Weekly Algorithm Review: 11/18/2023 to 11/24/2023

Performance Rankings

Long Term Portfolio: +1.05%

Base Algorithm: +0.95%

Overall Market: +0.91%

Variable Market Neutral: +0.22%

Market Neutral: +0.15%

Variable Sector Neutral: +0.05%

Sector Neutral: -0.11%

Performance this week was very similar to the previous week. The algorithm, while slightly negative, is largely in the black here. The portfolio did well this week, beating the market. It was a strong week for smaller cap stocks, but even with that in mind, it out-performed by a larger margin than would be expected.

The distribution of returns of by ticker is mixed. On one hand, the distribution is notably flatter overall. Since one of our main goals is a high Sharpe ratio, this should lead to a lower volatility of returns in the long run, which will help out this measure. On the other hand, there’s simply less green. The algorithm reduced its exposure to both winners and losers, and did so mostly proportionally.

And once again, I want to bring our attention to TSLA. It wasn’t a huge allocation per se, but it received allocations every day this week, usually of around 8% of the portfolio. Combined with its volatility, TSLA was the kingmaker almost every day this week.

I say this not to make an excuse for the algorithm’s performance, but to draw attention to a flaw we’ve been on the lookout for. This particular model does not include any anti-trend-chasing measures, and does not artificially diminish the weight given to older days in its training data. Consequently, if it’s biased towards a ticker, and said ticker begins to perform poorly or questionably, it might take a long time to pull away from it. In short, we need to see that it knows when to take its foot off the gas. So far, we’re not seeing great results on that front.

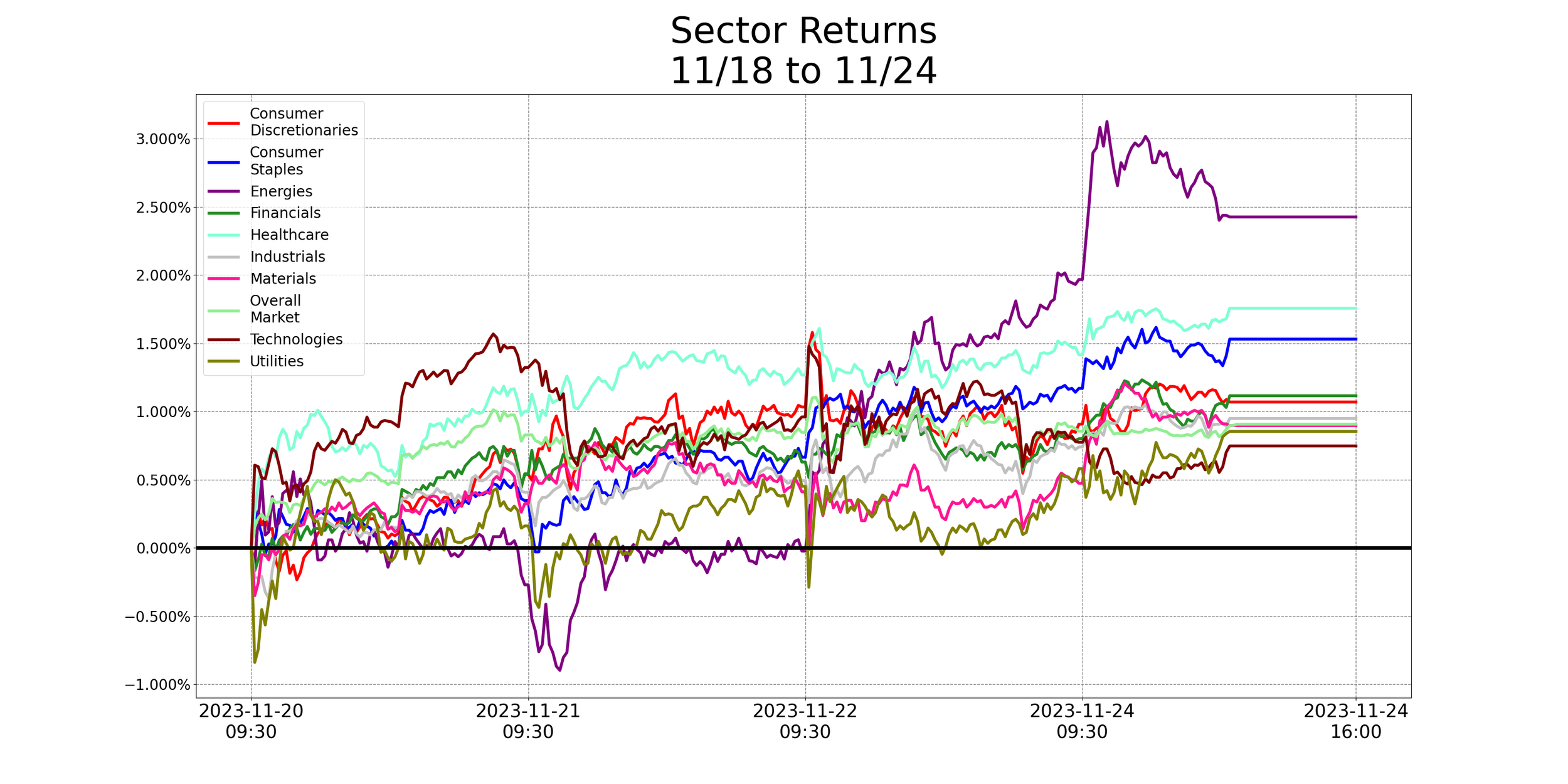

Performance by sector is about what we expect. Given the closeness of performance between the portfolio and the algorithm, minimal sector deviations is par for the course. Overall, this was a great week for the market. Not a single sector we track saw negative returns, though in general defensives tended to do better.

We’re going to continue this beta for at least one more week. We know we said we wanted to make a decision after a month, but so far we’ve seen 2 weeks finish in the black. We’re going to prepare an alternative daily algorithm to roll out if this one doesn’t show promise and continue working on the new intra-day bot, but we want a little more data before we make this decision.

What’s In The Pipeline?

We’ve gone into testing on our new intraday bot. We’ve run into some network connectivity issues this week which, unfortunately, mean that many of the trades we simulated this week are invalidated. Specifically, we lost our internet connection for a few days. This means the bot wasn’t able to exit these trades when it naturally would have wanted to, in addition to missing all new trades in that timeframe. This issue aside, it appears to be working well - all signals we were able to check matched up well with what our model recommended - but with this issue, combined with the usual weirdness of Thanksgiving week, we’re going to call this week a wash and start fresh.

In backtesting, this model achieves roughly a 3.0 Sharpe, with a small testing dataset backing this up. During live testing, we’ll be looking for this level of consistency.

Misc. Data For The Week