HaiKhuu Daily Report 9/27/2023

Good morning and happy Wednesday! Markets have been disgusting recently and we have continued to make new relative lows, but I hope you all have been alright! Market conditions are continuing to look extremely weak, but we are showing signs that the selling is slowing down. This does not mean to be hyper bullish, but to start to look for opportunities to trade with confidence, and attempt to start scaling in slowly into organizations that are fundamentally solid, and that you can hold with confidence, knowing that with time, a reversion to the mean is coming. As I have said before, stay away from general tech, and more specifically the mega-caps & semiconductor market, as both are overvalued at this point.

Continue to take advantage of the opportunities that are presented to us, but look to make some smart and diligent allocations in these conditions to ensure you are maximizing your potential while minimizing your generalized risk.

Watch out for the general market momentum over the next three days, as there will be a significant amount of economic news and institutional rebalancing during this time. Some organizations will slip in the process, and do not attempt to catch a falling knife, while other organizations will move up accordingly, and if you miss an entry, do not try to run after missing the train.

There will be many opportunities that are available to us in these market conditions, just take advantage of the ones that are apparent to you, and do not FOMO into opportunities you’ve already missed out on.

Good luck trading today, and make some smart decisions to realize some gains!

The updated $SPY daily levels are as follows:

Conversion Line Resistance: $436.25

Base Line Resistance: $439.35

Weak Psychological Resistance: $430

Weak Psychological Support: $425

Strong Psychological Support: $420

Daily Cloud Resistance: $442.63

$SPY Daily Candles - Bearish TK Cross & Continued Selling [9/26/2023]

Thoughts & Comments from 9/26/2023

Yesterday was an extremely bearish day and was one of the worst days we have seen in 2023. There was an overwhelming amount of bearish momentum that caused a significant amount of difficulties for the large majority of people attempting to trade. Lots of organizations had an extremely difficult time, with some mega-caps like $AMZN, $MSFT, and $AAPL, dropping significantly. It was a tough day but continues to provide value investors an amazing opportunity to watch some bloodshed to prepare to pick up the pieces like vultures once we’ve reached extreme fear in the markets.

$SPY started the day trading down significantly from the previous close, opening at $429.06, down almost $3 from the close on Monday. We showed signs of strength right at open, as we quickly recovered a small portion of the pre-market losses, as $SPY went on to make the official high of the day trading at $429.82, but showed significant weakness throughout the rest of the day. After making the official high of the day, the markets continued to slip and fall throughout the afternoon and continued to show signs of weakness despite continuing to make new relative lows.

After a significant amount of selling, $SPY continued to hover in the $427-$28 range, where going into the lunchtime lull, we made a relative low breaking down at trading below $427 but was quickly recovered as volume and momentum picked back up in the markets, and $SPY tested $428 again going into the afternoon.

Around 1:15 pm EST, we noticed that selling started to increase again, as $SPY continued to push new official lows of the day, looking extremely bloody in the process, as organizations like $AMZN slipped. The selling in the market was nonstop leading into power, continuing to make new lows intraday, making trading extremely difficult if you were attempting to “buy the dip”.

During the start of power hour, $SPY was trading at $425.80, and showed signs of relative strength as it appeared the low of the day was hit, and we saw a slight recovery in the markets, as we came back up to test $426, but to no avail, in typical market fashion, despite the weak bullish momentum, the markets continued to slip in the process, and we dropped again to make the official low of the day with $SPY trading at $425.02, down almost 1% intraday.

The markets recovered slightly from the low of the day, but not enough to provide any major confidence unfortunately, as $SPY ended the day trading at $425.88, down $6.35 for the day, or down approximately 1.5%, with an intraday bearish movement of -0.75%.

As I said before, it was an extremely tough day for the markets with a significant amount of bloodshed and opportunities to generate a significant amount of losses, but this is preparing us for what is going to be an amazing opportunity to enter into a lot of organizations at a phenomenal price with confidence. The interesting thing about yesterday is despite a lot of these mega-caps leading a significant amount of selling, we saw that organizations like $NVDA were only down a fraction of a percent, and for the large majority of the day, were nicely green, at one point, being up over 1.5%.

We are on the edge of extreme fear in the markets right now, so let’s see what happens today, if we continue this general momentum in the markets, welcome to extreme fear!

Heatmap - $SPY 9/26/2023

Thoughts & Comments for Today, 9/27/2023

Today is going to be an extremely interesting toss-up of a day. The markets have sold off significantly over the previous week, with $SPY being down 4% over the previous five trading days, and we are due for a bounce in the markets, but realistically, just because we are “due” for a bounce, does not mean it is coming. I would recommend being extremely cautious in these market conditions, but look to slowly scale into equity positions that are fundamentally solid, and undervalued at the moment. I would not scale in quickly, or recommend you get a full allocation, but look to slowly add to organizations you are comfortable and confident in holding at this time.

