HaiKhuu Daily Report - 12/24/2025

Good morning, and happy Wednesday! Happy Holidays!!!

This is going to be a quick report for a quick day for the markets. I hope you all are doing well and are excited about these market conditions! Markets will close today at 1 pm EST, so this is going to be one of those days that absolutely flies by. I hope you all are ready for some interesting volatility and momentum in the markets.

Go into today expecting markets to remain relatively low-volume, with another directional momentum-based move and a chance of hitting a new all-time high today. Please, just be careful and cautious while you are attempting to trade, and do everything in your power to realize a significant amount of gains in an extremely short period of time.

Just understand that today, of all days, is going to be extremely difficult to trade and allocate, but opportunities are going to be amongst us and we are going to have an amazing time in the process, so please, let’s do everything in our power to realize a significant amount of gains, and have an amazing time!

So let’s see where the markets take us today, and have some fun leading into the holidays!

Good luck trading today, and let’s see a new all-time high!

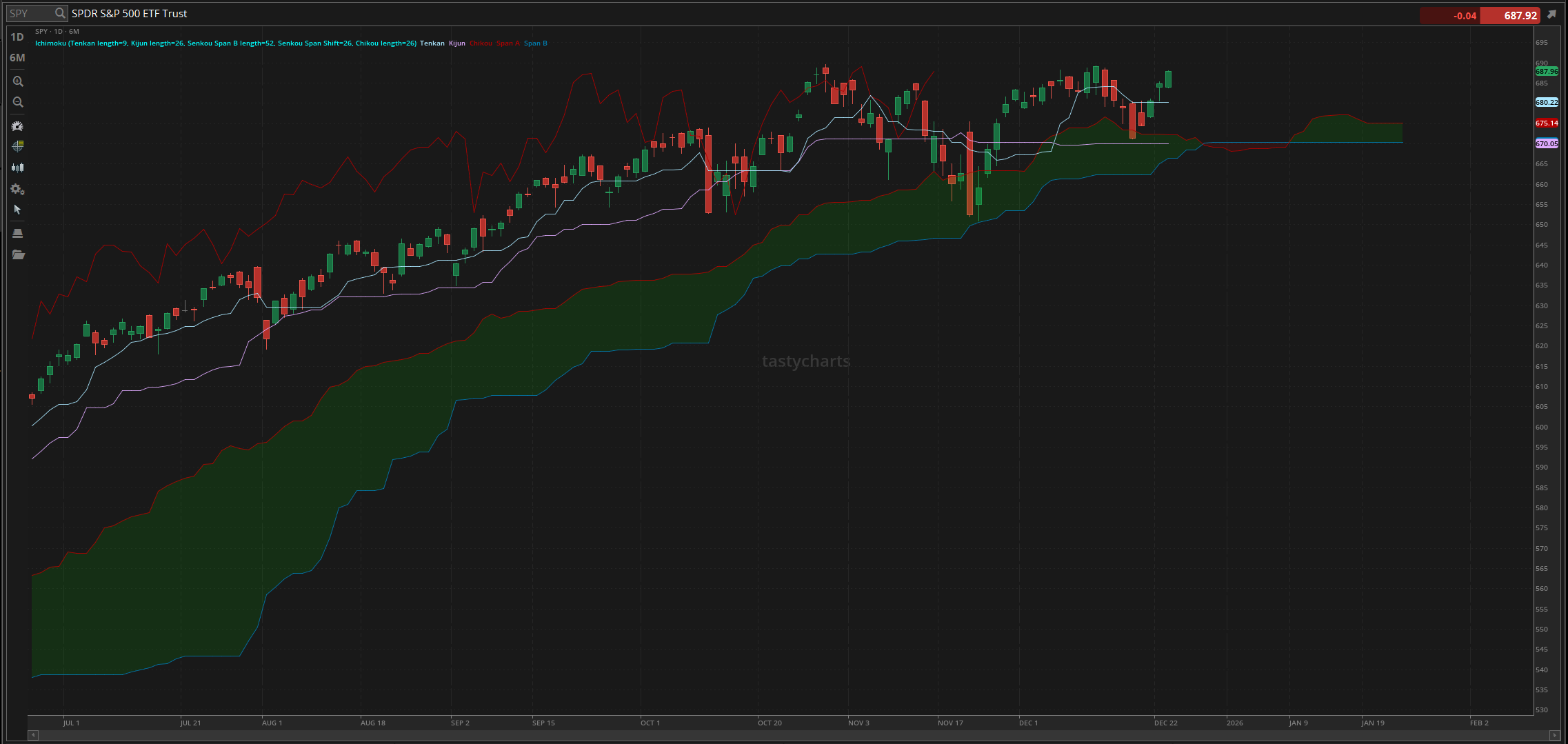

The updated $SPY daily levels are as follows:

