HaiKhuu Daily Report - 01/05/2026

Good morning, and happy Monday! I hope you all had a wonderful weekend and are ready for what should hopefully be a hyper bullish time for the markets! Traders are becoming increasingly comfortable and confident in these market conditions, which is a great sign, and the markets are up slightly at the time of writing this report.

With the state of the current political system, I will say that with the capture of the Venezuelan dictator, pro-American sentiment in the world has gone up significantly. Not to get political, but I genuinely believe this shift can easily have a positive impact on both the US and the US economy, so tread lightly, and we will see what plays out over the next couple of weeks!

But back to the markets: this will be the first “official” trading day of 2026. We had Friday, but that is nothing compared to today, where we get an entire week back. Traders should be awake now. Volume will start to pick up and normalize tomorrow, and we are back to our scheduled programming, so let’s have some fun, realize some gains, and make the most out of today!

And, on top of everything, we have our FIRST WEEKLY PREVIEW of 2026! So make sure to check it out to prepare accordingly for today! We all should have some fun and realize some gains. So be smart, be safe, and have an amazing time while attempting to trade this week!

Good luck trading this week, and let’s start this year strong!

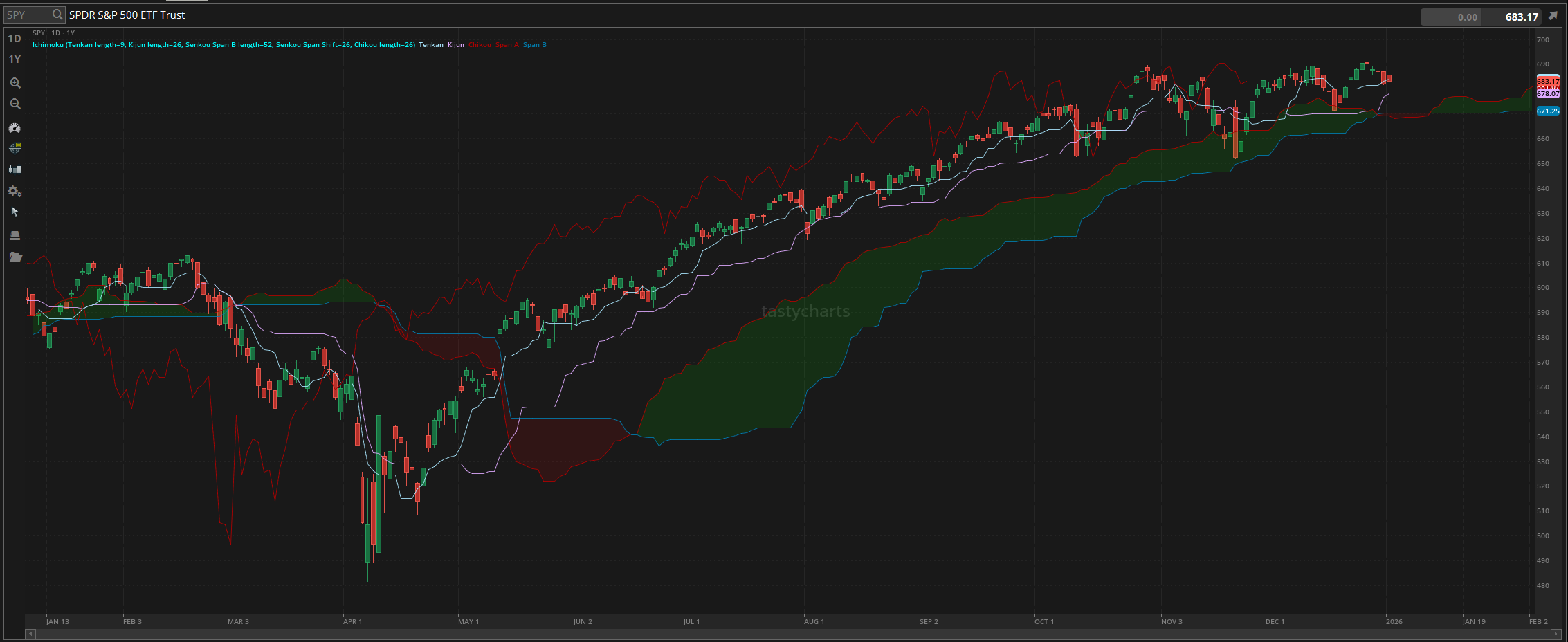

The updated $SPY daily levels are as follows:

Conversion Line Support: $684.07

Baseline Support: $678.07

Psychological Support: $680

Daily Cloud Support: $670.28

Thoughts & Comments from Last Week

Last week was a wild, irrational time for the markets. We watched as traders were coming back from the holidays, and volume and momentum lagged into the end of the year. The previous couple of trading days have not been sexy nor provided us with great opportunities, but life is still great, and provided us with some consistent opportunities across the board.

