tastytrade Fees | Trading Fees on tastytrade Examined (Formerly tastyworks)

tastytrade is a popular brokerage platform that specializes in options and futures trading. If you are interested in using tastytrade’s platform and products, you might be wondering how much they charge for their services and how you can save money on their fees.

This article will explain the different types of fees that tastytrade charges or passes through to their customers, such as commissions, clearing and regulatory fees, margin rates, banking fees, and trade-related fees. We will also provide some examples, comparisons, and tips to help you understand these fees.

Commissions: Low and Capped Rates for Opening and Closing Trades

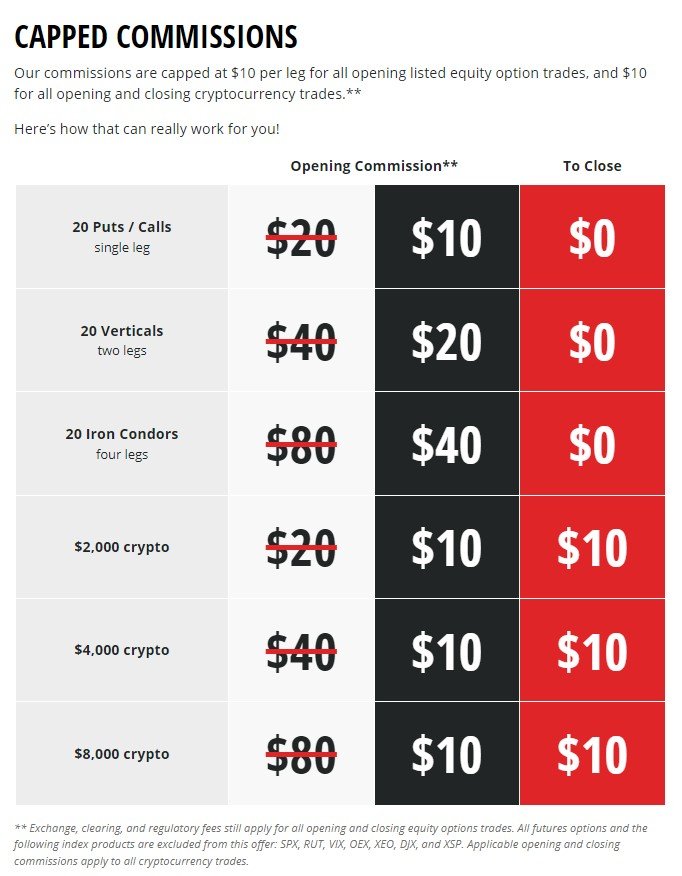

One of the main fees that tastytrade charges is the commission fee for opening and closing trades. The commission fee varies depending on the product and the quantity that you trade. Here are some of the commission rates for different products:

Stock and ETF orders: $0.00 to open and close unlimited shares

Equity options: $1.00 per contract to open, capped at $10 per leg; $0.00 to close

Cryptocurrencies: 1% of total purchase or sale, capped at $10 per order ticket

Futures: $1.25 per contract to open and close

Options on futures: $2.50 per contract to open; $0.00 to close

Micro futures: $0.85 per contract to open and close

Options on micro futures: $1.50 per contract to open; $0.00 to close

Small exchange products: $0.25 per contract to open and close

Options on small exchange products: $0.50 per contract to open; $0.00 to close

As you can see, tastytrade charges low commissions for opening and closing trades and caps the commissions at $10 per leg for equity options and $10 per order ticket for cryptocurrencies.

This means you can trade more contracts or shares without paying more commissions. For example, if you buy 100 contracts of a call option for $3.00 each, you will pay only $10 in commission to open the trade instead of $100 ($1 x 100). Similarly, if you buy $8,000 worth of Bitcoin, you will pay only $10 in commission to open the trade instead of $80 (1% x 8,000).

tastytrade’s commissions are also competitive compared to other brokers that charge higher or variable rates for different products or quantities. For example, E*TRADE charges $0.65 per contract for options with no cap, meaning you would pay $65 in commission for the same 100 contracts of a call option that costs only $10 at tastytrade.

