Weekly Algorithm Review: 11/25/2023 to 12/01/2023

Performance Rankings

Base Algorithm: +1.41%

Variable Market Neutral: +1.26%

Long Term Portfolio: +1.13%

Market Neutral: +0.99%

Variable Sector Neutral: +0.79%

Overall Market: +0.52%

Sector Neutral: +0.1%

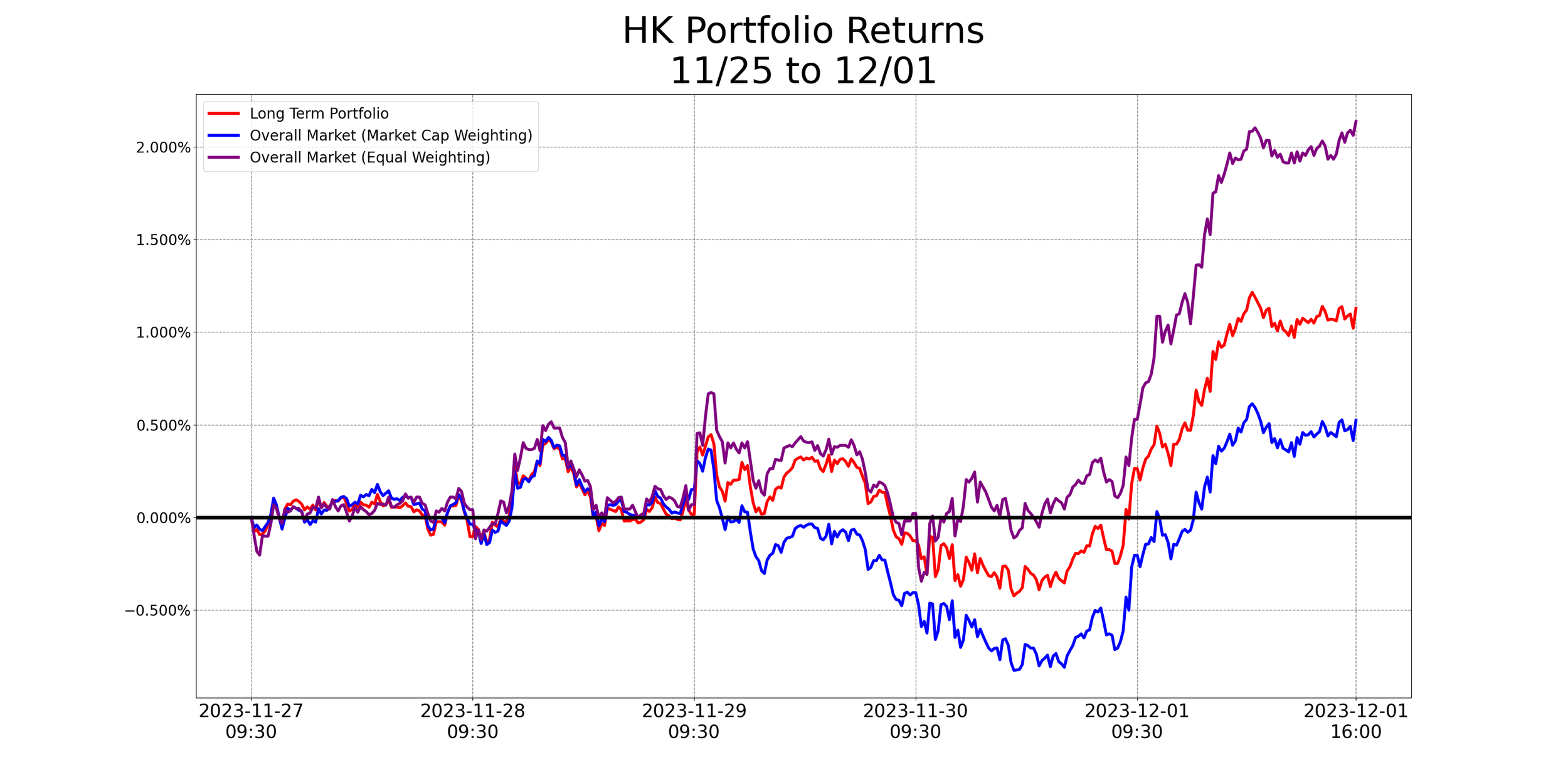

This was a much better week for us, in line with what we want to see. The algorithm out-performed by 28 bps - not a major win, but every win is one we like to see. The portfolio took a major win over the market, albeit carried by its bias towards smaller caps. We suspect this scenario will be rather common with our portfolio, for the foreseeable future. While the portfolio is equal-allocated, we try to get its sector-allocations close to the S&P 500. We expect it’ll usually beat one of the S&P 500 and equal-weighted S&P ETF - when looked at on a weekly basis. We expect the strength of our fundamental analysis to be more clear in the long run.

