HaiKhuu Daily Report - 01/09/2026

Good morning, and happy Friday! Wow, this week has absolutely flown by! Congrats on surviving the first full week of 2026, as long as you can make it through today, you’ve made it farther than a lot of people who’ve wiped themselves out over the previous couple of trading days!

Markets are looking interesting at the time of writing this report, remaining relatively neutral but retaining the level we’ve been holding over the previous couple of trading days.

With the confusion and neutrality going into today, I will warn you all to tread extremely lightly. Many individuals are going to have difficulties attempting to allocate at this level and retain consistency due to the lack of necessary momentum, but with the strength and exposure we are enjoying, it will be almost impossible not to be overly comfortable or confident. So remain level-headed, and practice risk management today.

There is a possibility that we do break out and make a new all-time high, so continue to do what you can to maximize your profit potential, and let’s make the most out of today!

Good luck trading, and let’s see where $SPY goes!

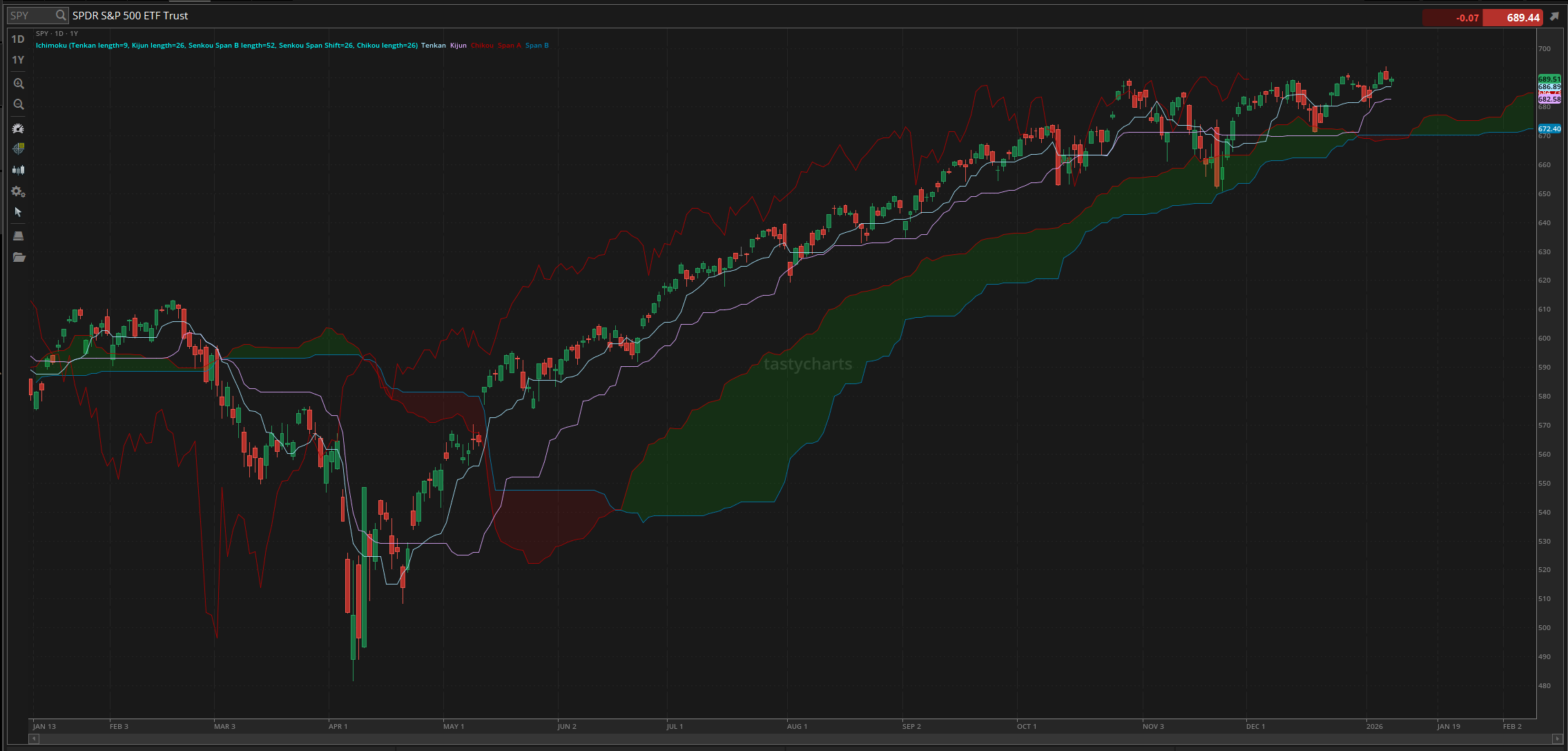

The updated $SPY daily levels are as follows:

Conversion Line Support: $686.69

Baseline Support: $682.58

Psychological Support: $680

Daily Cloud Support: $670.16

Thoughts & Comments from Yesterday - 01/08/2026

Yesterday was honestly a slow and gross day for the markets. There were opportunities to scalp on an intraday basis, but overall, the general markets were a snoozer yesterday! Anyone who forced trades or overleveraged themselves had a tough time, but thankfully, opportunities presented themselves, where, assuming you held individual names outside of health care and general tech, you should have done phenomenally yesterday! So it all really came down to the luck of the draw!