Fidelity charges $0.65 per contract for options with a cap of $19.95 per leg, meaning you would pay $19.95 in commission for the same 100 contracts of a call option that costs only $10 at tastytrade.

Clearing and Regulatory Fees: Passthrough Fees That Vary by Product and Market

Another type of fee that tastytrade charges or passes through to their customers is the clearing and regulatory fee. This fee covers the additional expenses related to clearing trades at their clearing firm Apex Clearing, their futures commissions merchant StoneX, and exchange clearing for small exchange products at the Options Clearing Corporation.

It also covers the fees various exchanges, regulators, and associations levied for each trade. The clearing and regulatory fee varies depending on the product and the market you trade in. Here are some examples of how the fee is calculated and what it covers:

Stock and ETF orders: The clearing fee is $0.0008 per share for both buys and sells; the FINRA TAF fee is $0.00244 per share for sells only with a cap of $5.95 per transaction; the SEC fee is $0.0000229 x number of shares x trade price for sells only.

Equity options: The clearing fee is $0.10 per contract per side; the ORF fee is $0.02905 per contract per side; the FINRA TAF fee is $0.00244 per contract for sells only; the SEC fee is $0.0000229 x number of contracts x 100 x trade price for sells only.

Cryptocurrencies: There are no clearing or regulatory fees for cryptocurrencies.

Futures: The clearing fee is $0.30 per contract per side; the exchange fee varies by contract and includes an NFA fee of $0.02 per contract per side.

Options on futures: The clearing fee is $0.30 per contract per side; the exchange fee varies by contract and includes an NFA fee of $0.02 per contract per side.

Micro futures: The clearing fee is $0.30 per contract per side; the exchange fee varies by contract and includes an NFA fee of $0.02 per contract per side.

Options on micro futures: The clearing fee is $0.30 per contract per side; the exchange fee varies by contract and includes an NFA fee of $0.02 per contract per side.

Small exchange products: The clearing fee is $0.05 per contract per side; the exchange fee is either $0.07 or $0.15 per contract, depending on whether you are a subscriber or not; the NFA fee is $0.02 per contract; the OCC clearing fee is $0.02 per contract.

Options on small exchange products: The clearing fee is $0.05 per contract; the exchange fee is either $0.07 or 0.15 depending on whether you are a subscriber or not; the NFA fee is .02/contract; and the OCC clearing fee is $.02/contract.

Fractional shares trading will incur a clearing fee of $0.10 per transaction

tastytrade charges or passes through various fees that are determined by different factors such as product type, market type, quantity traded, trade price, etc.

Margin Rates: Competitive Rates That Decrease With Higher Balances

Another type of fee that tastytrade charges is the margin rate for borrowing money from them to trade with leverage or short sell stocks or ETFs. The margin rate varies depending on your debit balance (the amount of money that you owe them) and the product that you trade. Here are some examples of how the margin rate is applied and what it means for traders:

Stock and ETF orders: The margin rate starts from 11% for debit balances up to $24,999 and decreases to 8% for balances over $1 million.

Equity options: The margin rate depends on whether you buy or sell options and whether they are in-the-money or out-of-the-money.

Cryptocurrencies: There is no margin trading available for cryptocurrencies.

Futures: The margin rate depends on whether you buy or sell futures contracts and whether they are intraday or overnight positions.

Options on futures: The margin rate depends on whether you buy or sell options on futures contracts and whether they are intraday or overnight positions.

Micro futures: The margin rate depends on whether you buy or sell micro futures contracts and whether they are intraday or overnight positions.

Options on micro futures: The margin rate depends on whether you buy or sell options on micro futures contracts and whether they are intraday or overnight positions.

Small exchange products: The margin rate depends on whether you buy or sell small exchange products contracts and whether they are intraday or overnight positions.

