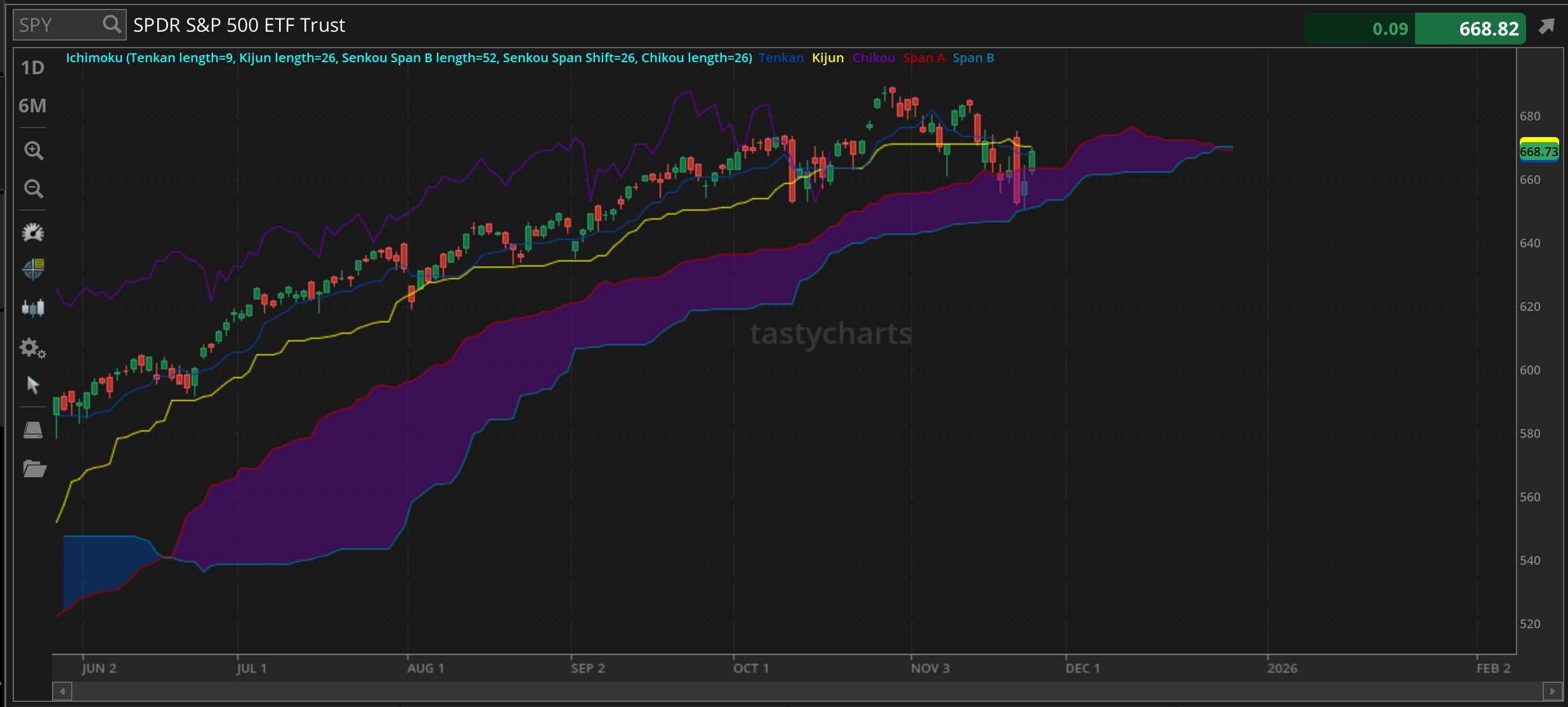

The updated $SPY daily levels are as follows:

Conversion Line Support: $667.90

Baseline Support: $670.28

Psychological Support: $660

Daily Cloud Support: $663.39

Thoughts & Comments Yesterday - 11/24/2025

Yesterday was an absolutely beautiful day for the markets that followed our predictions almost perfectly. Hopefully you all had general long exposure that continued to move up beautifully as that was an amazing day for the majority of individuals who simply continued to hold their tech allocations. Hopefully you all had a great time and realized some significant gains!

