HaiKhuu Daily Report - 12/13/2024

Good morning, and happy Friday the 13th! Things might be sketchy as it is Friday the 13th, but markets are looking great, and I hope you all have exciting plans for this weekend!

There are only TWELVE more trading days this year, so please continue to make the most out of the strength we are seeing in these conditions and do what we can to make the most out of these conditions! I am expecting to continue to see confusion from these market conditions as $SPY is currently testing major daily support, we are seeing minor weakness from semiconductors, and the fact that BTC is in consolidation at $100,000.

Please be on the lookout for a possible sell-off in the near future as a result of this confusion and weakness. Tread lightly and practice safe risk management, but just remember, market conditions are strong, but we are just seeing momentum slowing down. If the markets start to sell off, conditions will be extremely difficult, but just remember that market conditions, despite being in a state of confusion at the moment, are still exceptionally strong overall. Continue to take advantage of these market conditions, and do what you can to maximize your profit potential. I am expecting to see some great opportunities presented to us today, so please continue to practice risk management and make the most out of it!

TWO SIDE NOTES FOR TODAY -

We will have the Gryphon Digital Mining ($GRYP) CEO present to us right after markets open.

For our holiday donation, I will be out during the back half of the trading day giving out gifts!

Good luck trading today, and let’s see where the markets take us!

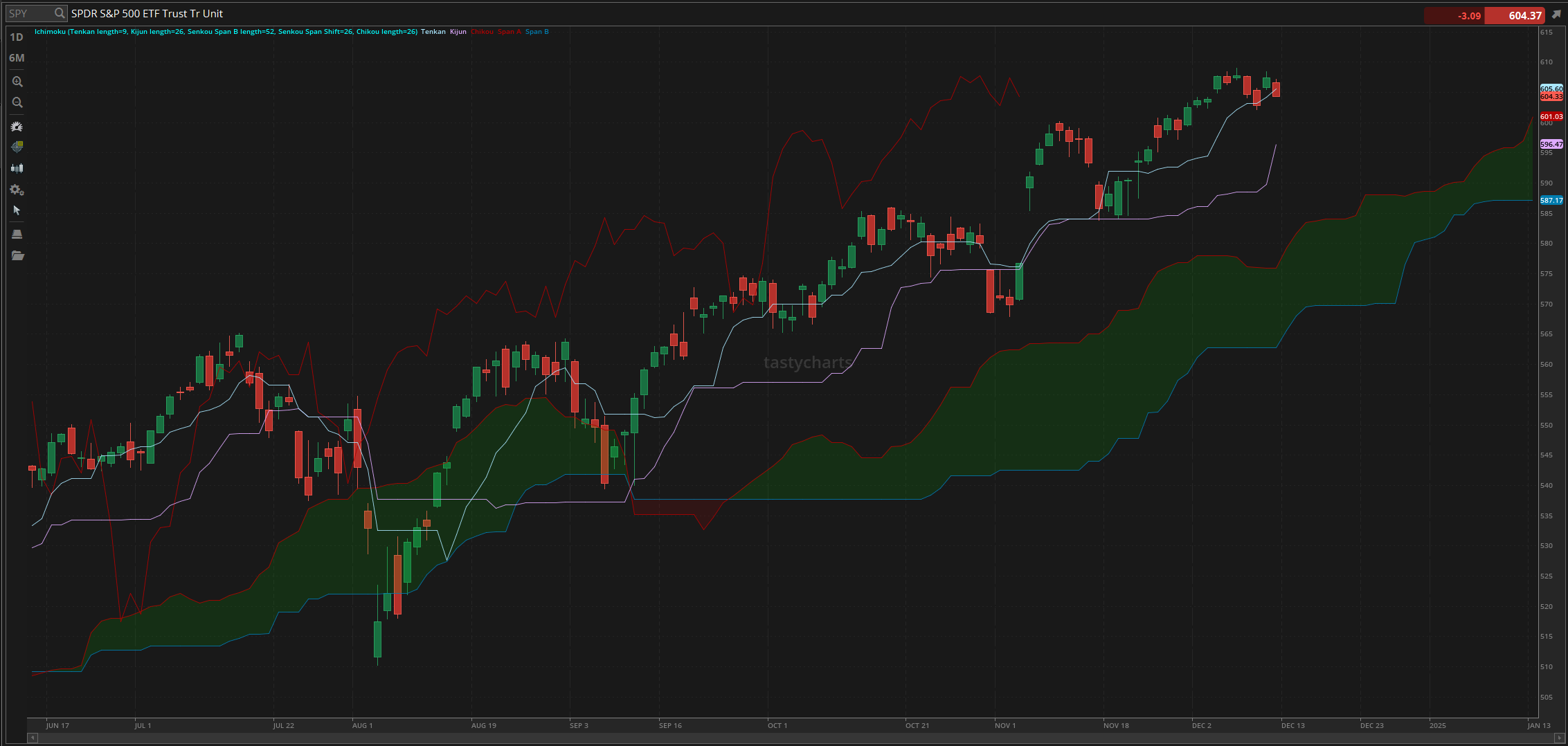

The updated $SPY daily levels are as follows:

