HaiKhuu Daily Report - 01/13/2026

Good morning, and happy Tuesday!!! Wow, new all-time highs, and general market conditions are overly optimistic leading into today. I hope you all are feeling amazing and ready for what today has in store! Markets are neutral at the time of writing this report, and market conditions are looking great.

This is going to be another amazing day for the markets. The question is: are you going to be able to capitalize on it?

Markets are sketchy at this level, but that's when I think it's best to trade. People are overly optimistic, traders are allocating, and markets are at an all-time high. It is almost hard not to be optimistic at this level, but I need to remind you and warn you: we are not dropping heavily today. But know that when the markets inevitably come crashing down, the selling will be swift and quick.

For now, we get to enjoy the slow ride of slightly higher all-time highs, day after day.

But hey, with the way the markets are trending, we will soon see $SPY $700 (Easily can happen today), and we will continue to do everything in our power to realize as many gains as possible.

Just make sure to practice basic risk management, and do everything you can to follow the general market momentum. Life is good, and so are these market conditions, so realize some gains and have a great time!

Good luck trading today, and let’s see $SPY $700!

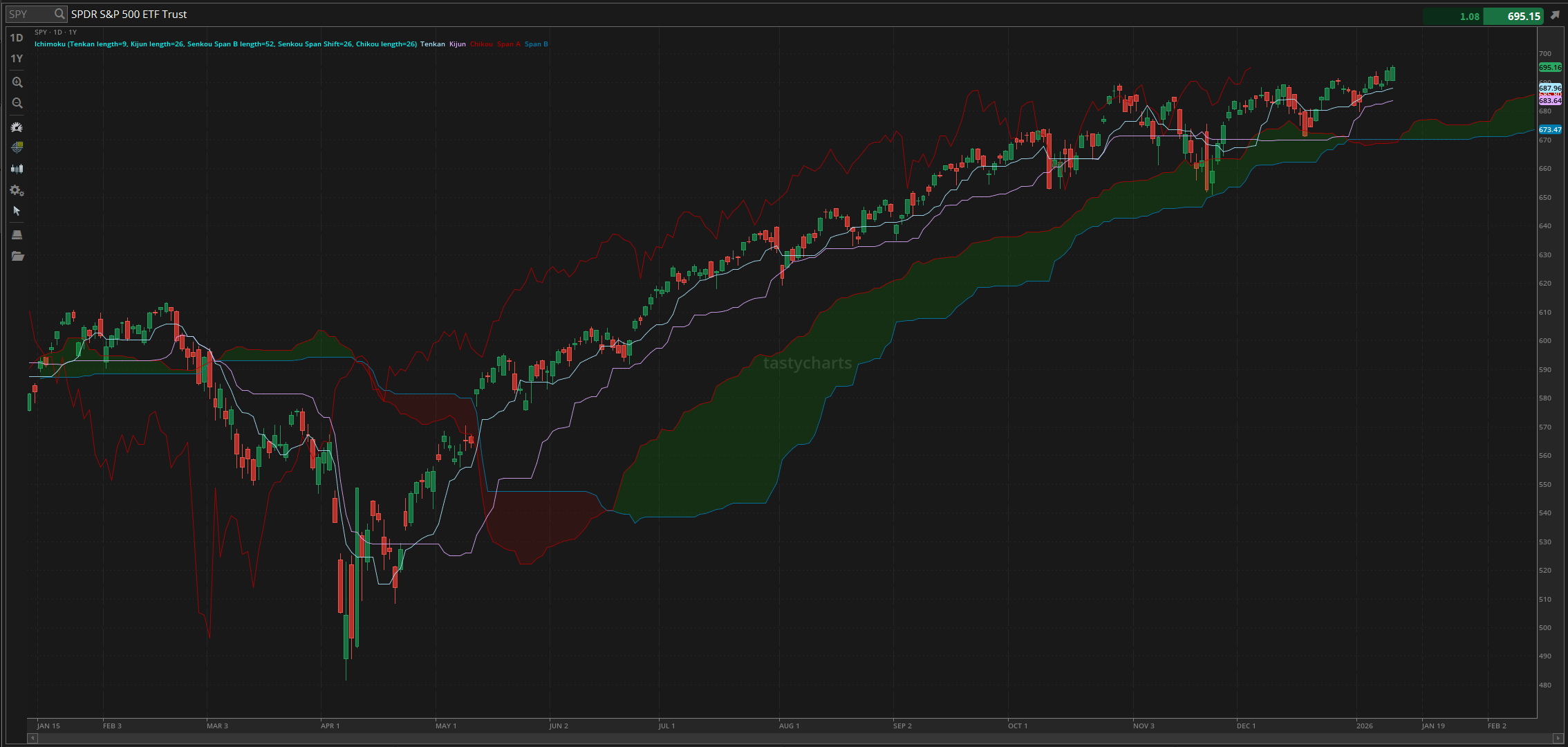

The updated $SPY daily levels are as follows:

Conversion Line Support: $687.96

Baseline Support: $687.96

Psychological Support: $680

Daily Cloud Support: $670.16

Thoughts & Comments from Yesterday - 01/12/2026

Yesterday was a beautiful day for the markets with strength, confidence, and an amazing buy-the-dip opportunity before we watched as $SPY went on and made a new all-time high. All traders had to do yesterday was simply hold strong equities, and they would have been taken care of. Everyone across the board could have and should have simply rode the market momentum, and you would have had a great time, so I hope you all listened to the report yesterday and made the most of it!

