Highlighted Trades - 04/15/2024

We saw 10 trades today - all shorts - across just 4 unique tickers. Let’s check them out.

Our most profitable trade of the day was a short on EL. This one consisted of 3 total entries and exits, returning 0.62% between them. Overall, I’m fond of these 3. The only entry I don’t think I would have taken is the last one, on the 15:00 candle. By the time we’d gotten there, the MACD had become considerably weaker. It was still negative, but increasing, and had nearly hit 0. Our initial entry was the only one to lose money here. While that’s unfortunate, I don’t think it detracts much from the overall strength of this trade, since the upwards momentum we saw reversed pretty shortly after.

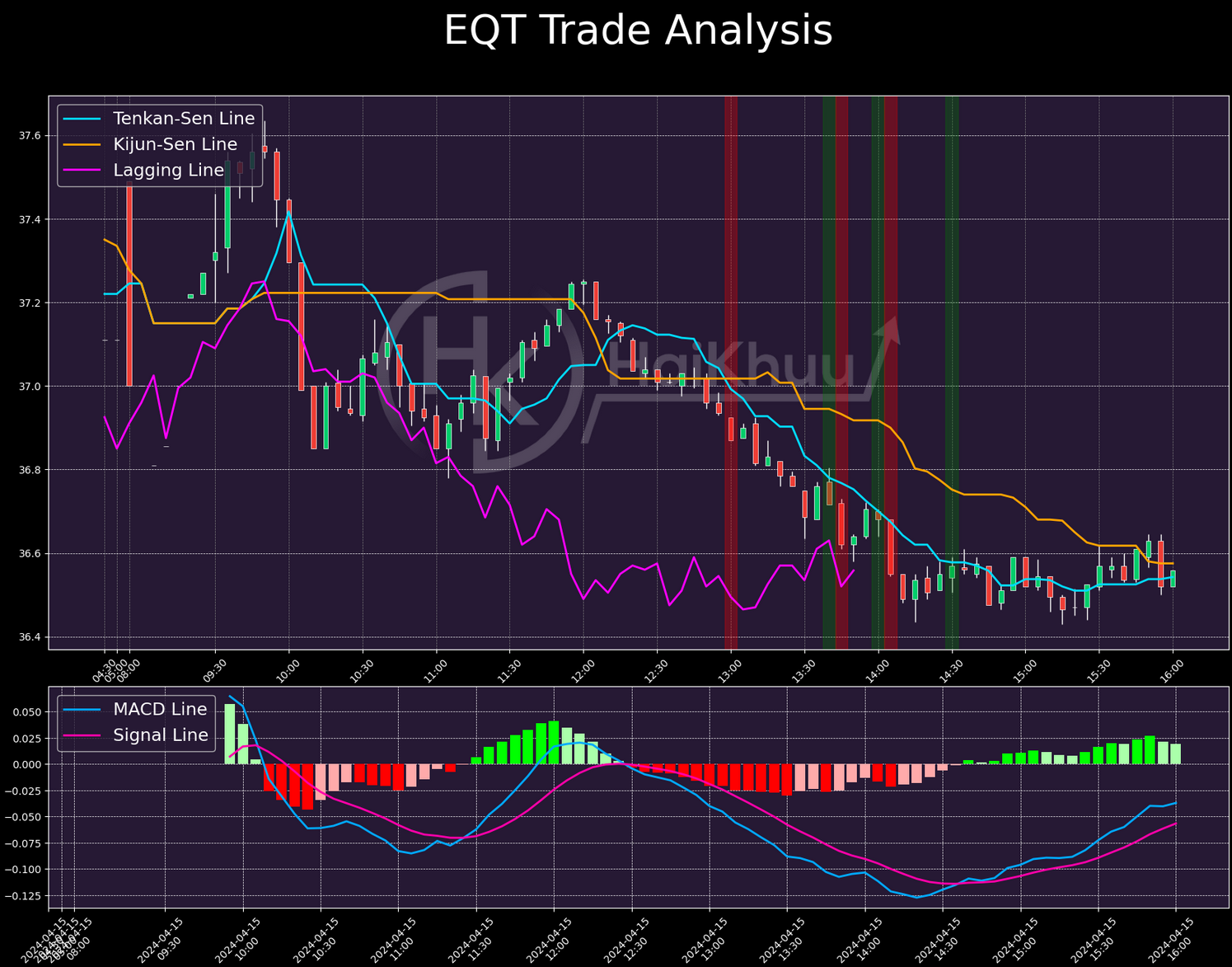

Our worst trade of the day is fairly benign by comparison, losing only 0.06% - largely in the black. It’s really that second entry that turns this trade from a moderate winner, to a slight loser. I’d extend it further to say that our first stop out is the main culprit. Judging a correct point to take profit or cut your losses is a complex question, as much so as the question of when to enter a trade in the first place. Our system is set to exit if, at any time during the formation of a candle, the price is above the most recent Tenkan-Sen level (for a short position). While the stop-out and subsequent re-entry are both correct on a purely technical level, I think they become a questionable move when you look at them together. Given how far that candle dropped the price, we missed out on a lot of potential profit, and that re-entry was a bet that the price would go even lower: a much tougher bet to take.