The markets can continue to come down, mostly as we are starting to reach extreme fear in the markets, and volatility is still relatively low, in comparison to where it “should” be for these current conditions. I believe that the markets can continue to come down in the short term, as organizations like $NVDA are still heavily overvalued and is a large allocation in $SPY. I would not say that we’ve hit a “bottom” until organizations like $NVDA come back to reality and are fair-priced in the current market condition.

Yesterday, I personally started to add more shares of $DG and purchased a leap on $DIS. This is not a recommendation nor endorsement to follow these positions at this time, but I have scaled into that equity with relative confidence, knowing that I will be able to personally hold that allocation as long as I personally need to in the short term, to be able to capitalize on a positive bullish movement in both of those organizations. My PT’s are as follows:

$DG, Daily baseline resistance - $133.51

$DIS, Indefinite hold - $95-100

Both of these are speculative plays, but I have a long enough expiration on $DIS that I can hold that for months on end until the organization finally moves up, while still holding equity that I can hold relatively indefinitely, while $DG, I only have shares, that I do not anticipate exiting anytime soon.

In the short term, I would be extremely cautious while attempting to allocate into the markets, mostly with the current conditions. I would not attempt to fight any trends, but simply follow the momentum in the markets until there is a clear sign of support on a larger timeframe and then, allocate with relative confidence. We are starting to see selling start to slow down, but what happens on a literal day basis, is not a large enough confidence boost to justify allocating heavily into the markets. Continue to grow your exposure, but make sure to have cash on hand ready to allocate to the markets.

Do not forget that we are going to be seeing a lot of institutional reallocations over the next couple of days, as well as have news in regards to jobless claims, GDP, and the government shutdown, all of which can cause a significant amount of bearish momentum in an extremely short timeframe.

If the markets dip as a result of this, it could be an amazing time to allocate into the markets with relative confidence, but please, as I have been saying. Practice safe risk management, and only allocate when YOU have confidence in these conditions. Do not look at the confidence of other traders, but only purchase when you feel comfortable allocating to organizations you are confident in.

Personally, I do not anticipate entering into many allocations today as a result of these current market conditions. I do believe there is a good chance that the markets will continue to slip over the next couple of days, but I am extremely interested in entering into day trades and scalps of mega-caps that look relatively strong at this point. $AMZN has dropped heavily as a result of the FTC Antitrust lawsuit, providing us with an amazing opportunity to buy and trade this dip, while $AAPL is looking strong during the pre-market session. If I were to enter into any day trades today (Which I most likely will), my allocations would be in either of these two organizations.

Continue to tread lightly on these market conditions and be smart in the process. Many people will realize a significant amount of losses attempting to trade these conditions, while others will be extremely successful and realize a significant amount of gains. Be smart, be consistent, and practice safe risk management. As long as you are not greedy and can remain level-headed and consistent in these market conditions, you will be awarded a significant amount of realized gains.

Good luck trading not only today but for the rest of the week as this is going to be an insane time.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Yesterday was another day that our technical analysis outperformed both our fundamental analysis and the general markets. This continues to provide us with confidence that the tests that we are doing at the moment and the improvements we are making to the algorithm are working as expected, so we anticipate lifting this hold in the near future. We still are on a tentative hold on our systems until we have 100% confidence in our systems, but just know that confidence is coming back and that we are anticipating a lift of this hold soon in the near future!

To get an in-depth analysis of our algorithms' performance, check out Asher’s Report!