So, we started the day with markets looking alright with $SPY opening at $662.72. Market conditions at open were alright, opening slightly above the previous close. We then watched as $SPY chopped around, going on to make a relative high around $665 before coming back down to make the official low of the day at $661.60, before quickly reversing again and going on and continually making new highs of the day.

We watched as there was an extremely low volume momentum based move in the markets that chopped traders out and displayed more and more confidence in the process. Traders who were able to outrun the chop, or simply just retain their holdings had a great time as $SPY continued to trend up into the afternoon, where $SPY consistently chopped around right below that $670 resistance level, never really having the strength to break above that point, and consistently chopped there throughout the entire afternoon.

Conditions at the top were slow, but as long as you didn’t get chopped out of your positions by the end of the day, you would have been fine, happy, and excited for the day. We went on to officially end the day with $SPY trading at $668.73, up approximately $10 for the day, or up about 1.5%.

I am not saying that the market conditions of yesterday were anything insane, but it was almost perfect the prediction we made in regards to the overall movement, so I hope that you all were able to realize a significant amount of gains and had a great time! Let’s see where the markets take us today and have a great time!

S&P 500 Heat Map - 11/24/2025

Thoughts & Comments for Today - 11/25/2025

So, let’s talk about today. I believe that today should be a continuation of the generalized movement we see around Thanksgiving. Opportunities are amongst us but if I am going to be completely honest, traders are going to have some difficulties. I am going into today under the expectations that the markets are going to be relatively lower volume, and display some choppy intraday market conditions.

I am not saying that the markets are going to be overly bullish or overly bearish, but I am going into today with the assumption that many traders who attempt to allocate today are going to have a difficult time realizing gains unless you time your plays out perfectly.

We should go into today with the expectations that there is going to be slow chop and that market conditions are going to be tough, while at the same time, in the case that there is any sort of larger movement in the markets that it will be a lower volume momentum based movement.

Again, I am not promising that these market conditions are perfect, but looking at historical data, typically what happens during low volume times, assuming that market conditions are strong, we typically see a slightly bullish run through the week. I am not saying that today is going to be perfect or beautifully green, but I am under the assumption that as long as you can remain solvent throughout the rest of this week, that you will be smooth sailing into the end of the year.

So tread lightly if you are attempting to trade on an intraday basis. Do not get caught in the chop and watch out for the directional breakout and movement. If the markets continue to look strong, look to take on lower risk long exposure, and in the case that markets sell off, continue to retain your bearish exposure.

Just make the most out of these market conditions and do everything you can to have an amazing time!!!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $NVDA, $TSLA, $MSTR, $TSM, $ORCL, $BABA

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 11/25/2025 (ET):

Producer Price Index (delayed report) - 8:30 AM

Core PPI - 8:30 AM

Consumer Confidence - 10:00 AM

Pending Home Sales -10:00 AM

Notable Earnings for 11/25/2025:

Pre-Market Earnings:

Alibaba Group (BABA)

Abercrombie & Fitch (ANF)

NIO (NIO)

Analog Devices (ADI)

Kohl's Corporation (KSS)

Best Buy Co (BBY)

Amentum (AMTM)

Burlington Stores (BURL)

DICK'S Sporting Goods (DKS)

After Market Earnings:

Dell Technologies (DELL)

Workday (WDAY)

Autodesk (ADSK)

Urban Outfitters (URBN)

HP Inc (HPQ)

NetApp (NTAP)

Petco Health and Wellness (WOOF)

Wrap up

Hopefully, market conditions only continue to slowly move up throughout the rest of today leading into thanksgiving. Just remember that again, volume will continue to decrease throughout the week as more and more traders are taking time off to enjoy Thanksgiving. Just remember, as long as you can remain solvent until December, you’re in a great spot!

Good luck trading, and let’s make the most out of today!