HaiKhuu Daily Report - 01/06/2026

Good morning, and happy Tuesday! Markets are looking great to start the day, and I hope you all are excited to see where conditions take us today! It’s almost hard not to be overly confident in these market conditions, so please go into today as level-headed as possible.

Markets are down ever so slightly at the time of writing this report, but not down enough to cause any type of major concern. Leading into today, with the way the markets are setting up, I genuinely believe that the large majority of individuals should have no problems realizing some gains while attempting to trade today, and the only people who are going to have difficulties will be those who are overexposed in these conditions.

Be smart, be rational, and practice risk management.

As long as you follow basic market strategy, opportunities will consistently present themselves for both quick scalping and to realize some gains! Just make sure that you are following the general market momentum and are practicing safe risk management. I’m excited to see where $SPY takes us today, and excited to enjoy these wonderful conditions!

Good luck trading today, and let’s watch $SPY BOUNCE!

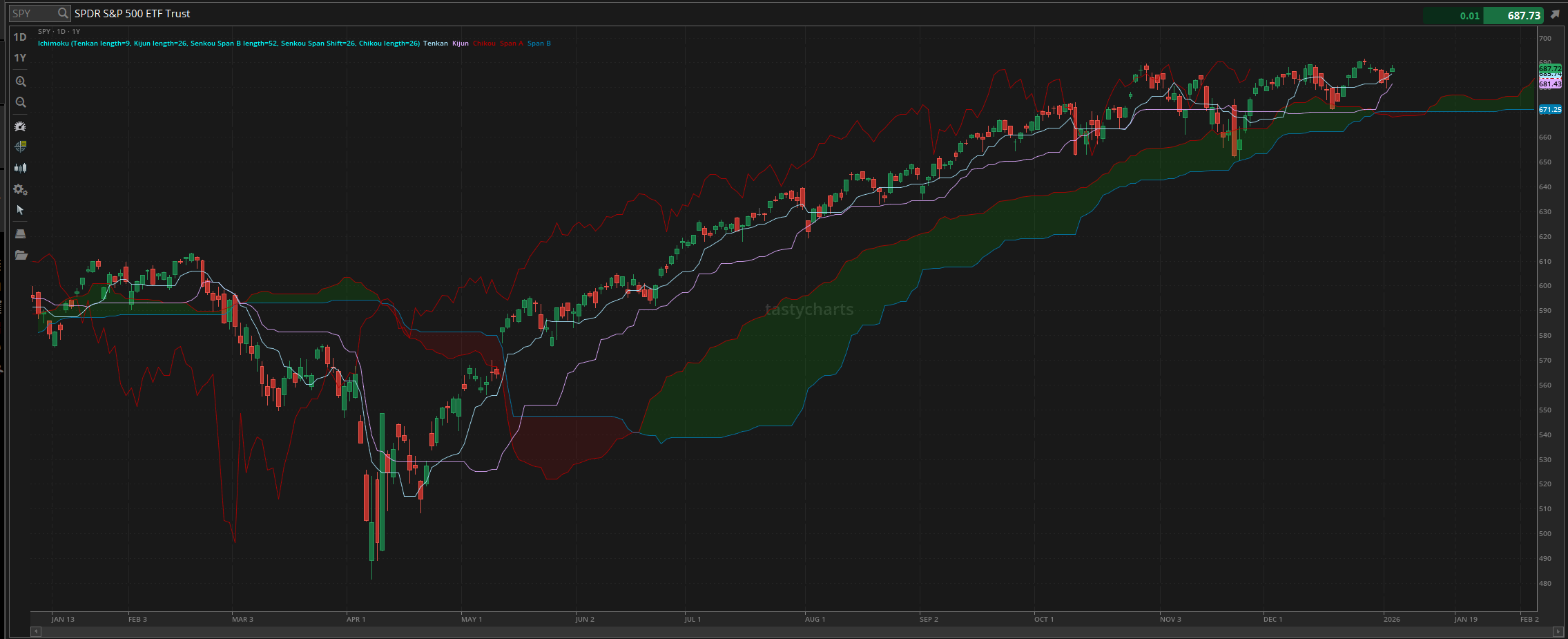

The updated $SPY daily levels are as follows:

Conversion Line Support: $685.74

Baseline Support: $681.43

Psychological Support: $680

Daily Cloud Support: $670.28

Thoughts & Comments from Yesterday - 01/05/2026

Yesterday was a relatively slow, extremely profitable day for the markets. I hope that you all were allocated correctly, because that was an insanely easy day both to trade and simply ride exposure. It was tough attempting to capitalize on the intraday conditions, but as long as you were able to retain long exposure, and assuming your organization moved up yesterday, you should have absolutely PRINTED.

