HK Weekly Recap & Analysis April 17th, 2023

THE WEEK AHEAD (APRIL 17th – APRIL 21st)

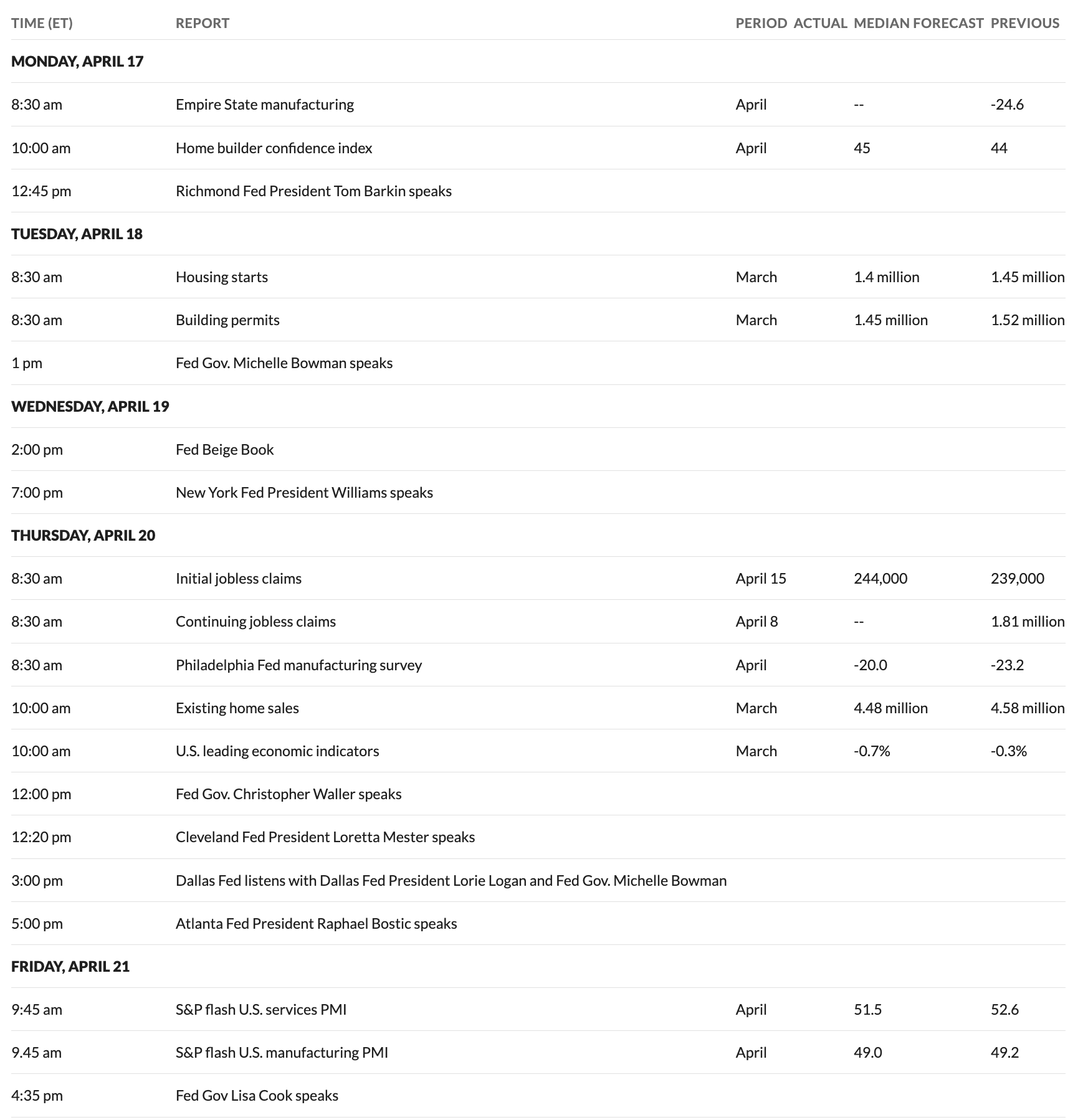

KEY ECONOMIC DATA RELEASES TO WATCH

MARKET RECAP FROM THE PREVIOUS WEEK

April 10, 2023

US Wholesale Inventories MoM Rev. Actual 0.1% (Forecast 0.2%, Previous 0.2%)

