HaiKhuu Daily Report - 12/12/2025

Good morning, and happy Friday! Wow, I don’t know where this week has gone, but it has absolutely FLOWN by! Markets did go on and make an unofficial ALL-TIME HIGH yesterday during the after-hours session, so I hope you all are ready for what should be an overly optimistic great time for the markets. $AVGO has fallen from the top, which is not a great sign, but market conditions are strong, traders are optimistic, and opportunities will be presented to us left and right today.

Hopefully, we go on and see a new all-time high here in a little bit as market conditions remain relatively neutral during the pre-market session.

Just go into today with your fists up, because this is going to be an interesting time. Please, go into today with two expectations: either we are going to watch as the markets break out beautifully from this level and continue to make new all-time highs, or we are going to reject this level short-term, and then a world of volatility ensues.

So I’m not going to tell you specifically which direction we are headed, as it genuinely is going to be a coin flip. Still, as I’ve said before, I genuinely believe that the irrationality has started and that $SPY is headed towards $700 by the end of this year! So realize some gains, generate some unrealized gains, and have a great time!

Good luck trading today, and let’s see a NEW all-time high!

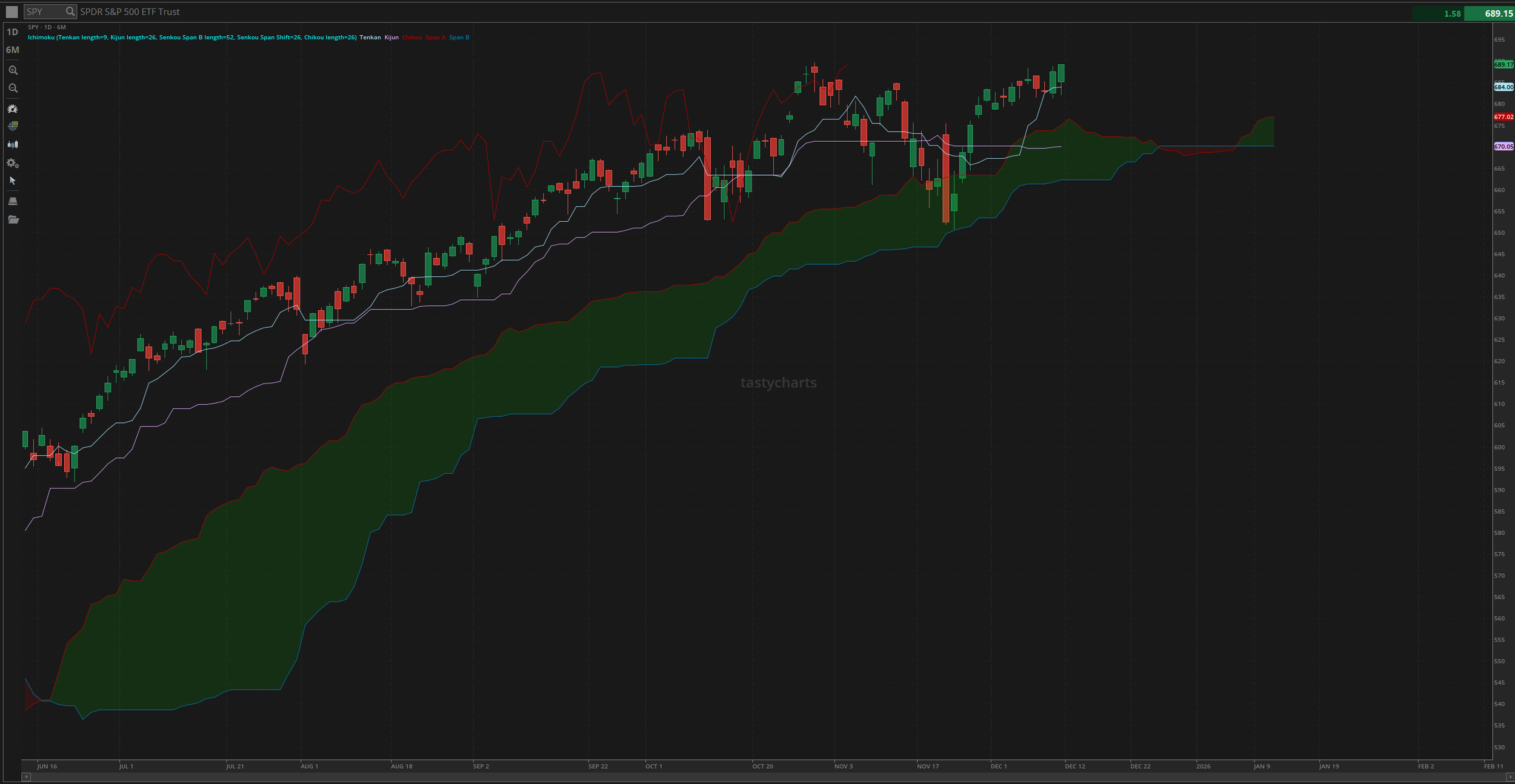

The updated $SPY daily levels are as follows:

