Weekly Algorithm Review: 06/24/2023 to 06/30/2023

Performance Rankings

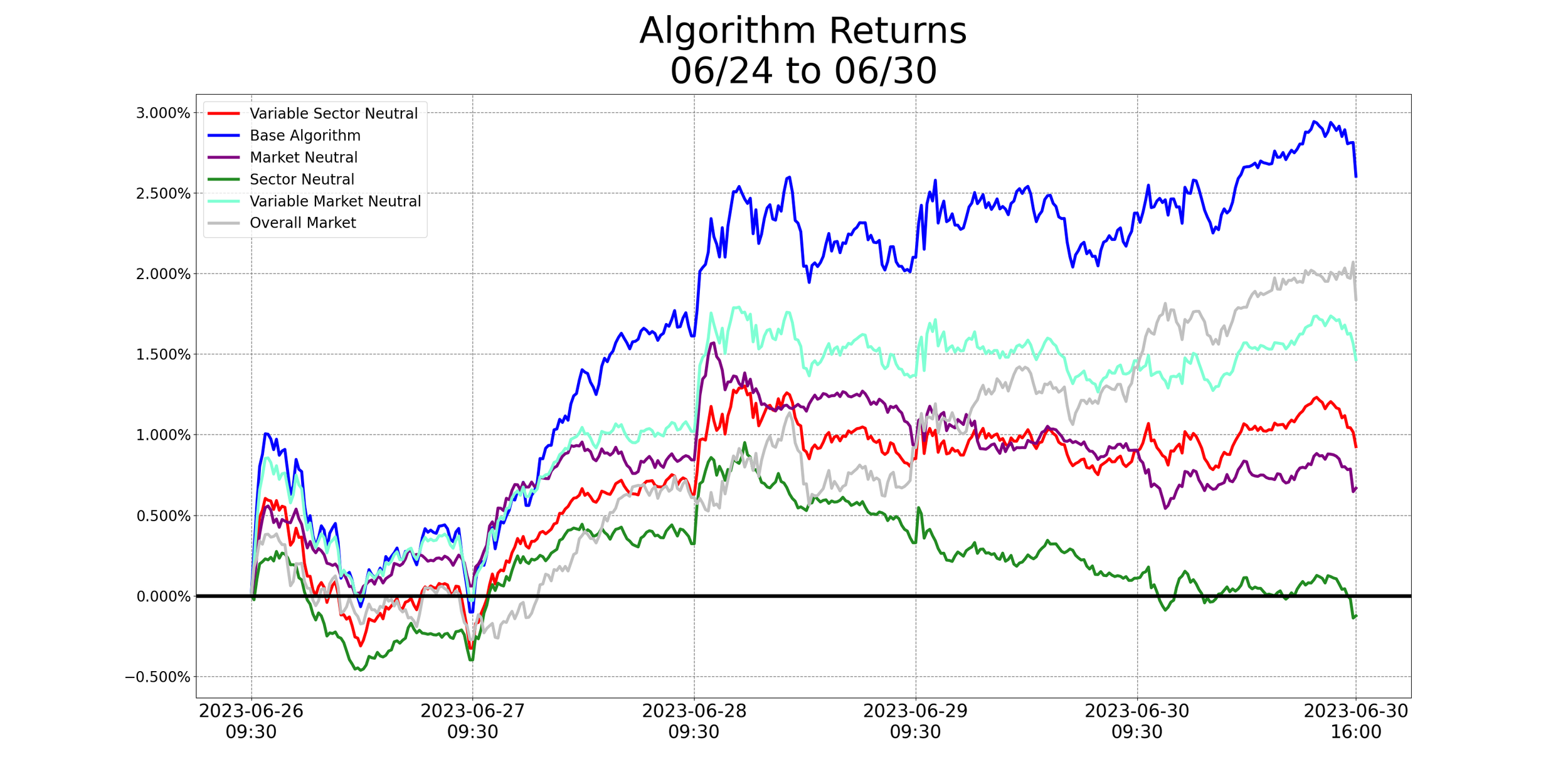

Base Algorithm: +2.6%

Long Term Portfolio: +2.56%

Overall Market: +1.84%

Variable Market Neutral: +1.46%

Variable Sector Neutral: +0.92%

Market Neutral: +0.67%

Sector Neutral: -0.13%

This was a strong week for our new, more bullish portfolio. A 72 bps win is fairly non-trivial. The algorithm, while technically a winner, was by all means trivial. For all intents and purposes, its outperformance of 4 bps is in the black. There doesn’t seem to be one major problem causing this, or an unusually large number of missed winners. Obviously I wish we’d put more into GFS, less into META for instance, but this level of missed opportunity isn’t out of the ordinary.

The similarity in performance between the base algo and portfolio can largely (though not fully) be explained by their sector allocations. The allocations by sector are different - but not nearly as much so as they’ve been when running the algorithm on our more defensive portfolios. For comparison, I’d like to show our sector allocations from last week; these were done on a far more defensive portfolio.

Compared to these massive changes in allocations (14% less in consumer staples, 16% more in technology, 11% less in utilities), the changes our algorithm makes to this bullish portfolio are much smaller. 5% less in tech, 4% more in materials, 4% less in industrials - the closeness of performance was rather predictable.

It’s hard to say if this trend will continue as we move towards more bullish portfolios. It’s possible that, since this portfolio did fairly well, there weren’t as many improvement opportunities for the algorithm as usual. If that’s not the case, the days of the 150+ basis point outperformance by the algorithm may be on hold for a while.

We’re still expecting the algorithm to perform well, but I won’t be surprised if the differences with this portfolio are far less extreme.

What’s In The Pipeline?

We’ve been playing with a new, proprietary indicator. Initial results are extremely promising; we’ll be doing further testing next week before rolling out any products based on this. Tentatively, this indicator has yielded great results, but with very narrow timeframes (on average, a buy signal is good for roughly 115 seconds with this indicator). As such, one of the problems we’re considering is how best to utilize this. We can’t have messages getting spammy - but if you’re looking to consult signals from the indicator, you’ll need to know ASAP.

If continued testing yields good results, we’ll give updates on this. If we never mention it again - you can safely assume results were unimpressive, or we concluded that the signals was too fast for a Discord server.

Misc. Data For The Week