HaiKhuu Daily Report 5/24/2023

Good morning and happy Wednesday traders! Hope you all had an amazing night and are excited for the markets today! $SPY is down and relatively flat at this moment signaling we are slowly continuing down at this moment. We are still in greed on the fear and greed index, which is not a good sign for the general market, and shows that there is still more room for us to fall. I hope you all are ready and were hedging your account at the top and opening up some bearish allocations because it seems like the cookie is starting to crumble.

$SPY has officially rejected $420 and has broken the minor psychological level of $415, and looks like the next level of support is $410. It would not surprise me if we magnet back to $410, and realistically, assuming that AI hype is slowly dying off, for us to continue to fall to test $400. Ideally, we do not break below $400, but I can very easily see that happen. Be on the lookout for $NVDA earnings after hours today, that in my opinion will be the catalyst for the next major movement in the general markets.

Please continue to tread lightly as the summer session is among us and is going to be extremely difficult for the large majority.

Stay solvent now. Cash is king. Allocate at the bottom, scale in slowly, and prepare for what is going to be one hell of a ride. Hope you all are excited because the best of us are going to make a HELL of a lot of money here in the near future.

Capitalize on the opportunities available to us now, and continue to make smart plays.

Good luck trading today, and let’s make some BANK!

Thoughts & Comments from 5/23/2023

Yesterday was an interesting and rough day for the general markets. We opened the day down from the previous close, with $SPY trading at $417.13, and did not look strong at all in any way shape, or form. The markets were lacking the confidence they previously had back at $420 and people were starting to get a little nervous about market conditions. We watched as from open, we had slight bullish confidence, as we moved up to test $418, but were not able to break it with enough confidence to sustain $SPY at those levels.

Markets remained relatively flat for the large majority of the morning, with $SPY making a high of day trading at $418.11, sustaining that level extremely well, but not having enough confidence to hold that level. We started to sell as people came back to the markets after the lunchtime lull, and that is where all of the bearish momentum in the markets started. We were trending around $418 for the large majority of the day, but quickly sold off to the $416 range, making a low of the day at that point. This level was significant as it did show support, but that support quickly was shattered after making a quick bounce. We continually made new lows of the day as $SPY quickly dropped off going from $416 all the way down to actively testing $414. We were able to hold $414 pretty well throughout the rest of the day, despite $SPY making the official low of the day being $413.68.

We ended the day with $SPY trading at $414.09, down $4.70 from the previous close, or down approximately 1.12%, with an intraday bearish movement of -0.71%. This was a tough time for the general markets as $SPY sold off, but I cannot say that this was not expected in any way shape, or form. We knew that $SPY 420 was going to be a rejection point and we’ve brought it up in the past.

Hopefully, you all ended the day alright, and you all took our warnings on holding cash, hedging your accounts, and entering into bearish allocations to prepare for this movement.

Thoughts & Comments for Today, 5/24/2023

Today should be another interesting time for the general markets. I personally am expecting to see some more chop in the general markets and a good chance that there is a small bounce before this selling continues, but in the short term, I think that we should all be preparing for a continuation of this downtrend in the markets. With this movement in the markets and people preparing for the long weekend, please expect to see selling, but be pleasantly surprised in the case we see some bullish momentum.

Historically, Thursday (tomorrow) is a bullish day for the general markets, but with the trends in the markets, I would be cautious attempting to allocate with that being the only justification for a move up. It is a little late to hedge your accounts now, but you still can hedge, it just is not as optimal now as when VIX was in the 16 range.

We have $NVDA earnings later today, which will really be the saving grace, or the final nail in the coffin for how the markets will move over the next couple of days, and watch as it will impact the sentiment towards AI and market conditions.

I do believe that AI is the future and that $NVDA, $MSFT, and $GOOGL will benefit heavily as a result, but I believe that in the short term, a lot of these organizations are highly overvalued and as a result will be a catalyst for the markets to either continue up with strength assuming strong $NVDA earnings, or come back down to “reasonable” levels, as $NVDA comes down on earnings, and impacts the AI “hype” and impact organizations like $AMD, $MSFT, and $GOOGL.

