HaiKhuu Daily Report 6/27/2023

Good morning and happy Tuesday! Hope you traders are feeling great, markets are moving up slowly at the time of writing this report and I think we are in store for a bullish day for the markets, or at least have the opportunities to play towards the bullish side. Please continue to be careful in these market conditions though, we have broken major support on the daily on $SPY, and have shifted from Extreme Greed to greed, on the fear and greed index which is a sign of confirmation that confidence is starting to slowly leave the markets.

Hopefully, the markets continue up with relative ease in the future for everyone who has long positions, but I think that realistically, we will continue to slip down for the foreseeable future.

Just a reminder for the remainder of the week and near future, Thursday is a historically bullish day for the general markets, Monday is a HALF DAY on the markets, and they close at 1 pm EST / Noon CST, and Tuesday, the markets are CLOSED for the Fourth of July!

Good luck trading today everyone and let’s make some bank in the markets today!

Thoughts & Comments from 6/26/2023

Yesterday was a tough day for the general markets with a significant amount of movement people could have capitalized on with relative ease. $SPY started the day trading at $432.65, down slightly from the previous close of $433.21, and watched as the markets moved up significantly from open. The bullish momentum was beautiful, and we made an official high of the day trading at $434.61, before getting shot back down.

Once $SPY started to come down, that was the start of the bearish choppiness for the general markets. The bearish momentum lasted until the end of the day, outside of a small big of bullish momentum leading into power hour, but the move up was nothing of major significance. We watched as $SPY reject the $433 resistance when attempting to move up, and watched as the markets continually fall in power hour.

In the final half hour of the trading day yesterday, there was a significant amount of bearish momentum in the markets, that sold off all of the previous movement up, and we pushed new lows of the day while Putin was speaking.

We made an official low of the day with $SPY trading at $431.20 into close, and ended the day with $SPY trading at $431.44, down $1.77 for the day, or down 0.41%, with an intraday bearish movement of -0.27%.

It was an extremely tough day for the general markets that did not provide us with many great opportunities to trade but allowed us the opportunity to capitalize on the bearish movement in the markets with ease.

Hopefully, not many losses were incurred yesterday and you were able to realize some gains by capitalizing on the bearish movement.

Let’s see what today has in store for us, but I am expecting to see a lot of movement and chop in the markets.

Thoughts & Comments for Today, 6/27/2023

Today should be a fun day for the markets. Expect a lot of chop today, but with the way a lot of equities have moved over the previous couple of days, I honestly expect to see some bullish momentum in the markets. This is not going to be some absolutely face-ripping bullish momentum that will be insane, but I do believe that there is a very good chance for some short-term bullish movement assuming that there is enough buying momentum for us all to capitalize on. Despite having this general bullish sentiment in the markets, I am going to advise the same things I have been for the previous couple of weeks.

Be safe in these market conditions, tread extremely lightly, take profit on positions you are comfortable taking your profits out of, and ride the market momentum.

Hedging a position is extremely cheap right now, and we are coming down to test major support on $SPY. Daily baseline support is $SPY 426.89, and we can realistically get that low within just a couple of days assuming that markets do not see any consistent movement up. $SPY’s conversion line resistance is at $437.54, which can be easily achieved with the right bullish sentiment, but to get back up to that level, realistically I do not think it is possible in the short term unless there is major news or a sudden shift in confidence.

I do believe that the markets are only going to continue to come down over the next couple of weeks, so please continue to tread lightly in this summer session. Things have been extremely profitable for a lot of the summer as a result of the bullish momentum created by “AI-Hype” and $NVDA bringing up both Semiconductors, and mega-caps following suit, but with $NVDA falling, watch for a break of support at $400, as once that break on $NVDA happens, I think that will be the leading indicator that the markets come down.

Once the markets start coming down and breaking support levels, I do believe there will be blind buying with days where both $SPY and volatility move up, but we are at the point where confidence is slipping, and before we know it, fear will be in the markets resulting in a significant amount of losses being generated.

Continue to capitalize on the opportunities in the markets, but do not fight any trends in the short term. Get some bearish allocations and continually short equities that you personally are confident are highly overpriced, and that you want to ride down, and make sure to practice safe risk management, as a lot of people are going to have an extremely difficult time in this market.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

