HaiKhuu Daily Report 2/03/2023

Good morning and happy Friday! I hope you all are feeling amazing after the insane movements we’ve seen in the general markets this week. I know I’ve been constantly talking about hedging your portfolio, and I am going to continue to say it as I am expecting a significant downtrend in the market that will result in a significant amount of traders having a difficult time. Here at HaiKhuu, we are attempting to ease those difficult times and assist you in securing consistent profits.

If you have not hedged your portfolio yet, please look to do so. If you’ve already hedged, and have extra cash set aside, look to sell some 0-DTE CSPs to capitalize on the generalized momentum in the markets and are able to realize some relatively passive gains today. I’ll talk more about CSPs that interest me later in this report.

Thoughts & Comments from 2/02/2023

Yesterday was an extremely interesting yet volatile day for the markets. Lots of traders made a significant amount of money, and a significant amount of traders unfortunately lost. There were great opportunities to go both long and short intraday and realize some serious gains. If you were actively trading yesterday and were able to make money due to confidence rather than luck, great job timing out your allocations, and good job to anyone who listened to me to hedge at what was literally the cheapest point a hedge.

The markets started off relatively slower yesterday, with $SPY opening the day trading at $414.83 and showing a relative downtrend for the start of the day, selling off and making an official low of the trading day with $SPY hitting $412.89 and then going on an absolute tear. Markets came up from the relative bottom and actively chopped and tested the $417 level.

We were fortunate that we were able to break out above that level to make an official high of day at $418.31 and watched as the markets went from extremely confident and hitting that high to selling off extremely hard, coming all the way back down to $413.50. It was a great opportunity to hedge your long positions at the relative top and watch as you were able to secure profits on the way down. After testing $413.50, we did watch as the markets recovered in power hour, moving up all the way to $416.78 at close, with a lot of people being excited about the major earnings happening after hours.

It was an extremely choppy day for the markets resulting in a significant amount of momentum in both directions. If you were able to catch any of those general waves, you should have been able to realize a lot of gains, but if you were incorrect on your timing, sorry… That should have been relatively rough. I hope you all had fun trading yesterday and seized the opportunities that were available to you!

$SPY ONE MINUTE INTRADAY CHART 2/02

Thoughts & Comments for Today 2/03/2023

Today is going to be an interesting day for the markets. At the time of writing this report, markets are down as a result of major earnings happening yesterday. $AMZN, $AAPL, and $GOOGL all had earnings and showed great momentum… and great selling after the fact. Apple has recovered the majority of the incurred losses, while $GOOGL and $AMZN are down roughly 3% each.

Markets are moving up after making relative pre-market lows, but realistically there will be many opportunities to go both long and short in these current market conditions. One position I would highly recommend in these current market conditions and the fact that it is Friday is to look into selling 0-DTE CSPs on both $AMZN and $GOOGL. Between the two, you are going to make a higher return allocating into the $GOOGL CSP, but realistically, both are going to be a great opportunity early in the morning.

I would recommend that you scale into these positions accordingly to minimize the amount of general risk and exposure you are taking on while all of this is happening. Selling these CSPs around the ~$100 strike price will net you a significant amount of gains in a relatively short period of time, and if you want to take on more risk while limiting the capital requirement, you can look into making that CSP’s a spread, by purchasing something in the $90-95 range, to minimize the capital requirement by roughly 90~ish%

Creating a spread will theoretically increase your general risks significantly in the case of a major market downturn, but realistically you will be able to capitalize on enough premium early in the day where you will be able to exit your position and realize between 50-75% of the premium that would have been collected and exit the position about an hour after open. Please be careful with this strategy, make sure you are not overallocated, and limit the amount of general exposure you are taking.

There will be many trading opportunities in these current market conditions. Please do not get greedy, and make sure you are limiting your trades today. Lots of people will get burnt today and will get burnt over the next couple of weeks.

Hedge your portfolio, realize some gains, and do not get greedy. Have some fun in the process, but again. Do NOT get greedy.

February will be a difficult month for the markets, so make the most out of it and roll with the flow. Follow the momentum and do not fight any trends.

Have cash ready to allocate when the markets have hit a relative bottom.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

