Weekly Algorithm Review: 12/04/2022

Algorithm Performance This Week

Overall Market +2.83%

Long Term Portfolio +2.26%

Base Algorithm +2.14%

Variable Market Neutral +1.41%

Variable Sector Neutral +0.56%

Market Neutral -0.34%

Sector Neutral -0.78%

Let’s start by looking at our returns. This was a great week for the market, largely driven by Powell’s statements on Wednesday. Our bullish base algorithm and more conservative long term portfolio both rode that spike, but lagged behind slightly. For the remainder of the week, our portfolio and base algorithm both followed the uptrend, but lagged behind some.

Our long term portfolio did as it’s intended to do. Our strategy is a conservative one, since we’re expecting further market decline and a recession in the next few months. Comparing the sector makeup of the S&P 500 to that of our long term portfolio can shed some more light on this.

Our portfolio leans much more heavily on Consumer Defensive and Healthcare companies. It also allocates a little extra into Utilities. These are reliable, albeit lower market beta sectors. This is the main reason we underperformed the market this week - when the market shoots up, we can’t follow it. This is a consequence of our defensive strategy, but we consider it a worthwhile problem to have, because our portfolio will do better in declining market environments. We can see on Monday and Tuesday we outperformed a slightly red market - a situation we expect to encounter more often.

The base algorithm followed our portfolio fairly closely throughout the week, and was ultimately very close to it in performance. Although the long term portfolio won out, with a return of +2.23% vs an algo return of +2.14%, I think this was a good week for us. Given that most of the return we saw from both was purely fundamentals-based, and our algorithm is entirely technical, I’m more than happy with this performance.

