HaiKhuu Daily Report 12/01/2022

Good morning and happy December! Hope you all are feeling amazing after the results of the pump in the US equities market yesterday. It was an unexpected surprise resulting in everyone (except the bears) making a significant amount of realized gains. Hopefully, you all were able to ride the wave and enjoy the high of Jerome Powell pumping the markets.

Thoughts & Comments from 11/30/2022

Yesterday was a beautiful day for the markets. There was a significant amount of momentum that resulted in some insane positive movement generated in the markets. The day started off normally with $SPY under the $400 resistance level, opening at $395.35 and looking mildly bearish. The markets slowly continued to trend down throughout the morning despite knowing there was major economic news coming out later in the day and knowing Jerome Powell was speaking.

$SPY went on to slow bleed throughout the whole morning with $SPY making an official low of day trading at $393.48. Markets slowly picked back up and nothing crazy was going on until… Jerome Powell’s speech started. Right at 1:30 pm EST, the markets started ripping heavily and moved up accordingly. Right from the rip, $SPY went from trading under $395, to reaching $397 in a single candle, and went on to continue to push.

We rejected $399 and came down for a little before proceeding to continue to push throughout the rest of the day. Once $SPY broke the $400 resistance, it was genuinely game over. $SPY went on to push for the rest of the day with the markets consistently making new highs until the end of the trading day.

After pushing the entire day, $SPY officially closed the day at $407.68, up +$12.45 (3.15%) with an intraday movement of +3.08%.

Hopefully, you seized every opportunity presented to you and realized a significant amount of gains. It was a beautiful day yesterday, and let’s watch as this trend hopefully continues.

$SPY ONE MINUTE INTRADAY CHART 11/30

Thoughts & Comments for Today 12/01/2022

Today is hopefully going to be an amazing day for the markets. We are trending up at the time of writing this report, with a significant amount of bullish momentum in the markets. With the movement of yesterday, though, I would advise relative caution in the markets as there is a good chance we come back down accordingly. Ideally, though, with this shift in general confidence in the markets, we will see a continued movement in our favor across the board with a follow-up of the significant movement of yesterday.

If you are trading, be quick with your scalps and realize a significant amount of gains, and if given an opportunity, sit back and realize some free equity in the process of your trading.

Follow the momentum today, don’t be greedy and make good positions. Trading today will not be difficult as there will be many opportunities to trade, but just remember to be smart and limit the amount of risk & exposure you are taking on.

Realize some gains when given an opportunity to do so and limit the amount of general exposure you have.

It should be a great day for the markets so seize any opportunities presented to you and have some fun in the process!

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Yesterday was a wonderful day for the markets, with a significant amount of realized gains in both the pilot and the general markets. Our algorithms, unfortunately, did not beat out $SPY, but that is known that on a day like yesterday, it will be assumed that when the markets go insane, we, unfortunately, underperform. C’est la vie, still a wonderful day across the board!

If you want to read more in-depth about the performance of all of our algorithms, please check out Asher’s report.

The results of yesterday are as follows:

Baseline:

$SPY: +3.08%

Our Results:

Base Algorithm: +2.53%

Long-Term Portfolio: +2.17%

Variable Market Neutral: +1.66%

Variable Sector Neutral: +1.02%

Market Neutral: -0.17%

Sector Neutral: -0.33%

Today, we will be allocated directly into the base algorithm with the intention of cutting all positions early when given an opportunity to do so. We are going to be watching general market momentum and will set stops in guaranteed profit and continually move them up throughout the day.

Watch for when I ultimately cut all allocations for the morning, and make sure to be smart with any algo plays you take!

All positions will be disclosed prior to markets opening.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

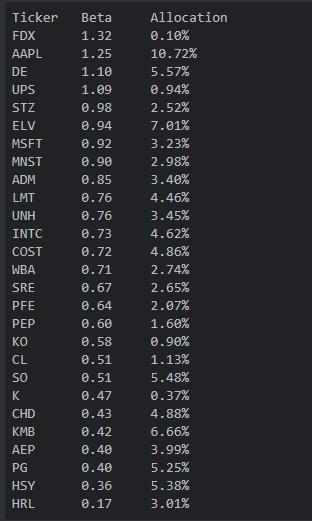

Generated entries for 12/01/2022

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $GOOG/L , $AAPL , $MSFT , $META , $TSLA , $BA , $AMD , $RBLX

Free Equity List:

Safe - $SPY

Risky - $META , $AMZN , $RBLX , $BABA

Position Opportunities:

Look to allocate into strong equities that you anticipate holding until the end of the year

Pick up some leaps in organizations you are bullish on over the span of a couple of years ($GOOG/L, $AMZN, $META)

Pick up broad market ETFs slowly ($SPY / $QQQ)

Sell short-dated CSPs with the intention of collecting premium on Friday

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN

Long-Term Safe Play - $BA

Long-Term Speculative Play - $META

Short-Term Speculative Play - $RBLX

Economic News for 12/01/2022

Initial jobless claims - 8:30 AM ET

Continuing jobless claims - 8:30 AM ET

PCE price index - 8:30 AM ET

Core PCE price index - 8:30 AM ET

PCE price index (year-on-year) - 8:30 AM ET

Core PCE price index (year-on-year) - 8:30 AM ET

Real disposable income - 8:30 AM ET

Real consumer spending - 8:30 AM ET

S&P U.S. manufacturing PMI (final) - 9:45 AM ET

ISM manufacturing index - 10 AM ET

Construction spending - 10 AM ET

Motor vehicle sales (SAAR) - Varies

Notable Earnings for 12/01/2022

Pre-Market Earnings:

Toronto Dominion Bank (TD)

Bank of Montreal (BMO)

Dollar General (DG)

Canadian Imperial Bank (CM)

Kroger (KR)

Big Lots (BIG)

Patterson Companies (PDCO)

After-Market Earnings:

Marvell Technology (MRVL)

Veeva Systems (VEEV)

Ulta Beauty (ULTA)

Zscaler (ZS)

UiPath (PATH)

Samsara (IOT)

ChargePoint (CHPT)

Asana (ASAN)

Ambarella (AMBA)

PagerDuty (PD)

Wrap up

Overall, be smart with your allocations today, but with the markets on easy mode, realize as many gains as possible when given an opportunity to do so and seize the day. Let’s make some bank and have some fun!

I’d say good luck today, but we don’t need it. Enjoy making some bank today!