HaiKhuu Daily Report - 01/12/2026

Good morning, and happy Monday!!! Uh, the DOJ has served the Federal Reserve??? These are news headlines that are absolutely INSANE. If you have not seen anything regarding it yet, here is a direct LINK to the Feds' statement.

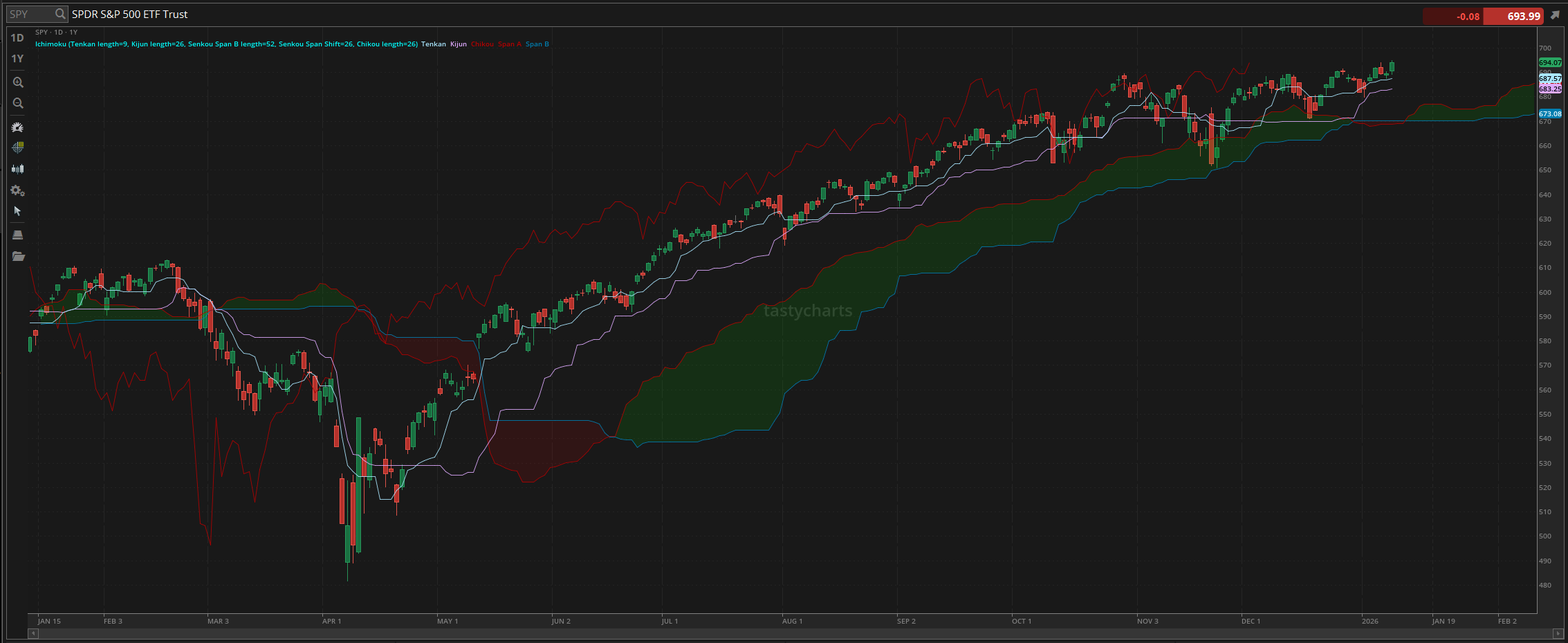

$SPY is trending around a new all-time high, there’s a non-zero chance that Jerome Powell gets arrested, and yet the markets are still looking amazing? None of this was on my 2026 Bingo Card, and we are literally in the second full week of the year. If this does not show that 2026 is going to be a wild and volatile time, I don’t know what will.

Going into today, with everything that has happened over the previous couple of trading days, it will be extremely interesting. There is a little bit of fear and concern leading into today as a result of the uncertainty that DJT drives, but if you guys have taken anything away from me, you should know that these times of uncertainty will provide you with a great opportunity.

Just make sure to follow the general market momentum, do not fight any trends, and make sure you practice risk management.

Opportunities will be amongst us today, and many will have an amazing time, so be smart, be safe, and kill it!

+ If you’ve not checked out the weekly preview, check it out HERE to prepare for the week!

Good luck trading today, and let’s see some uncertainty!

The updated $SPY daily levels are as follows:

Conversion Line Support: $687.57

Baseline Support: $683.57

Psychological Support: $680

Daily Cloud Support: $670.16

Thoughts & Comments from Last Week

Last week was honestly an amazing week for the markets. We watched as $SPY went on and made new all-time highs, traders enjoyed as both unrealized and realized gains flooded their accounts, and hopefully, everyone across the board had an amazing time. Opportunities were consistently amongst us to trade, and traders had an amazing time assuming they followed the general market momentum. It was a great way to start the year, and I hope you all enjoyed!

