HaiKhuu Daily Report - 12/01/2025

Good morning, and happy Monday! Wow, it is such a great feeling to be back home in Chicago. I hope you all are ready for what the rest of this year has in store for us and are ready for an amazing time.

As I have stated before, I believe December should be an extremely bullish month for us, as tensions are easing. We are slowly coming out of extreme fear on the Fear & Greed Index. Traders have watched as the markets have moved up nicely over the previous FIVE trading days, and conditions are looking great as $SPY is less than 2% away from a new all-time high.

Markets are down slightly at the time of writing this report, with $SPY down about $5 during the pre-market session, but honestly, that is not too much of a fear. Conditions are still exceptionally strong across the markets, and we are in a position where we should be highly excited to allocate to them. Please, just make sure to practice safe risk management and mitigate as much risk as possible when attempting to allocate.

Many traders are going to print a significant amount of money in my opinion, so please, make the most out of this month, and let’s end this year strong!

If you have not checked out the WEEKLY PREVIEW, please check it out. There are SO many economic events happening this week that you simply do not want to miss!

I’ll talk more about these market conditions in the full report…. but for now….

Good luck trading this week, and let’s see a NEW all-time high!

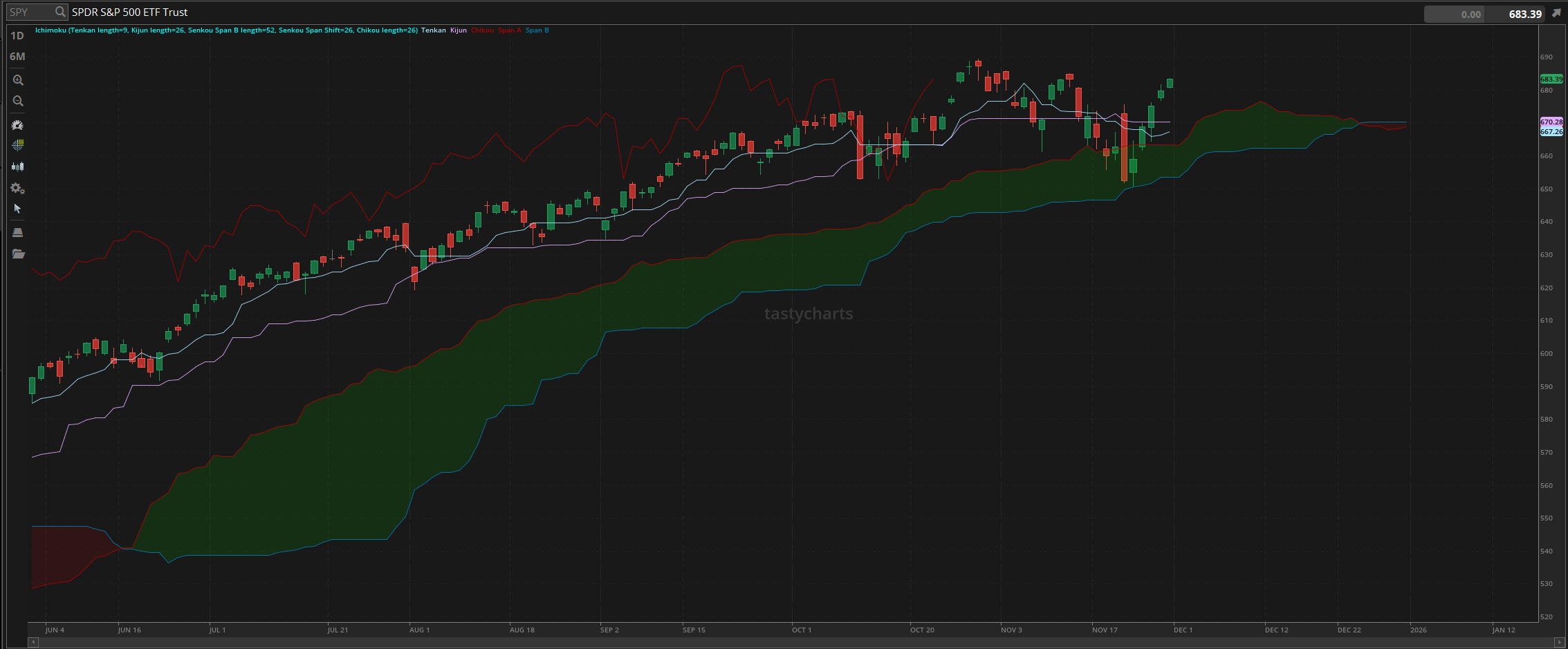

The updated $SPY daily levels are as follows:

Conversion Line Support: $667.26

Baseline Support: $670.28

Psychological Support: $660

Daily Cloud Support: $663.39

Thoughts & Comments from Last Week

Last week was an absolutely beautiful and perfect week for the overall markets. I hope that you all were able to hear our warnings about the markets and made the most out of the opportunities! We said that last week was going to be a low-volume, bullish, choppy day for the markets, and man, was that prediction perfect. Conditions were great as everyone should have generated a significant amount of both unrealized and realized gains last week, and had an amazing time in the process!

