Algorithm and Portfolio Stats: 06/24/2024 - 06/28/2024

Our new algorithm finishes its first month up 0.34%. To be clear, we’re expecting it to do better than this most months, but it’s great to see it finish positive. We are still on a drawdown from its overall high, but given its relatively consistent performance, we’re optimistic about continued success here.

This month, we saw a total of 717 trades - 52.3% of which were long and 47.7% short - across 298 unique tickers. Let’s check out some highlights.

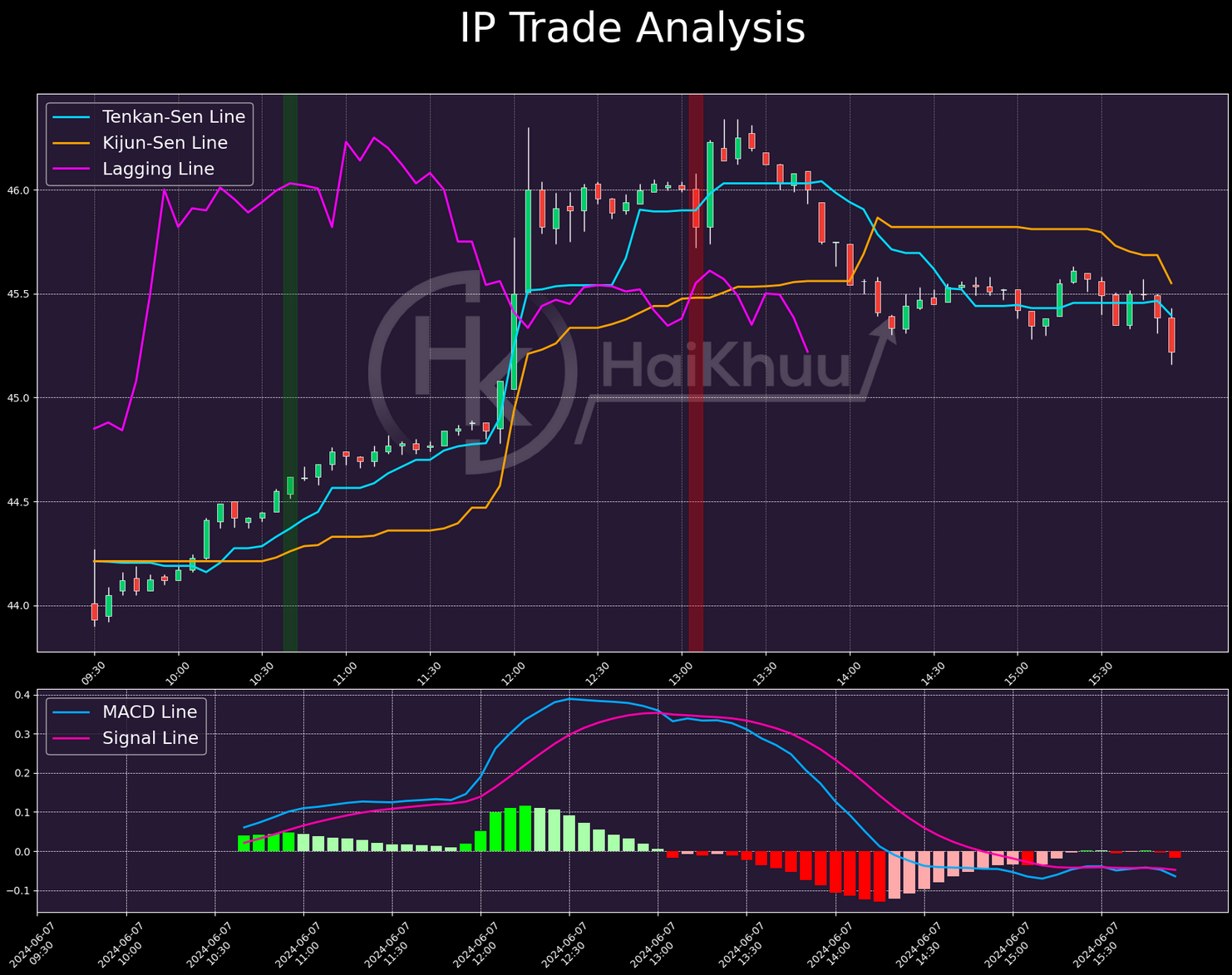

Our biggest success of the month was IP - where we made a massive 2.87% on a single long position. This is a great example of what our new system is doing differently - it highlights the more forgiving stop loss system. Under our previous parameters, we would have been stopped out on the 11:55 candle, for a drastically lower return here. Our new system gives winning trades this kind of opportunity to really shine.

At the same time, it hasn’t been just one direction carrying the algorithm. Our best short of the month was a position we took on ALB this week. This one returned 1.87% overall. Obviously, most of our positions - both long and short - haven’t been this successful. But the ceiling on this system is now much higher. Thanks to our reworked system, we see many more big winners like these.

By comparison, our biggest loser this month was fairly benign - losing 1.02% between 3 entries. It’s noteworthy here that, for the most part, this loss was avoidable. If you were watching this live, you probably didn’t take either re-entry. Momentum is decent enough when we take our initial long position, but by the time we see our second entry signal, that momentum is much weaker. By the third entry, we’re already seeing rapid opens/closes, which is also a pretty major red flag. The main lesson behind this one is that, for all of our algorithm’s strengths, it isn’t the end-all be-all of trading. If you have experience in the markets, you can turn a lot of its losers into winners, and winners into bigger winners. As always, this isn’t financial advice. We would never advise you to take a trade without doing your own due diligence and reaching your own conclusions.

Now then, let’s examine our portfolio.

Our portfolio had a solid week - beating SPY by 0.19%. Since the beginning of this year, we’re up 19.18% on our portfolio, compared to SPY being up 15.91%. We’ve been highly successful this year, owing largely to our high-beta, momentum-favoring portfolio constructions. I’m excited to see what we do next!

This week, our strategy is remaining mostly the same. Our market beta is high, our tech allocation is large, and our exposure to all other sectors is much lower. As always, our portfolio holdings for this week are listed below. All tickers with allocations below 0.5% are excluded for brevity.

That’s all I have for you today. As always, thank you for reading and happy trading!