We started last week with $SPY opening at $686.46. Market conditions were strong going into the week, despite seeing some confusing momentum through Monday. Markets quickly rallied from open to show bearish neutrality throughout the rest of the day, which was followed by only blind bullish momentum on Tuesday, going on to make a new all-time high in the markets, which was followed by ANOTHER new all-time high in the markets on Wednesday.

Thursday was lackluster as a day, as markets dropped on Wednesday leading into close, and Thursday was just a vomit-inducing, snoozer of a trading day.

Friday is when things got spicy quickly.

We started Friday with $SPY opening at $690.67. Market conditions were beautiful to start the day as $SPY pushed up to test $692, before coming back down and making the official low of the day, trading at $689.19. That was a great buy-the-dip opportunity as we watched $SPY continue to rally from the bottom, display significantly more strength, and continue to rally throughout the morning, into the lunchtime lull, and into the afternoon. Conditions all across the board were absolutely amazing, and $SPY continued to make a new all-time high after a new all-time high.

Conditions were amazing on Friday, and $SPY went on to make the high of the day, high of the week, and all-time high, trading at $695.30.

Markets did come back down leading into the end of the day, where $SPY officially ended the week trading at $694.07, up $4.56 on Friday, and up $7.52 for the entire week, up roughly 1.1%.

So I am not going to say that was a perfect week for the markets, as there were many points of failure, but at the same time, those who were holding strong positions or simply just retaining strong equity exposure should have absolutely PRINTED trading last week, so let’s see where this week takes us and have an amazing time!!!

S&P 500 Heat Map - 01/09/2026

Thoughts & Comments for Today - 01/12/2026

The conditions leading into today are going to be interesting, and I hope you all are ready for what is to come in the near future. There is general strength and confidence in the markets that we all should be overly excited about, but as a result of both market sentiment and political turbulence, we are now seeing some short-term weakness appear out of nowhere. This is not necessarily a bad thing, and the inconsistencies are going to provide us with some great opportunities not only to trade but to realize a significant amount of gains.

With the markets being down during the pre-market session, I will say that is not the best look, nor is it “ideal”, but at the same time, with the confidence that traders are feeling, it is almost hard not to be optimistic at this time. Yes, we are seeing some short-term uncertainty, mostly with the DOJ investigating the Fed, but with the way that everything is trending, this uncertainty is going to result in some great trading opportunities.

I am not sure where the “buy the dip” opportunity will be, but just note that here in the near future, assuming the markets do not just absolutely collapse on us, it is going to rotate back and show us strength and opportunity again. It's all just a matter of capitalizing on the rotation back. So look for an opportunity to allocate in these market conditions, and do everything in your power to realize some gains. Traders can and will have opportunities to allocate on an intraday basis, but whether the play works out or not is a different story.

So please, make sure to tread lightly, practice safe risk management, and do not overallocate in these market conditions.

Many individuals will get lucky, and many individuals will be unlucky. It does not matter if you are lucky or not; it all just comes down to where you allocate and when.

Stick to trading fundamentally solid, fairly valued organizations at this time. Try and stay away from overpriced equities that have some sort of government exposure, and make sure there is momentum on a larger scale in a play that you are looking at here in the short term. There will be “discounts” available , but many of these discounted organizations are going to have a tougher time.

A great example of a great organization that has been trading at a massive discount over the previous couple of months is $COST. We are watching as $COST is continuing to reverse from the bottom and show relative strength. Yes, there is some risk exposure and exposure from the government, but at the same time, $COST’s operations are not heavily reliant on Govt contracts or spending. $COST is fundamentally solid and has been at a discount. I would personally take $COST over many of these highly irrational speculative allocations that retail is attempting to create here in the short term.

Just tread lightly on these conditions, prepare for some volatility, and make the most out of this confusion. We will have an amazing time today, so let’s realize some gains this week and have some fun!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $PLTR, $ORCL, $NVDA, $TSLA, $AMD, $INTC

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 01/12/2026 (ET):

Richmond Fed President Tom Barkin speaks - 8:00 AM

Atlanta Fed President Raphael Bostic speaks - 12:30 PM

Notable Earnings for 01/12/2026:

Pre-Market Earnings:

No Earnings Scheduled

After Market Earnings:

No Earnings Scheduled

Wrap up

This is going to be an interesting day for the markets. Prepare accordingly for some irrationality, and accept whatever the markets decide to give us. I want to be optimistic, but please make sure to remain realistic with your hopes and expectations of the markets this week. There is a lot of uncertainty and unrest at the moment, so expect irrationality and volatility. As long as you are prepared for a battle this week, we all should have a great time!

Good luck trading, and let’s see what this week has in store for us!