So, we started last week with $SPY opening at $662.67. Market conditions on Monday were relatively slow, but it was completely expected with the short week following it. Markets continued to move up beautifully throughout Monday, showing slow, choppy, bullish momentum, and that momentum was followed on Tuesday and Wednesday, watching as $SPY continued to make new relative highs every single day.

Conditions only continued to remain strong as $SPY bounced off the daily cloud support, and watched as the markets were closed on Thursday for Thanksgiving, and followd by an extremely short, yet extremely profitable Friday, where $SPY went on to end the week trading at $683.39, meaning that it was up $21 for the week, or up just over 3%.

I stated early in the week that the week was going to be slow, bullish, and optimistic with some chop and relatively low volume, and it appears that it was the case once again. The same thing should only continue to happen every Thanksgiving week, assuming that market conditions are strong. So little nugget of advice for the future regarding what possibly may happen in the future short weeks for the markets!

S&P 500 Heat Map - 11/26/2025

Thoughts & Comments for Today - 12/01/2025

So let’s talk about today. Today is either going to be an absolutely amazing day for the markets as we watch a full recovery of this bearish momentum early in the day, or we are going to watch a disgusting time as markets sell off heavily in a short period of time. I am not saying that we are going either direction, but all I am saying, going into today, is that I am personally expecting to see a larger directional move in the markets as everyone is back and ready to roll.

Personally, I believe this is going to be a massive buy-the-dip opportunity as the markets attempt to fake out retail traders at this level, but at the same time, I expect to see general difficulties from the large majority of traders. Conditions like these are the entire reason why I tell everyone to hold fundamentally solid organizations they personally have faith in, because in the case of short-term weakness when an organization’s valuation drops by 1-2-5%, you are not sitting there panicking and freaking out over your allocation. Just continue to hold the strong allocations that you are confident in, and retain your general exposure.

Again, I need to state that I believe we will see a large directional move. If it is up or down, I genuinely cannot tell at this point, but the biggest thing to remember is not to fight any trends. General market momentum is larger than all of us, and there is no reason to attempt to fight that trend, especially on a day like today. Only attempt to allocate against the trend once there is confirmation of a reversal in either direction, but until that point, it is wise to continue to follow the momentum in the markets.

Do not catch a falling knife, wait for a sign of a reversal, and do not short a rally.

It sounds very simple, and it is that easy. Everything just comes down to your ability to navigate the markets here in the short term.

I personally will be looking for opportunities today to actively day trade and scalp. The plan is to look at higher-beta organizations like $ORCL and $NVDA that were down last week and find an opportunity to buy with confidence. Any allocations created will have an extremely tight stop, and ideally will have the ability to run with ease. I will personally be staying away from buying or selling any option contracts against those names and will stick to scalping and trading equities.

Conditions again are not the best going into open, but it all comes down to what you make of these conditions. Many are going to have zero issues realizing some gains, so please again, be smart and safe while attempting to trade, but understand that if you are not confident, or you are reckless, you will have a tough time. Practice risk management, and let’s make the most out of these conditions!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $NVDA, $TSLA, $MSTR, $TSM, $ORCL, $BABA

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 12/01/2025 (ET):

Manufacturing PMI - 9:45 AM

Notable Earnings for 12/01/2025:

Pre-Market Earnings:

No Earnings Scheduled

After Market Earnings:

Credo Technology Group (CRDO)

MongoDB Inc. (MDB)

Simulations Plus (SLP)

Vestis (VSTS)

Wrap up

Hopefully, market conditions follow exactly my game plan for the day. If they wiull or not is going to be an interesting question to see the answer to, but for now, markets are not looking the best, but I know we will all make the most out of these conditions. So let’s have some fun, realize some gains, and start this month off strong.

Good luck trading, and let’s see how long it takes for $SPY to make a new all-time high!