Weekly Algorithm Review: 01/07/2023 to 01/13/2023

Algorithm Performance This Week

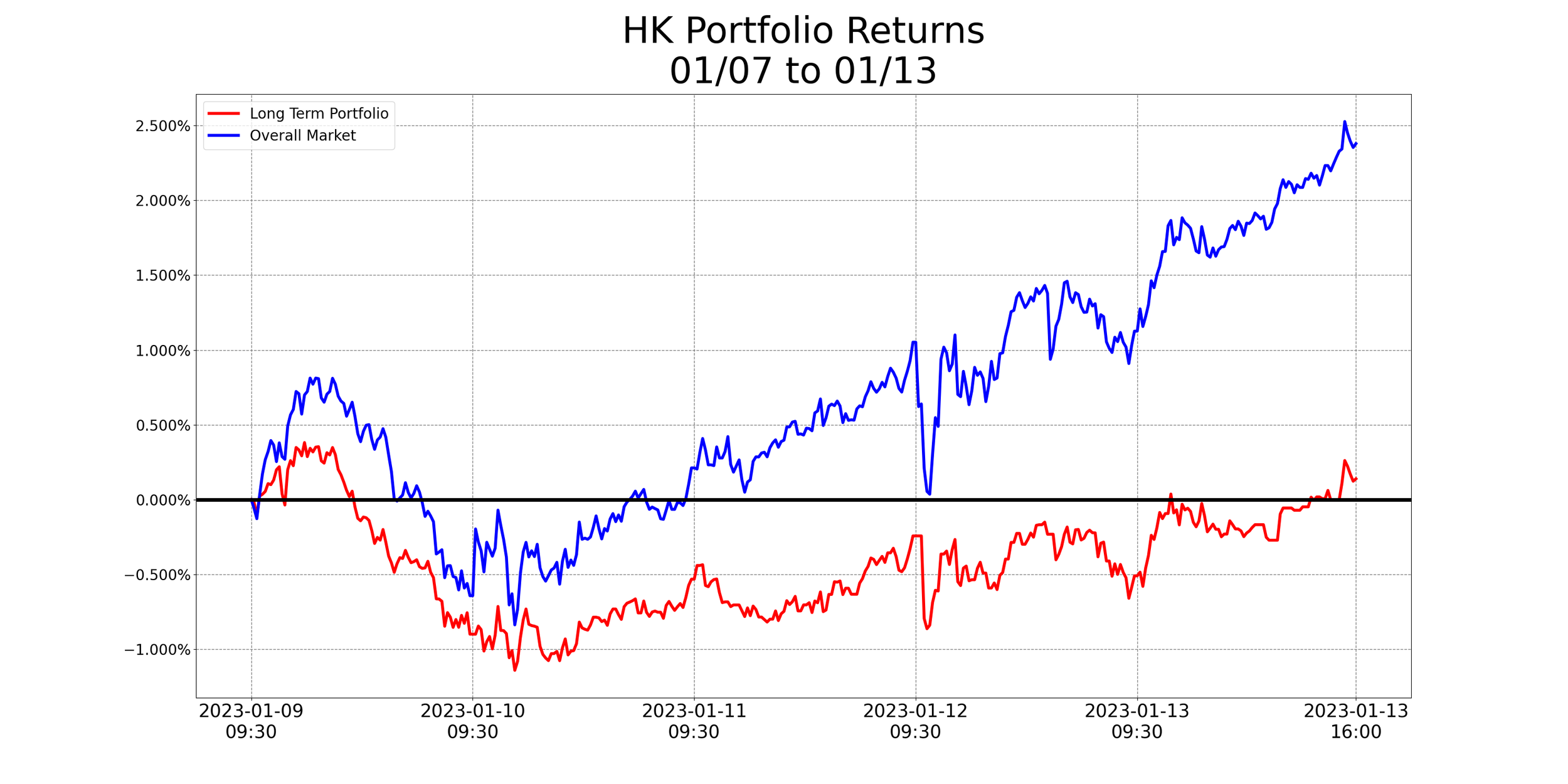

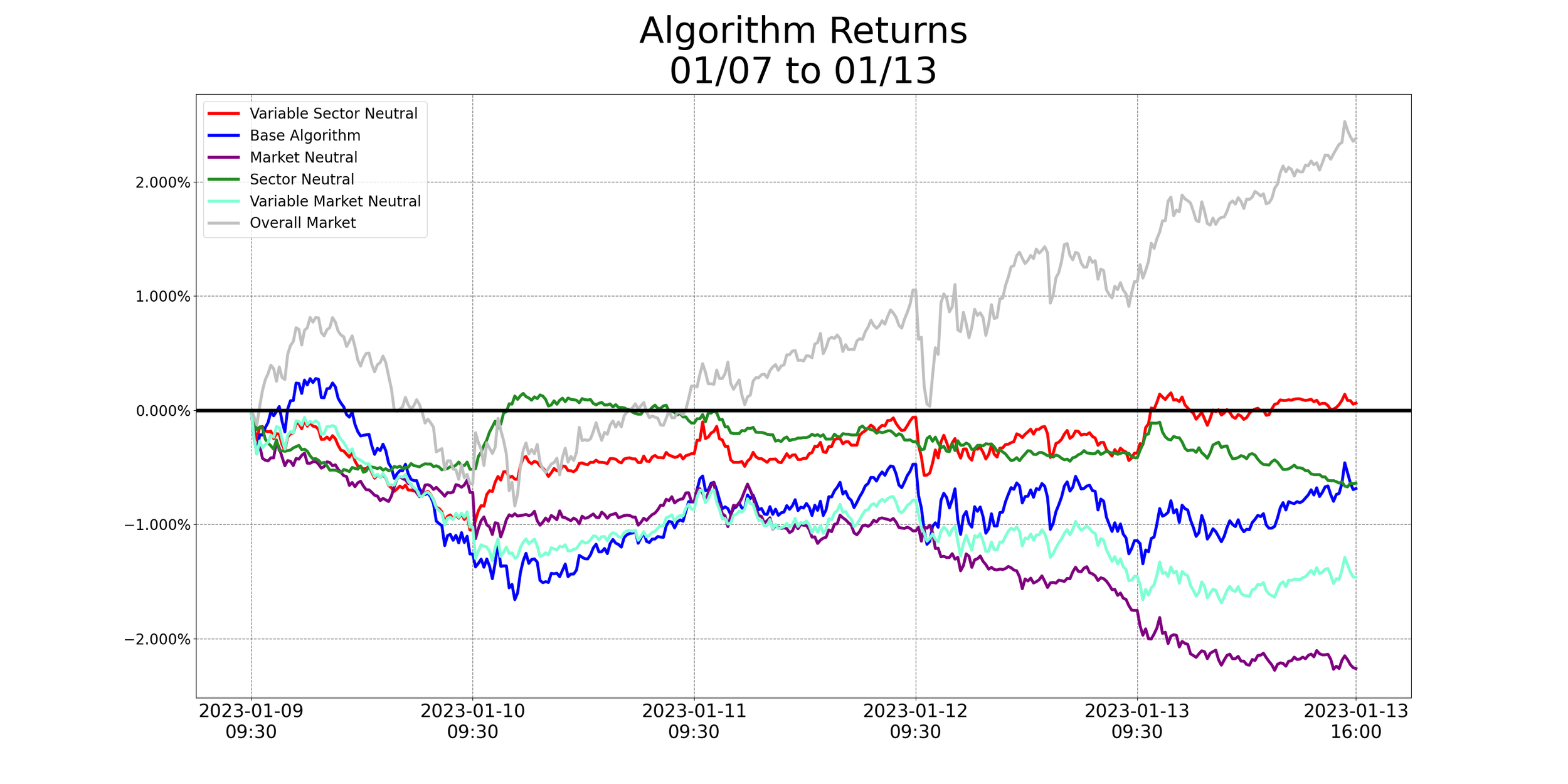

Overall Market: +2.38%

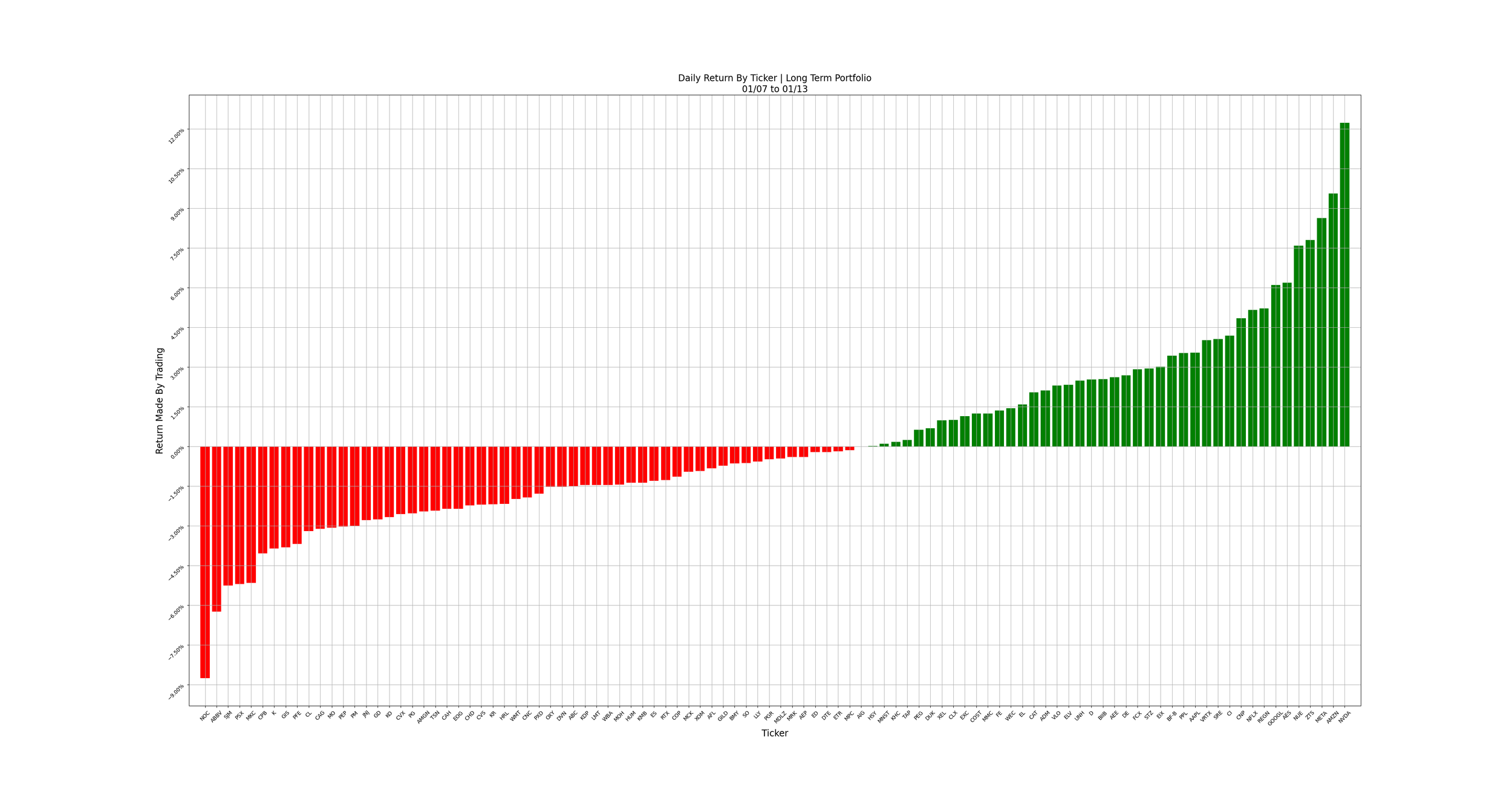

Long Term Portfolio: +0.14%

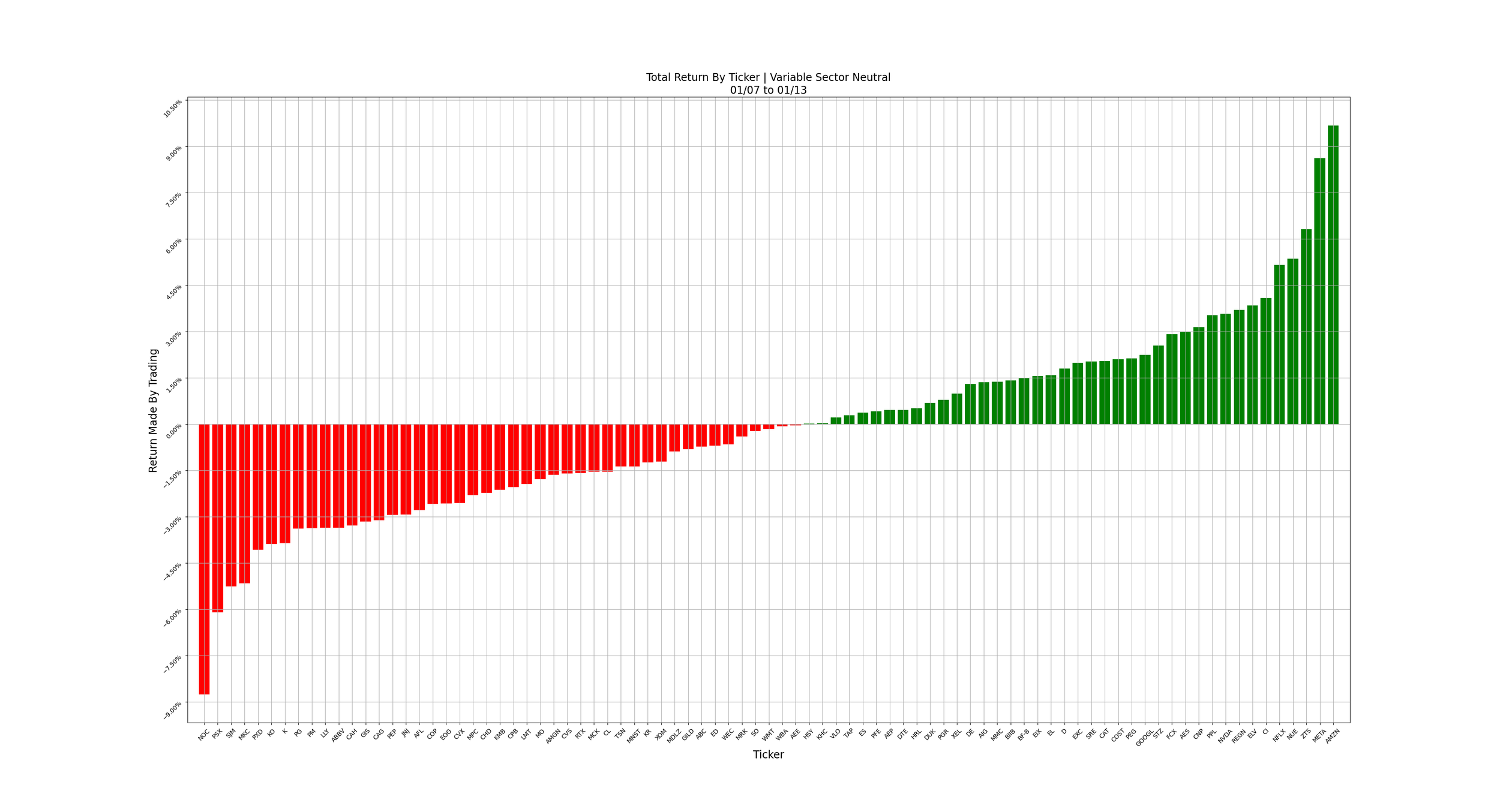

Variable Sector Neutral: +0.06%

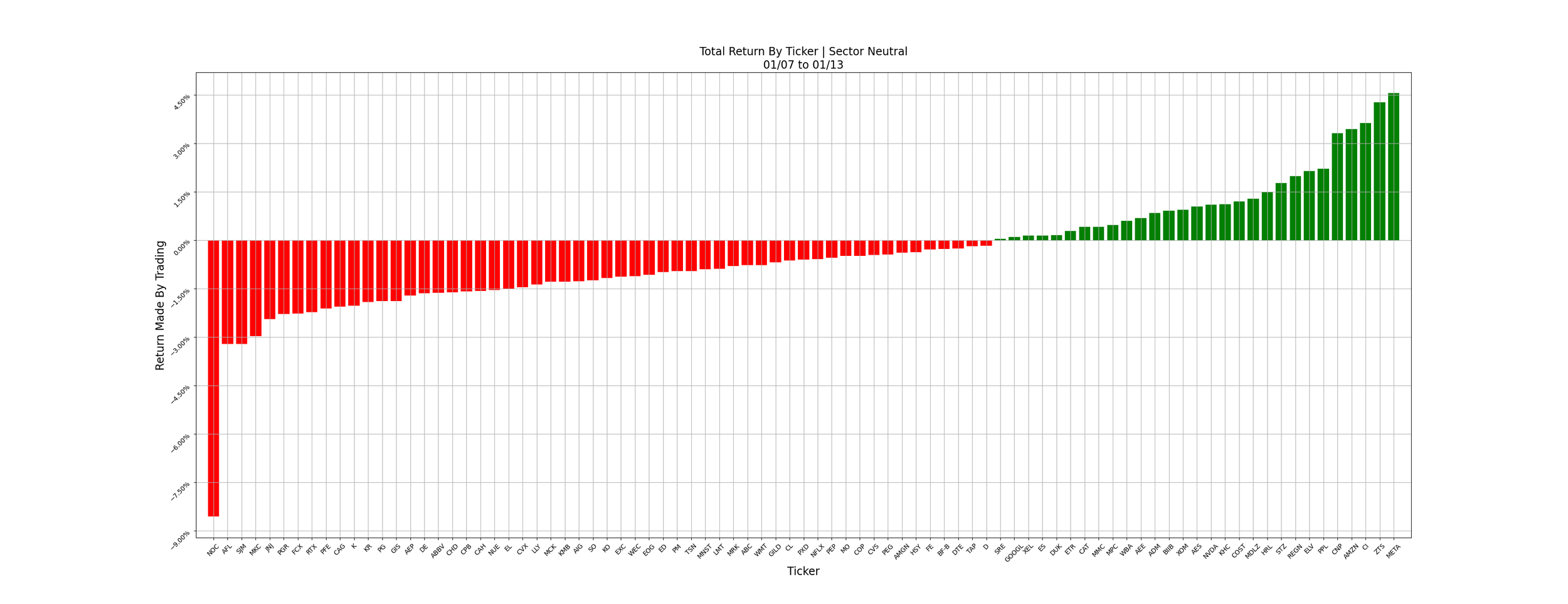

