HaiKhuu Daily Report 9/19/2023

Good morning and happy Tuesday! Markets are up slightly at the time of writing this report, and I hope you all are excited! We have bounced on the daily baseline support, and are showing possible signs of strength through the confusion. Expect to see some extremely choppy market conditions in the short term that will cause difficulties for the majority of traders.

Be aware that the FOMC is meeting today, and will be making an announcement tomorrow at 2 PM EST in regards to their interest rate decision, and Jerome Powell will be speaking at a press conference as a result of this at 2:30 PM EST. Many positions will be shifted and reallocated today and tomorrow in anticipation of this.

Look to capitalize on the opportunities that are available to us, but continue to tread lightly and proceed with caution. Practicing proper risk management will be key to your success.

Side note; $CART IPO is today. Instacart is a phenomenal service, but fundamentally is a terrible organization. I would highly recommend staying away from seriously allocating into the organization, but I will talk more about how to capitalize on the opportunity later on in this report.

The updated $SPY daily levels are as follows:

Conversion Line Resistance: $446.83

Base Line Support: $443.34

Weak Psychological Resistance: $450

Strong Psychological Support: $440

Daily Cloud Resistance: $449.40

Daily Cloud Support: $437.83

$SPY Daily Candles - Bounce on Baseline Support [9/18/2023]

Thoughts & Comments from 9/18/2023

Yesterday was a tough day for the markets which made it difficult to trade. This was a result of a lack of a large overall movement but provided us with phenomenal opportunities to capitalize on the intraday momentum and trade in both directions. It was an extremely choppy day that overall was a wash, but if you were able to capitalize on the market movement, you should have realized gains with ease.

$SPY started the day trading at $443.00, down slightly from the previous close of $443.37. We looked neutral going into market open as $SPY dropped during the pre-market session but recovered from the relative bottom. We saw that there was bullish momentum right at open, which was quickly matched by a quick snap back and load-up opportunity. Within the first half hour of the day, we made the official low of the trading day, with $SPY trading at $442.58.

Despite hitting this low early in the morning, the markets quickly recovered and went green going into the lunchtime lull, and moved up accordingly despite lower relative volume in the markets. The movement up was not of any major significance, as there was less than 0.5% movement from the official low of the day to the official high of the day, but it was nice seeing active buying and an opportunity to go long with confidence.

As the market momentum slowed down, we continued to hover around $444.50 on $SPY, making the official high of the day $444.97, and chopped around that level for approximately two hours. Going into the back half of the day, we started to see some selling off in the markets as buying volume slowed down, where we tested $444 again, and leading into power hour, watched as there was significant selling causing us to go officially black again for the day.

For power hour, there was not much general momentum or opportunities in the markets, as for the majority of the time, we chopped within a $0.25 range on $SPY, providing us with “opportunities” to trade, but nothing that would have justified any serious allocations, or considerations as there was no clear nor decisive movements. We ended the day with a quick pump into close on $SPY, ending the day trading at $443.63, up $0.26 for the day, or approximately 0.06%, with an intraday bullish movement of +0.13%.

There were many opportunities to actively trade throughout the day yesterday, but on an overall basis, it was extremely difficult to watch the market momentum in real time and capitalize on the opportunities that were presented to us. I hope you all were able to realize some significant gains in the process and had a great time actively trading. Yesterday was the first time in a while I can say with confidence that I have performed absolutely zero trades. So let’s see what the markets have in store for us today, and hope for the best.

Thoughts & Comments for Today, 9/19/2023

There are a lot of conflicting sentiments in the markets right now that will make it extremely difficult to get a strong narrative, and will result in a significant amount of chop and confusion in the markets. From an unbiased standpoint, there is a chance that we bounce off of the daily baseline support and show strength, but at the same time, there is a significant amount of weakness in the markets, as people are indecisive and do not know how they want to allocate, mostly with the Fed’s decision on the interest rates coming out tomorrow. I would not be overly bullish or bearish at this moment, but look for opportunities to capitalize on the market momentum in the short term. There will be many great opportunities to trade and capitalize on short-term movements, but it will be difficult to have confidence in a large movement in the markets at this point, mostly if you are hyper-bullish.

The significant level to watch out for in these market conditions is the daily baseline support. Despite how the markets are doing, and the momentum in the markets in the short term, we only had a slight bounce on the daily baseline support on $SPY. This level as mentioned before is $443.34. This level will show us that regardless of the sentiment in the retail space, will show us the sentiment of the overall markets. If we break below that level, watch out and be careful as there is a fall risk, while if we are able to sustain this level and push back up to the conversion line resistance, there is going to be relative strength and a possibility of a breakout.

These conditions are primed to print money for the market makers and suck money out from retail. Fight back and realize some gains, and don’t be greedy. The market markers are going to realize gains regardless of what they do, but it is just a matter of if you are able to realize gains for yourself. Do not get greedy, and realize gains. Set stops in guaranteed profit, continually increase that limit to secure more profit, and do not be overly ambitious in these conditions. That is how a lot of people are going to get wiped out in a matter of three trades.

