HaiKhuu Daily Report - 01/07/2026

Good morning, and happy Wednesday!!!

I hope you all are ready for what should be an interesting time for the markets!

Traders are confident leading into today, as we have just made a new all-time high, but are starting to see some short-term weakness build from cryptocurrencies. $MSTR rallied extremely hard last night after the announcement that they are NOT being removed from the MSCI index. We have watched as Silver has continued to rise in price, and traders are genuinely in this confusing standstill at the moment.

No one knows what to do.

Do we FOMO in at all-time highs?

Do we wait for a minor correction?

Do we attempt to fight the trend?

There is so much we can do, and many who simply do not know what to attempt to do.

This is not necessarily a bad thing if you do not know what to do while attempting to trade, but at the same time, this will be a sketchy time to attempt to force any plays, so be smart, be safe, and practice risk management today.

Good luck trading today, and let’s see a NEW all-time high on $SPY!

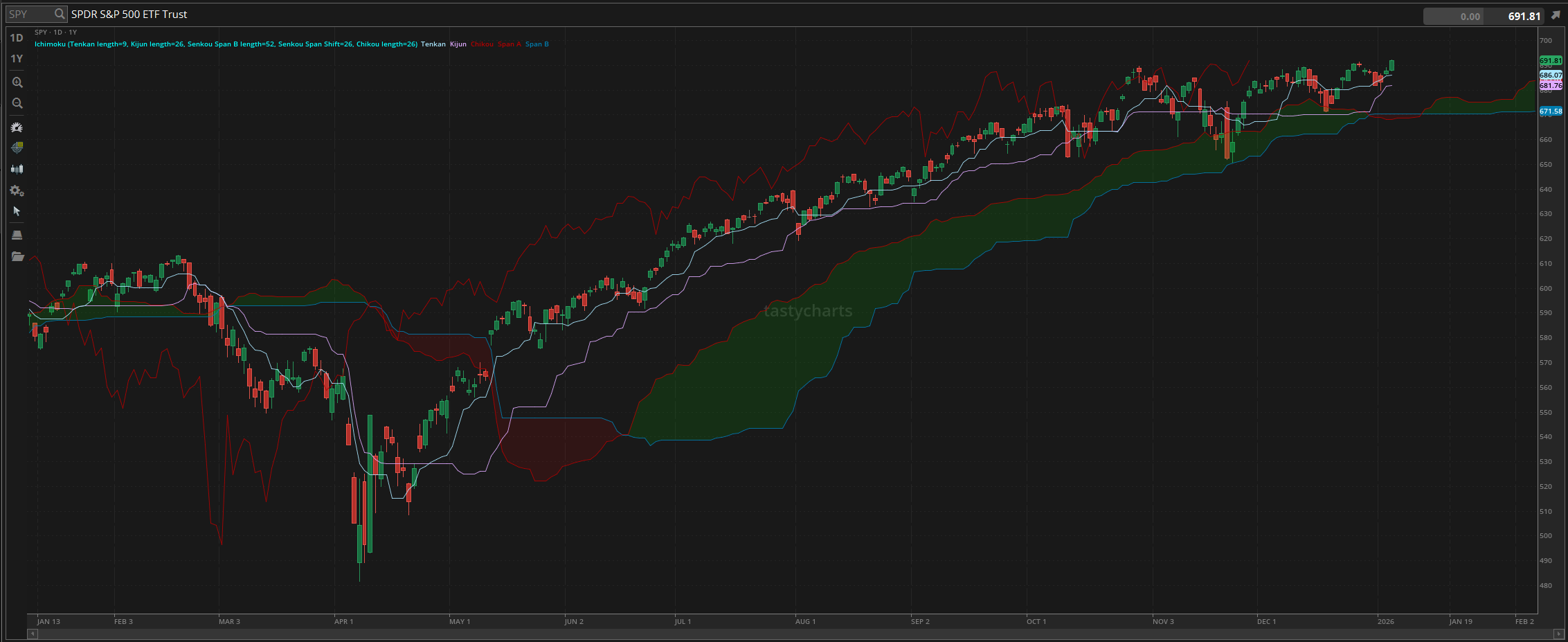

The updated $SPY daily levels are as follows:

Conversion Line Support: $686.07

Baseline Support: $671.25

Psychological Support: $680

Daily Cloud Support: $670.16

Thoughts & Comments from Yesterday - 01/06/2026

Yesterday was another great day for the markets. As warned in the report, I stated that I genuinely thought that the large majority of individuals would have absolutely zero issues realizing a significant amount of gains, and man oh man did that become true. Many traders, anyone who held strong positions should have had a great time, and honestly realized a significant amount of gains with ease. Traders had opportunities to scalp either direction, but as an extremely momentum based day, just simply following the market momentum would have been so easy. We watched as $SPY made a new all-time high, and honestly had a great day making the most out of these conditions!

