Weekly Algorithm Review: 06/10/2023 to 06/16/2023

Performance Rankings

Base Algorithm: +1.9%

Variable Market Neutral: +1.72%

Overall Market: +1.65%

Long Term Portfolio: +0.99%

Variable Sector Neutral: +0.88%

Market Neutral: +0.16%

Sector Neutral: -0.71%

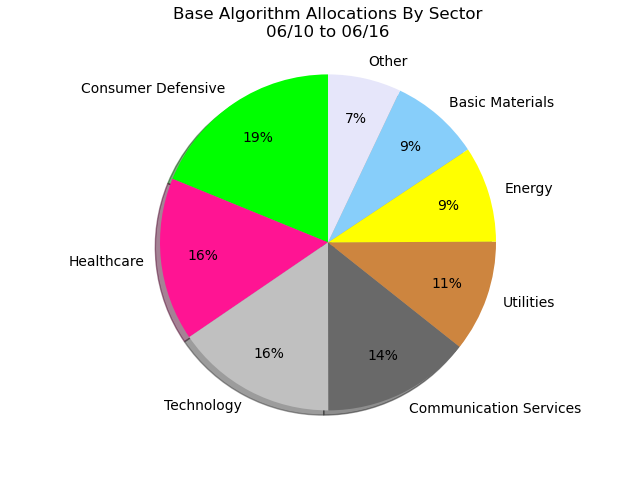

In terms of performance, there isn’t much to go into this week. The algorithm performed pretty exceptionally, outperforming our portfolio by 91 bps. To those unaware, we switched back to our defensive portfolio at the start of this week. This is the reason certain mainstays from the last few weeks of recommendations (AMD, for instance) have not been present. This is also why the algorithm has shifted to become more defensive.

We’re very happy with its performance this week. I not only like how much return its generated, but its diversification as well. For how well tech stocks have done the last few months, I’m confident in saying that 53% of the portfolio in one sector is too much.

I do, however, want to discuss the attributions of our P&L this week.

A large portion of our gains are attributed to NVDA this week, but the base algorithm would have outperformed the portfolio even without it. Further, NVDA was the portfolio’s 2nd biggest earner of the week. That in mind, this level of over-allocation is a feature, rather than a bug. I would have liked to see more widespread gains, but with a 91 bps success for the trading week, I find it hard to object.

What’s In The Pipeline?

My tentative project schedule is as follows. Once these are finished, I’ll be returning to experimenting with the algorithm for an indefinite amount of time. Periodic updates to the algorithm will be accompanied by updates to our intraday recommendation system. More info will come about the specifics of these updates at a later time.

The options update is finally here! The options side of the grapher bot can become unresponsive if a lot of people are using it at once. For this reason, we’ll do a sequential rollout of this. We’ll be releasing the options update to the grapher bot on Tuesday afternoon. To start, only HK Staff, and Diamond Community members will be able to access the options tools. We’ll release it to the Platinum Community 30-60 minutes later, and to everyone sometime after that. By Wednesday afternoon, the options update will be usable by all HK members

OpenAI has pushed an update to the GPT API’s. I won’t go into technical detail here, but it opens some doors for us on what we can make TradeBot capable of. To start: we can now show it the data in a graph it requests. This means that it can not only show financial data, but meaningfully discuss it as well (an example from a beta build is below - this feature will be released with the rest of the TradeBot update).

On top of that, we’re going to be equipping TradeBot with some technical analysis and backtesting tools. When asked for its stance on a stock, or which stocks it’s bullish on, TradeBot will currently refuse to answer. Instead, we intend to have it respond something like “Bullish on MMM! It just broke out of its upper Donchian Channel on the 5m candles - it usually responds well to this signal!”

We’re looking to drop this update to TradeBot in a little over a week.

Misc. Data For The Week