Algorithm Performance: 2022-08-02

Performance Rankings

The Market: -0.26%

GoodVibrations: -0.29%

Trading Bot: -0.29%

Base Algorithm: -0.72%

Kokomo: -0.72%

The Neural Net: -0.80%

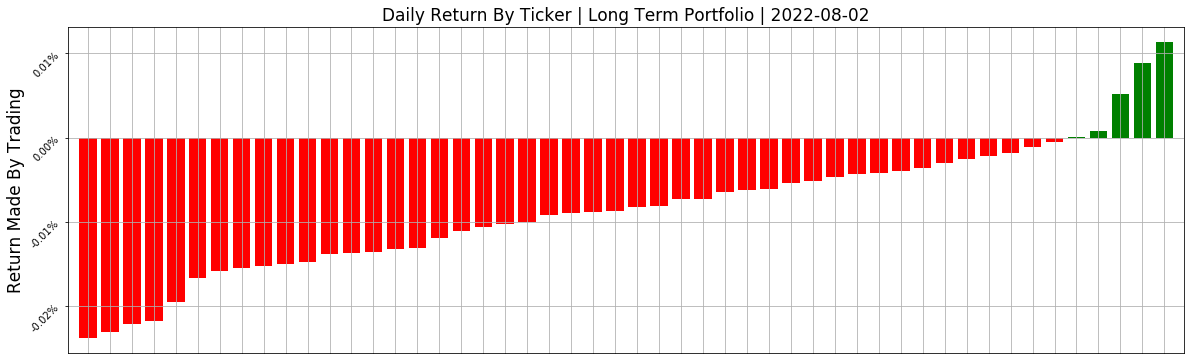

Long Term Portfolio: -0.85%

What Happened And Why?

Trading days like today remind of Playboi Carti - Whole Lotta Red.

In full seriousness, analysis of what went wrong is especially important on days like today. While the market itself also went down, all of our algorithms failed to surpass it. So: what happened?

The simple answer is that our long term portfolio had a bad day. Our algorithms all take in our long term ticker choices and determine which ones they want to allocate into each day. This way, we are able to restrict our algorithms to only buying companies we believe in for the long run.

However, the long term portfolio has a fairly long horizon (usually several months). As such, we expect it to have a low-performing day every now and then. As it usually performs very well (yesterday it outperformed the market and all of our algorithms), we don’t think anything needs to change. Frankly, I’m impressed at how few bad days it’s had.

Today, almost all of the long term portfolio was in the red. Unfortunate, but again it’s to be expected sometimes.

Our algorithms all helped to mitigate this, but with these options to choose from, I think we were always going to end up in the red day today.

To give a more in-depth picture of intraday results, there are 2 moments I want to shine a spotlight on during the trading day. I’ve circled them in the chart below:

Our algorithms had 2 major drops today - one at open (mitigated only by GoodVibrations) and one at about 1:30 ET (mitigated by Kokomo and GoodVibrations). I’d like to compare the above chart to one of the overall market, and some sector ETFs to give a good picture of what caused this.

We can see observe following:

The first drop is seen by almost every sector, to varying degrees. This is why GoodVibrations was mostly unaffected - referring to our exposures from yesterday, GoodVibrations had a near-zero beta to every sector we look at. Kokomo however, had a higher exposure to a few (betas of ~0.25 to both Consumer Staples and Utilities). Kokomo saw this drop because Consumer Staples (and to a lesser extent, Utilities) dropped off hard at the start of the trading day.

The second drop is avoided by GoodVibrations for the same reasons as the first one. Kokomo successfully dodges this one because Consumer Staples and Utilities (the only sectors it had a middling beta with) each drop by a fairly small amount, relative to the rest of the market.

To me, this is a case of our algorithms performing as intended. The Neural Net and Base Algo - our high beta systems - both followed the market pretty closely. Kokomo successfully avoided drops felt by the market as a whole, but was still pulled around by a couple sectors. GoodVibrations managed to act pretty independently, as desired.

All in all, while we took some losses today, I don’t think anything in our toolbox is explicitly not-working. All of our algorithms outperformed the tickers we fed into them. Our safer algorithms avoided large market and sector movements. And our long term portfolio will naturally have some bad days, but all in all, has been a great winner for us.

Apologies to everyone who took a loss today. Let’s hope tomorrow is different.

Tomorrow’s Outlook

The full algorithm reports will be published tomorrow morning, once Allen has had a chance to vet its recommendations. In the meantime, here are our tentative exposures for the trading day tomorrow:

You’ll notice each algorithm’s exposure looks pretty similar to its last exposure. We are nothing if not consistent.

That’s all for tonight. Good luck trading tomorrow, and thank you for reading.

-Asher