While I do want to see the markets continue to move up with relative strength, I personally do believe that AI is what is keeping the markets up at this point and that if $NVDA sees a decline, the whole market will follow suit as a result.

Please be careful and tread extremely lightly in these market conditions as we are at the point of make or break.

Follow the momentum, follow the smart money, and do not make any positions that are overly risky. Make sure to have capital free to allocate at the bottom, and prepare for what should be a bumpy ride, followed by an exciting time for us to allocate into strong equities at the relative bottom, to watch a face-ripping bullish movement in the general markets.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Yesterday was a rough time for the markets and a terrible time to switch to a more aggressive portfolio. C’est la vie, it is what it is. We will see how we can improve the situation and positively adjust accordingly going into the summer session. Just as a reminder, we are LIVE TESTING a new portfolio at this time, so please take any allocations recommended with a grain of salt. In the case market conditions are good, this portfolio should do phenomenally, but in the case market conditions are weak, please be extremely cautious on any allocation.

To get an in-depth analysis of our algorithms' performance, check out Asher’s Report!

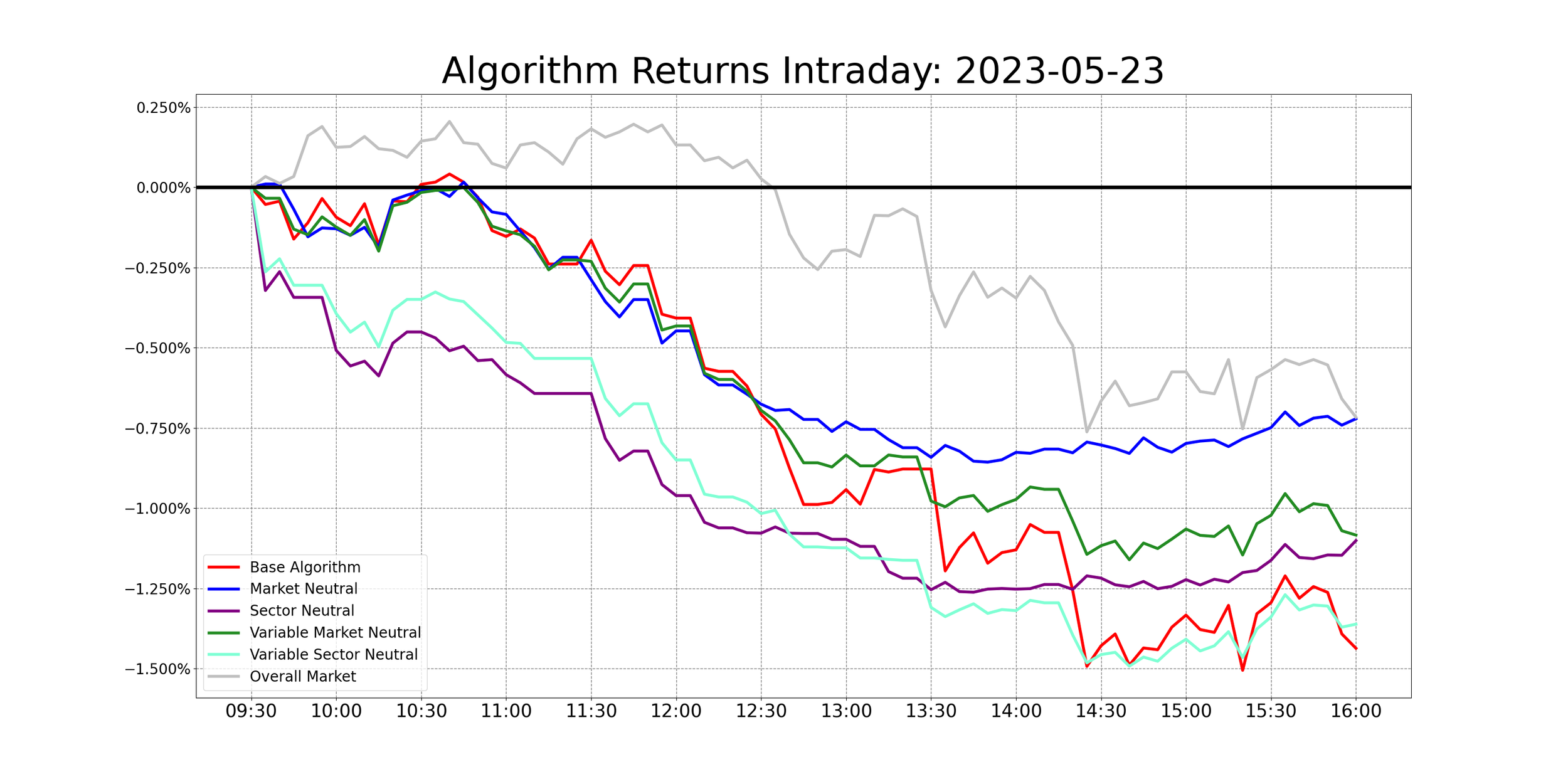

The results of yesterday are as followed:

Baseline:

$SPY: -0.71%

Our Results:

Market Neutral: -0.73%

Variable Market Neutral: -1.09%

Sector Neutral: -1.09%

Long-Term Portfolio: -1.35%

Variable Sector Neutral: -1.35%

Base Algorithm: -1.44%

Please be cautious about taking these alerts right now. As always, they are valid from a technical analysis standpoint, but market conditions are not optimal right now, nor are they looking optimistic. As I said before, we are currently performing a live test on our new portfolio to see how it reacts in choppy conditions, so please take extreme caution when attempting to enter