HaiKhuu Daily Report 7/21/2023

Good morning and happy Friday! Hope you all are feeling great and are ready for the weekend! Markets are up at the time of writing this report, and with no major economic news to impact the pre-market session, I believe there is a good chance the markets remain up.

Just a reminder that today is July Expirations and historically, is a bearish day for the general markets. There will be many great opportunities to trade and some solid momentum in the markets we can all capitalize on.

Get ready for today as I am expecting chop and volatility, but the ability to make a significant amount of profitable trades with relative ease!

Good luck trading today and let’s end this week strong!

Thoughts & Comments from 7/20/2023

Yesterday was a crazy day for the markets with a significant amount of selling. Historically, it was a bullish day for the markets, but it seemed that as a result of $NFLX and $TSLA earnings, the sentiment was different.

We watched as $SPY opened up slightly down from the previous close, at $454.16. From open, we did look strong as within the first half hour, all we did was slowly move up, despite never going officially green for the day. We topped out at the high of the day trading at $455.09, and after that, started to see some crazy red candles as the markets moved down extremely quickly, making the first low of the day trading right under $453.

Going into the lunchtime session, the markets did recover slightly, where we did come back from the initial sell-off, and recovered back up to make a relative high at $454.60, but that was the last of the bullish buying momentum.

Afterward, the markets only continued to move down with relative strength. We continually came down into power hour as people continued to sell their positions.

Halfway through power hour, we made the official low of the day trading at $451.45, looking extremely weak in comparison to open, but recovered slightly into the market close.

We ended the day with $SPY trading at $452.18, down $3.02 for the day, or approximately 0.66%, with an intraday bearish movement of -0.44%. It was an extremely tough day for the general markets that did not provide many opportunities to realize many gains but provided us the ability to ride the momentum with confidence. I hope you all were able to capitalize on the movement in the markets and realized some gains in the process of everything!

Thoughts & Comments for Today, 7/21/2023

Today should be a fun time for the markets! As I said before, today historically is a bearish day for the general markets, and this is the July expirations, so expect to see a significant amount of momentum and an increase in volatility. It will be difficult to trade today for the large majority of individuals, but if you are able to trade with confidence in the markets, you should have absolutely zero problems realizing some gains today.

I will say that despite the markets being historically bearish today, there still is a significant amount of confidence in the markets. I am not overly bullish or bearish today, but I would highly recommend that if you are looking to trade, the most consistent ways to make money today, will be to relax and sell some 0-DTE options today, or by actively scalping the momentum in the markets.

Markets are looking good at the time of writing this report, and VIX is significantly lower than we normally see it, but that is not a general point of concern in the short term.

A couple of positions that I recommend you look into taking today, are selling 0-DTE CSPs on organizations that have sold off heavily over the previous couple of days, continually scalping larger tech organizations that have a higher beta to get increased gains to profit easier, or to take some risky plays, and look to sell NAKED calls on organizations that have moved up significantly that you do not believe will be sustained. The first two plays are very sustainable and realistic, while the last one, while being realistic, is not sustainable. It is extremely risky and involves a significant amount of knowledge of options to do efficiently and effectively.

Two risky organization that I am interested in looking at selling naked calls in today is $SIRI and $CVNA. They moved heavily yesterday and both are highly overpriced in my opinion. I would prefer to sell against $SIRI rather than $CVNA, but both will provide you with an opportunity to realize a significant amount of gains, with relative ease during this time. I have been looking at the 0-DTE $8 Calls on $SIRI, and as long as the organization does not go absolutely insane today, it will provide us an opportunity to collect 100% premium with relative ease. If / when I enter into this position, I will be consistently looking to exit the position when given an opportunity to do so, while collecting as much premium as possible. I will set a 100% stop loss and will be attempting to scale out of the position as quickly as possible. I do not want to hold this play until the end of the day, and will ideally be out of the play within the first hour of the trading day.

Again, selling 0-DTE Naked Calls on organizations is an extremely risky strategy that hypothetically, has an unlimited potential for losses, but assuming you set up your position correctly, should provide you with an amazing opportunity to trade and realize some gains.

Just continue to be smart in these market conditions, take on opportunities that are available to you, and just be smart in the process of everything. Do not do anything that would highly jeopardize your account, and just have a great time in the process of everything. Practice safe risk management and simply follow the momentum in the markets right now.

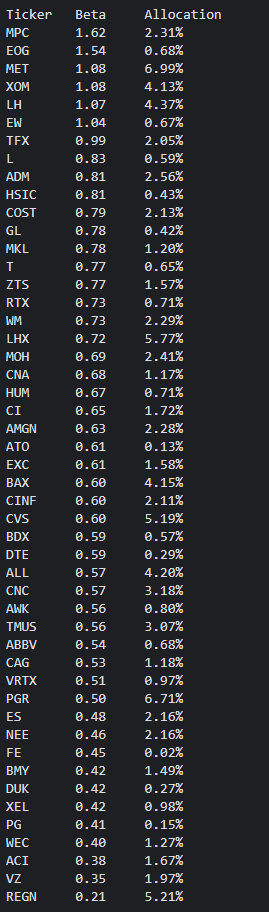

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Yesterday was an amazing day for the algorithms despite the significant downside on the markets. All of our systems outperformed the markets by a significant margin, and our portfolio benefited heavily on a day like yesterday. I am extremely excited about this and hope that you all are ready and excited for the positions today!

To get an in-depth analysis of our algorithms' performance, check out Asher’s Report!

The results of yesterday are as followed:

Baseline:

$SPY: -0.44%

Our Results:

Market Neutral: +1.22%

Long Term Portfolio: +1.12%

Variable Market Neutral: +1.11%

Base Algorithm: +1.04%

Variable Sector Neutral: +0.68%

Sector Neutral: -0.15%

With market conditions being at an interesting spot today, use the momentum in the markets to capitalize on the opportunities that are available to us, but make sure to practice risk management in the process. In the case market conditions are not optimal, then look to cut all positions and take profit when given an opportunity to do so. As always, do your own due diligence prior to entering into any of these positions, and have a great time in the process of everything!

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

Algorithmic Alerts for 7/21/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $RIVN, $MAT , $DIS, $MSFT , $NVDA, $TSLA, $AAPL

Position Opportunities:

Ride the momentum in the markets

Set stops in guaranteed profit for any position you are in profit in

Cut all positions you are not comfortable holding

Exit positions you are comfortable taking profit on

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN

Long-Term Riskier EV Play - $RIVN

Economic News for 7/21/2023

None Scheduled

Notable Earnings for 7/21/2023

Pre-Market Earnings:

American Express Co. (AXP)

AutoNation (AN)

Comerica Inc (CMA)

Sensient Technologies (SXT)

SLB (SLB)

Huntington Bancshares (HBAN)

Wrap up

Overall, this should be a fun day for the markets with lots of volatility, chop, and opportunities to trade. Make some smart decisions, capitalize on the momentum, and realize some gains. Look to take on a little more risk while trading today to increase your profitability, and just make sure you are not making any irrational moves. This will be a great way to end the week, so let’s wrap things up with an amazing day for the markets.

Good luck trading, and let’s have some fun today!

P.S., don’t forget to check out Oppenheimer and Barbie this weekend!