Conversion Line Support: $680.22

Baseline Support: $670.05

Psychological Support: $680

Daily Cloud Support: $672.39

Thoughts & Comments from Yesterday - 12/23/2025

Yesterday was one of those perfect predictions. I hope you all heard the report and listened to what was said, because our prediction was almost perfect. I went into the day with the expectation of a momentum-based directional move in the markets that was slow and choppy. I clearly stated I did not know the direction we were headed, but due to the conditions, we were naturally more bullish, and as a result, we absolutely killed it yesterday with the momentum available, so I hope you all had some fun and printed a significant amount of cash in the process!

We started yesterday with $SPY opening at $683.94, conditions at open were relatively neutral with $SPY dropping about $1 from the previous close, but watched as $SPY quickly popped up and made a relative high around $686 before coming back down, and testing the previous close price.

Once we had our final reversal for the morning, $SPY slowly went from $685 to $686 to $687, going on to make the official high of the day at $688.20. Conditions all across the board were relatively neutral, slow, and did not provide us with great opportunities to quickly scalp, but anyone who simply held strong equities, or attempted to follow the momentum in the markets with a longer day trade, absolutely printed.

We officially ended the day with $SPY trading at $687.96, up roughly $3 for the day, or just shy of 0.5%.

I am not saying that the market conditions of yesterday were perfect, but I am saying that if anyone simply listened to the warnings provided and followed the sentiment of yesterday, you all would have been able to print with ease. So, I hope you all are ready to see where the markets are going to take us today, and make the most out of these conditions! Let’s have some fun, realize some gains, and have a great time!

S&P 500 Heat Map - 12/23/2025

Thoughts & Comments for Today - 12/24/2025

Today should be a fun time for the markets. As I have said multiple times already, the markets are going to close early today, so the sentiment today is going to be the same as any typical half-day for the markets.

Please, go into today with the expectations that these market conditions are going to be significantly lower volume, and there are momentum-based movements here in the short term. It genuinely would not surprise me in the case that the markets decide to have a larger directional move today in preparation for the Santa rally, but at the same time, with the way the markets are moving, everyone should be extremely skeptical about attempting to allocate here.

I genuinely believe that anyone who is attempting to FOMO into the markets at this point is either going to watch as the markets absolutely rip and rally on their behalf, watching as the markets provide them with everything they hoped for, or watch as the markets humble a bunch of children as we see inconsistencies throughout the day.

If I had to state my sentiment again, I would say that I am a skittish bull, where I am going to continue to remain bullish and optimistic about these market conditions, mostly leading into the end of the year, but at the same time, with the way the markets are moving, no one should be blindly bullish.

Continue to watch the real-time market momentum. As much as I love being bullish and optimistic, if we are seeing signs of a reversal and bearish signals in the water, there is no reason to be overly bullish. Just watch the general market momentum and do everything in your power to realize as many gains as you can. Traders are going to have a tough time with these market conditions, but that is exactly what we need to be able to capitalize on these conditions.

So, please, just continue to be smart, be safe, and have an amazing time. Many traders genuinely should print a significant amount today, it just depends on where you allocate and which direction.

I’ve said this before, just please don’t be overly bullish and hope that the markets work out in your favor. Have conviction with your allocations, and do not force anything today. If I am being real, I do not anticipate actively trading today; that is just my personal sentiment and what I anticipate doing going into today. Obviously, if there is an opportunity that I can capitalize on, you know I will do everything in my power to achieve that, so again, let’s just make the most out of today and see where the markets take us!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $ORCL, $NVDA, $TSLA, $BABA, $MSFT

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 12/24/2025 (ET):

Initial Jobless Claims - 8:30 AM

Notable Earnings for 12/24/2025:

Pre-Market Earnings:

No Earnings Scheduled

After Market Earnings:

Limoneira (LMNR)

Wrap up

Hopefully, this is going to be a quick day for the markets that provide us all with a significant amount of gains in an extremely short period of time, leading into the holiday season. Again, don’t forget that the markets close at 1 pm EST today! So please, be smart, be safe, and just have a great time while attempting to trade these market conditions today!

Good luck trading, and let’s see where $SPY takes us!