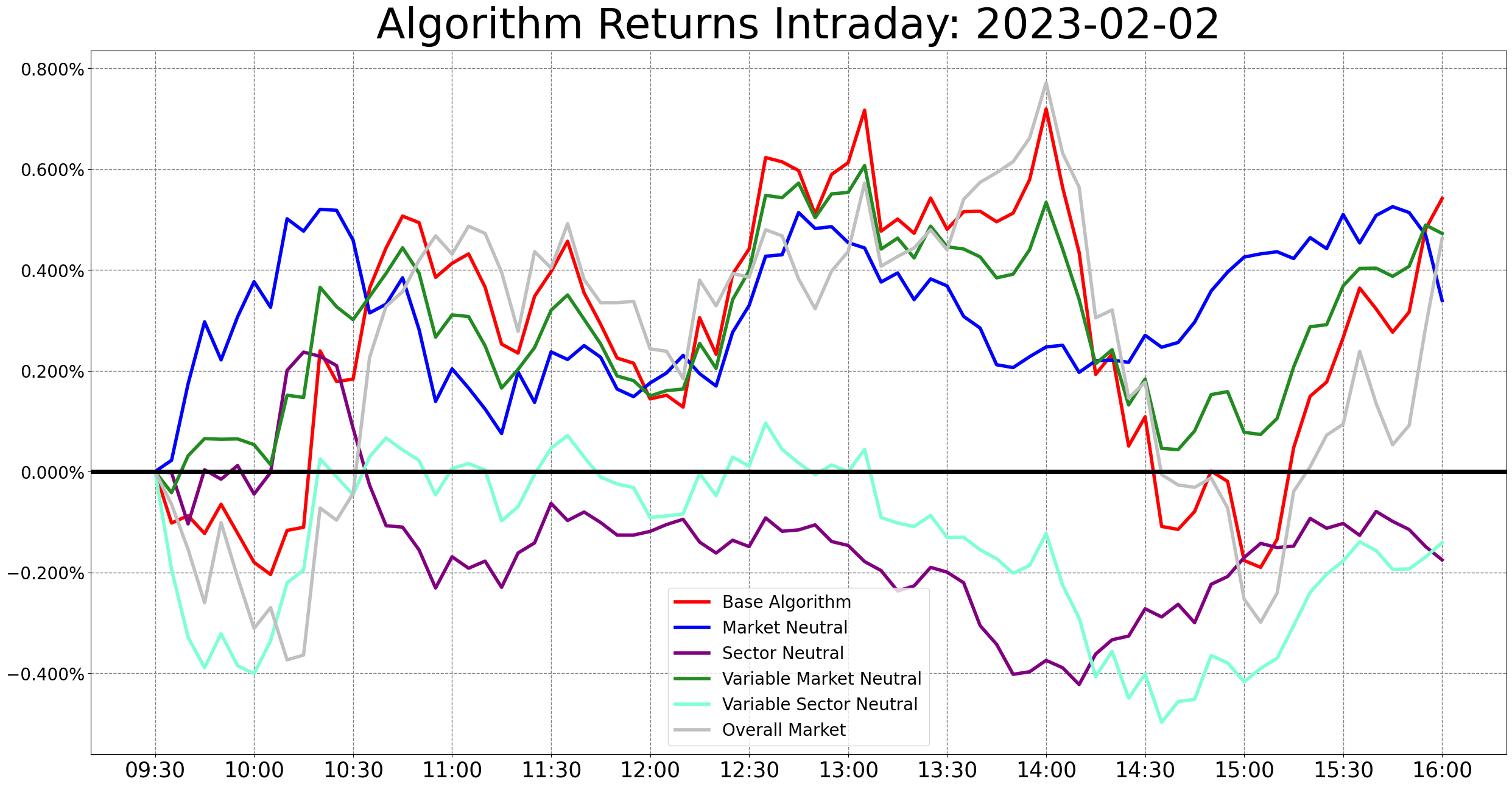

HaiKhuu Proprietary Algorithm Report:

Yesterday was an amazing day for the algorithm outperforming the general markets by a small margin and outperforming the long-term portfolio it was built on. Our technical analysis is doing amazing in these current market conditions, and we are extremely proud of the results. There is nothing else that needs to be said, as the results speak for themselves.

The results of last week are as follows:

Baseline:

The Market +0.46%

Our Results:

Base Algorithm +0.54%

Variable Market Neutral +0.47%

Market Neutral +0.34%

Variable Sector Neutral -0.14%

Sector Neutral -0.18%

Long-Term Portfolio -0.55%

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

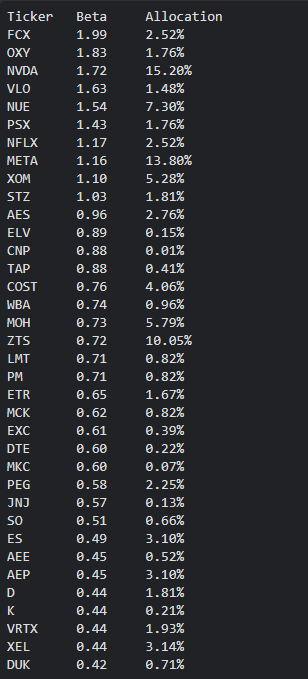

Generated entries for 2/03/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $AAPL, $AMZN , $GOOGL, $META, $BABA , $RBLX , $MSFT

Free Equity List:

Safe - $SPY

Risky - $TSLA , $RBLX , $AMZN , $GOOGL

Position Opportunities:

Start hedging your portfolio while vix is extremely low. Grab multiple puts with a long expiration to protect your portfolio

Set stops in guaranteed profit for any position you have.

Pick up some leaps in organizations you are bullish on over the span of a couple of years ($GOOG/L & $AMZN)

Pick up broad market ETFs slowly ($SPY / $QQQ)

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN

Long-Term Speculative Play - $META * PLAYED OUT, IF IN SELL*

Short-Term Risky Play - $TSLA * PLAYED OUT, IF IN SELL*

Short-Term Speculative Play - $RBLX * PLAYED OUT, IF IN SELL*

Economic News for 2/03/2023

Nonfarm payrolls - 8:30 AM ET

Unemployment rate - 8:30 AM ET

Average hourly earnings - 8:30 AM ET

Labor-force participation rate, 25-54 year-olds - 8:30 AM ET

S&P U.S. services PMI (final) - 9:45 AM ET

ISM services index - 10 AM ET

Notable Earnings for 2/03/2023

Pre-Market Earnings:

Sanofi (SNY)

Cigna Corp (CI)

Regeneron (REGN)

Aon Plc (AON)

LyondellBasell (LYB)

Cboe Global Markets (CBOE)

Saia (SAIA)

Piper Sandler (PIPR)

GrafTech International (EAF)

Avantor (AVTR)

Wrap up

Overall, PLEASE be smart while trading today. If you hedged your portfolio yesterday at the top, you are in a great place, if you did not hedge, there still is an opportunity to hedge, but the timing is not as optimal for entry. Look to realize gains when given an opportunity to do so and look to sell some 0-DTE CSPs to capitalize on the general momentum of the current market conditions

Good luck trading today and have a wonderful weekend!