Robinhood Margin Rates | What are the Robinhood Margin Rates?

Robinhood Margin Rates

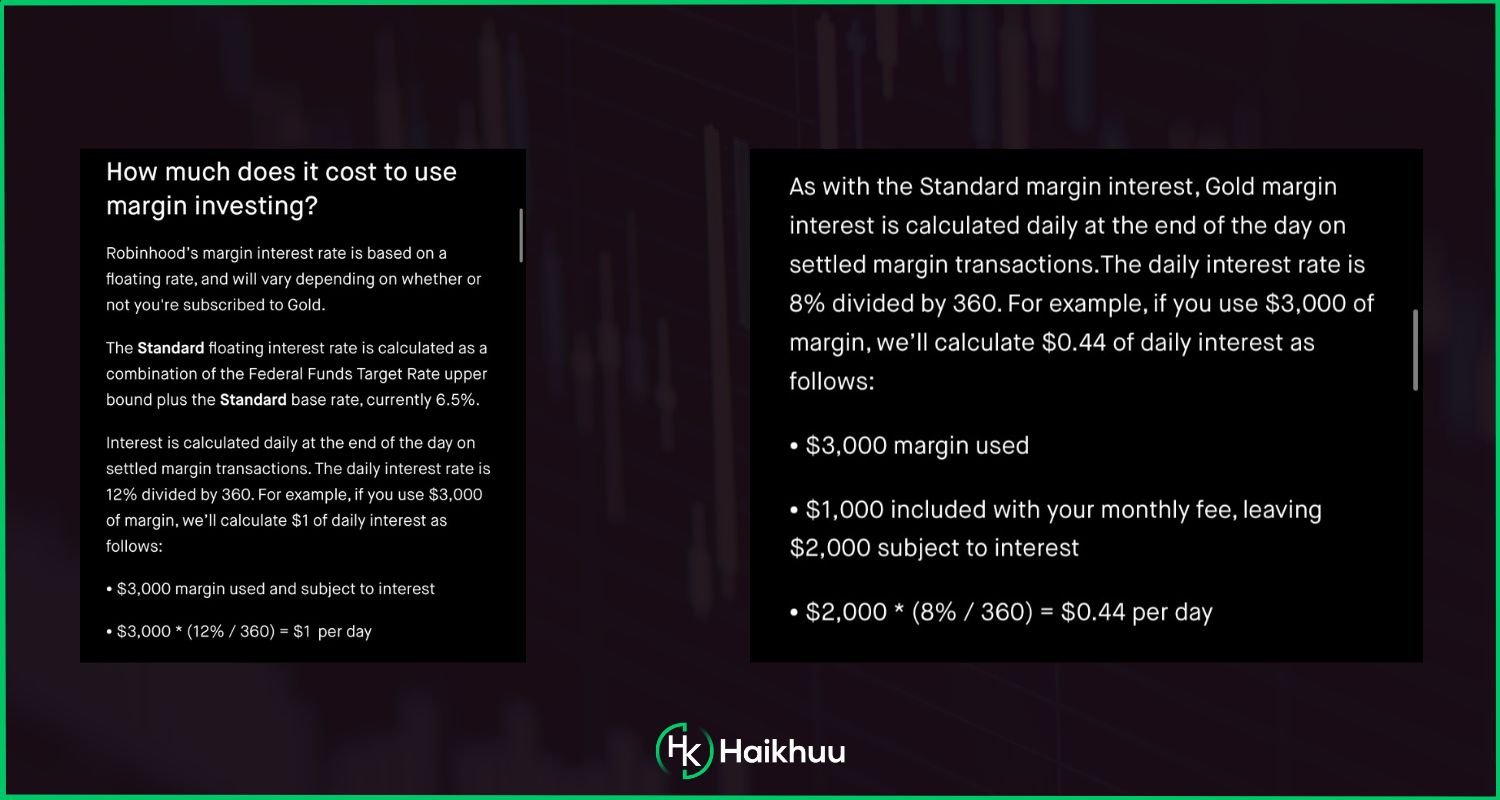

Margin rates on Robinhood depend on if you are subscribed to gold and are based on a floating rate similar to the Federal Funds Rate.

