HaiKhuu Daily Report - 12/27/2024

Good morning, and happy Friday!!! Welcome to the last Friday of 2024! Market conditions are looking kinda fun with $SPY testing $600 again, and opportunities will be consistently presented to us to take care of these fun conditions.

I would be careful attempting to capitalize on these market conditions as anything can genuinely happen, but at the same time, just remember that these market conditions are still strong, and we can watch as $SPY rallies back above $600 and continues to move up beautifully in the process. I will warn you all to practice safe risk management. So please tread lightly and prepare for some choppy market conditions, as many traders are confused.

This will be a fun day, so good luck, and let’s end this week strong!

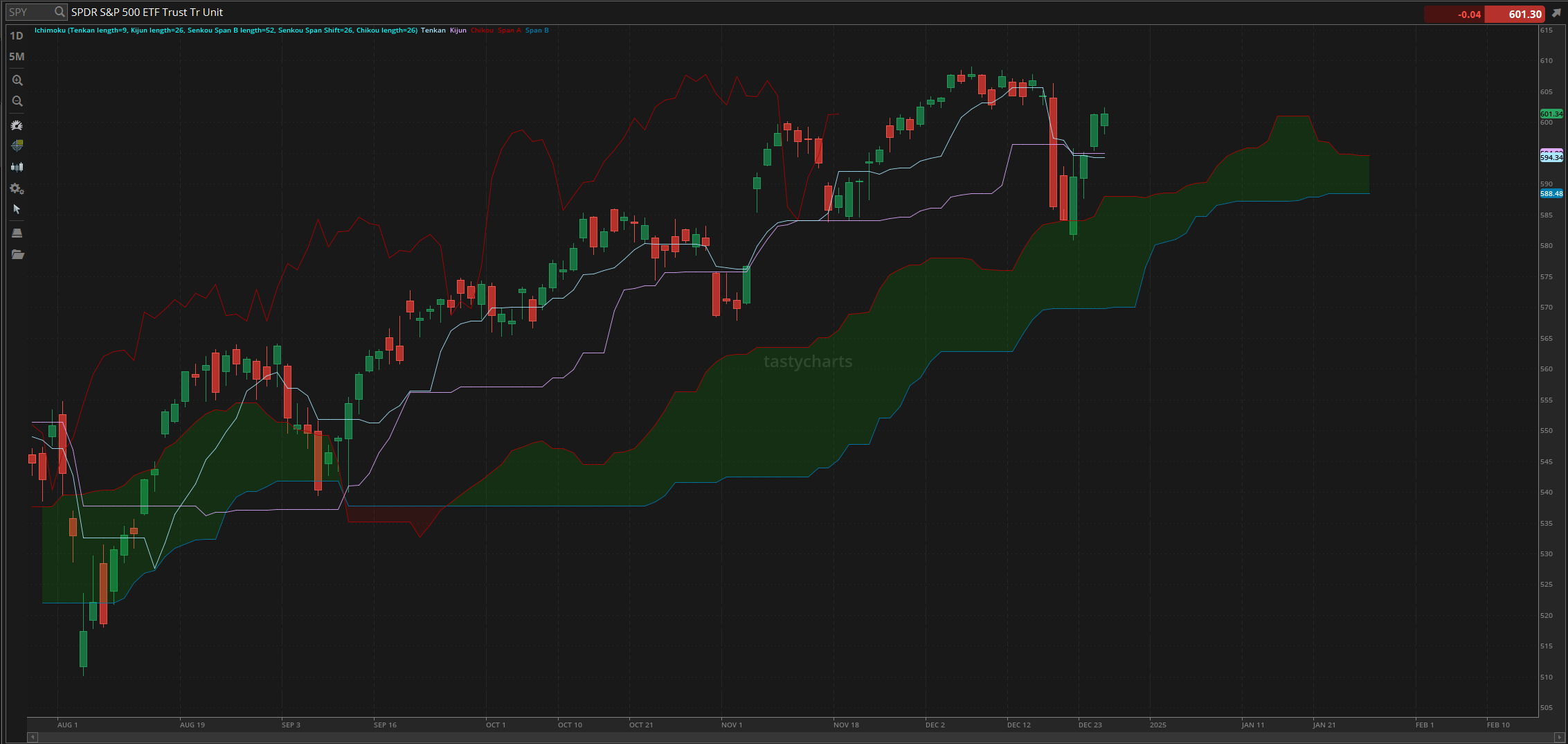

The updated $SPY daily levels are as follows:

Conversion Line Support: $594.34

Baseline Support: $594.99

Psychological Resistance: $600

Daily Cloud Support: $588.02

Thoughts & Comments from Yesterday - 12/26/2024

Yesterday was a great day for the markets despite remaining relatively neutral overall. Conditions were looking tough going into the morning. Still, by the end of the day, we were presented with a beautiful buy-the-dip opportunity and were able to capitalize on the overall strong market conditions!

