HaiKhuu Daily Report 8/16/2023

Good morning and happy Wednesday! Markets have been confusing during this pre-market session, so I hope you all are doing well and are excited about today. Please tread lightly on these market conditions as we are looking at continued opportunities to see some bearish momentum in the markets. We are slightly red at the time of writing this report and I do not believe conditions will get much better by the market open. We have FOMC minutes coming out today, which will heavily impact the markets at 2 pm EST, so please make a mental note of that if you are actively trading around that time.

Take advantage of these market conditions and prepare accordingly. We are starting to see the $SPY bearish TK cross under on the daily start to get stronger, signaling there is more bearish momentum ahead of us. We are currently Neutral on the fear and greed index signaling that greed has left the markets and that there is more possible downside ahead of us as people start to phase out greed, and are starting to worry about the current market conditions. This will obviously be difficult in the short term but is exactly what I personally have been waiting for in the markets, and will give us an amazing opportunity to actively trade and realize some gains while there is fear in the markets.

Continue to navigate the markets with confidence, make some smart plays, and realize some gains when you are happy. There will be many great opportunities to trade over the upcoming weeks, so make the most out of these opportunities, and have a great time in the process!

Good luck trading today and let’s see what today has in store for us!

The updated $SPY daily levels are as followed:

Conversion Line Resistance: $447.60

Base Line Support: $450.87

Weak Psychological Resistance: $450

Strong Psychological Support: $440

Thoughts & Comments from 8/15/2023

Yesterday was a crazy and bearish day for the markets, with not many opportunities to trade general equities or any indices with confidence. $SPY opened the day red, trading at $446.28, down nicely from the previous close of $448.11. This momentum was not strong at all, and within the first couple of minutes of trading, we saw the reality of the markets and saw a significant amount of bearish momentum. $SPY moved up ever so slightly to hit the official high of the day trading at $446.64 and was followed by a significant amount of bearish momentum throughout the rest of the day.

We quickly sold off after making the official high of the day and quickly dropped down to test $444. We were able to hold that level and chop around $444 and $445, with no decisive movement for the large majority of the day, with a little buying happening to go into the lunchtime lull, which was quickly followed by a significant amount of selling come back to that $444 level on $SPY.

Power hour though, was where all of the fun started. We did see some more significant bearish momentum right at open, but at power hour, markets were looking slightly optimistic, moving up into power hour, but what the markets had in store for us was the complete opposite.

The markets quickly came down throughout the whole power hour, where we went on to drop almost $2 on $SPY, and making the official low of the day 15 minutes from close, at $442.31, and recovered ever so slightly into close, where $SPY ended the day trading at $442.89, down $5.22 for the day, or approximately 1.2%, with an intraday bearish movement of -0.74%. It was a nasty day for the overall markets that did not provide us with many opportunities to trade, but there is one opportunity that I hope you all took advantage of.

I brought up $VFS yesterday during the pre-market session and wrote about it in the report. This was a hype-based Vietnamese EV-Producer, that just de-SPACed, and as a result, had a significant amount of hype and momentum in the play. I initially alerted the play at $17 a share, and we watched it push up consistently throughout the whole day. I took profit at $23 a share, but shares ran and pushed up all the way to $37, up over 100% since the initial alert, and absolutely decimating any sort of general market returns of yesterday. I hope you all were able to capitalize on the opportunities that were available to us yesterday and had an amazing time in the process. There were a lot of gains to be made with this play, and it was a lot of fun participating with you all on this opportunity!

Thoughts & Comments for Today, 8/16/2023

Today is going to be an extremely interesting time for the general markets as a result of the place that we are currently in. Max pain today is $SPY $445, which means there is a slight bullish edge, but market conditions are not looking strong, and as a result, we are most likely going to see some bearish momentum that will impact people’s ability to trade with confidence.

As I have stated before, there is a bearish TK crossover on the $SPY daily chart which is strengthening, while we are at neutral on the fear and greed index. This is a sign that bearish momentum is in the markets and we are displaying weakness in comparison to where we were this time just a couple of weeks ago. If you look at organizations like $TSLA, it is down approximately 20% from this time last month and does not show many signs of strength right now.

I have some personal comments about these current market conditions, so please take this with a grain of salt, but give it the weight that you believe it deserves.

Just know that these market conditions are going to be extremely difficult for the large majority of traders who are not experienced enough and know how to navigate these conditions properly. There is a lot of confusion in the markets right now, mostly with people wanting to be either bullish or bearish, but there is not any decisive movement in the markets.

If you are looking to allocate into the markets, I would go to either side of the spectrum. Either trade extremely quick plays where you can capitalize on quick movements in the markets, where larger scale sentiment does not impact you at all, or invest and hold some solid organizations, where the larger scale sentiment does impact you, but you are holding with enough strength, with the intentions of holding for a while, that that sentiment does not truly impact you.