Conversion Line Support: $684.00

Baseline Support: $670.05

Psychological Support: $680

Daily Cloud Support: $675.01

Thoughts & Comments from Yesterday - 12/11/2025

Yesterday was an absolutely beautiful day for the markets, with $SPY making a NEW all-time high during the after-hours session. I don’t know about you guys, but we all should have realized some gains, or at least generated consistent unrealized gains throughout the entire day!

So, we started yesterday with markets looking weak. $ORCL sold off as a result of earnings, so the markets opened the day at $685.11. Conditions at open weren’t the best as $SPY was down roughly $2.50, but the worst wasn’t over. Markets opened quickly and sold off, going on to make the official low of the day at $682.17, and rallying beautifully from the bottom.

The markets gave us a beautiful buy-the-dip opportunity, and hopefully everyone was able to capitalize on that strength.

Markets continued to move up slowly, hitting $686 around the lunchtime lull, and watched as the markets continued to break out into the afternoon with both strength and confidence leading into the end of the day, inching closer and closer to that new all-time high.

Before we knew it, $SPY was trading at $689.25 and looking strong, while everyone continued to realize a significant amount of gains.

We ended the day with $SPY trading at $689.17, and went on to make an unofficial all-time high after hours on positive $AVGO earnings. So, it will be exciting to see where the markets take us today, and I hope you all are ready to realize some gains!

S&P 500 Heat Map - 12/11/2025

Thoughts & Comments for Today - 12/12/2025

Today is going to be a hectic time. As I said before, these market conditions are volatile, and we are in a range of making a new all-time high. I mean, we did make one unofficially after hours yesterday, but the question is, are the markets going to have enough strength and confidence to break out once again and go on and make a new all-time high? The reality is, yes, that is very much a possibility today. The real question then becomes, will it happen…

Obviously, I would not recommend you all to blindly bet long and pray that the markets break out, but I will say that conditions do appear more bullish as a result of the ongoing market sentiment, so it will be interesting to watch how everything plays out.

The only concern I have today is the uncertainty about direction; I am worried we may see short-term chop towards the previous all-time high. If we break out and get to the previous level, I think we will see a short-term market slowdown that will make scalping difficult before everything breaks out once again afterward.

But if the markets break out from that point and continue to make new highs, my warning to you all is: NOT to fight the trend. Yes, the markets might need to come down, and yes, the markets may have moved up irrationally, but I can tell you with certain confidence that 9/10, I’ve seen bearish traders get wiped out while the markets are rallying. So please, just remember to NEVER short the new all-time highs.

Again, I am not saying that the markets cannot come crashing down after making a new high; it is just that the likelihood of the markets coming down in such fashion is significantly lower. Many traders believe they can time the markets perfectly and predict tops. I am not saying that I cannot color within the lines in a coloring book, but you often know how that goes. So, if you are attempting to trade or capitalize on these market conditions today, please do everything in your power to realize significant gains and follow the trend.

The best places to look to take on some risk if you are attempting at this point are to look at higher beta plays that have shown short-term weakness but overall strength. Organizations like $ORCL and $AVGO today are going to be extremely high risk, extremely high reward, where realistically I genuinely believe that the large majority of you are going to have a difficult time attempting to trade either of those names today, but in the case that you are lucky, tallented, or dillusional, you will have an amazing time watching as these major organizations experience elevated volatility and opportunities to print!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $ORCL, $NVDA, $TSLA, $BABA, $MSFT

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 12/12/2025 (ET):

None Scheduled

Notable Earnings for 12/12/2025:

Pre-Market Earnings:

Johnson Outdoors (JOUT)

Wrap up

Hopefully, market conditions only remain strong and break out and make a new all-time high today. The likihood of it happening in my opinion is extremely likely, the question is, how quickly can we do it, and will there be enough solvency to continue this rally. This will be an extremely interesting time with opportunities consistently presented to us, so please, have some fun, realize some gains, and make the most out of these conditions!!!

Good luck trading, and let’s end this week strong!!!