HaiKhuu Daily Report - 01/08/2026

Good morning, and happy Thursday! Wow, this week has flown by. I love and appreciate each and every one of you, and welcome to another day full of opportunities and trades!

Markets are down slightly at the time of writing this report, and it appears that we are seeing a continuation of mild weakness in the markets. Continue to tread lightly on these market conditions and look to follow the general market momentum. We made a new all-time high, and it will be interesting to see where the markets take us today.

We have inched back into Fear on the Fear and Greed Index, and we are seeing weakness coming from Crypto, so this will be interesting to see what happens later today. I want to be optimistic and excited about these conditions, but I am just being realistic with the way the markets are moving. So be careful in regards to the bearish momentum that we are seeing during the pre-market session, and look for an opportunity to capitalize on these conditions and buy the dip.

But this is going to be a fun day with opportunities to scalp and trade on an intraday basis. The only problem will be catching those opportunities in real time, so be smart, be safe, and practice risk management today, because this is going to be an inconsistent yet fun day to trade.

Good luck trading today, and let’s wrap up the first week of the year strong!

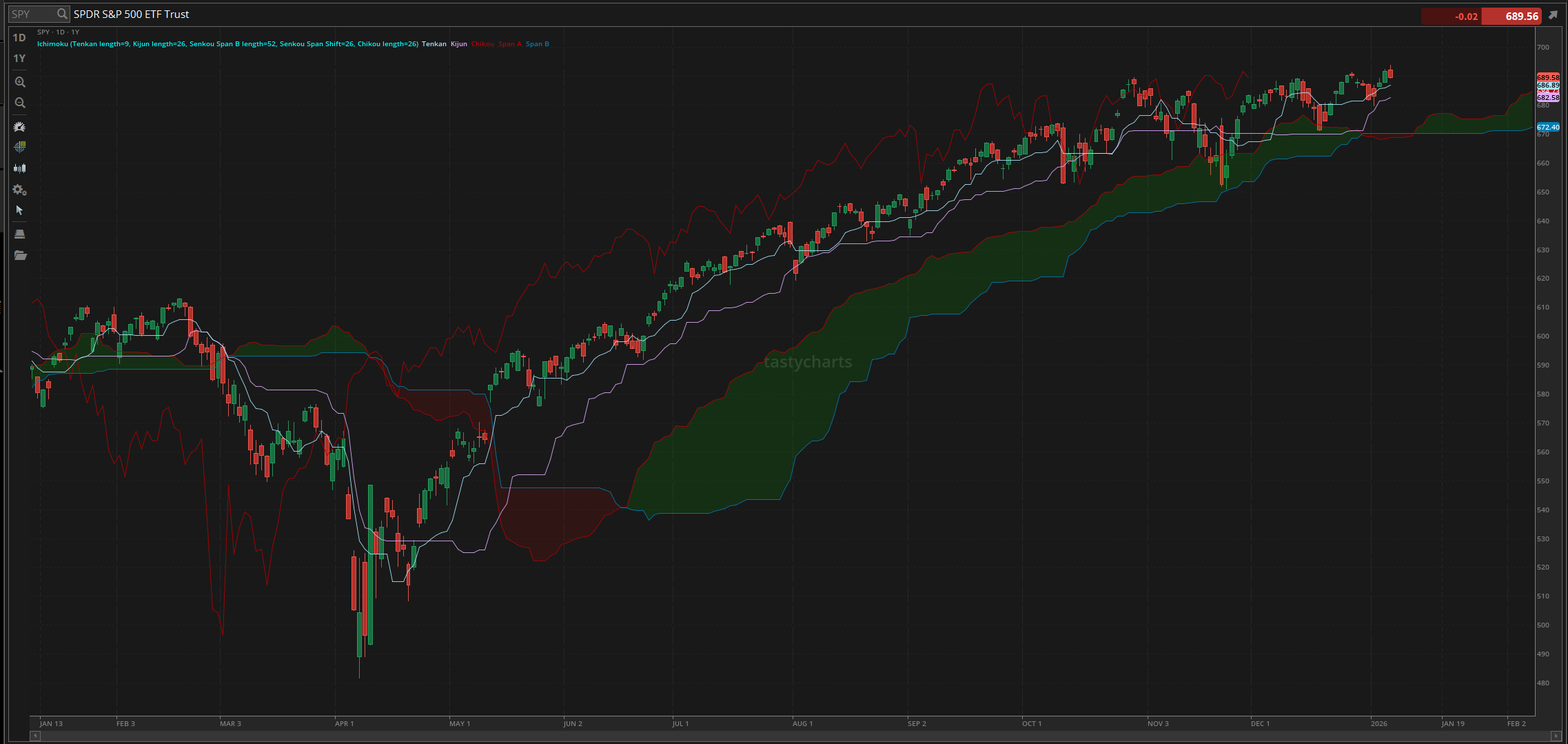

The updated $SPY daily levels are as follows:

Conversion Line Support: $686.89

Baseline Support: $682.58

Psychological Support: $680

Daily Cloud Support: $670.16

Thoughts & Comments from Yesterday - 01/07/2026

Yesterday was an interesting day for the markets! We watched as $SPY went on and made some new all-time highs, and watched as $SPY reversed heavily from the top. Nothing that happened was unexpected, and we predicted both the reversal as well as confirmation of a reversal at the top, so if you simply just followed the trend and listened to what we had to say in real time yesterday, you would have absolutely PRINTED.