Know that a lot of others are realizing losses too at this time. You will always see the people that are winning, and the best traders are going to continue to win in these market conditions, but the large majority of people will ultimately realize some losses over the next couple of weeks.

Do not fight the momentum in the markets, lots of people want to time out the bottom or the top perfectly in these market conditions. Don’t do that as it will be extremely difficult to do so in choppy market conditions. Just follow the momentum, you will not get the most optimal realized gains in the short term, but you will be able to be extremely consistent in difficult times to navigate the markets with confidence.

For my personal positions today, I do not know how much active trading I will be doing, I am still riding the high from realizing a nice amount of gains on $VFS yesterday, and am allocated into a significant amount of positions that I have a lot of confidence in, in the short term. If I get into any play, it will most likely be some sort of scalp or day trade for the day, as I do not intend on getting into any long positions at this point, as I believe there is more downside ahead of us. Once I see a reversal in the larger markets, then I will be able to allocate more with relative confidence. Until then though, I intend on treading lightly on these market conditions and capitalizing on what I can, when I can.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Yesterday was a tough day for both the markets and the algorithm. It was unfortunate but we went into the day knowing it was going to be tough. The algorithm is still on hold as results have not come back conclusive, and we are not confident in either market conditions or are confident in the ability of the algorithm to handle this indecisive movement in the markets. We will still provide all of the alerts that the algorithm produces for us to provide transparency. Again, we do not endorse any of these allocations until market conditions shift and our tests come back conclusive.

To get an in-depth analysis of our algorithms' performance, check out Asher’s Report!

The results of yesterday are as followed:

Baseline:

$SPY: -0.74%

Our Results:

Sector Neutral: 0.05%

Variable Sector Neutral: -0.37%

Market Neutral: -0.43%

Variable Market Neutral: -0.62%

Long Term Portfolio: -0.81%

Base Algorithm: -0.82%

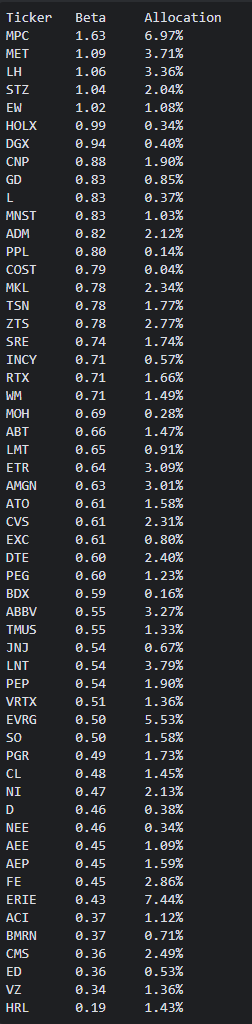

With our tests still not coming back conclusive on market navigation in these conditions with the algorithm, we are not endorsing any allocations that are generated from the algorithm at this time. Please take these all with a large grain of salt as we do not recommend active allocations into these positions at this time. These positions are only posted for transparency's sake while we are actively testing systems, so if you want to utilize this list, use it as a watchlist for tickers the algorithm believes will do well today, and let you positively benefit as a result. Please make sure to practice safe risk management if you enter into any of these allocations and set stops to limit your downside risk.

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

Algorithmic Alerts for 8/16/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $VFS, $TSLA, $RIVN, $AAPL , $MSFT, $DIS, $NVDA

Position Opportunities:

Follow the momentum in the markets

Open up hedges for any positions you want to hold

Exit all positions you are not comfortable holding

Watch for a breakdown & hold cash to allocate accordingly at the bottom

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $DIS

Economic News for 8/16/2023

Housing Starts - 8:30 AM ET

Industrial Production 9:15 AM ET

FOMC July Meeting Minutes - 2:00 PM ET

Notable Earnings for 8/16/2023

Pre-Market Earnings:

Target (TGT)

ZIM Integrated Shipping Services (ZIM)

JD.com (JD)

TJX Companies (TJX)

Brinker International (EAT)

Colgate-Palmolive (CL)

After-Market Earnings:

Cisco Systems (CSCO)

Synopsys (SNPS)

Wolfspeed (WOLF)

Kimball Electronics (KE)

Wrap up

Overall, this is going to be an interesting time for the markets. Please be careful and practice safe risk management at this time. Do not do anything that is overly risky and continue to follow the momentum in the markets. Watch out for 2 pm EST as we have FOMC minutes coming out, which should impact the market momentum and sentiment. Let’s have a great time trading today and make sure you survive and trade for another day!

Good luck trading, and let’s make the most out of the current market conditions!