Sector Neutral: -0.64%

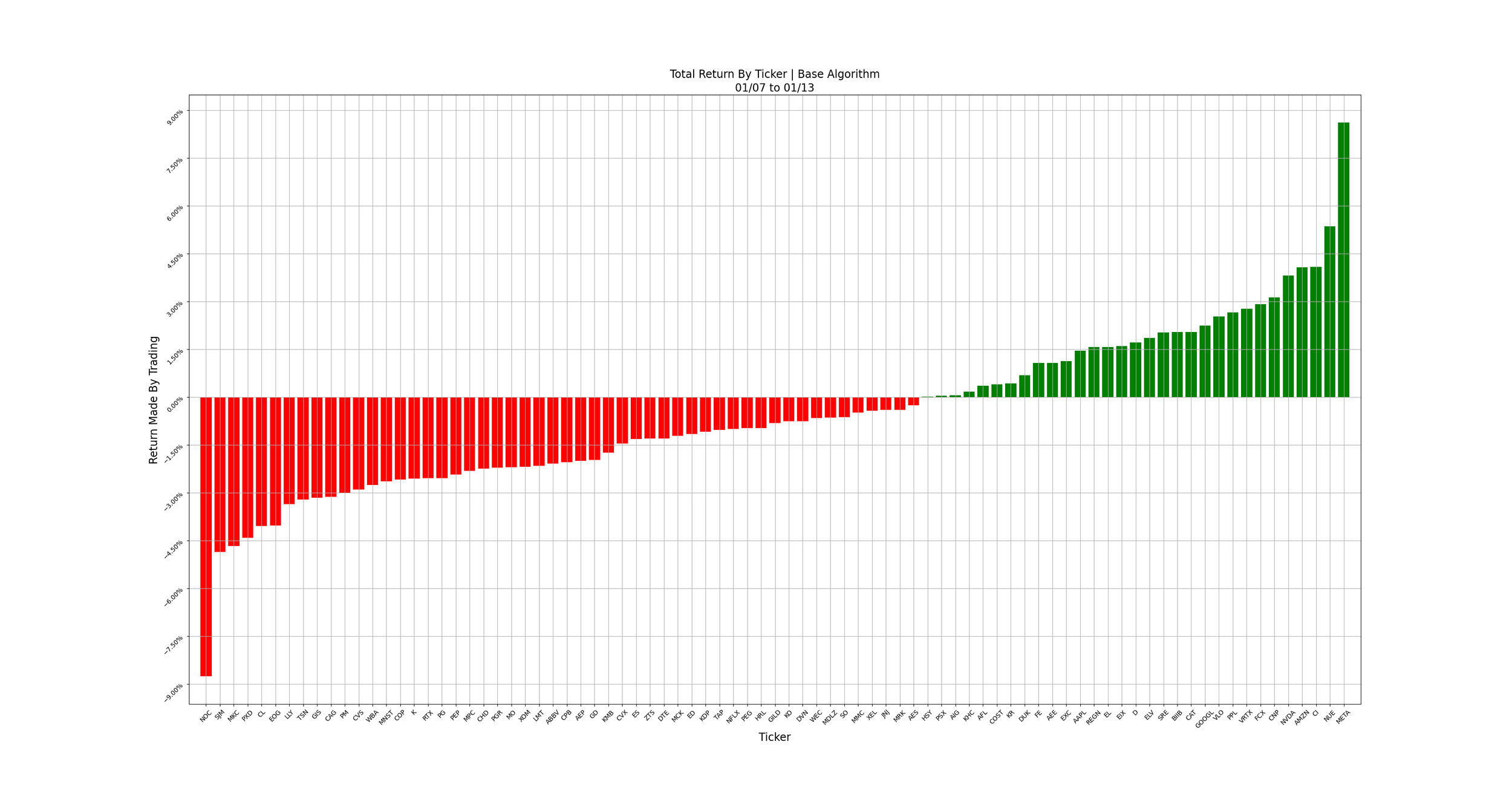

Base Algorithm: -0.69%

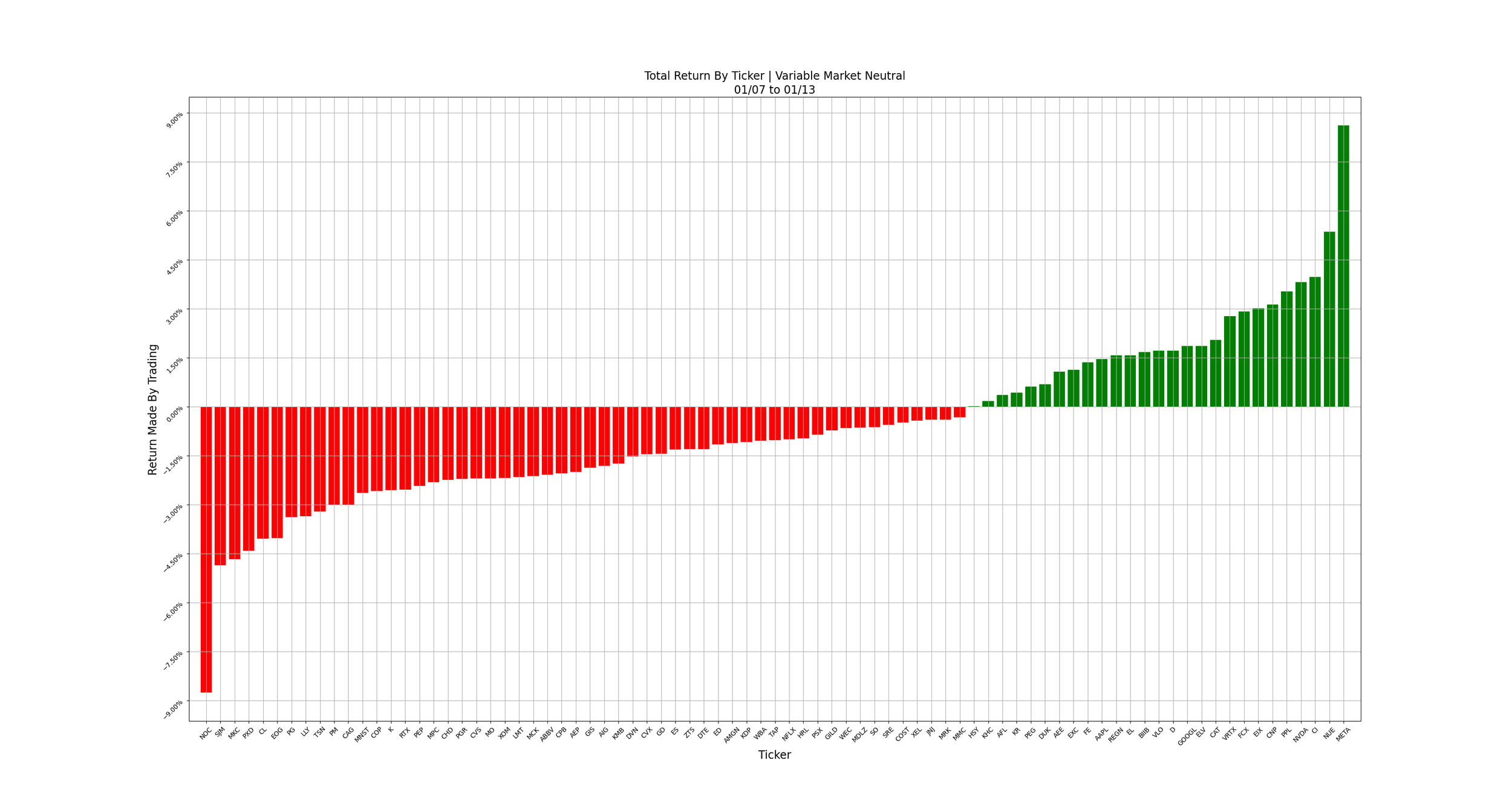

Variable Market Neutral: -1.46%

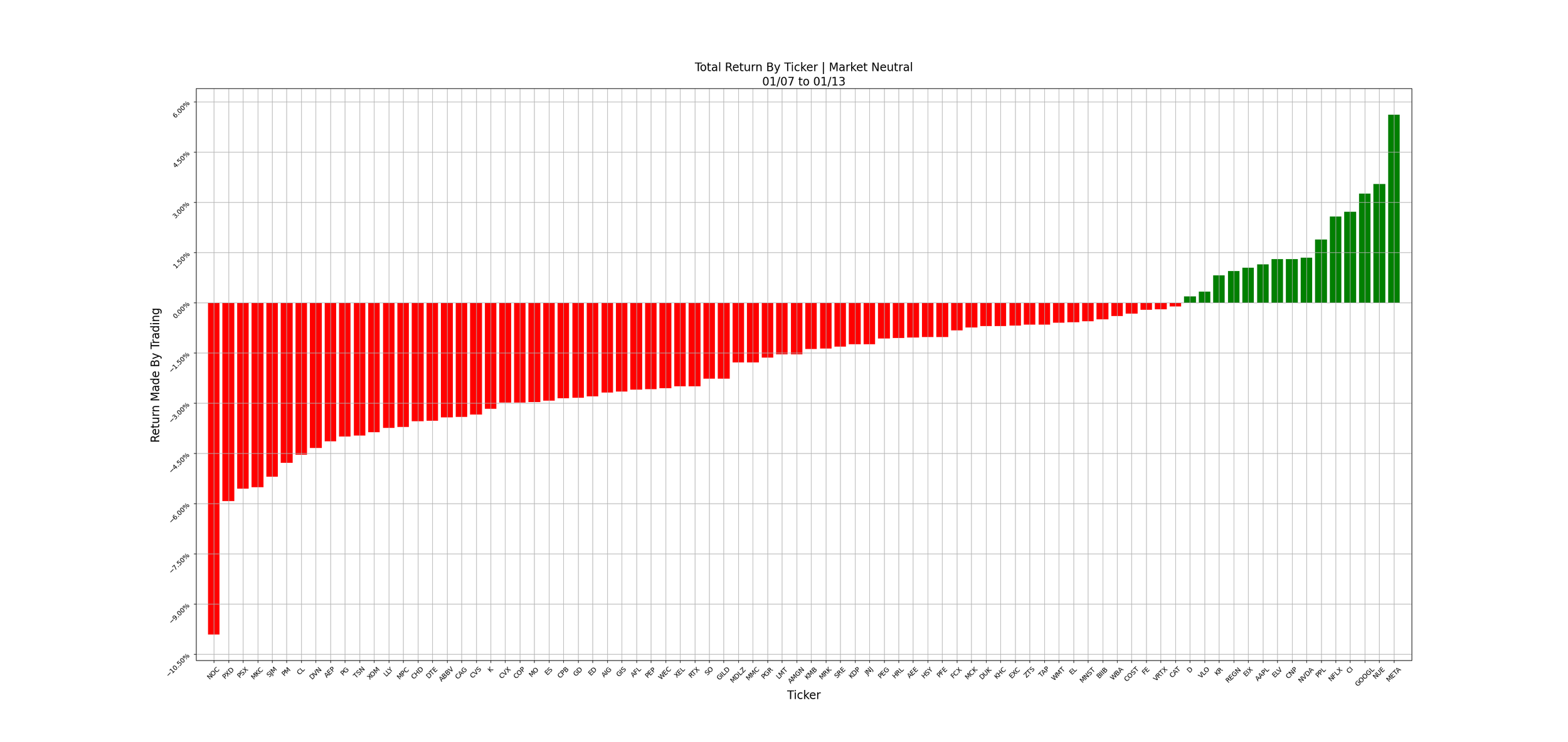

Market Neutral: -2.26%

This was our first week fully utilizing our new portfolio, and it was a bad week. Our long term portfolio underperformed by more than 200 bps, and our base algorithm underperformed that by another 75 bps.

