HaiKhuu Daily Report - 12/05/2025

Good morning, and happy Friday!

Wow, this week has flown by, and I absolutely love each and every one of you. These conditions have been volatile, providing us with some absolutely insane opportunities to trade and realize gains. I hope that you all have had a great time and have consistently realized gains during this volatile time. Man, these market conditions have been spicy, but that's just life. Please, continue to make the most of these market conditions, and let’s continue to have a great time.

We are less than 1% away from making a new all-time high, and these market conditions are providing us with both comfort and confidence at these levels. So please, continue to practice safe risk management, and let’s do everything in our power to make the most of this strength while possible.

Again, I am still confident we are going to see another large breakout in the markets by the end of the year. My prediction of $SPY $700 by the end of the year is within the realm of possibility, and I am excited to see where these conditions take us. So please, continue to enjoy these wonderful market conditions, and let’s have an amazing time.

It has been great being back at home and trading from my desk. I am excited to see where the markets take us from here.

Good luck trading today, let’s see if $SPY can break out again!

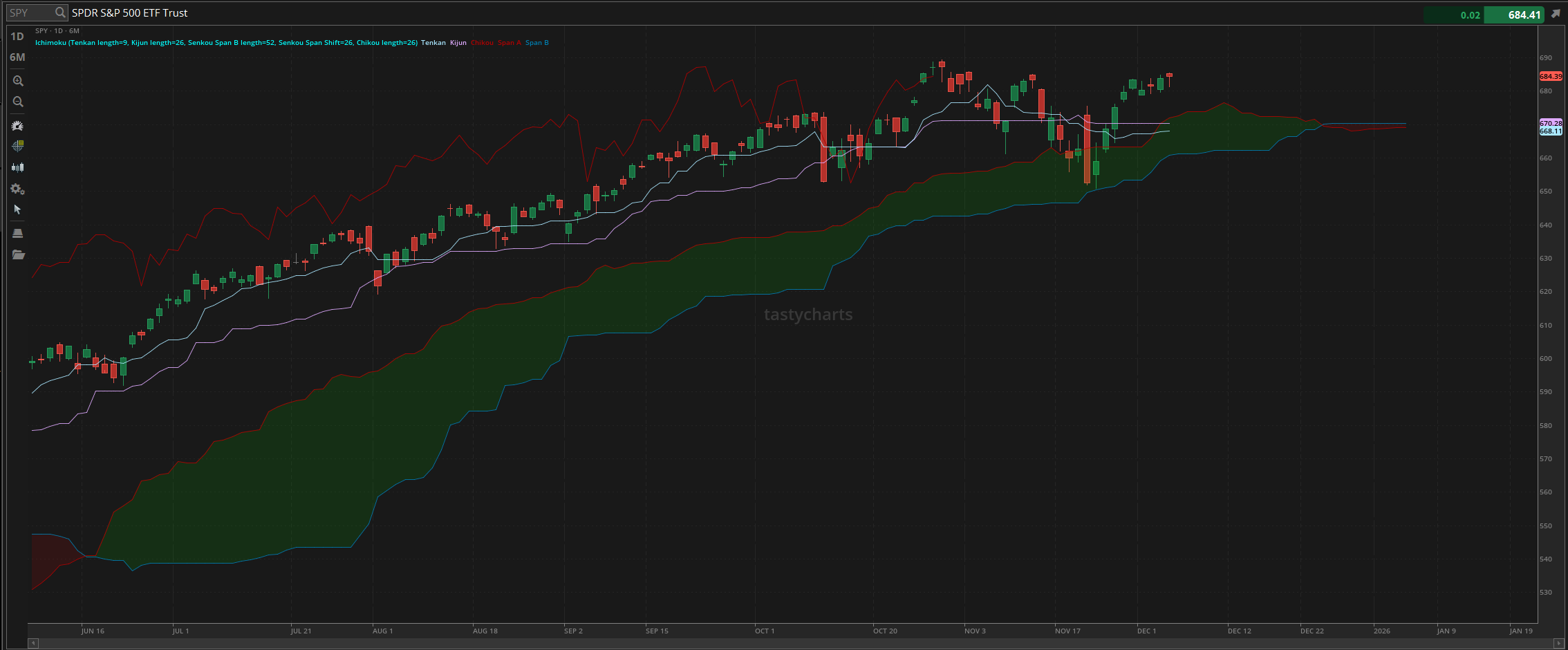

The updated $SPY daily levels are as follows:

Conversion Line Support: $668.11

Baseline Support: $670.29

Psychological Support: $680

Daily Cloud Support: $671.94

Thoughts & Comments from Yesterday - 12/04/2025

Yesterday was kind of just a weird and choppy day for the markets that honestly was extremely difficult to navigate, but easy and fun for those who were comfortable, confident, and simply followed the market momentum. Opportunities were consistently amongst us to trade in either direction, and there were 10x more opportunities to get burnt and stopped out of your plays. Regardless, though, such is simply life. I hope you all had a wonderful time trading and were able to realize some gains!

