VFIAX vs. VTSAX | Vanguard 500 vs. Vanguard Total Stock Market

Looking to invest in the US stock market? Learn the key differences between VFIAX vs. VTSAX in performance, holdings, dividends, and more.

Key Takeaways

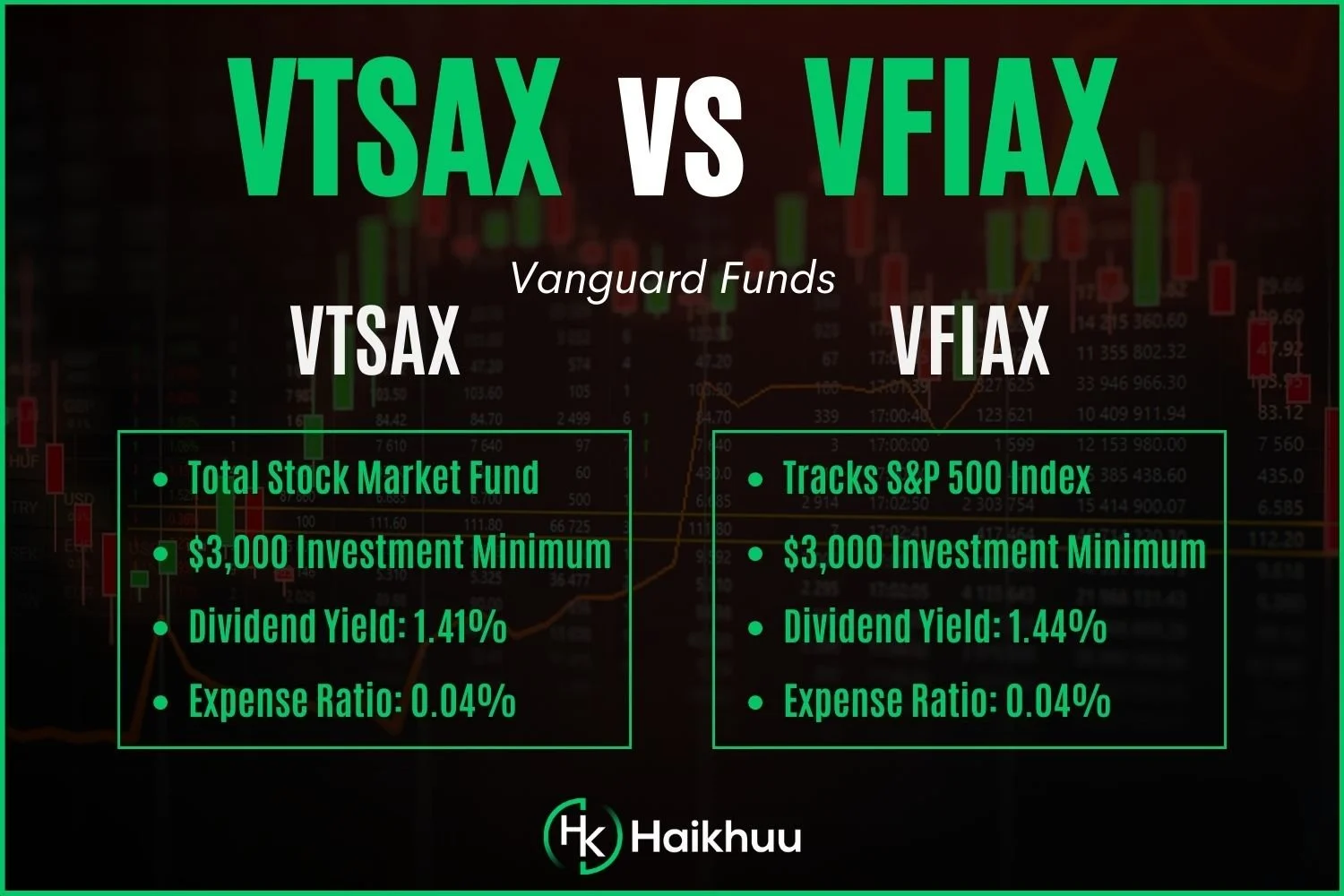

VFIAX and VTSAX are both index funds that track the performance of the U.S. stock market, but they have different composition and strategies.

