tastylive Lookback: A Comprehensive Guide to Backtesting

What is the tastylive Lookback Feature?

The Lookback feature is a tool provided by tastylive. It's designed to analyze options trading strategies based on historical data, allowing users to see how a particular strategy would have performed in the past. This process is known as backtesting.

In addition to backtesting, Lookback also offers a forward testing feature. Forward testing helps traders to see the probabilities of a particular outcome for their trading strategy. For example, a user can input a specific options strategy, and Lookback will project the results of that strategy all the way to its expiration.

The tastylive Lookback tool can review up to 15 years of data to provide insights into a strategy's track record. It can also provide estimates for the projected outcome of profit and loss and the current probability of reaching that price.

The Lookback feature aims to help traders understand the potential performance of their options strategies before committing their capital to those trades. It's a tool for risk assessment and decision-making in options trading.

The tastylive Backtesting Tab

The first tab, called ‘backtesting,’ allows you to see how an options strategy performed as if you entered it on a historical date. For example, today is 5/5/2023, but you can select an entry date of 1/2/2023 to backtest a trade.

We will use a short put strategy on SPY for this example. We will select the 47DTE expiration, which is 2/17/2023, and sell the 365 put with a delta of -0.26. Next, we will click ‘see results’ at the bottom, which will pop up with the backtesting data.

The data shown include the stock price and running P/L for each day. Therefore, you can determine how a specific options trade will play out thanks to this tastylive backtesting feature on lookback.

The tastylive Advanced Backtesting Tab

The advanced backtesting tab is an excellent way to automatically backtest a strategy for several years based on a set of custom parameters. For example, we can backtest a short put strategy on SPY with data starting from 2006.

The study will cover Jan 1, 2006, to May 5, 2023. The backtest will use a stop loss at -200% on the credit received and take profit when we collect 50% of the premium. The trade will sell -1 put at a 16 delta using the expiration closest to 60DTE.

Once the parameters are set, we click ‘run strategy backtest,’ and we will see the backtest data nearly instantly. This test examined 271 trades and provided a win rate of 91%. The largest profit was $464 in Feb 2022, and the largest loss was $1,250 in April 2022.

The average days in trade was about 14 while the profit per day was around $2.10. Based on these results, we can determine how much risk we will take for this strategy. Additionally, you can test several different combinations of parameters before you begin trading a strategy with real money.

The tastylive Simulation Tab (Forward Testing)

Finally, you can conduct forward tests with tastylive’s lookback tool. This features uses Monte Carlo simulations and the Black-Scholes model to predict how a trade will perform going forward.