US Wholesale Sales MoM Actual 0.4% (Forecast 0.6%, Previous 1.0%)

NY Fed Inflation Expectations:

March is one year ahead at 4.7% vs. Feb’s 4.2%

March three years earlier at 2.8% vs. February’s 2.7%

March, five years earlier at 2.5% vs. February’s 2.6%

Fed's Williams:

This year, I expect inflation to be around 3.75%, and

I anticipate achieving 2% inflation by 2025.

This year, I expect growth to be less than 1%.

Global PC shipments slumped 30% in Q1, with Apple dropping the most at 40%

April 11, 2023

US Redbook YoY Actual 1.5% (Forecast -, Previous 3.7%)

Wish announced a 1-30 reverse stock split

Bitcoin just broke above $30,000 for the first time in 10 months

FTX will consider restarting its crypto exchange in the second quarter, and FTX has recovered $7.3 billion in assets

Twitter inc has changed its incorporated name to X Corp as Elon Musk plans to create an “everything app.”

April 12, 2023

US CPI YoY Actual 5% (Forecast 5.1%, Previous 6.0%)

US CPI MoM Actual 0.1% (Forecast 0.2%, Previous 0.4%)

US Core CPI YoY Actual 5.6% (Forecast 5.6%, Previous 5.5%)

US Core CPI MoM Actual 0.4% (Forecast 0.4%, Previous 0.5%)

April 13, 2023

US Initial Jobless Claims Actual 239k (Forecast 235k, Previous 228k)

US Continued Jobless Claims Actual 1.81M (Forecast 1.835M, Previous 1.823M)

US PPI YoY Actual 2.7% (Forecast 3%, Previous 4.6%)

US PPI MoM Actual -0.5% (Forecast 0%, Previous -0.1%)

US Core PPI YoY Actual 3.4% (Forecast 3.4%, Previous 4.4%)

US Core PPI MoM Actual -0.1% (Forecast 0.2%, Previous 0.0%)

Twitter has partnered with eToro to let users trade stocks and crypto and view charts on the app

April 14, 2023

US Retail Sales MoM Actual -1% (Forecast -0.4%, Previous -0.4%)

US Core Retail Sales MoM Actual -0.8% (Forecast -0.4%, Previous -0.1%)

US Import Prices MoM Actual -0.6% (Forecast -0.1%, Previous -0.1%)

US Export Prices MoM Actual -0.3% (Forecast 0%, Previous 0.2%)

Fed's Waller: Recent numbers indicate the Fed has yet to progress toward its inflation goal, and rates need to increase even higher.

Fed swaps upgrade May rate-hike odds to nearly 90%.

US Industrial Production MoM Actual 0.4% (Forecast 0.2%, Previous 0.0%)

US Industrial Production YoY Actual 0.53% (Forecast -, Previous -0.25%)

University Michigan Numbers:

Sentiment Prelim Actual 63.5 (Forecast 62.1, Previous 62.0)

1 Yr Inflation Prelim Actual 4.6% (Forecast 3.7%, Previous 3.6%)

5 Yr Inflation Prelim Actual 2.9% (Forecast 2.9%, Previous 2.9%)

Expectations Prelim Actual 60.3 (Forecast 58.5, Previous 59.2)

Condition Prelim Actual 68.6 (Forecast 66, Previous 66.3)

Elon Musk is planning to create an artificial intelligence start-up to rival OpenAI.