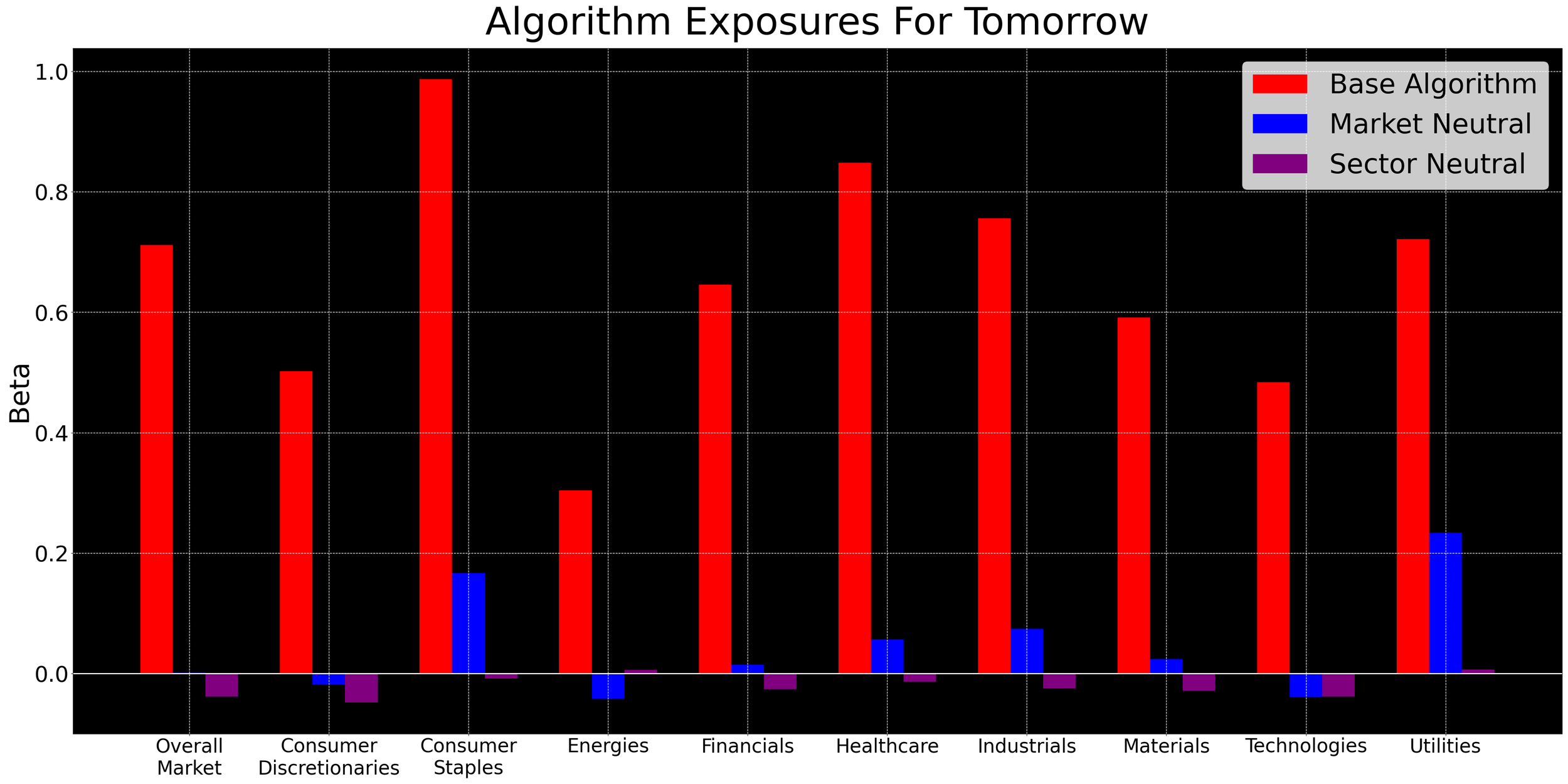

Our hedging algorithms did unremarkably. I’d like to note our sector neutral and market neutral algorithms. They both almost completely ignored the Wednesday spike, taking comparatively small declines. As unfortunate as it is to miss out on market growth, this is exactly what we want to see in a situation like that. This reassures me that the next time the opposite happens (there will always be a next time for that), we’ll see virtually none of it on our fully-hedged systems.

Future Developments - What’s In The Pipeline?

At this time, I’m not looking to tweak the algorithms we have in place. Instead, I’m looking to try a new system all together. I think it’s important to try totally new strategies every so often, lest we spend all of our time on an improvable system. Our current algorithms take in a list of technical signals, and uses these to conclude how “similar” each day in recent history is to the current day we’re looking to trade. Based on whether these days’ weighted average return is positive or negative, we make the decision on how much to allocate into each ticker.

I’m interested in using that same training data to instead come up with hard rules on when to enter and exit positions with each ticker. Instead of something akin to “trade AAPL using 20% RSI and 80% Heiken-Ashi candles”, “trade AAPL when we see 2 consecutive HA candles, and RSI is below 30”. This could more closely mirror strategies that real traders would use, but isn’t without problems.

For one, it’s going to be harder to build a machine learning model for this. I’m not going to go into technical reasons, but the short version is it’s easier to optimize a finite set of float values, versus an arbitrarily sized set of finite rules.

Our other major development is the market game, and how we intend to use its inputs as a data point. As of now, we’re just using it to decide how much exposure to hedge away on our variable algorithms, but can we get something more useful?

I’d like to convert our users’ answers to a probability density function, rather than just a single percentage. Instead of just saying “the market game recommends we hedge 37% of our exposures today”, what if instead we could say “the market game forecasts a 65% chance the market goes up today, with a mean expected return of 0.42%”. We could use this to drive higher or lower risk strategies, and even the use of more nuanced instruments like option structures.

I wouldn’t expect this in the near future - we’ll need a lot more data on the market game before this is plausible - but if we can get this working, it’ll open a lot of strategic doors for us. This is also something we’d like to make available to users (or just on our website).

Extra Data

Thank you all for reading, best of luck trading this week.

-Asher