into any of these positions today. Make sure to practice the highest level of risk management to limit your downside exposure, and to always set stops to minimize that downside risk. Increase those stops when given an opportunity to do so and be smart in the process of everything. Do your own due diligence prior to entering into any of these positions and make sure YOU have confidence in the allocation.

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

Algorithmic Alerts for 5/24/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $NVDA, $GOOGL, $BABA , $AAPL , $MSFT

Position Opportunities:

Hedge the positions you want to hold

Set stops in guaranteed profit for any position you are in profit in

Cut all positions you are not comfortable holding

Exit positions you are comfortable taking profit on

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN

Long-Term Riskier EV Play - $RIVN

Economic News for 5/24/2023

Fed Gov. Christopher Waller speaks - 12:40 PM ET

Minutes of Fed's May FOMC meeting - 2 PM ET

Notable Earnings for 5/24/2023

Pre-Market Earnings:

Analog Devices (ADI)

Xpeng (XPEV)

KANZHUN LIMITED (BZ)

Futu Holdings (FUTU)

Petco (WOOF)

Kohl's (KSS)

Super Group (SGHC)

Abercrombie & Fitch (ANF)

Photronics (PLAB)

Dorian (LPG)

After-Market Earnings:

Nvidia (NVDA)

Snowflake (SNOW)

Splunk (SPLK)

U-Haul Holding (UHAL)

UiPath (PATH)

Nutanix (NTNX)

Digital Turbine (APPS)

Enersys (ENS)

American Eagle Outfitter (AEO)

LiveRamp Holdings (RAMP)

Wrap up

Overall, please just be smart and safe in these market conditions. Follow the momentum and the money when given an opportunity to do so, but look to continually decrease risk, and take advantage of the opportunities that are presented to you. We are about to see a shift in market momentum and sentiment, and the large majority of this movement in the near future will come from $NVDA earnings after hours today.

Be smart, be safe, realize some gains, and practice safe risk management today

Good luck trading, and I hope you all are prepared for this summer session!