Options on small exchange products: The margin rate depends on whether you buy or sell options on small exchange products contracts and whether they are intraday or overnight positions.

tastytrade offers competitive margin rates that decrease with higher balances and vary by product type. tastytrade’s margin rates are also favorable compared to other brokers that charge higher or fixed rates for different balances or products.

For example, E*TRADE charges 9% for debit balances up to $24,999 and 6% for balances over $1 million for stock orders. Fidelity charges 8% for debit balances up to $24,999 and 4% for balances over $1 million for stock orders.

Banking Fees: Some Fees That Apply For Various Transactions

Another type of fee that tastytrade charges is the banking fee for various transactions such as wires, checks, ACAT transfers, etc. The banking fee varies depending on the transaction type and amount. Here are some examples of how the banking fee is charged and what it covers:

ACH deposits and withdrawals: FREE

Outgoing domestic wire: $25

Outgoing foreign wire: $45

Reorg wire fee: $25 minimum

ACH notice of correction: $5

Domestic check: $5

Foreign check: $10

Dividend check: $5

Overnight check delivery - domestic: $50

Overnight check delivery - international: $100

Returned check / wire / ACH / recall: $30

Check copies: $15

Stop payment on Apex issued checks: $30

Outgoing ACAT transfers: $75

As you can see, tastytrade charges some banking fees for various transactions that involve moving money in or out of your account. Some of these fees are high compared to other brokers that offer free or lower-cost options.

For example, E*TRADE offers free outgoing ACAT transfers, while Fidelity offers free outgoing domestic wires. However, you can avoid or minimize some of these banking fees by using alternative methods such as ACH deposits and withdrawals or online statements.

Trade-Related Fees: Some Fees That Apply For Various Events or Services

Another type of fee that tastytrade charges is the trade-related fee for various events or services such as option exercise or assignment, restricted stock processing, IRA closing fee, etc. The trade-related fee varies depending on the event or service type and amount. Here are some examples of how the trade-related fee is charged and what it covers:

Option exercise / assignment: $5

Options regulatory fee: $0.02905 per contract per side

Transfer and ship certificate: $235

Certificate processing: $300 minimum

Certificate processing return: $100 minimum

Restricted stock processing: $205

IRA closing fee: $60

Annual IRA maintenance fee: FREE

Prepayment fee: Greater of 0.2% or $20

Transfer on death account transfer fee: $50

Incoming & outgoing DRS transfers: $115 per symbol

As you can see, tastytrade charges some trade-related fees for various events or services that involve special handling or processing of your trades or accounts. Some of these fees are high compared to other brokers that offer free or lower-cost options.

For example, E*TRADE offers free option exercise and assignment, while Fidelity offers free certificate processing. However, you can avoid or minimize some of these trade-related fees by using alternative methods such as using automatic exercise or assignment or closing positions before expiration.

tastytrade Fees | Bottom Line

tastytrade is a brokerage platform specializing in options and futures trading. It offers low and capped commissions for opening and closing trades, competitive margin rates that decrease with higher balances, and various fees for clearing and regulatory, banking, and trade-related transactions. To help you understand the brokerage better, we have prepared a comprehensive tastytrade review.

To save money on tastytrade fees, you should be aware of the different types of fees that apply to your trades and products, compare them with other brokers to see how they are better or worse, and use some tips and tricks to avoid or minimize some of the fees such as using ACH deposits and withdrawals, automatic exercise or assignment, or online statements. To learn more about trading options, check out our tastylive options course article.

Tastytrade Disclosure

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Marketing Agent (“HaiKhuu LLC.”) whereby tastytrade pays compensation to HaiKhuu LLC. to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of HaiKhuu LLC. by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of HaiKhuu LLC. or this website. tastytrade does not warrant the accuracy or content of the products or services offered by HaiKhuu LLC. or this website. HaiKhuu LLC. is independent and is not an affiliate of tastytrade.

tastytrade was previously known as tastyworks, Inc.