We started the day with $SPY trading normally, down ever so slightly, but it provided us with an amazing buy-the-dip opportunity. Traders quickly had an opportunity to allocate at open as $SPY started the day at $690.72, and watched as there was a constant rally throughout the entire day. The momentum early in the day was bullish, and that was all that was necessary.

By the lunchtime lull, the markets had recovered absolutely everything that was lost during the pre-market session, officially going black again for the day, and then watched as throughout the entire afternoon, $SPY continued to make a new all-time high after new all-time high.

We made the official high of the day and all-time high trading at $696.09, and had an amazing time in the process, before $SPY came back down ever so slightly, leading into close, where we officially ended the day with $SPY trading at $695.16, up $1 for the day.

It was a quick day for the markets, but opportunities were consistently amongst us, and traders could have very easily realized a significant amount of gains. Congrats to anyone who simply followed the general market momentum, and congratulations to anyone who was following our plays. It was a beautiful time and extremely easy to realize a significant amount of gains yesterday! Let’s see where the markets take us today and have a great time!

S&P 500 Heat Map - 01/12/2026

Thoughts & Comments for Today - 01/13/2026

Today is going to be another interesting time for the markets. With the confusion and optimism that everyone is experiencing at this moment, it is hard not to be excited to see where the markets are going to take us. But, I will warn you all, there is a big difference between someone who is excited to see where the markets take us today and someone who is blindly running into their death.

These conditions are amazing, and hopefully should continue to provide us with opportunities not only to trade but also to realize a significant amount of gains in a short period of time. But, with the way that the markets are trending, we are seeing all-time highs on $SPY, extreme evaluations from many organizations, and volatility that is irrational and inconsistent.

Everyone wants to make money, but some people just take on too much risk to attempt to achieve it.

The easiest way to attempt to trade at these levels is honestly to not attempt to trade. By simply holding strong equity positions and retaining the confidence necessary to remain profitable, it is almost impossible to lose money. You get to ride the waves and watch as the markets continue to move up accordingly. But the tough part is how do you attempt to allocate NOW, without taking on too much risk.

It is extremely easy for us to say it’s the “easiest” way to capitalize on these conditions when we bought the literal dip of 2025, and are holding positions that in some cases are up 100%+ from our entry. Traders in long positions with us from the bottom have such a nice cushion below them that it will be almost impossible to lose holding these positions at this point.

If you are attempting to trade and allocate at these levels, here are a couple of suggestions:

Short & quick scalps will allow you an opportunity to get exposure into many of these organizations that are trending, without giving you too much risk and exposure. Set tight stops to limit your downside risk.

Do NOT fight the momentum & new all-time highs. In the case that the markets are looking strong, I would say that the $700B in assets in $SPY will have more liquidity than your $1,000 account.

Allocate where there is confidence & value. Yes, many organizations are not undervalued at the moment compared to a couple of months ago, but at the same time, there are still going to be many hidden gems that start to slowly take off. We are seeing strength out of some organizations at the moment, and many are outperforming other organizations; look at $PTLO over the previous couple of days. It all comes down to having the right allocations in the right organizations at the right time. If you held PTLO over the previous couple of months, you’ve had a tough time, but if you’ve held PTLO through the previous two trading days, you would have absolutely killed it.

But again, the biggest thing you all need to make sure that you are doing is practicing basic risk management. I am not saying that you should attempt to be extremely safe in these conditions, but at the same time, there is no reason to attempt to make some dumb plays.

Allocate wisely with confidence, follow the trend, and realize some gains. It can’t be that difficult. So have a great time today, and let’s see where $SPY takes us!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $PLTR, $ORCL, $NVDA, $TSLA, $AMD, $INTC

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 01/13/2026 (ET):

NFIB Optimism Index - 6:00 AM

Consumer Price Index - 8:30 AM

Core CPI - 8:30 AM

New Homes Sales - 10:00 AM

St. Louis Fed President Alberto Musalem speaks - 10:00 AM

Budget Deficit - 2:00 PM

Richmond Fed President Tom Barkin speaks - 4:00 PM

Notable Earnings for 01/13/2026:

Pre-Market Earnings:

JPMorgan Chase & Co (JPM)

Delta Air Lines (DAL)

Bank of New York (BK)

Concentrix (CNXC)

Rezolve Ai (RZLV)

After Market Earnings:

Concrete Pumping (BBCP)

Phoenix Education (PXED)

Wrap up

This should be an interesting day full of opportunity and confusion. Please make sure to practice safe risk management, and do everything in your power to make the most out of these conditions. Markets are great, so let’s have an amazing time following the momentum and realizing some gains!

Good luck trading, and let’s see another NEW all-time high on $SPY!