So we started yesterday with market conditions looking great. $SPY opened the day at $685.37, and surprise, that was the official high of the day.sss Markets came tumbling down right from the open price, where, within the first 30~ minutes of the day, there was just straight bearish momentum. Opportunities were amongst us to trade in both directions and scalp and have fun, but realistically, markets just remained extremely neutral before starting to move up with more confidence.

$SPY then went and tested $684 for the large majority of the middle of the day. Conditions were not insane nor gave us any great opportunities to realize some gains, just gave market makers opportunities to stop out comfortable traders, and had an absolutely insane time doing so for hours on end, until we started to see the bearish trend finally give way, where $SPY quickly went from green on the overall day trading around $684, to selling off and hitting the official low of the day at $681.35. The sell-off was sudden, gross, and unpredictable, but the recovery afterward was textbook.

There was a beautiful buy-the-dip opportunity as the markets quickly reversed, displaying a V-shaped recovery, and bouncing again, leading into close. We then officially ended the day with $SPY trading at $684.39, up $0.50 for the day, or up 0.073% overall. I am not saying that these market conditions were perfect, but man, oh man, were there some insane opportunities to trade and realize some gains. We had some fun, we realized some gains, and had an amazing time. So, let’s see where the markets take us today, and hopefully we continue to inch closer and closer to that new all-time high!

S&P 500 Heat Map - 12/04/2025

Thoughts & Comments for Today - 12/05/2025

Today is gearing up to be a repeat of the previous couple of trading days. Are we about to watch as the markets finally break out? Are we about to watch as $SPYT magnet’s back to $680? Or are we going to simply watch as there is choppy neutrality that simply takes out traders? I don’t know. There is a lot that is going on, and traders should be both comfortable and confident with everything that is going on at this point. If you are not comfortable or confident, you are taking on too much risk or too much exposure at this point.

I do not see a reason why all of you are not overly bullish and comfortable in these market conditions. It is one thing to look at the markets and say that things need to come down; it is another to look at a bullish chart and not know what to do or how to allocate at this point.

As bad as this sounds, this is going to be an ongoing issue for many people in the markets, mostly as the price of underlying equities comes up.

So, a couple of things that you should attempt to consider when attempting to trade or realize some gains:

What is your timeframe

What direction are you headed

Are you comfortable allocating INTO this organization

Are you comfortable with your SIZING into this organization

What are your plans to scale in and out of the play

What are your stops

Where do you want to take profits

All of these questions are straightforward and should be considered when attempting to enter a position. Entering into a position without a plan is like putting on a blindfold, spinning in a circle, and throwing a dart. You pray that you hit, and you don’t understand the possible risks involved.

Make sure you understand the timeframe of your position, the market momentum, and the operations of the underlying organization you are considering. Yes, it is not “necessary” to have to worry about the performance of the underlying equity in the case that you are simply scalping or day trading, but that adds to your confidence in a play. It is a lot easier to invest in an organization that is cashflow positive and printing money than trading an organization where you don’t know how they make money; all you know is how they lose hundreds of millions of dollars a year.

So, on top of that, once you know what timeframe you want to allocate, which direction, into an organization you are comfortable holding. How are you going to size into your play, and how are you going to scale in and out? I always say proper risk management is having less than 10% of your entire portfolio in a single position to midigate overall risk, and while this is a statement that stands true, it is often broken by many traders (myself included), but is commonly said so you are not overallocating into the markets in a short period of time and taking on too much risk.

Now you know everything about the entry style of the play, now what about the exit signs? Having those targets for both your entry and exit honestly is one of the best things that you can do to remain rational. You won’t have to worry about the $0.03 movement down on your play, nor are you going to be overly ambitious and not take profit at the top because you are greedy. You know exactly when and where you want to move regardless of the play, so respect those levels and adjust your position accordingly, but simply respect those levels.

With all that has been said, I hope that some of you have learned part of the mental game of the markets, which has to be conceptualized and considered in real time in these market conditions. It is not easy. But man, it's fun.

So, to wrap things up, just again make the most out of these market conditions. $SPY is less than 1% away from an all-time high, so be smart, practice risk management, and do everything in your power to make the most out of today!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $NVDA, $TSLA, $MSTR, $TSM, $ORCL, $BABA

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 12/05/2025 (ET):

Personal Income (delayed report) - 8:30 AM

Personal Spending (delayed report) - 8:30 AM

PCE Index (delayed report) - 8:30 AM

Notable Earnings for 12/05/2025:

Pre-Market Earnings:

MoneyHero Limited (MNY)

KNOT Offshore Partners (KNOP)

Victoria's Secret & Co (VSCO)

Wrap up

This will be a fun time and a fun way to end this week. I am personally very excited to see where the markets take us today, and it is all going to be a matter of simply allocating when and where you have confidence, and making the most of these conditions. It would not surprise me in the case that the markets did finally break out, so just prepare accordingly for some volatile times and hope for the best!

Good luck trading, and let’s end this week strong!!!