For Robinhood Gold users, the discounted base rate is 2.5%, and the daily interest rate is calculated as 12% / 360. Gold users also get a free $1,000 of margin usage.

For Robinhood Instant users, the base rate is 6.5%, and the daily interest rate is calculated as 8% / 360.

Image From the Robinhood App

The Risks of Margin on Robinhood

It's important to note that margin trading involves borrowing money from the brokerage firm to buy securities, and it can increase the potential for gains and losses. Therefore, it is important to be familiar with margin trading and its risks and costs and to be aware of your own financial capacity and investment goals before engaging in margin trading.

It's also important to keep in mind that the margin rates can change over time and can be subject to market conditions. You should check the current margin rates on Robinhood's website or contact their customer service for the most up-to-date information.

What is Robinhood Gold?

Robinhood Gold is a premium subscription service offered by the Robinhood brokerage platform. It provides access to additional features such as larger instant deposits, margin trading, and extended trading hours. It also provides access to research and other financial analysis tools to help users make informed investment decisions. The cost of a Robinhood Gold subscription varies depending on the level of service you choose.

To access margin on Robinhood, you must buy Robinhood Gold which is $5 per month.

How Much Margin Can You Use?

For margin equity trading on Robinhood, you can buy 2x more stock than the cash you have in your account. For example, if you have a $10,000 account, you can buy up to $20,000 of equity.

However, you will pay margin interest for any value above $10,000. So if you own $20,000 worth of equity, you will pay margin interest on $10,000 until you sell the position.

In the gold settings screen, you can track various margin metrics like the following:

Total Margin

Total margin indicates how much margin you can use based on your account’s value and the volatility of your holdings.

Margin Available

The margin available considers the minimum of your total margin and your borrowing limit.

Margin Used

The margin used indicates the amount of margin you are currently utilizing.

Borrowing Limit

The borrowing limit indicates the maximum limit on the amount of margin you can utilize.

What is a Margin Call?

A margin call is a demand from a broker to a margin account holder to deposit additional money or securities to bring the account back to the minimum required margin. Margin trading allows investors to borrow money from their broker to buy securities, but the increased risk comes with increased buying power. A margin call occurs when the value of the securities in the account drops and the account's equity falls below a certain percentage of the loan, called the maintenance margin.

The broker will typically issue a margin call to protect itself from a potential loss if the securities continue to lose value. The investor must either deposit more money or securities into the account or sell some of the securities to meet the margin call. The broker will liquidate some of the securities in the account to meet the margin call.

What is Minimum Margin?

On Robinhood, the minimum margin requirement is 25% for most securities. This means that when an investor opens a margin account, they must have at least 25% of the total value of their purchase in their account as collateral.

For example, if an investor wants to buy $1,000 worth of stock using margin, they must have at least $250 in their account. This is the minimum amount of equity an investor must maintain in their margin account to keep the position open.

It's worth noting that certain securities, such as options and cryptocurrencies, have a higher margin requirement, meaning you need to have more of your own money in the account as collateral. In addition, Robinhood Gold has lower minimum margin requirements than a standard margin account and more buying power. However, it comes with higher fees and more risk, so it's important to understand the terms before subscribing to it.

How to Learn More About the Stock Market

If you want to learn more about the stock market, joining a community of like-minded individuals is a great way to accelerate your learning curve.

Benefits of Joining a Trading Community

Converse with thousands of other experienced traders

When you join a community, you can talk with other traders with unique viewpoints on the stock market.

Learn new strategies

There are a million ways to trade on the stock market, and you will surely learn new strategies when you talk with other traders.

Stay up to date on the latest stock market news

Additionally, trading communities will keep you updated on the latest economic news. You can also ask questions if you don’t understand some of the complex financial terms.

The HaiKhuu Trading Community

The HaiKhuu Trading community is one of the largest stock trading communities online, with over a quarter million members within its communities.

The community includes beginner and professional traders who can assist with your day-to-day trading activities.

Related Educational Articles

Can You Have Multiple Robinhood Accounts?

Why Can’t You Withdraw Money From Robinhood?

How to Delete Your Robinhood Account

Selling Covered Calls on Robinhood

Selling Cash-Secured Puts on Robinhood

What is the Average Robinhood Account Size?

What are Unsettled Funds in Robinhood?