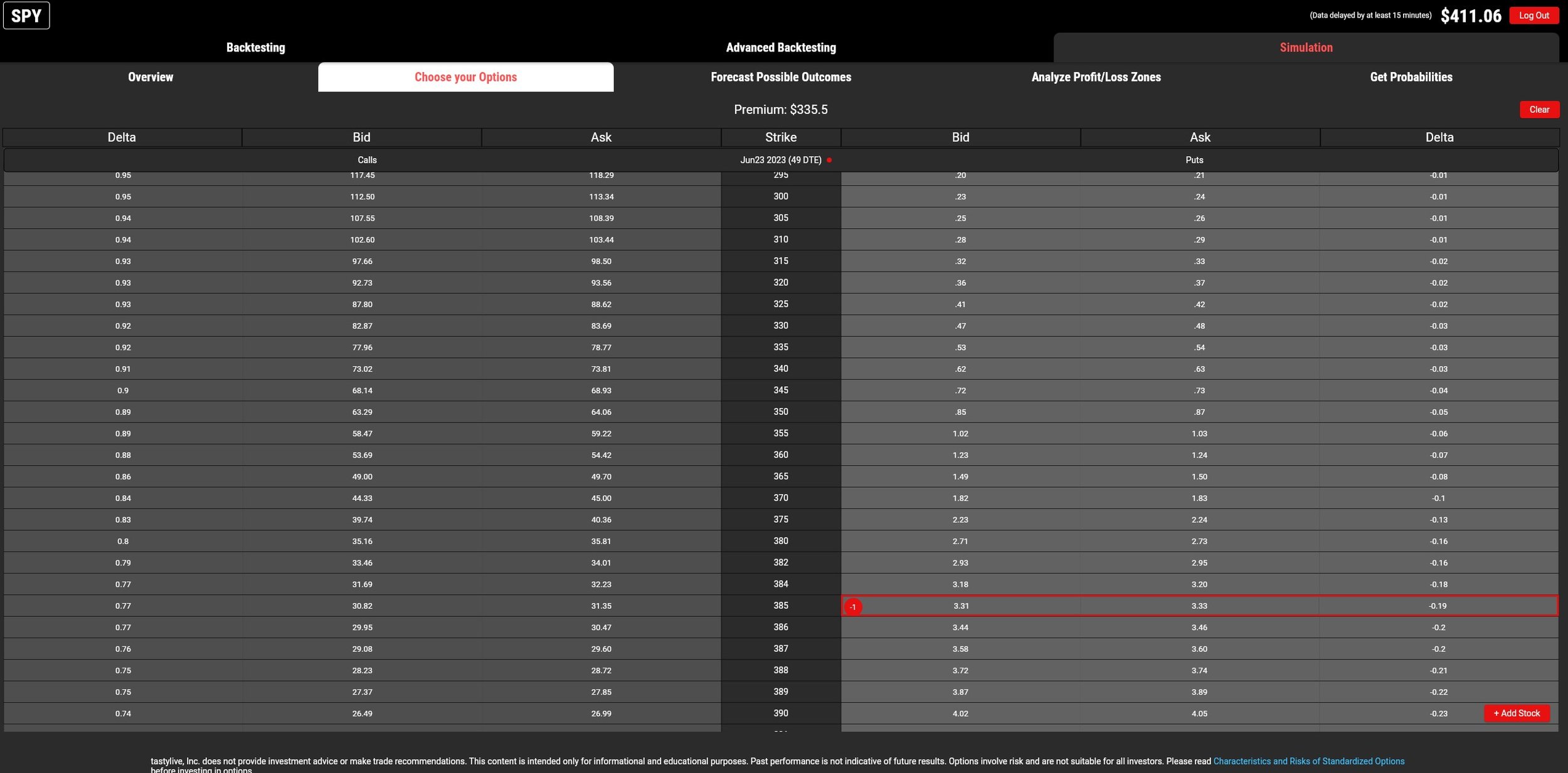

Choose Your Options Tab

To use this tool, first, let’s select an option. This example will use the SPY 385 put at 49DTE with about a 19 delta.

Forecast Possible Outcomes Tab

After selecting the option, we can view the forecasted possible outcomes on the next tab. You can move your mouse around the screen and view the expected results of your trade based on days in the future.

In our example, if the stock price is $420.34 on May 12th, the expected profit is $197.96. Additionally, there is a 23% chance the stock will be above $420.34 on May 12th and a 77% chance of being below $420.34 on May 12th.

Analyze Profit/Loss Zones

The next tab shows a standard hockey stick or payoff diagram for the trade. You can view its expected P/L by date and even add delta and theta to the diagram.

Get Probabilities Tab

The final tab allows you to change the date to give you more data about your trade. In our example, on June 2nd, there is a 66% probability you will make more than $168.64. The standard deviation is +/-$571.66, and the probability of breaking even is 76%.

Comparing the Various tastylive Backtesting Features

Standard Backtesting: Your First Step in Evaluating a Strategy

The standard Backtesting tab is often the first stop for traders. This tool allows you to review the performance of an options strategy as if it were implemented on a specific past date. The Backtesting tool is an excellent place to start if you're considering a new trading strategy. It will give you a snapshot of how the strategy would have performed under the specific conditions of that date.

Use the Backtesting tab when you're in the early stages of assessing a new strategy. It's also useful for checking the performance of known strategies under different market conditions.

Advanced Backtesting: For Detailed Historical Analysis

While standard backtesting is useful, it only provides a single snapshot of a strategy's performance. If you want a more comprehensive understanding of how a strategy performs over time and under various conditions, the Advanced Backtesting tab is the way to go.

Advanced Backtesting allows you to run a strategy through multiple historical scenarios based on custom parameters. It can consider factors like stop losses, profit-taking thresholds, and specific trade parameters. By examining the performance of a strategy over a large number of trades and a broad timespan, you can gain a deep understanding of its strengths, weaknesses, and risk profile.

Use the Advanced Backtesting tab when you're ready to commit to a strategy and want to thoroughly understand its historical performance. It's also useful for fine-tuning strategy parameters and exploring different "what if" scenarios.

Simulation Tab: Forward Testing for Future Insights

While backtesting is valuable, it's also important to look to the future. That's where the Simulation tab comes in. This feature uses techniques like Monte Carlo simulations and the Black-Scholes model to predict how a strategy will perform moving forward.

The Simulation tab helps you understand the potential future performance of a strategy, including potential profits, losses, and probabilities of various outcomes. By providing a forward-looking perspective, it complements the historical analysis provided by the backtesting features.

Use the Simulation tab when you're comfortable with a strategy's historical performance and want to understand its potential future results. It's particularly valuable when considering strategies for volatile markets, as it can help you understand the range of possible outcomes and their associated probabilities.