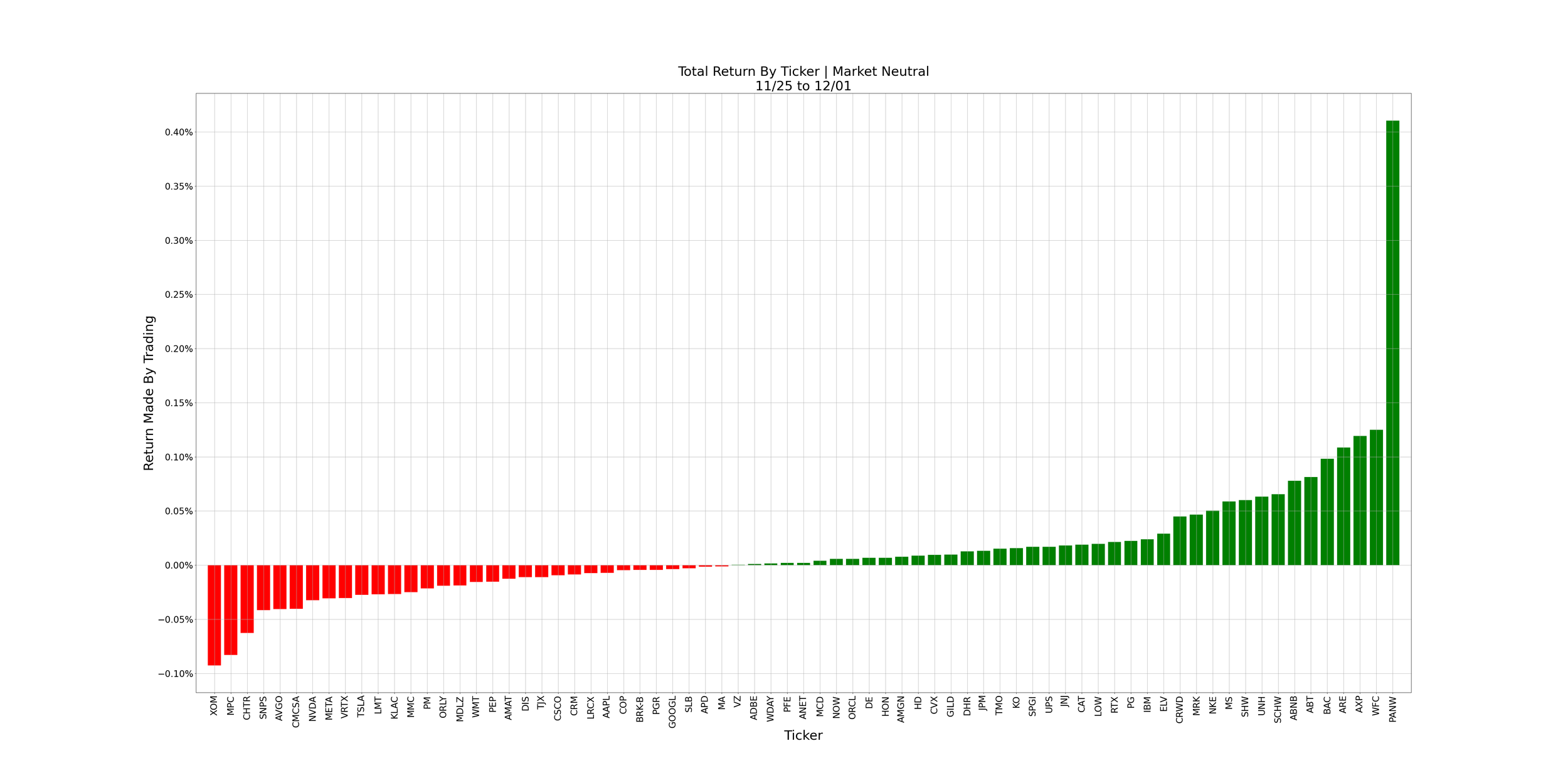

There are 2 main standouts here - one negative, one positive. PANW is very much what we want to see from this system. High returns, but without crazy over-allocations. PANW, despite being our biggest earner this week, never broke a 4% daily allocation. Now the trial for the algorithm shifts. We’re no longer seeing if it can correctly take its foot off the gas with TSLA. Now, we want to see if it accelerates correctly on PANW.

PANW had a great week, great month, and a great last year. This could be an instance of trend-chasing, or it picking up on technical signals that tend to precede upward movement. I’ll note that the algorithm is recommending an allocation of 4.68& in PANW on Monday. It’s nothing big right now, but this’ll be useful to observe about our system’s performance.

Consistent with last week, sector allocations remain similar between the algorithm and our portfolio. Not much to go into there.

What’s In The Pipeline?

We have 1 week of testing in the books with our new intraday bot. So far, its return (assuming equal amounts of capital are put into each ticker it trades) is: -0.0023%. This bot will always have a final return closer to 0. Unlike our daily algorithm, this one isn’t using all of its capital all of the time. In fact, most of its capital usually isn’t in use. Though a human trading with it, and making live decisions about allocations can choose to allocate their capital more aggressively.

But even for an algorithm like this, -0.0023% is fairly “in the black”. It’s far too early to draw a meaningful conclusion on it, especially with results like these. For now, the daily algorithm will continue being released, and the intraday bot will remain in testing. Further updates will come as we get them.

Misc. Data For The Week