Weekly Algorithm Review: 03/18/2023 to 03/24/2023

(This week’s algorithm review has been delayed due to familial engagements - your patience is appreciated)

Algorithm Performance This Week

Long Term Portfolio: +0.31%

Base Algorithm: +0.24%

Variable Market Neutral: +0.23%

Overall Market: -0.02%

Variable Sector Neutral: -0.05%

Sector Neutral: -0.15%

Market Neutral: -0.16%

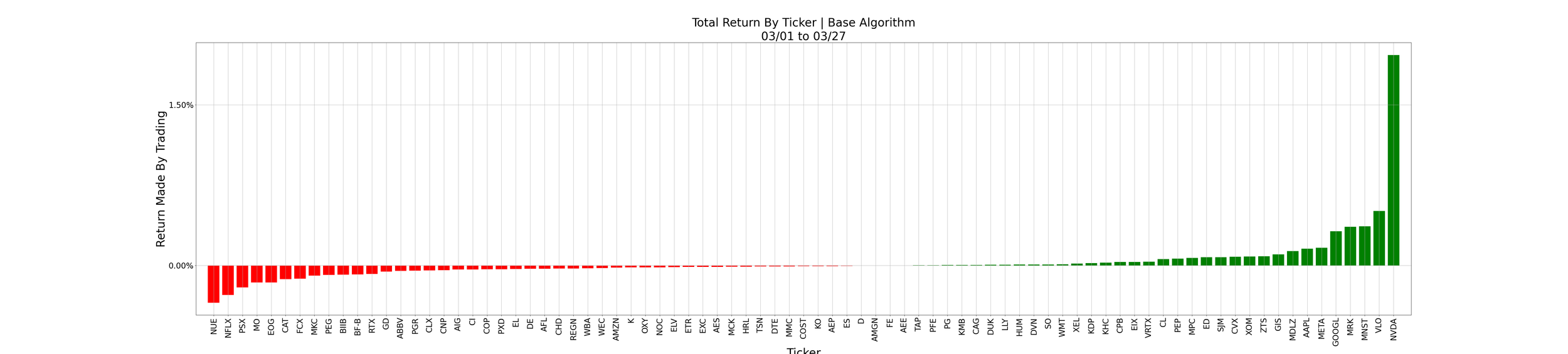

This week was a loss for our technicals, losing by 7 bps. For a loss that small in a week this volatile, I’m prepared to dismiss it as “in the black”. Still, I’d like to talk a bit about why our algorithm didn’t generate profits for us. The biggest outlier in its recommendations as of late has been consistent, large allocations into NVDA - but this isn’t the reason for its underperformance; trading NVDA has been a net positive for us this week, and moreso overall. META is also a major allocation for it, and while it took a loss trading it this week, over the month it’s been a solid source of returns.

Recently, we haven’t had a major losing ticker. We’ve obviously lost on some (NUE and NFLX for instance), but our biggest allocations have performed well, and put us squarely in the green.

What I think this week comes down to is heavy fundamental influence. Much of the intraday movement we observed in the markets was due to financial news - mainly FOMC, the lead up into it, and aftermath. While the algorithm is strong with technical analysis, its weakness is macro forecasting - especially now, when the markets are deciding which way they’re going.

As a side note, I’ve tried determining my moves in the HK Market Game using our algorithm (plugging some long and short ETF’s into it, and seeing which ones it prefers to hold each day). As expected, it doesn’t do well. The macro market doesn’t often move due to technicals, and that’s the only thing our system analyzes. It’s for this reason that hedging (ie: choosing between the Base Algorithm, a neutral one, or a variable neutral one) is a choice that’s always in the hands of a human trader.

For a market this uncertain, and this driven by fundamentals, I’m more than happy with a 7 bps loss in technicals.

What’s In The Pipeline?

Last week, we gained access to the GPT-4 API, and used it to roll out a more advanced version of TradeBot - one that can do technical analysis.

GPT-4, as you can imagine, is much more expensive for us to run. Due to limited capacity, the wait time can also be a few minutes. For now, we’re keeping this bot staff-only; it will only reply to HK moderators. We intend to implement a limited-use system for all of our users (with higher limits for Platinum and Diamond members), so stay on the lookout. In the meantime, feel free to request staff ask it things.

Our big priority right now is updating our TradeBots. AI is advancing at an incredible rate; exciting new projects are being released every hour. We’re expecting our AI powered tools to keep improving as well. In the near future, I hope to give them access to fundamental data on companies, and perhaps even quarterly reports. We can’t trade on technicals alone, after all.

Misc. Data For The Week