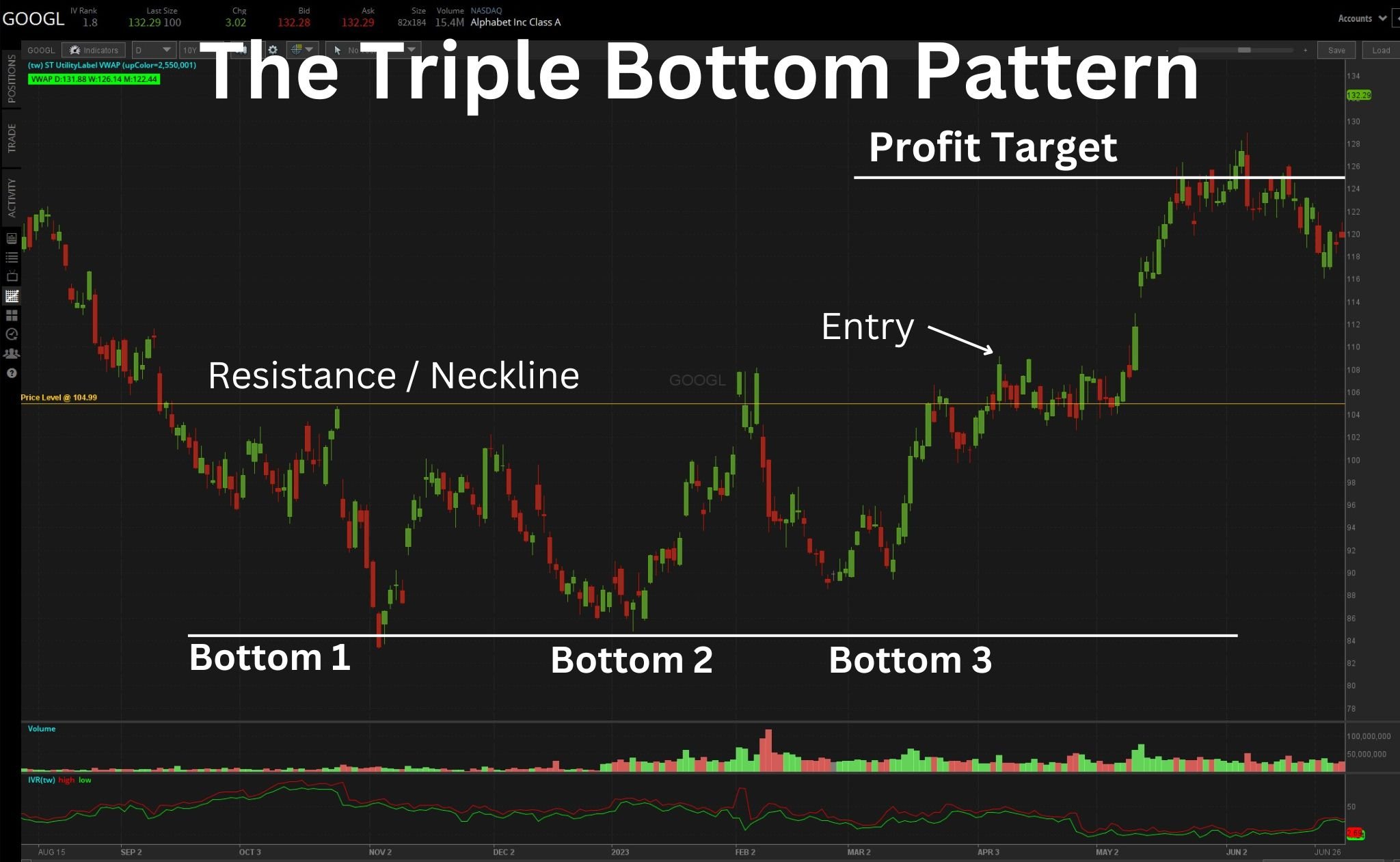

Technical Analysis

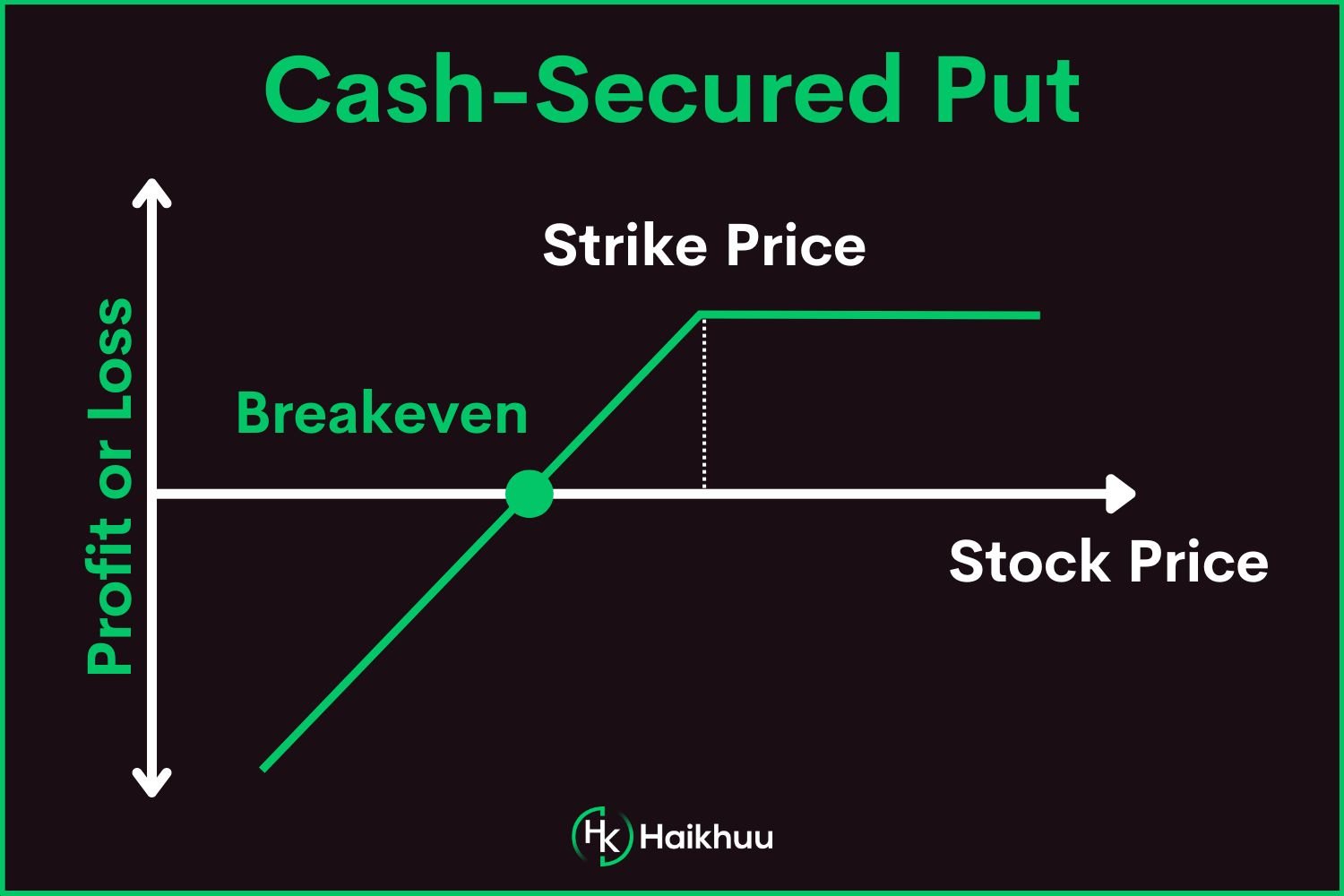

Options Trading

Fundamental Analysis

Recent Posts

Analyzing Historical Volatility for Options Trading

Learn how to analyze historical volatility on Tastytrade with charts and watchlists. Compare IV and HV to find trading opportunities.

Trailing Stop Loss: A Beginner's Guide

Learn how to use trailing stop losses to protect your profits and limit your losses.

tastylive Lookback: A Comprehensive Guide to Backtesting

Explore tastytrade's Lookback feature for powerful backtesting and forward testing of your options strategies.

Broken Heart Butterfly: A Versatile Options Strategy

Discover the Broken Heart Butterfly, a high-probability options trading strategy. Learn its mechanics, advantages, and comparison to Broken Wing Butterfly.

Grey Swan: Understanding Rare but Predictable Events

Discover the concept of grey swan events, their impact on the global economy, and how they differ from black and white swans.

AI Stocks to Buy: 5 Companies Leading the AI Revolution

Explore top AI stocks to buy. Discover key players like Nvidia, IBM, Microsoft, Amazon, and C3.ai driving AI innovation and growth.

Notional Value Meaning: Assessing Risk in Derivatives Trades

Explore notional value in derivatives trading, its meaning, role in risk assessment, and impact on options, swaps, and futures.

tastylive Iron Condor: Strategy and Mechanics

Discover tastylive's approach to trading iron condors, maximizing profits, and managing risk in options.

Trading Options Explained for Dummies

Discover trading options for dummies with examples! Our beginner's guide explains call and put options, strategies, risks, and examples.