VFIAX tracks the S&P 500 index, which includes 500 large-cap U.S. stocks, while VTSAX tracks the total U.S. stock market, including small, mid, and large-cap stocks.

VFIAX may be a better option for investors seeking exposure to large-cap stocks, while VTSAX may offer more diversification across the entire U.S. stock market.

Both funds have low expense ratios and are good long-term investment options.

VFIAX (Vanguard 500) vs. VTSAX (Vanguard Total Stock Market)

VFIAX and VTSAX are two popular mutual funds offered by Vanguard, a leading investment company known for its low-cost index funds.

VFIAX, also known as the Vanguard 500 Index Fund, tracks the performance of the S&P 500 Index, which is a benchmark for the performance of the U.S. stock market.

VTSAX, or the Vanguard Total Stock Market Index Fund, tracks the performance of the entire U.S. stock market, including small, mid, and large-cap stocks.

While both funds have similar objectives of tracking the performance of the U.S. stock market, they have different investment strategies and may be more suitable for different types of investors.

This article will compare and contrast VFIAX and VTSAX regarding their historical performance, holdings, dividends, and other factors to help investors determine which fund might better fit their investment goals.

VFIAX Details

Expense Ratio: 0.04%

Dividend Yield: 1.56%

10yr Return: 12.64%

VTSAX Details

Expense Ratio: 0.04%

Dividend Yield: 1.53%

10yr Return: 12.22%

VFIAX vs. VTSAX Historical Performance

One of the key factors that investors consider when choosing between different mutual funds is their historical performance. When comparing VFIAX and VTSAX, we find that both funds have delivered strong returns to investors over the past decade.

According to Vanguard's website, VFIAX has a 10-year return of 12.64%, while VTSAX has a 10-year return of 12.22%.

VFIAX Holdings

Does VFIAX pay dividends?

Dividends are payments made by companies to their shareholders out of their profits. When a mutual fund holds stocks that pay dividends, it can pass those dividends on to its investors through dividend payments.

In the case of VFIAX, the fund holds stocks of companies that are part of the S&P 500 Index, some of which pay dividends. VFIAX has a dividend yield of 1.56%, which is the percentage of the fund's net asset value paid out as dividends over a year.

VTSAX Holdings

How much does VTSAX pay in dividends?

VTSAX has a dividend yield of approximately 1.39%. This means that for every $100 invested in VTSAX, investors can expect to receive around $1.39 in dividend payments over the course of a year.

Is it better to buy Vanguard funds through Vanguard?

Investors interested in buying Vanguard funds like VFIAX and VTSAX may wonder whether it is better to buy them through Vanguard or another investment platform.

Most brokers do not charge additional fees for buying and selling mutual funds and ETFs. Therefore, without these additional fees, it doesn’t matter if you buy it directly from Vanguard.

VFIAX vs. VTSAX | Bottom Line

VFIAX and VTSAX are two popular mutual funds offered by Vanguard that are designed to provide low-cost exposure to the U.S. stock market. While both funds have similar objectives of tracking the performance of the U.S. stock market, they have some differences in their investment strategies and holdings.

When choosing between VFIAX and VTSAX, investors should consider their individual investment goals and risk tolerance. For investors who want exposure to large-cap U.S. stocks, VFIAX may be a good option, while those who want more diversified exposure across the entire U.S. stock market may prefer VTSAX.

Additionally, investors should consider the potential benefits and drawbacks of investing in a fund that pays dividends and whether it makes sense to buy Vanguard funds through Vanguard or another investment platform.