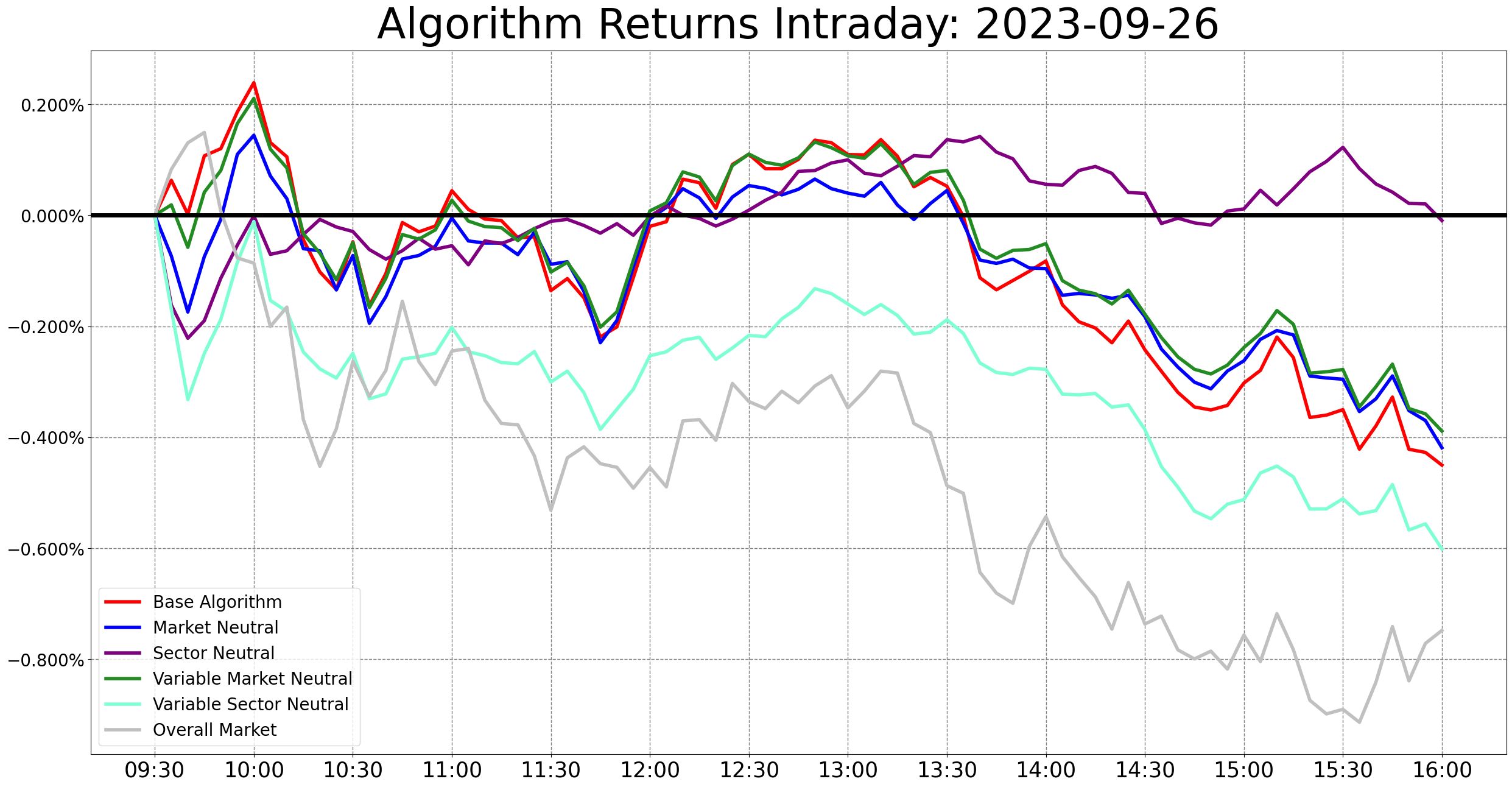

The results of yesterday are as follows:

Baseline:

$SPY: -0.75%

Our Results:

Sector Neutral -0.01%

Variable Market Neutral -0.39%

Market Neutral -0.42%

Base Algorithm -0.45%

Variable Sector Neutral -0.60%

Long Term Portfolio -0.93%

Algorithmic Returns - 9/26/2023

As I said before, the algorithm is on a tentative hold as a result of a loss of confidence in these extremely difficult market conditions. We are looking to lift this hold soon, but for now, it is still on hold. If you are attempting to follow any of these positions, know that HaiKhuu is not currently endorsing any of these positions, and are only continuing to provide them for complete transparency and consistency sake while we are actively testing new systems to improve our algorithm. If you are attempting to allocate into any of these positions right now, we highly recommend you follow the allocations of the current long-term portfolio that the algorithm is built on, as those are all fundamentally solid organizations that should provide you with positive returns over time.

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

Algorithmic Alerts for 9/27/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $AAPL, $AMZN, $TSLA , $NVDA , $ARM, $DG , $DIS

Position Opportunities:

Follow the market momentum

Limit your downside risk

Hold cash & prepare to allocate into the markets

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $DIS

Economic News for 9/27/2023

Durable Goods Orders - 8:30 AM ET

SEC’s Gensler Testifies on Bitcoin - (tentatively) 11:00 AM ET

Notable Earnings for 9/27/2023

Pre-Market Earnings:

Paychex (PAYX)

After-Market Earnings:

Micron Technology (MU)

Duckhorn Portfolio (NAPA)

Cocentrix Corp. (CNXC)

H.B. Fuller Company (FUL)

Worthington Industries (WOR)

Jeffries Financial Group (JEF)

Wrap up

Overall, be smart and safe in these market conditions. We are seeing signs that selling is slowing down after yesterday, but it can easily pick back up with relative confidence. Make some smart decisions, follow the momentum in the markets, and slowly start scaling into positions you have confidence in. Do not get greedy, and practice safe risk management in these conditions.

Good luck trading, and let’s realize some gains trading today!