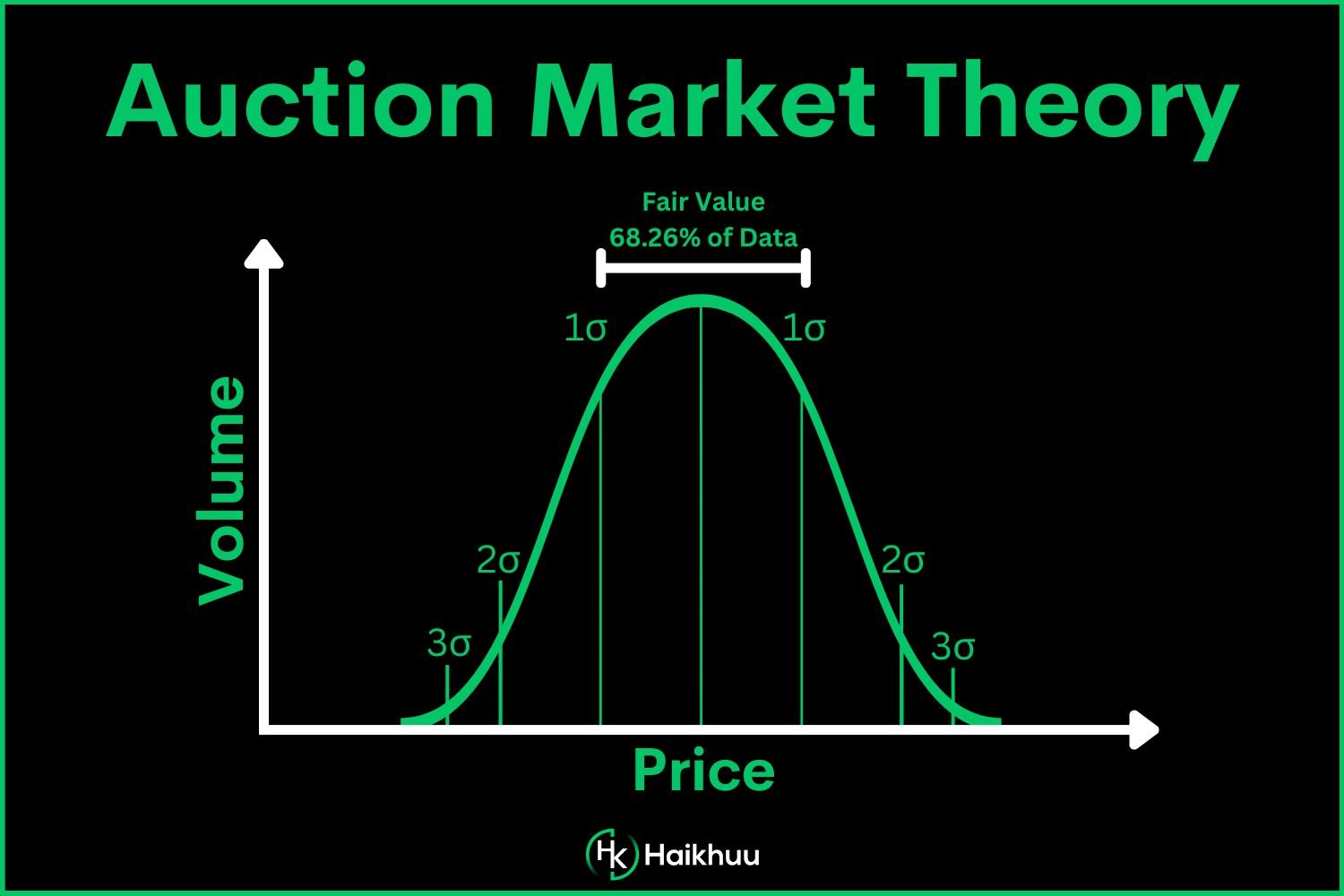

Auction Market Theory: Decoding Market Behavior

Explore Auction Market Theory (AMT) and its applications in financial markets. Learn about balance, value area, pioneers, and AMT principles.

Merriman 4 Fund Portfolio: Diversification Strategy

Discover the Merriman 4 Fund Portfolio, its components, benefits, risks, and implementation. A complete guide for investors.

Option Volume vs. Open Interest: Key Metrics for Options Traders

Explore the key differences between option volume and open interest, their significance in options trading, and insights for informed decision-making.

How Much Is a Penny Doubled Everyday for 30 Days?

Discover the power of compounding as we explore how much a penny doubled for 30 days can grow.

Why Are Equities Volatile? Understanding the Dynamics of Stock Market Fluctuations

Explore the factors that contribute to equity volatility and its impact on investors. Learn how to navigate risks and opportunities in volatile markets.

TTM Squeeze Thinkorswim: The TTM Squeeze Indicator

Discover the power of the TTM Squeeze indicator on Thinkorswim. Learn how it detects explosive market moves and enhances your trading strategy.