We started the day with $SPY opening at $686.52. Market conditions were looking great and optimistic from open as $SPY was up a little over $3 to start the week. We watched as $SPY continued to rally throughout the morning, going on to make the official high of the day during the lunchtime lull at $689.43. Market conditions at the top honestly were great; traders simply had to hold any exposure from the morning and had an amazing time.

The afternoon, on the other hand, was slow and slightly bearish. I wouldn’t say the conditions were necessarily bad, as they really were not, but we watched as $SPY dropped about $1.50 in the process. It was a slow four hours of selling, and not much happened by close, when we officially ended the day with $SPY trading at $687.72, up $4.55 for the day, or up roughly 0.7% in the process.

Again, you all should have had almost zero issues printing yesterday. I hope you all had a lot of fun and were able to realize a significant amount of gains in an extremely quick and easy day for the markets. It will be interesting to see where the markets take us today, but it will be great to sit back, relax, and see where the markets take us!

S&P 500 Heat Map - 01/05/2026

Thoughts & Comments for Today - 01/06/2026

Today is going to be a great time for the markets. With the strength and confidence we are seeing across the board, it is hard not to be optimistic going into today. This has been a great beginning of the year for the markets, and everyone should be excited to see where $SPY takes us today. We are seeing mild confidence coming from cryptocurrencies, and we are out of fear on the Fear and Greed index, meaning that we are starting to show opportunities for a bullish breakout.

Tinfoil hat theory, but look at the $SPY daily chart, we are bouncing off of the conversion line support, showing comfort, confidence, and a possibility, so it will be an interesting time seeing how the markets decide to break out from here. But these conditions look great, and traders should be optimistic.

As I typically warn, just because traders are optimistic and want to trade does not necessarily mean that the markets are only going to move up from here. We may get some bearish momentum. I do not want this to happen, nor do I believe that there is enough bearish sentiment to cause a significant sell-off, but as it is now 2026, anything is a possibility. $SPY can easily reject, we can easily sell back off to the $680 magnet zone, and we can have a tough time, but this is again more of a warning than a prediction of bearish sentiment.

I don’t see a reason why people are not trying to take advantage of this momentum that is available to us. Regardless of the direction we head, as long as you have confidence in your play and follow the general momentum, just know that both bulls and bears have opportunities to realize some gains. It will just be mentally significantly easier to realize gains following a bullish trend with confidence.

But just continue to watch commodities. With everything going on right now with oil, precious metals, and cryptocurrencies, it is going to be almost impossible not to be overly optimistic about what the future holds. But, I do need to warn you all now, there is going to be a significant difference between those who bought silver months ago, versus attempting to FOMO in now. Back when silver was underpriced, it was not a bad pick up, but now, looking and attempting to FOMO into silver at these all-time highs is a little sketchy of a play. Perspective in pricing matters significantly, and that by itself should be enough justification for anyone who is attempting to either force any trades at these levels. So just make sure that you are confident in your allocation and are prepared accordingly for what happens in the case that the position goes against you.

This should be a fun and interesting day for the markets. Just make sure that you are practicing safe risk management and following the momentum. There will be opportunities to scalp in both directions, and in a perfect case scenario, both bulls and bears are happy today. So make the most out of these current volatile conditions, keep your fists up, and go into today ready for war!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $PLTR, $ORCL, $NVDA, $TSLA, $BABA, $MSFT

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 01/06/2026 (ET):

Richmond Fed President Tom Barkin speaks - 8:00 AM

Notable Earnings for 01/06/2026:

Pre-Market Earnings:

AngioDynamics (ANGO)

After Market Earnings:

AIR (AIR)

Penguin Solutions (PENG)

Wrap up

This will be a fun day for the markets. Just make sure to practice safe risk management and do not take on too much exposure at these prices. Many people are going to print money attempting to trade today, while others will have a difficult time. It won’t be hard to make the most of the confidence, so have a great time and let’s have some fun today!

Good luck trading, and let’s see where $SPY takes us!