As much as I hate to see this for our long term portfolio, it is within our projections for it. Our 2022 portfolio finished with a Sharpe ratio of 0.054, with a total return of 0.4% for the year, verses SPY’s Sharpe of -0.187, and return of -3.7% (note that all of these numbers refer exclusively to intraday movements).

Plain and simple, it’s been a tough year for trading. Our long term portfolio is successfully generating alpha for us, but with this market, it’s difficult to achieve a high Sharpe. And with a Sharpe of 0.05, we expect to have underperforming weeks, and even red ones, fairly often.

It’s important to keep in mind that our portfolio has a fairly long horizon. As such, a negative week or two does not a failed strategy make.

The algorithm underperforming is also concerning, but at the same time, within our projections for it. I was concerned that it might have done poorly due to some hiccup with the new portfolio, so I ran a backtest on it.

This backtest was run from July 2022 to January 2023, with the new portfolio we’ve adopted. There is some selection bias here, since these are tickers chosen based on their standing at the end of the test rather than the beginning, but there isn’t any other data to run this on. The results were:

Base Algorithm: 1.573 Sharpe, 13.2% return

Market Neutral: 2.024 Sharpe, 9.47% return

Sector Neutral: 2.712 Sharpe, 6.93% return

Long Term Portfolio: 0.494 Sharpe, 3.74% return

SPY: 0.590 Sharpe, 5.65% return

Based on this backtest, all of our algorithms are able to generate clear alpha over the current portfolio, which is a great sign. Further, we generally only expect almost every week to be positive when a strategy has a Sharpe ratio of 3.0 or greater. Given that only one of our strategies even comes close in this backtest, this week shouldn’t be a major red flag.