We started yesterday with $SPY opening relatively mild, trading at $692.17. Market conditions were strong around open, but we saw some early morning confusion. We made a new all-time high right after open, and then watched as there was mild bearish momentum. Sentiment in the morning definitely was a confusing time, but we watched as opportunities presented themselves, as that drop to $691 from the previous all-time high was a quick buy-the-dip opportunity.

Markets continued to climb going into the afternoon, making the official high of the day trading at $693.96. Conditions at the top were relatively slow, but it was absolutely beautiful as traders could have easily realized a significant amount of gains at the time.

Then, coincidently enough, someone in the Discord… cough cough… called out the first signs of a confirmation of a reversal in the general markets, then stepped away, and oddly enough, that happened to be the top, and happened to be the confirmation of a reversal many individuals were waiting for as $SPY conitnued to sell off throughout the entire afternoon, continually making new low after new low, where we went on and made the official low of the day right before close at $689.33, meaning we dropped roughly $5 from the top, and ended the day with $SPY trading at $698.58, down $2.25 for the day, or down roughly 0.3%.

So, I’m not going to say that we absolutely predicted everything in the markets perfectly, but this has been one of those times that, realistically, we absolutely killed it on an intraday trading perspective mostly with the shouts that were provided in the short period of time that I was around for the morning, and provided everyone with opportunities to trade both directions. I hope you all were able to capitalize on the strong market conditions that were available and simply followed the general market momentum. It was a lot of fun and we all were able to realize a significant amount of gains, so let’s just see where the markets take us today, and make the most of these conditions!

S&P 500 Heat Map - 01/07/2026

Thoughts & Comments for Today - 01/08/2026

Today appears to be an interesting time for the markets. With the mild bearish sentiment we are seeing during the pre-market session after the selling that occured yesterday is not the best feeling, nor is it going to cause traders to feel any sort of confidence, but at the same time, with the way that the markets are trending, and the general strength that we are seeing at this level, as much as I hate saying this, this is our thesis working out perfectly once again.

Markets go and BARELY make a new all-time high, show mild strength and confidence, fake out the kids, and watch as we reverse and drop to stop the kids out, before getting everyone to lose faith once again, to only once again go on and make a new all-time high, show confidence, then fake the kids out once again. That is the unfortunate cycle of the markets, but at this point is extremely predictable and easily accomplished.

These large dollar movements we are seeing in the markets will be difficult to capitalize on consistently with confidence, but at the same time, I am telling you that any selling that occurs in the short term that is not directly impacted by news or any other major catalyst will be bought up over the course of time. We may not recover instantly on an intraday basis, and it might take some time to pop back up, but realistically, with the way that the markets are trending in these conditions, this selling that has occured will provide us with a beautiful buy the dip opportunity.

Just wait until there is signs of confidence and a reversal coming prior to forcing an entry. Like I said yesterday, wait for those confirmations of a reversal. We watched as the markets moved up beautifully in the morning, and then watched as the signs of a reversal towards the downside occured on an intraday basis, and then and only then should anyone have been both comfortable and confident in the opportunities that were available to short. The same thing will occur soon about an opportunity to buy the dip and go long. The issue is, when is the bottom, and will there be any confidence created in the process.

As long as there is not any major news that ultimately causes a shift in the overall investor sentiment in the markets, nor anything that would cause weakness in the global economy, I do not see a short term justification for major selling to occur. We may see a continuation of selling, but at the same time, I know that I personally will be looking for opportunities to actively trade and realize some gains on an intraday basis.

If that will occur or not is going to be a different story, but I genuinely believe tha t today will be a more difficult day for people who WANT to trade and will attempt for force positions, but this WILL be a great day for those who know how to be patient and allocate accordingly.

Again, just wait and make sure there is any sign of confirmation of a reversal prior to attempting an entry. Don’t blindly attempt to buy the dip and catch a falling knife. Wait unti the knife has hit the ground and the coast is clear. Once there is that reversal, take advantage of it, pick up the knife and have a great time. I believe that the large majority of confident traders will have no problems with following the momentum and realizing some gains today, so make the most out of today, and let’s have an amazing time!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $MSTR, $PLTR, $ORCL, $NVDA, $TSLA

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 01/08/2026 (ET):

Initial Jobless Claims - 8:30 AM

U.S. Trade Deficit - 8:30 AM

U.S. Productivity - 8:30 AM

U.S. Consumer Credit - 3:00 PM

Notable Earnings for 01/08/2026:

Pre-Market Earnings:

TD SYNNEX (SNX)

Acuity Brands (AYI)

Commercial Metals (CMC)

Neogen (NEOG)

Helen of Troy (HELE)

RPM International (RPM)

Lindsay Manufacturing (LNN)

Simply Good Foods Company (SMPL)

After Market Earnings:

Tilray (TLRY)

Simulations Plus (SLP)

Wrap up

This will be an interesting time for the markets. With the bearish sentiment in the water and during the pre-market session, conditions are looking more bearish, but at the same time, we may see an insane buy-the-dip opportunity later today as a result. So tread lightly, practice safe risk management, and do everything in your power to capitalize on these conditions. This will be an interesting day.

Good luck trading, and let’s see what confusion the markets throw at us!