So, we started the day with the markets not looking the best, opening the day at $599.41, and watched as the markets quickly dropped roughly a half hour after open, making the official low of the day trading at $598.10, looking relatively weak, but watched as market conditions quickly strengthened and rallied into the lunchtime session, and went on to make the official high of the day trading at $602.48. Conditions at the top were great, but we watched as the entirety of the afternoon had relatively lower momentum and was significantly slower than the morning.

The afternoon consisted of choppy conditions as we watched $SPYT remain relatively neutral around the previous close price and did not deviate heavily from that point. Conditions were tough to navigate and difficult to capitalize on, but thankfully, again, we remained relatively strong in the process and watched as $SPY ended the day officially trading at $601.34, up $0.04 for the day, or up 0.0067%. Quite a large movement overall (sarcasm), but at the same time, despite lower volume and opportunity, we did not watch as the markets fell as a result.

I would definitely consider the movement in the markets yesterday a beautiful win, but I feel like it is subjective, as well as dependent on where you allocated in the process. Life goes on, and market conditions continue to change. So, hopefully, you all were able to make the most out of yesterday and had a great time with us!

S&P 500 Heat Map - 12/24/2024

Thoughts & Comments for Today - 12/27/2024

Today should be a fun way to round out the year. With this being the last Friday of the year, I expect many traders to attempt to trade this expiration and have fun rounding out the year. With this said, again, be cautious on where you decide to enter and what you decide to allocate towards, but at the same time, there are going to be many traders that will be taking on some irrationally large risks today, meaning expect to see some irrational movements in the markets. Expect choppy market conditions mostly as $SPY hovers around $600, and tread lightly.

I believe there is a high likelihood that we will watch the markets have a large directional movement, but not before chopping traders around consistently at $600. This is going to be an amazing day for the people who are attempting to scalp. Opportunities will constantly be presented to you, but at the same time, there are sharks in the water, and these conditions will be difficult to navigate confidently. Make smart plays, take on smart risks, and protect your bottom line.

If you are scalping, this will be an amazing day to trade with great opportunities presented to us. If you are day trading, you should have some fun finding some insane opportunities, and if you are simply holding strong positions and enjoying this overall market momentum, continue relaxing and loving these conditions. I think the markets should only continue to naturally go up for a bit in 2025, so continue holding and enjoying these conditions.

Just again, continue to practice risk management. These conditions are significantly less sketchy than last Wednesday, and people should be comfortable navigating these conditions with ease. Sit back, enjoy the ride, and make the most of these conditions!

For my allocations today, I intend to grab some 0-DTE contracts on $SPY. I do not know when I will enter them or whichever direction I will pick, but I will be attempting to trade some $SPY today to have some fun. This is going to be extremely risky, mostly if I do not manage the position well, so please tread lightly if you attempt to trade 0-DTE’s. I'm just trying to have some fun, not trying to make/lose some life-changing money. I’m still holding a bunch of long positions in my portfolio that I do not anticipate selling soon, but I will actively manage those positions.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $INTC, $GRYP, BTC, $AIFF, $RIVN, $TSLA, $DG, $NVDA

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC / $BA / $RIVN / $DG

Economic News for 12/27/2024 (ET):

Retail Inventories - 8:30 AM

Wholesale Inventories - 8:30 AM

Notable Earnings for 12/27/2024

Pre-Market Earnings:

No Earnings Scheduled

After-Market Earnings:

No Earnings Scheduled

Wrap up

Hopefully, market conditions will continue to print for us as we round the year out. Please continue to tread lightly and understand the amount of underlying risk involved in attempting to trade today. Lucky traders will print money, great traders will print money, and everyone else will burn in the process. Have some fun and take advantage of the opportunities that will be presented today, but just be smart and safe. 2024 has been an amazing year, and I will see you in 2025!

Good luck trading, and let’s end this year strong!!!