I absolutely would have preferred to have a better week, but our testing does not suggest a long term weakness here. So, if we have a few more bad weeks in a row, we’ll look further into this.

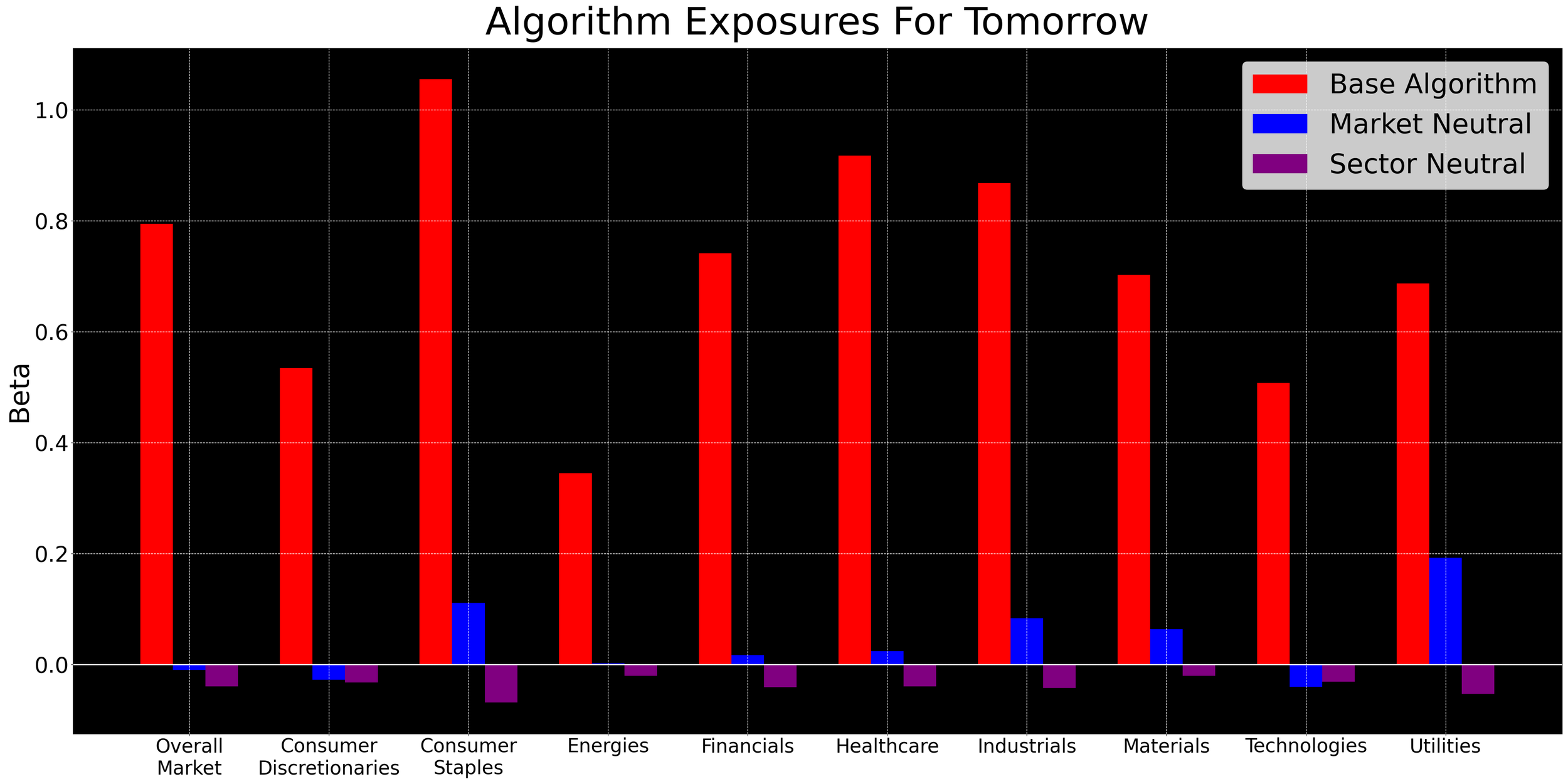

This test also serves to confirm an earlier hypothesis of mine. With our previous portfolio, I recommended market neutral on days of market uncertainty, to preserve our higher betas in defensive sectors. Since our new portfolio has a higher proportion of its betas in less defensive sectors, this is no longer the move. For the foreseeable future, I’m leaning towards base algorithm most days, sector neutral when we don’t feel good about the market, and variable sector neutral when we’re too uncertain to pick one.

That’s all I have for you this week. Thank you for reading, and good luck trading tomorrow.

-Asher