THE WEEK AHEAD & EARNINGS

Monday – 04/17/2023

Empire State manufacturing - 8:30 AM ET

Home builder confidence index - 10 AM ET

Richmond Fed President Tom Barkin speaks - 12:45 PM ET

AM Earnings: Charles Schwab (SCHW), State Street Corporation (STT), M&T Bank Corp (MTB), Guaranty Bancshares (GNTY)

PM Earnings: JB Hunt Transport (JBHT), Equity Lifestyle Properties (ELS), Pinnacle Financial Partners (PNFP), ServisFirst Bancshares (SFBS), FB Financial Corporation (FBK), CrossFirst Bankshares (CFB)

Tuesday – 04/18/2023

Housing starts - 8:30 AM ET

Building permits - 8:30 AM ET

Fed Gov. Michelle Bowman speaks - 1 PM ET

AM Earnings: Johnson & Johnson (JNJ), Bank of America Corporation (BAC), Lockheed Martin Corporation (LMT), Prologis (PLD), Goldman Sachs (GS), Bank of New York Mellon (BK), Ericsson (ERIC), Commerce Bancshares (CBSH)

PM Earnings: Netflix (NFLX), Intuitive Surgical (ISRG), Omnicom Group (OMC), United Airlines (UAL), First Horizon Corporation (FHN), Interactive Brokers Group (IBKR), Western Alliance Bancorp (WAL), Hancock Whitney Corp (HWC), United Community Banks (UCBI), Fulton Financial Corp (FULT)

Wednesday – 04/19/2023

Fed Beige Book - 2 PM ET

New York Fed President Williams speaks - 7 PM ET

AM Earnings: ASML Holding NV (ASML), Abbott Laboratories (ABT), Morgan Stanley (MS), Elevance Health (ELV), US Bancorp (USB), Travelers (TRV), Baker Hughes (BKR), Nasdaq (NDAQ), Citizens Financial Group (CFG), Ally Financial (ALLY)

PM Earnings: TSLA Tesla IBM International Business Machines Corporation LRCX Lam Research Corporation CCI Crown Castle KMI Kinder Morgan DFS Discover Financial Services EFX Equifax STLD Steel Dynamics REXR Rexford Industrial Realty AA Alcoa Corporation

Thursday – 04/20/2023

Initial jobless claims - 8:30 AM ET

Continuing jobless claims - 8:30 AM ET

Philadelphia Fed manufacturing survey - 8:30 AM ET

Existing home sales - 10 AM ET

U.S. leading economic indicators - 10 AM ET

Fed Gov. Christopher Waller speaks - 12 PM ET

Cleveland Fed President Loretta Mester speaks - 12:20 PM ET

Dallas Fed listens with Dallas Fed President Lorie Logan and Fed Gov. Michelle Bowman - 3 PM ET

Atlanta Fed President Raphael Bostic speaks - 5 PM ET

AM Earnings: Taiwan Semiconductor (TSM), Philip Morris (PM), AT&T Inc (T), Union Pacific Corp (UNP), American Express (AXP), Blackstone (BX), Marsh & McLennan (MMC), Truist Financial Corp (TFC), Nucor Corporation (NUE), Nokia (NOK)

PM Earnings: CSX Corporation (CSX), PPG Industries (PPG), WR Berkley Corp (WRB), Seagate Technology (STX), Knight Transportation (KNX), Valmont Industries (VMI), Bank OZK (OZK), Independent Bank Corp (INDB), Associated Banc-Corp (ASB), SEI Investments Company (SEIC)

Friday – 04/21/2023

S&P flash U.S. services PMI - 9:45 AM ET

S&P flash U.S. manufacturing PMI - 9:45 AM ET

Fed Gov Lisa Cook speaks - 4:35

AM Earnings: Procter & Gamble (PG), SAP SE (SAP), HCA Healthcare (HCA), Schlumberger NV (SLB), Freeport-McMoran (FCX), Regions Financial Corp (RF), Autoliv, Inc (ALV)