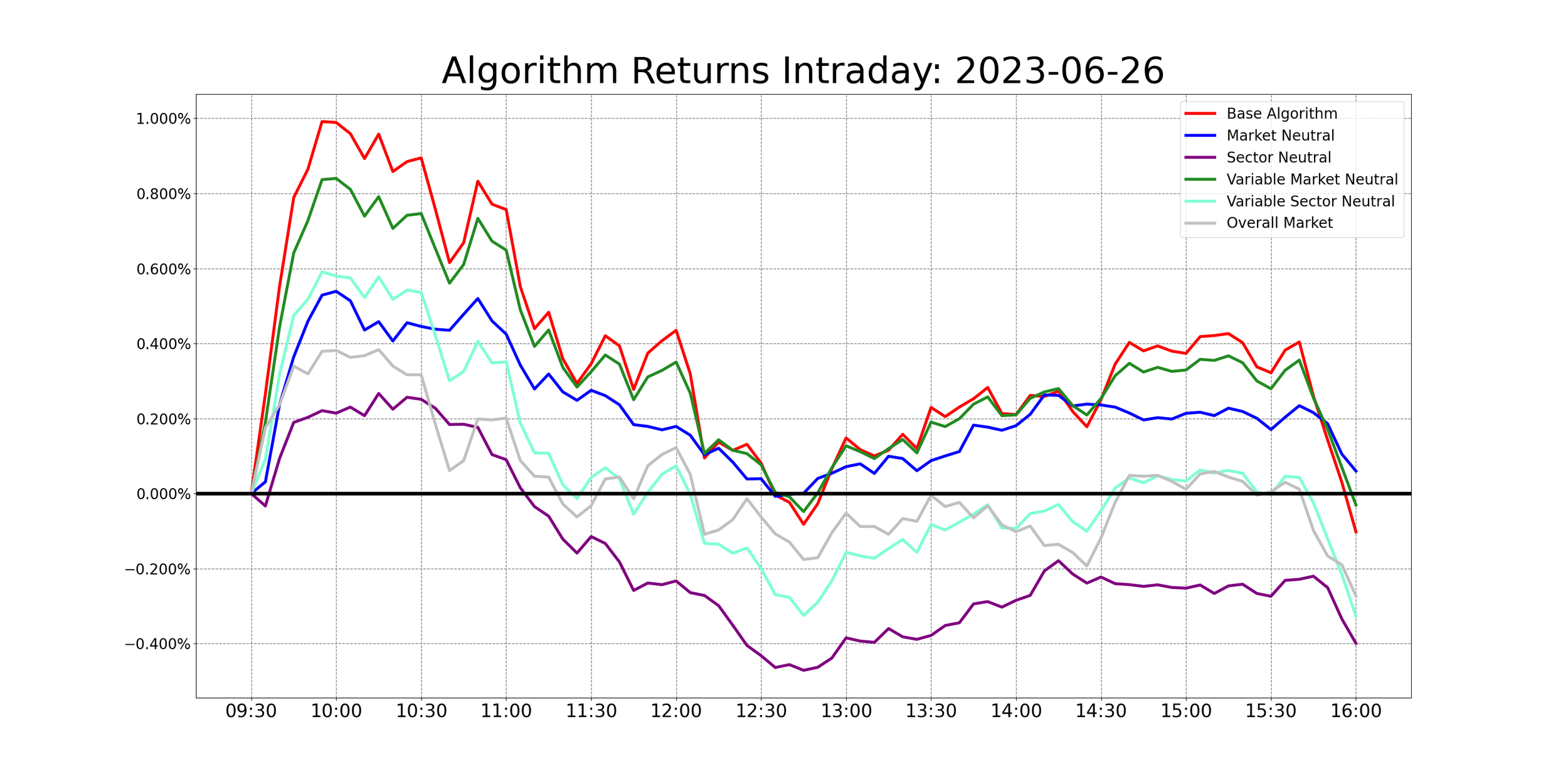

HaiKhuu Proprietary Algorithm Report:

Yesterday was a relatively neutral day for our systems, but I am very happy seeing the movement that has happened within our results. The long-term portfolio was pretty much black, and the base algorithm underperformed the fundamental analysis slightly. This is one of those days that the long-term portfolio was able to save our technical analysis, as these results could be significantly worst. So great day for the fundamental analysis and I am extremely excited to see what happens over the next couple of days.

To get an in-depth analysis of our algorithms' performance, check out Asher’s Report!

The results of yesterday are as followed:

Baseline:

$SPY: -0.27%

Our Results:

Market Neutral: +0.06%

Long Term Portfolio: -0.02%

Variable Market Neutral: -0.03%

Base Algorithm: -0.1%

Variable Sector Neutral: -0.33%

Sector Neutral: -0.4%

With market conditions not being the most optimal and us testing out a new portfolio, please do your own due dilligance prior to entering into any of these positions and make sure you are practicing safe risk management. Regardless of the market conditions, I do believe this portfolio should do phenomenally, but obviously, it should do even better in the case that conditions are optimal. So just make sure to limit your downside risk when given an opportunity to do so, and realize some gains with our algos today!

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

Algorithmic Alerts for 6/27/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $VIX , $NVDA, $TSLA , $AAPL , $DIS, $RIVN, $BABA

Position Opportunities:

Ride the momentum in the markets

Hedge the positions you want to hold

Set stops in guaranteed profit for any position you are in profit in

Cut all positions you are not comfortable holding

Exit positions you are comfortable taking profit on

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN

Long-Term Riskier EV Play - $RIVN

Economic News for 6/27/2023

Durable-goods orders - 8:30 AM ET

Durable-goods minus transportation - 8:30 AM ET

S&P Case-Shiller home price index (20 cities) - 9 AM ET

New home sales - 10 AM ET

Consumer confidence - 10 AM ET

Notable Earnings for 6/27/2023

Pre-Market Earnings:

Walgreens (WBA)

TD SYNNEX Corporation (SNX)

Korn Ferry (KFY)

Schnitzer Steel Industries, Inc. (SCHN)

After-Market Earnings:

Jefferies Financial Group Inc. (JEF)

AeroVironment, Inc. (AVAV)

Novagold Resources Inc. (NG)

Transphorm, Inc. (TGAN)

Wrap up

Please just be safe in these market conditions. Look to follow the momentum in the markets, but do what you can to practice safe risk management and limit your downside risk. I do believe there will be a solid opportunity to play to the bull side today, but with the current sentiment in the markets, be careful and watch for things to slip with relative ease. We should have a fun day full of chop, so take advantage of the opportunities that are available to us and realize some gains!

Good luck trading, and let’s make the most out of today!