HaiKhuu Daily Report - 01/20/2026

Good morning, and happy Tuesday! Wow, that long weekend went by so quickly! I hope you all had a wonderful time, and your day off was filled with rest and relaxation. Things have been volatile with Trump saying some interesting things regarding tariffs again, so I hope you all are ready for an interesting and confusing time.

$SPY $680 is back in play. The markets have dropped heavily, and this is going to be a volatile and irrational day. This will be an interesting time for the markets, so tread lightly and practice safe risk management.

We do have some other volatility events coming up this week, including major earnings from organizations like $NFLX and $INTC, as well as jobless claims and GDP, so make sure to check out the WEEKLY PREVIEW to prepare accordingly for this volatility.

Just know that the next couple of days are going to be volatile and difficult to navigate, so tread lightly, practice safe risk management, and do everything you can to enjoy these conditions. I’ll talk more about my tinfoil hat thesis later on in the report, but for now…

Good luck trading this week, and let’s see where this volatility takes us!

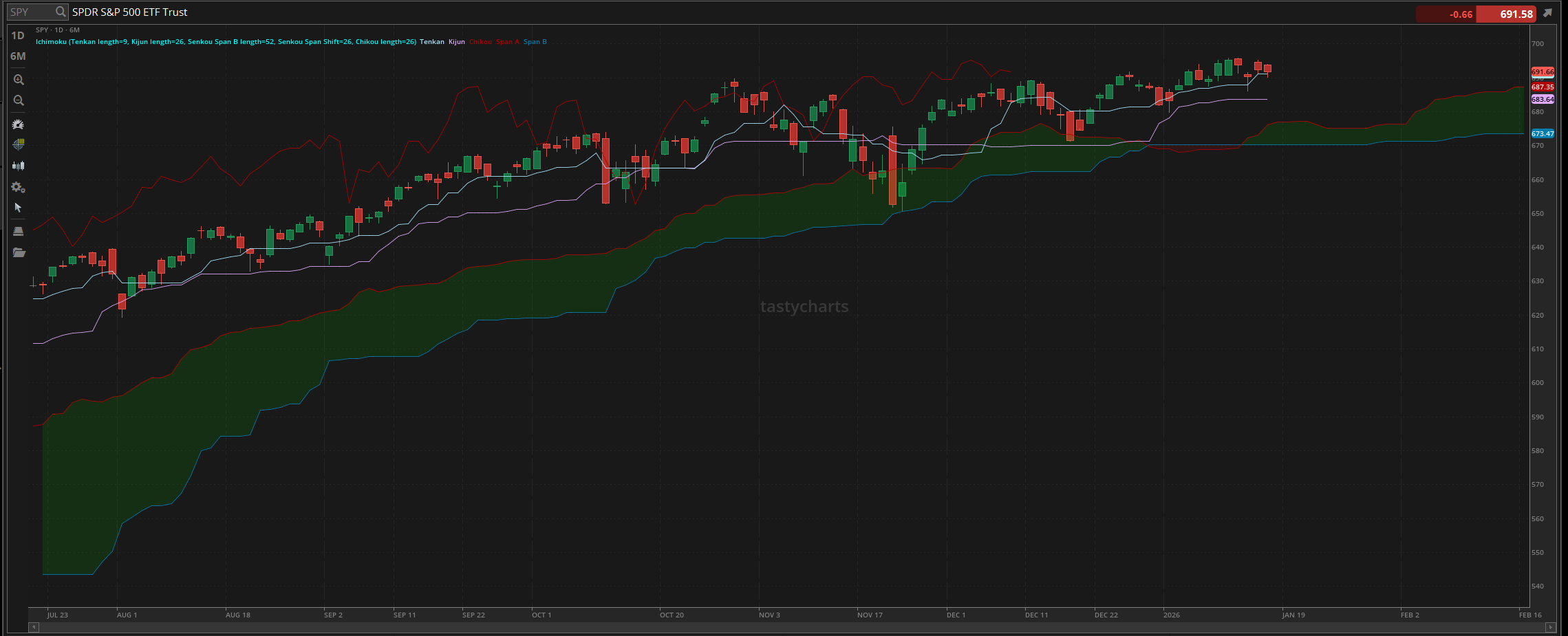

The updated $SPY daily levels are as follows:

Conversion Line Support: $691.07

Baseline Support: $683.64

Psychological Support: $680

Daily Cloud Support: $670.28

Thoughts & Comments from Last Week

Last week was a volatile time for the markets, but opportunities were consistently presenting themselves to us. With strength and confidence in some equities, we saw $SPY make a NEW all-time high, and many organizations rallied significantly. There was weakness in the Financial and tech sectors, but that was offset by markets everywhere else being beautifully green, so it all really just came down to where you were allocated, how you were allocated, and how lucky you were with your positions. Assuming you nailed all three, you absolutely killed it last week. Congrats :)

We started last week with $SPY looking alright; it gapped down from the close on Friday and started the week trading at $690.81. Market conditions were just okay. The initial bearish sentiment was not a great way to start the week, but it was beautiful as $SPY quickly rallied from the open, showing that it was all one massive fake-out. We watched as $SPY rallied towards its previous all-time high and quickly made a new one on Monday. The momentum of Monday after the rally was relatively slow, as we watched that strength rally into Tuesday.