Conversion Line Support: $605.60

Baseline Support: $596.47

Psychological Support: $600

Daily Cloud Support: $575.93

Thoughts & Comments from Yesterday - 12/12/2024

Yesterday was tough for the overall markets, as there was no solid bullish momentum. Opportunities were consistently presented to us, but traders were unfortunately caught in a cycle of bearish momentum, difficult-to-navigate conditions, and overall confusion as $SPY was consistently chopping around and displaying weakness across the board. It did not help that there was a consistent bearish sentiment that was driven into the markets as a result of BTC dropping continually since opening, but as we always say… C’est la vie!

We started the day with $SPY opening at $606.64, looking relatively weak at open as a result of PPI data coming back slightly higher than expected. The slightly higher PPI report was nothing of any major concern, but it did cause enough slight bearish sentiment to make trading a little more challenging to do with confidence. We dropped from open to make a relative low, slightly above $605. We watched as $SPY recovered nicely during the lunchtime lull, going on to make the official high of the day trading at $607.14, before quickly reversing, snapping back down, and continuing the bearish trend during the afternoon.

The afternoon session was no better, as it was met with consistent bearish momentum. $SPY continually made new lows of the day throughout the entire afternoon and quickly dropped leading into close, where yesterday was one of those days where the official low of the day was the close price, as $SPY ended the day trading at $604.33, down a little over $3 for the day, or down roughly 0.5%.

Despite relatively challenging market conditions, there were many great opportunities to trade and allocate. Many of our positions worked phenomenally, so we consider that a win in our books. Congratulations to anyone in $INTC with us, for once we were the top performing semiconductor!

It will be interesting to see where the markets take us today, so I hope you all are prepared!

S&P 500 Heat Map - 12/12/2024

Thoughts & Comments for Today - 12/13/2024

Today SHOULD be a rather interesting and fun time for the overall markets. With the way that everything sits during the pre-market session. Conditions are looking strong, traders should be optimistic, and hopefully, today is an extremely profitable day for the overall markets. Traders should be presented with great opportunities to capitalize on the bullish momentum generated during the pre-market session. Still, now it is just a matter of remaining consistent with finding those said opportunities.

The one thing I am actively watching out for in these market conditions is seeing how $SPY reacts to the daily conversion line support. We have watched as $SPY has started to stagnate, displaying signs of momentum slowing down. I am still confident as a result of the market placement, as markets are still extremely strong, but cracks are starting to form here at the top. Bullish momentum has come to a screeching halt, while markets have remained extremely close to the previous all-time high. Please be on the lookout as we will have a large directional move here in the inevitable future; the real question is, are we going to break out and make new all-time highs in the process? Or are we going to watch as $SPY finally breaks daily support below and starts a minor sell-off?

As bad as this sounds, I do not think I would mind capitalizing on a minor market reversal. With the Santa rally hopefully happening again this year, I would love for us to find an opportunity to buy a dip and allocate accordingly into some mega-cap organizations with relative confidence to allow us to ride general market strength leading into next year.

Just watch out for semiconductors and cryptocurrency, which are the leading indicators for the markets. If both cryptocurrencies and semiconductors rally, then the markets are only going to continue to move up, make new all-time highs, and we get to relax and enjoy comfort, but if we watch BTC break below $100,000 again and watch as semiconductors sell-off, please prepare accordingly and tread lightly.

I would highly advise each and every one of you to start to take risks off the table at these levels and reallocate your portfolios accordingly when given an opportunity to do so.

For my allocations today, as I have stated previously, I do not intend on actively attempting to scalp or day trade as much this week. I added to my $INTC and $GRYP position yesterday, adding roughly 40% to my $INTC position and roughly 10,000 shares of $GRYP to my portfolio to average down. I’ll adjust my positions accordingly when given an opportunity to do so. Still, I do intend on simply sitting back and having a relatively stress-free time today, preparing accordingly for next week, and adjusting my portfolio where I can!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $GRYP, $TSLA, $AIFF, $NVDA, $RIVN, $GOOGL, $INTC, $BA

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC / $DG / $BA / $RIVN

Economic News for 12/13/2024 (ET):

Import Price Index - 8:30 AM

Notable Earnings for 12/13/2024

Pre-Market Earnings:

No Earnings Scheduled

Wrap up

Hopefully, market conditions will continue to remain favorable for us. Opportunities will consistently be presented to us to capitalize on these conditions, so make the most out of the trading day today, and let’s have some fun in the process. I think that many traders should be able to realize a significant amount of gains today with relative ease, so now it is just a matter of being able to do so and go on to enjoy the weekend! Again, I apologize for being away during the back half of the trading day; I am sure you all understand!!!

Good luck trading, and let’s end this week strong!!!