We started the day yesterday with $SPY trading black, opening at $687.86, up $0.14 from the previous close. We watched as $SPY moved up nicely from the open price to break above $690 and test the previous all-time high. Conditions at the top were beautiful, opportunities were amongst us, and then we watched as we unfortunately rejected that relative high, coming back down into the lunchtime lull, going on to make a relative low around $689.

Thankfully, after the lunchtime lull was over, we watched as the markets displayed a significant amount of strength and opportunity, moving up beautifully throughout the antire afternoon, quickly going on to test the relative high of the previous run, and then watched as $SPY moved up beautifully, breaking out once again, and then going on to make the official all-time high.

Leading into the final two hours of the trading day, the markets continued to remain relatively neutral at the previous all-time high, but continued to inch and play around slightly towards the end of the day, making the all-time high on $SPY now $692.31.

The markets did come back down ever so slightly leading into close, where $SPY officially ended the day at $691.81, up $4 for the day, or up roughly 0.6%. Market conditions were great, trades were available, and everyone had opportunities to consistently print across the board. So, I hope you all had an amazing time while attempting to trade yesterday and were able to realize a significant amount of gains. That is 3/3 on absolutely amazing trading days for the year, so let’s see if this can become the 4th great day for the markets this year!

S&P 500 Heat Map - 01/06/2026

Thoughts & Comments for Today - 01/07/2026

Today is going to be a fun time for the markets. With the way that everything is looking, it is hard not to be optimistic. $SPY has just made a new all-time high, pro-america sentiment is apparent across the globe, and traders are ready and willing to trade and allocate at these levels. Conditions are looking absolutely beautiful, but extremely sketchy at the same time. Traders can and easily will realize a significant amount of gains in these conditions, but at the same time, with the difficulties that many traders are going to face as a result of this price action, it will be a tough time. Fun…. but tough.

If you are attempting to trade today, just make sure that you are practicing safe risk management and mitigating the risks that are involved with attempting to trade at these levels. Many traders should have no problem realizing some gains; the issue is that many other traders will have those difficulties. So please, do not attempt to fight any trends, and make sure to practice safe risk management.

These conditions are going to be extremely profitable or extremely deadly for the large majority of traders; it just comes down to how and where you attempt to allocate. I mean, with the current market conditions, $SPY is trading at an all-time high. Those who are holding strong positions from the bottom, those with positions they are comfortable and confident with, and those who got lucky are going to continue to realize a significant amount of gains with ease. It is those who are attempting to overallocate, overtrade, or fail to practice risk management are the ones who are getting burnt the most.

So when you are attempting to trade today, please make sure that there is momentum in the organization that you are attempting to trade, make sure that you are comfortable allocating into that organization at that price, and make sure you are confident in your ability to execute your trading plan, because the large majority of traders who fail, it’s not due to the play necessarily being wrong (despite it being the case pretty often), but it its typically the failure of the individual as a trader in the short term.

”I am going to enter into a position at $100, stop out at $99, and adjust accordingly.” - But then, plot twist, stops were not set, adjustments were not planned, and then you now have significantly more losses than originally planned.

Just stick to your plan, follow the market momentum, and make the most out of this optimistic day. I will warn you all that I am worried about some possible downside coming in the near future in the markets, but for now, I do not see any reason why we should not all continue to be optimistic and ready for these market conditions today. So let’s have some fun, realize some gains, and make the most out of today!

*Side note - I have a bunch of meetings this afternoon, so I will be MIA leading towards lunch CST - I apologize for this, but hope you all understand!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $MSTR, $PLTR, $ORCL, $NVDA, $TSLA

Speculative: $PTLO, $RIVN,

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 01/07/2026 (ET):

ADP Employment - 8:30 AM

ISM Services Index - 10:00 AM

Job Openings - 10:00 AM

U.S. Factory Orders - 10:00 AM

Fed Vice Chair for Supervision Michelle Bowman speaks - 4:10 PM

Notable Earnings for 01/07/2026:

Pre-Market Earnings:

Apogee Enterprises (APOG)

Albertsons Companies (ACI)

UniFirst Corporation (UNF)

After Market Earnings:

Applied Digital (APLD)

Constellation Brands (STZ)

AZZ Inc (AZZ)

Jefferies Financial (JEF)

Franklin Covey (FC)

Saratoga Investment (SAR)

Resources Connection (RGP

Wrap up

This will be quite an interesting time for the markets. With the way that everything is trending at the moment, it appears almost hard not to be optimistic, so please, tread lightly, practice safe risk management, and simply follow the momentum. Many people will struggle with this, but at the same time, many will prosper today, so enjoy today, make the most out of the opportunities, and have a great time.

Good luck trading, and let’s see where $SPY takes us!