HaiKhuu Daily Report 5/25/2023

Good morning and happy Thursday! Hope you traders all are hyped and are ready for a day of increased bullish momentum and short-term hype in the markets. $NVDA is up to all-time highs after having an amazing performance during earnings, driving them up over 25% overnight, and bringing them officially to a TRILLION dollar market cap. This hype and momentum is not sustainable in the grand scheme of things, but it is an amazing opportunity to actively trade and take advantage of this confidence in the markets. Look to actively day trade and capitalize on the opportunities that are presented to us in these market conditions.

Congratulations to anyone who went long $NVDA, you should be up significantly as a result.

The markets should be strong through the next week, and I would not recommend attempting to play this momentum on $NVDA. It is highly overpriced at the momentum but realistically should continue moving up as people FOMO into them at literally the top. Be careful, be safe, and wait for a shift in the momentum prior to attempting to short $NVDA or this market.

Good luck trading today, and let’s make the most out of the opportunities that are presented to us in these current conditions.

Thoughts & Comments from 5/24/2023

Yesterday was an extremely interesting time for the general markets with a significant amount of bearish momentum that impacted people’s ability to actively trade. At open, we watched as $SPY opened down significantly from the previous close, with $SPY trading at $412.43, and showing a significant amount of bearish momentum right from open. We watched as the markets came down heavily within the first half hour of the day, and lacked momentum to move up for the large majority of the day.

We hovered around the $410 magnet zone, and consistently chopped around the entire day, making it extremely difficult to attempt to capitalize on any sort of large movement, and stopping a lot of traders out.

$SPY made an official low of the trading day right under $410, at $409.88, and was quickly bought back up. We did watch as people started to come back for FOMC minutes, that there was a small movement back up on $SPY, causing it to make a relative high, trading slightly above $411, but did not provide enough encouragement, to get the markets to continue moving up.

Leading into power hour, we watched as the markets came down slightly to get back into the lower $410 range, but watched as we quickly ran up afterward to make a relative high, trading around $412, prior to coming down to officially close the day trading at $411.09, down $3 from the previous close, or down approximately 0.72%, with an intraday bearish movement of -0.31%

It was a tough day to trade, with not many opportunities to allocate into the markets with confidence, so C’est la vie.

The large movement that positively impacted the markets, was $NVDA earnings after hours. $NVDA caused the markets to move up heavily and bring up other semiconductors like $AMD, and other companies involved with AI, like $MSFT and $GOOGL.

For those organizations, this is amazing as they are reaching new 52-week highs, while $NVDA has made a new official all-time high. I will talk more about my personal sentiment in the markets a little later on in this report.

Thoughts & Comments for Today, 5/25/2023

Today will be a fun day for the general markets providing us with many opportunities to actively trade and realize some significant gains with relative ease. Look to follow the momentum in the general markets, and do not attempt to fight any trends.

My personal recommendation is to allocate into strong equities with confidence, and hold them throughout the day as a day trade on a sign of a reversal from a relative bottom, or to continually scalp whenever there is an opportunity to do so. $NVDA has positively impacted the markets and will continue to bring a lot of bullish momentum into the markets in the short term.

I personally would not recommend attempting to short $NVDA anytime soon, I would give it a couple of days prior to attempting to short, as I do believe that $NVDA is highly overvalued right now, but you all know that the markets can, and will act irrationally as a result of significant movements like this. Do not get caught attempting to short while it is trending. Wait until people start FOMOing into $NVDA, buying momentum slows down, and that selling activity is starting to outweigh buying.

Once that happens, I would highly recommend looking into shorting equity or looking to purchase at the money puts at the top. Purchasing puts will be expensive but offer you a high return, while shorting shares will be the safer option, but not provide you the same rate of return.

Please just be safe though right now, as despite the markets being extremely confident, I personally am still extremely skeptical of these market conditions. There will be a couple of days of confidence that will be sustained in the markets, but I personally do expect that within two weeks, a lot of the confidence will fade from the markets, and equities will slip during this time.

Capitalize on the opportunities that are presented to us right now, if you have cash sitting on the side not allocated, look to actively day trade today and realize some gains while there is relative strength in the markets.

Look for opportunities to hedge your account over the next couple of days, but be extremely cautious entering right now as puts are still extremely cheap, and there is relative strength. We can see puts continue to decrease in price as volatility drops while there is confidence in the markets.

I do not like that there is this confidence in the markets right now, and a lot of retail traders are going to lose as a result of this sentiment. Do what you can to decrease your downside risk potential, make sure to practice safe risk management, and look to realize some gains when given a chance to do so.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