We started yesterday with $SPY trading at $688.81; $SPY was down ever so slightly, but the bearish momentum was almost non-existent. We watched as $SPY went on to make the official low of the day at $687.49 right after open, and watched as $SPY quickly reversed and remained around that $689/$690 range for a while. We did watch as $SPY made a new high of the day after the lunchtime lull, trading at $690.62, before coming back down and maintaining that $689/690 range throughout the rest of the day.

As much as I would love to tell you guys about the insane momentum and opportunities available, they were almost non-existent as general market momentum was absolutely non-existent, and we ultimately ended the day with $SPY going on and trading at $689.51, down $0.07 for the day, or down 0.01% overall.

So I am not going to say that it was a bad day for the markets, this is far from what actually is a bad aday, but a thte same time, with the overall movement, anyone that forced a significant amount of trades or overallocated to attempt to realize some gains had a difficult time and lost a significant amount of vapital, but at the same time, was quite the easy dodge assuming you held some great organizations that independently did well. We watched as organizations like $LMT and other major organizations rallied irrationally yesterday, but again, it all comes down to how you allocated and where you attempted to allocate your capital yesterday.

I hope you all were able to realize a significant amount of gains, and are prepared to see where $SPY takes us today!

S&P 500 Heat Map - 01/08/2026

Thoughts & Comments for Today - 01/09/2026

Today will be a confusing time leading into open. With the way that the markets are trending at the time of writing this report, things are not looking overly bullish or bearish, which is kind of a great sign, but at the same time, with the way the markets are trending, I am worried about another tight and generally choppy day for the markets. I do believe the likelihood of that happening is relatively lower, as the markets have moved up nicely over the previous couple of trading days, but my worry is that we see another day like yesterday, where we lacked general momentum and were presented with no great opportunities.

In the case that we see a lack of momentum in the markets, please make sure that you are practicing safe risk management and are not forcing or overallocating into trades during that time. In the case of neutrality, what typically will happen is that people will look to take on more risk as we are within a “tight” range, so risk potential is minimal, or we watch as people overallocate and attempt to realize more gains. By the book, this all makes a little more sense so you can attempt to make more out of a tough condition, but at the same time, with the difficulties many traders face during those tight moments in the markets, that will typically result in more sustained losses being generated quicker in a shorter period of time.

Just make sure that you are not overallocating and are doing everything in your power to practice basic risk management. That means scaling your positions properly, staying away from overallocating into option contracts, and making sure there is market momentum prior to attempting to enter into any position. If you are caught in a position and are overallocated, things are not bad until things get bad, then there is too much risk and exposure on the table, when you are losing more money than you are comfortable losing, in an extremely short period of time.

As long as you can remain diligent during this process, though, I genuinely do not see a reason why traders cannot continue to capitalize on these conditions. Holding strong equities is never sexy. Traders often hate the idea of doing so, but if we look at the general intraday market momentum of yesterday, there were no great opportunities to actively trade $SPY, but if you held strong organizations that performed well, it was almost impossible to lose anything of any major significance yesterday.

So, follow the momentum in the markets, and capitalize on these conditions. I won’t say which direction the markets are headed because again, anything can genuinely happen on an intraday basis today, but I will voice the fact that I am concerned about the momentum we are going to face here at these all-time highs. It will be hard to trade consistently, but assuming organizations continue to operate the way they should, it will be exciting to see the markets move accordingly, and it will be fun making the most out of the opportunities.

Just be smart, be safe, and make the most out of today!!!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $ORCL, $NVDA, $TSLA, $BABA, $MSFT

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 01/09/2026 (ET):

U.S. Employment Report - 8:30 AM

U.S. Unemployment Rate - 9:45 AM

U.S. Hourly Wages - 9:45 AM

U.S. Housing Starts - 9:45 AM

Richmond Fed President Tom Barkin speaks - 1:35 PM

Notable Earnings for 01/09/2026:

Pre-Market Earnings:

No Earnings Scheduled

Wrap up

These market conditions are volatile, and we are in the process of seeing some interesting action in the markets. Is $SPY about to break out once again, or sell back off and come back to the $680 magnet zone. It would genuinely surprise me to see some difficult times in the near future as I am optimistic to see where the markets take us, but at the same time, we all have to tread lightly and practice safe risk management in these conditions! So be smart, be safe, and realize some gains today!

Good luck trading, and let’s end this week strong!