This trade just has a lot of missed potential, when following the algorithm blindly. Even though it lost, I’m still glad we called this one - ignoring a single stop loss candle turns it into a solid winner.

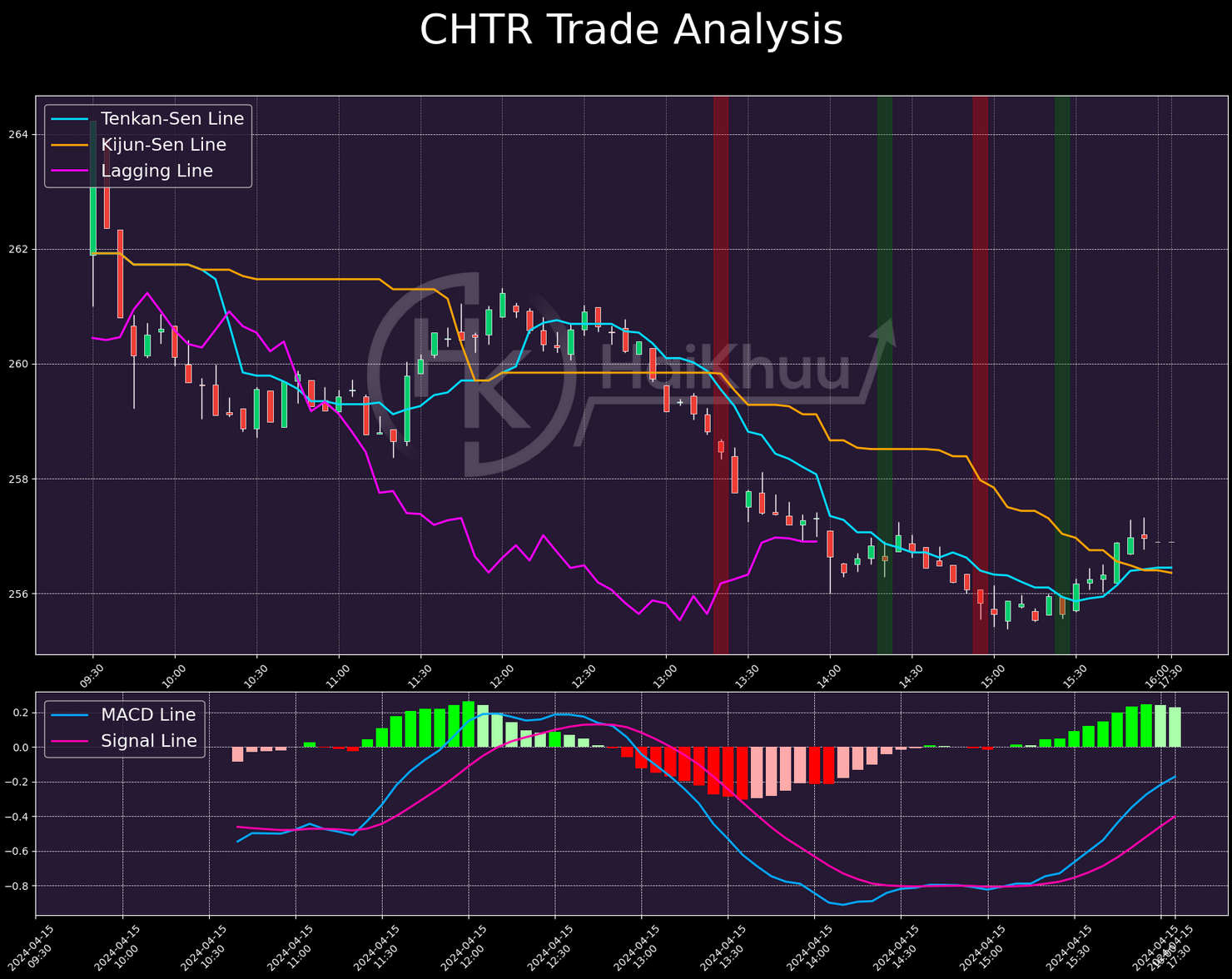

The last trade I want to discuss is CHTR. We made 0.58% here across 2 positions. Upon first seeing the chart, you might wonder why we wait so long to re-enter, but examining the MACD makes me ask why re-enter at all? After our first stop-out, MACD is still solidly negative, but approaching zero. The next candle that’s solidly below the Tenkan-Sen line is the 14:45 candle. At that time, MACD is slightly positive, but for the most part it’s holding at zero. We don’t re-enter until 14:55, where MACD is technically increasingly negative, but only very slightly. I would not have taken this re-entry, and I feel that most of our users wouldn’t have done so either. Even if it’s negative - a bearish signal - it’s so slight relative to recent action that, to a human trader, it’s obviously not meaningful.

Still, a strong trade overall. Even taking that re-entry only loses 0.04%, so the impact on bottom line here would have been pretty minimal.

That’s all I have for you tonight. Thanks for reading - and happy trading!