Many people are going to be watching the $CART IPO today, and my sentiment for the IPO has remained the exact same as previously stated. I do NOT recommend the majority of people attempt to allocate into $CART. I am bearish on the organization, and believe that they are highly overpriced in the short term, and will come down accordingly given some time. Despite this sentiment, I do believe they will have an amazing opportunity to bounce on “IPO-Hype” and be able to generate some money in the short term for a lot of traders. If you are attempting to allocate into $CART, look to purchase right at open, possibly average in within the first couple of minutes if we see a dip, and then get out of the position once you are given an opportunity to realize some gains. I would not attempt to hold the position for more than 15 minutes, as once the initial hype fades, we will see a significant amount of selling from people, causing $CART to lose all of its general momentum and generate a significant amount of losses extremely quickly.

Please be extremely careful if you are attempting to trade in general today, and more so if you are attempting to allocate into $CART. I do not recommend the majority of people attempt to force any trades today, and I believe that the only trade I will actively contemplate making today will be an attempt to live trade the $CART IPO. Make sure to tune into the call and stick around throughout the morning for the $CART IPO. If I am actively trading it, I will let you all know my sentiment in real time, and let you all know when I enter and exit the position.

Good luck trading today, and let’s realize some gains.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

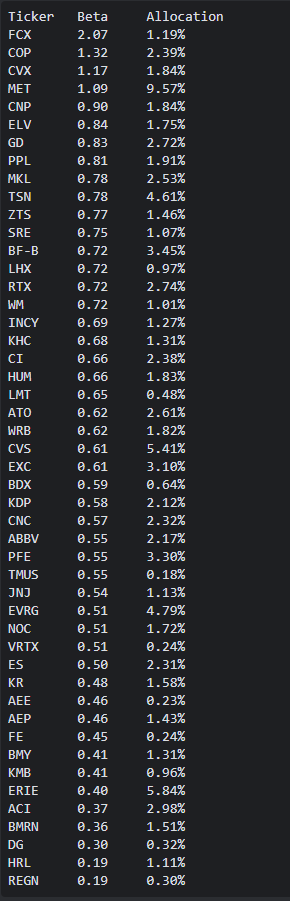

HaiKhuu Proprietary Algorithm Report:

Yesterday was an alright day for our systems as there was not much overall movement in the markets and we watched as the majority of these allocations remained relatively neutral throughout the day. We did not see much in terms of realized losses or gains throughout the day which is unfortunate, but as I say, C’est la vie.

The one thing I want to talk about, is the fact that we will be postponing the launch of our intraday algorithmic alert system last minute. The tests that we have been running have been extremely consistent, but are not up to our personal standards. We believe that these alerts will be consistent and profitable when attempting to allocate via them, but as I said before, they are not up to my personal standard of confidence, and I am not comfortable expediting a launch that I am not comfortable with. This delay should only be a week or two while we finalize some tests, and get live results after making some changes, and hopefully we are able to launch next week, but I would rather launch something that I personally have comfort and confidence in, than force something out that is not up to our standards and as a result, cause some realized losses. We apologize again for this delay but just know that we are doing it for everyone’s safety. Thank you all for understanding.

To get an in-depth analysis of our algorithms' performance, check out Asher’s Report!

The results of yesterday are as follows:

Baseline:

$SPY: +0.13%

Our Results:

Sector Neutral: +0.17%

Variable Sector Neutral: -0.05%

Long Term Portfolio: -0.11%

Market Neutral: -0.12%

Variable Market Neutral: -0.14%

Base Algorithm: -0.15%

As I said before, these positions are on a tentative hold at the moment while we are live testing in these current market conditions. We are going to be lifting the hold soon as long as situationally everything is looking as expected. Just a reminder that these positions are not currently endorsed by HaiKhuu, but we are providing them for complete transparency and consistency sake while we are working on active improvements. If you are taking any of these positions, take them at your own risk and practice safe risk management in the process!

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

Algorithmic Alerts for 9/19/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $CART* , $DIS , $TSLA , $AAPL , $NVDA , $ARM, $FAZE*

Position Opportunities:

Follow the market momentum

Exit positions you are not comfortable holding

Hedge positions you want to hold

Have cash ready to allocate in the markets

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $DIS

Economic News for 9/19/2023

Housing Starts - 8:30 AM ET

Building Permits - 8:30 AM ET

Notable Earnings for 9/19/2023

Pre-Market Earnings:

AutoZone (AZO)

Endava (DAVA)

Apogee Enterprises (APOG)

After-Market Earnings:

Steelcase Inc (SCS)

Wrap up

Overall, this should be an interesting day despite the weakness that is being displayed in the overall markets. Realize some gains when given an opportunity to do so and just be smart and safe in these market conditions. There are going to be a lot of difficulties in actively trading and navigating these conditions, but the best traders will be able to realize gains with comfort, confidence, and consistency today. So let’s have a great time and make some bank trading the $CART IPO!

Good luck trading, and let’s realize some gains today!