We started last week with $SPY opening at $687.57. Traders were both relatively comfortable and confident leading into the end of the year, but as expected, we saw some weak momentum and low volume. We watched as there was a slow momentum-based move in the markets, and traders watched as $SPY continued to come down slowly, displaying mild continued weakness. Opportunities weren’t overly bearish, and we watched as traders lacked opportunities to allocate into anything overly strong leading into the end of the year.

Conditions continued to slightly weaken through the rest of Tuesday, selling off once again, leading into Wednesday, which was the end of the year. We officially ended 2025 with $SPY trading at $681.92, up $97.28 for the year, or up roughly 16.6%.

The mild selling into the end of the year was unfortunate, but honestly not that bad, as again, $SPY was up 16.6% for 2025, and up roughly 40% from the bottom in April, so we take our wins and enjoy our lives.

Thursday was closed for the new year, and Friday was just an extremely low-volume gross day for the general markets. We started the day with $SPY trading at $685.67, but watched as we sold off and tested $680 again on Friday, before bouncing up slightly into close to officially end the week at $683.17.

What I will say is the first official trading day of 2026 was kind of a snoozer, but when you have NYE, a day off, and then a single trading day right before the weekend, it is almost hard not to have low volume, as no one wants to watch the markets. But hey, it’s simply life. Hopefully, you all were able to capitalize on the conditions of 2025 and prepared for what 2026 has in store for us!

S&P 500 Heat Map - 01/05/2026

Thoughts & Comments for Today - 01/05/2026

Today will be a great time for the markets, full of opportunities through the new year. With the confidence that people are feeling leading into 2026, it is almost hard not to be optimistic here in the short term and excited to see where the markets take us from here. This is just a reminder , the biggest thing that everyone has to worry about here in the short term is practicing safe risk management.

With the fact that $SPY is here at $680~, we are going to see extremely large dollar movements, despite seeing relatively smaller % based movements in the overall markets. This means that those who are attempting to buy in now, or those who are attempting to take on a significant amount of leverage and exposure, will be overexposed to the risks of these levels, without understanding the reality of the situation. I am not attempting to put anyone down when I say this, but anyone who is purchasing multiple larger option contracts is most likely taking on too much risk for their portfolios here in the short term and ultimately is most likely going to generate losses in the short term as a result.

This pricing is a double-edged sword. If you are attempting to trade today and understand the risks that are involved, you understand that the larger dollar movements will result in quicker opportunities to realize larger gains. It will be great for those who understand how to take on risk, but will be extremely unfortunate for everyone else.

The larger dollar movements will stop kids out, will burn the overtraders, and will absolutely kill anyone who is overleveraged incorrectly with option contracts. So please, make sure you are practicing safe risk management when attempting to trade or allocate at these levels.

An interesting sector to look at today and over the next couple of days will be oil. With the capture of the Venezuelan president, there have been countless rumors regarding oil and America’s plans in the short term. In the case that America is able to capture Venezuelan oil, this will be huge for oil companies in America, resulting in more profitability for them due to cheaper oil, and hopefully, as a aftermath of everything, we ultimately get cheaper gas.

Obviously, that is all going to be speculation and cannot be guaranteed to happen in any way; this may result in the beginning of WW3 for all we know, but realistically, I do believe that gas prices should come down for the consumers here over the next couple of months as a result of what is going on.

Previous metals and crypto are starting to hit the spotlight again, so just be on the lookout for a bunch of different commodity prices over the next couple of days. If your allocations depend heavily on the way that precious metals trade, then tread lightly, as there will be a lot of uncertainty in your future, along with many great opportunities to realize a significant amount of gains.

Just be smart, be sane, and be confident in your ability to trade in these conditions!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $ORCL, $NVDA, $TSLA, $BABA, $MSFT

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 01/05/2026 (ET):

ISM Manufacturing Index - 10:00 AM

Notable Earnings for 01/05/2026:

Pre-Market Earnings:

No Earnings Scheduled

After Market Earnings:

No Earnings Scheduled

Wrap up

This should be a fun time to start the year. Please just make sure to start the year strong, and make sure you are forming great habits through 2026. Make sure you practice safe risk management and do everything in your power to sustain your portfolio. There is going to be no reason to take on a significant amount of risk, so as long as you make some smart plays, we all should realize some gains with ease. So make some great plays, and let’s make 2026 a record year!

Good luck trading, and let’s see where $SPY takes us this week!