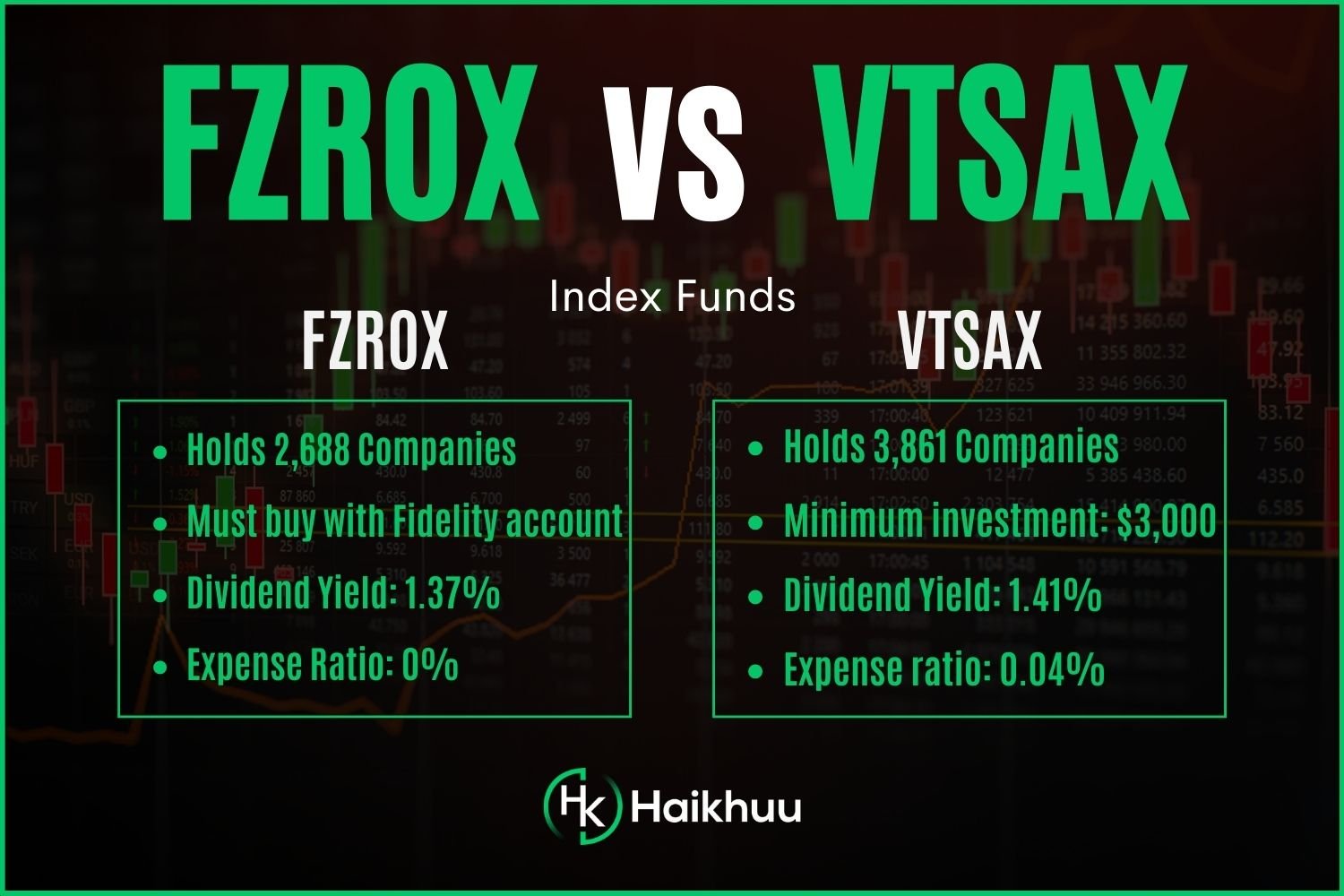

FZROX vs. VTSAX: Which Is Best For You?

Discover the differences of FZROX vs VTSAX to help you decide which is best for you!

Black Rifle Coffee Company Stock: Brewing Growth and Challenges for BRCC Stock

Explore Black Rifle Coffee Company Stock (BRCC) performance, growth prospects, financials, and challenges for investors. Insights on BRCC stock.

Dollar Cost Averaging Calculator

Calculate your average purchase price with our easy-to-use Dollar Cost Averaging Calculator. Track multiple investments, assess your strategy, and optimize your cost basis.

Purchasing Power Risk | Understanding Inflation Risk

Explore purchasing power risk, its impact on finances, and how inflation affects it. Learn strategies to manage this risk for financial well-being.

Is Common Stock an Asset, Liability, or Equity?

Discover if common stock is an asset, liability, or equity. The answer may surprise you!