On Tuesday, $SPY went on and made the official all-time high, trading at $696.09, and conditions were great until $SPY started to sell off from the top.

A little bit of bearish momentum never hurt anyone, but the sudden, quick selling into Wednesday did. $SPY went from trading at the official all-time high to quickly snapping down and making the official low of the week, trading at $690.11.

Conditions were tough; the majority of active scalpers and traders struggled, and the bears printed in that quick downside. Thankfully, that sell-off was quickly bought back up intraday, and we watched as $SPY recovered slightly on Thursday, leading into mild neutrality on Friday.

We officially ended the week with $SPY trading at $691.66, up $0.85, or roughly 0.12% overall. So, I won’t say it was necessarily a great week for the markets, but there was 100% volatility that any trader could have easily capitalized on, and $SPY went on to make a new all-time high. There really is not much to complain about unless you had a tough time trading last week and realized a significant amount of losses, but regardless, it is simply life, so let’s just see where the markets take us today, and have an amazing time!

S&P 500 Heat Map - 01/16/2026

Thoughts & Comments for Today - 01/20/2026

Whatever your sentiment was for the markets was at close on Friday, just know that the tables have been flipped at this point, and that anything can realistically happen in the next couple of days. We are seeing news regarding these tariffs. We have earnings and economic data coming out this week, and since it is a short week for the markets, please go into today and every day this week expecting to see some irrationality.

As I said before, the $SPY $680 magnet is back in effect. This is absolutely disgusting, but at the same time, it is going to provide us with tons of opportunities to trade and realize significant gains if you know how to take advantage of this selling. I genuinely believe that this is going to be an extremely difficult day for many traders, and I believe that losses will be quickly generated if you do not tread lightly.

Please go into today with the expectation that conditions are going to continue to remain volatile and irrational. Anything can happen and we can easily recover, but with the way the markets are looking, it is going to be hard not to be skeptical. Anything can truly happen today, and anyone’s prediction is as valid as anyone else’s.

I am worried about the possible continuation of the downside of the markets at this point, and honestly, we are in a place where there is not much we can do except speculate on what will happen in the near future, and hope that everything turns out all right.

There is going to be a lot of fear that comes back into the market as a result of this movement, and the downside risks are very apparent at this point. This should be concerning to everyone, but I will say that I do believe that this is just a continuation of short-term weakness and confusion. Market conditions overall are still extremely strong, but at the same time, losses will be generated as a result of this movement.

Just be careful, as during times like this, you will watch as many traders become overly bearish, and as a result of that, start to spread FUD.

Yes, these conditions are disgusting, and there is downside risk at the moment, but these market conditions are still extremely strong on a larger scale; we are just seeing some short-term weakness at this point.

Traders should be uncomfortable with the movement we have seen over the long weekend, but should be excited about the opportunities that are presenting themselves to us.

I am not saying that the markets are a buy at the moment, but what I can say is that I do believe that the selling that has occurred will result in a new buy-the-dip opportunity. The question is, how far do we sell off, when do we see signs of a reversal, and how beautiful a buy-the-dip opportunity will be presented to us?

Everyone should tread extremely lightly and make sure to practice safe risk management in these conditions, but genuinely look to take advantage of these conditions. As I’ve said before, when we sell off, it will be quick, sudden, and unexpected, and that has remained completely true with the way the markets have moved at this point. But, as bad as these market conditions are, and how sudden this selling has been, please expect the same type of movement once we start to recover.

If/when the markets recover from this drop, expect that we are going to see a large bullish movement that is unexpected and quick, in the same fashion as this movement. I do not know what the catalyst is; it could be the Supreme Court ruling against the tariffs, or some other type of news that will result in the markets recovering, but regardless of what the cause is, it will be sudden and confusing.

I will warn you again, those who do not know what they are doing in these market conditions are going to get absolutely slaughtered by overtrading, taking on too much risk, and being irrational, while the markets continue to remain irrational.

Remain optimistic and do everything in your power to make the most out of these conditions. Many individuals will generate losses as a result of overtrading and simply taking on too much risk, while others will be patient and rational with their decisions, resulting in easy gains. So please, be smart and safe while the markets are acting irrationally, and take advantage of this fear that will be generated.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $PLTR, $ORCL, $NVDA, $TSLA, $AMD, $INTC

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 01/20/2026 (ET):

Initial Jobless Claims - 8:30 AM

Import Price Index - 8:30 AM

Philadelphia Fed’s Manufacturing Survey - 8:30 AM

Richmond Fed President Tom Barkin speaks

Pre-Market Earnings:

Fifth Third Bancorp (FITB)

D.R Horton (DHI)

U.S. Bancorp (USB)

3M Company (MMM)

Fastenal (FAST)

KeyCorp (KEY)

After Market Earnings:

Netflix (NFLX)

Interactive Brokers Group (IBKR)

United Airlines (UAL)

Karoooooo (KARO)

Simmons First National (SFNC)

Zions (ZION)

Wrap up

This is going to be a hectic way to start the week. Market conditions are confused and highly irrational at this time, and realistically, we should be nervous about the momentum but optimistic to see where the markets take us from here. Be careful, as we are back in the $680 magnet zone, but be excited because this is going to provide us with a great opportunity in the near future. Tread lightly and practice safe risk management today, but let’s have some fun and make the most of it!

Good luck trading, and let’s see where $SPY takes us this week!