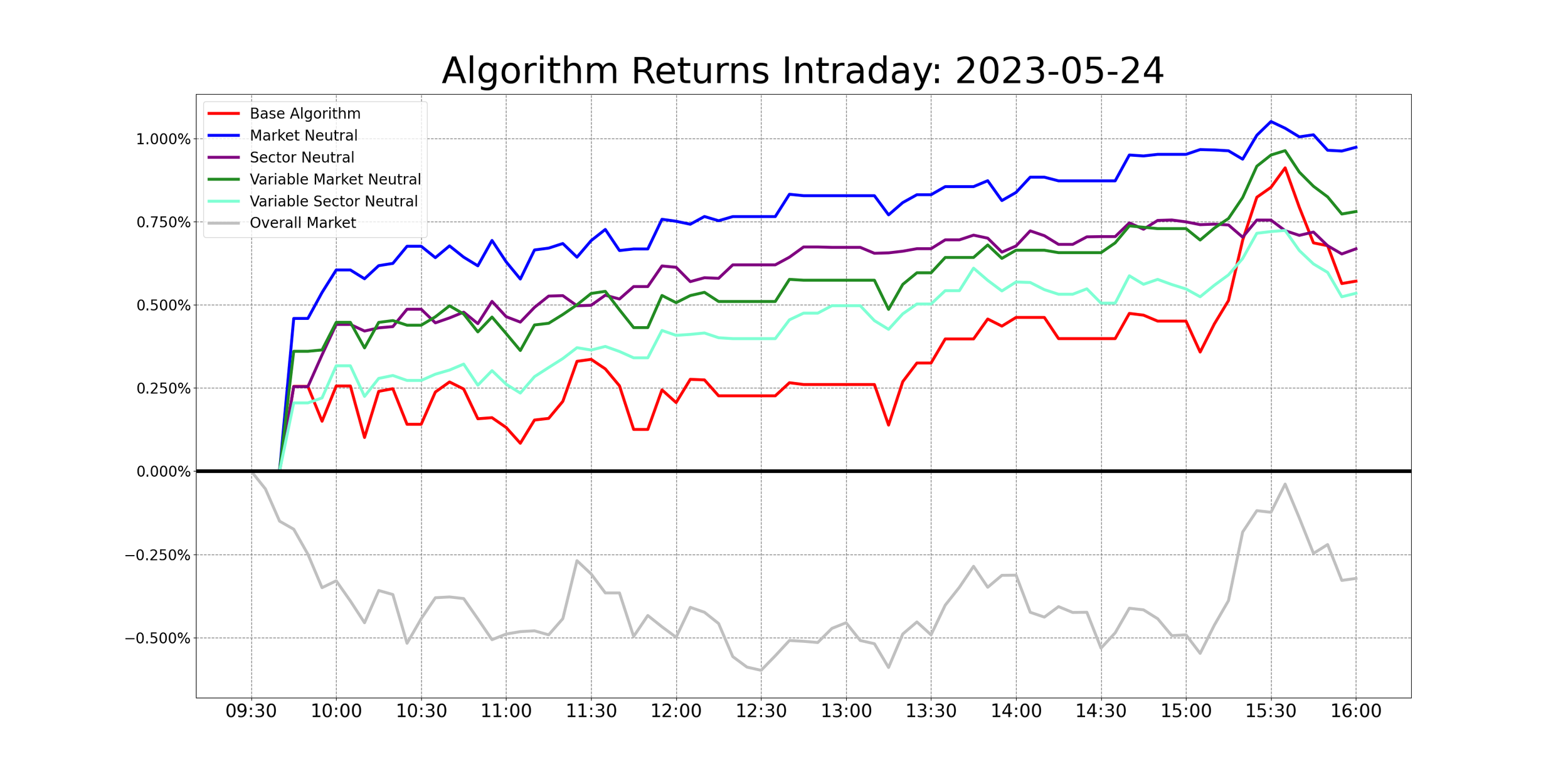

Yesterday was an extremely interesting day for the general markets as a result of some bearish momentum, but amazing opportunities. Everything across the board beat out the markets including the new portfolio we’ve created and our technical analysis absolutely killed $SPY. With this being the first successful day of the launch of the new portfolio, I hope to see a continuation of the success of this new portfolio!

To get an in-depth analysis of our algorithms' performance, check out Asher’s Report!

The results of yesterday are as followed:

Baseline:

$SPY: -0.31%

Our Results:

Market Neutral: +0.95%

Variable Market Neutral: +0.76%

Sector Neutral: +0.65%

Base Algorithm: +0.57%

Variable Sector Neutral: +0.52%

Long Term Portfolio: -0.04%

With market conditions looking exceptionally optimistic today, I would highly recommend that you look into these allocations, do some due diligence and cherry pick the positions that you personally believe will outperform the market today from a buy at open, sell by close perspective. There will be a lot of opportunities to actively trade today, so look to capitalize on the opportunities that are available, while still practicing safe risk management and limiting your downside risk. Make sure to set stops in guaranteed profit to limit your downside risk potential, and have some fun in the process of everything!

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

Algorithmic Alerts for 5/25/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $NVDA, $GOOGL, $BABA , $AAPL , $MSFT

Position Opportunities:

Hedge the positions you want to hold

Set stops in guaranteed profit for any position you are in profit in

Cut all positions you are not comfortable holding

Exit positions you are comfortable taking profit on

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN

Long-Term Riskier EV Play - $RIVN

Economic News for 5/25/2023

GDP (second reading) - 8:30 AM ET

Initial jobless claims - 8:30 AM ET

Richmond Fed President Tom Barkin speaks - 9:50 AM ET

Pending home sales - 10 AM ET

Notable Earnings for 5/25/2023

Pre-Market Earnings:

Royal Bank of Canada (RY)

Medtronic (MDT)

Toronto Dominion Bank (TD)

NetEase (NTES)

Canadian Imperial Bank (CM)

Dollar Tree (DLTR)

Best Buy Co (BBY)

Burlington Stores (BURL)

Ralph Lauren (RL)

Weibo Corp (WB)

After-Market Earnings:

Costco (COST)

Workday (WDAY)

Autodesk (ADSK)

Marvell Technology (MRVL)

Ulta Beauty (ULTA)

Deckers Outdoor Corp (DECK),

Gap, Inc (GPS)

23andMe (ME)

Domo (DOMO)

Silvercorp (SVM)

Wrap up

Overall, this should be an amazing day for the general markets with lots of opportunities to capitalize on the momentum and opportunities in the market. Please be smart, please be safe, but take advantage of this market sentiment and realize as many gains as possible, while remembering to plan and prepare for the summer session.

Good luck trading, and I hope you all make some BANK!