HaiKhuu Daily Report - 01/21/2026

Good morning, and happy Wednesday. Wow, this week has just started, but it has been a volatile and disgusting time. I hope you all are ready for another day of general confusion and bearish sentiment for the markets. Markets are up slightly at the time of writing this report, and hopefully, we see an insane bounce in the markets today.

Regardless of your personal sentiment about the markets, just please make sure to tread lightly. Many individuals are going to take on too much risk in these market conditions, which will result in losses being generated, but at the same time, when the markets do inevitably bounce, please expect a large, sudden directional move that is going to ultimately result in all of the losses that have been generated over the previous couple of days all suddenly coming back.

Just make sure to follow the trend of the markets, and make sure you are actively attempting to practice safe risk management when attempting to allocate today, as losses can stack up quickly and wipe any trader out quickly.

The $680 magnet is back in play, and we are BELOW that level at the moment, showing both bullish strength and opportunity, so we will see where the markets take us and try to make the most of these conditions.

Good luck trading today, and let’s hope there’s a quick recovery!

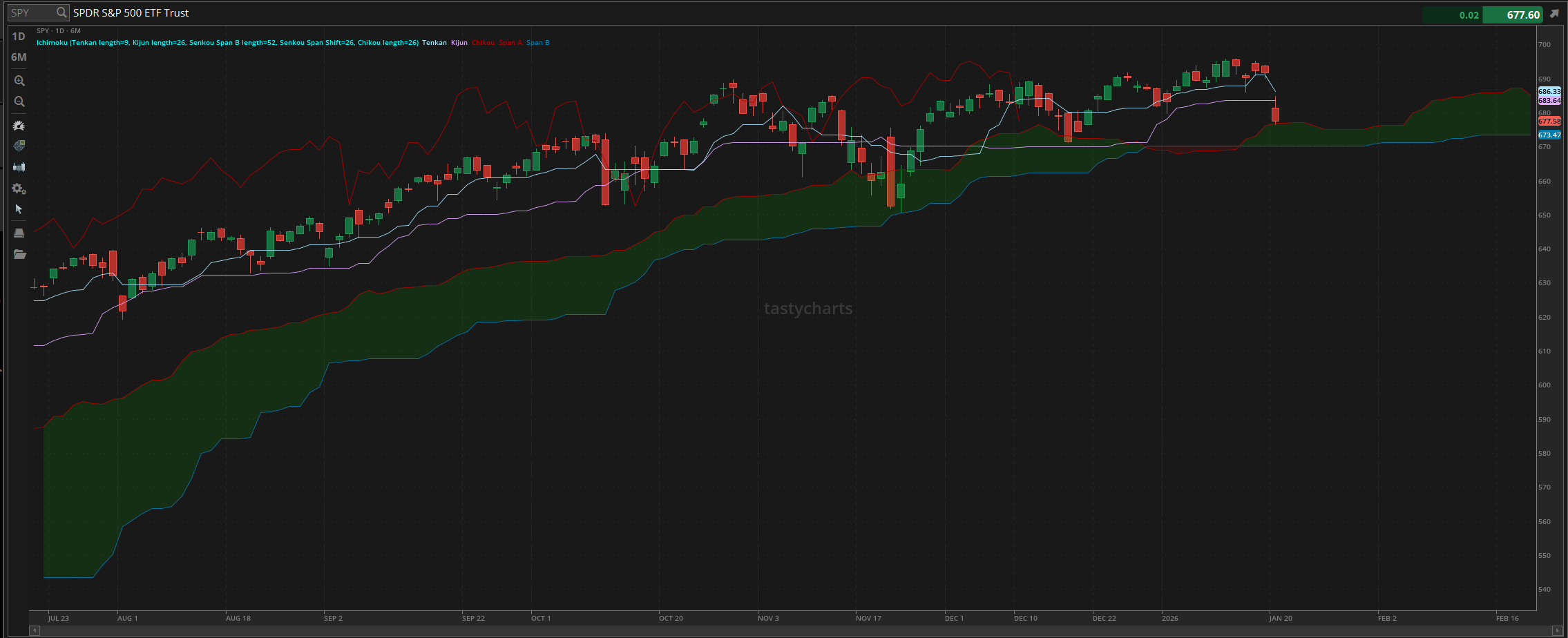

The updated $SPY daily levels are as follows:

Conversion Line Support: $686.33

Baseline Support: $683.64

Psychological Support: $680

Daily Cloud Support: $676.88

Thoughts & Comments from Yesterday - 01/20/2026

Yesterday was an insane day for the markets. As warned, losses could have been easily generated, and many traders did, unfortunately, realize a significant amount of losses as a result of the general market momentum. Hopefully, any losses that were generated yesterday were not of any major significance, and anything lost can easily be recovered in the near future. Just know that the large majority of traders had a tough time, and if you are kicking yourself for what happened, just know you are not the only one who feels that way. Welcome to the markets and these conditions!

We started the week by enjoying an insane bearish movement to start the trading week. $SPY started the day trading at $681.45, down approximately $10 from the previous close, and watched as market conditions only continued to get tougher throughout the morning.

$SPY did recover slightly, moving up to make the official high of the day, trading at $684.76, but once the bullish momentum slowed down, it was just a disgusting bearish trend throughout the rest of the day. We dropped after the lunchtime lull and continued to drop all the way until close, where $SPY ultimately went on to test the daily cloud support and made the official low of the day, trading at $676.57.

Conditions at the bottom were absolutely disgusting, and that honestly continues to remain true when looking back in hindsight. There was no great opportunity to allocate towards the back half of the day, and anyone who attempted to buy the dip had a terrible time realizing a significant amount of losses in the process.

We went on to officially end the day with $SPY trading at $677.58, down $14 for the day, or down roughly 2% overall.

That was genuinely a disgusting day for the markets with continued bearish momentum from the top, but it at least provided traders with opportunities to allocate and take on some risk. Those who were bearish and followed the market momentum had a great time as they printed hand over fist, and hopefully everyone was able to make the most out of those absolutely insane market conditions. It was interesting to see how the markets worked out yesterday, and hopefully they can recover nicely today!

S&P 500 Heat Map - 01/20/2026

Thoughts & Comments for Today - 01/21/2026

Today is going to be the most difficult trading day we’ve faced so far in 2026, and I hope you all are ready for it. With everything that is going on at the moment, we are currently in a place where the markets can very easily do anything. We can easily pump, we can easily dump, or in the worst-case scenario, we move back towards that $680 magnet zone and remain dead neutral.

Please go into today understanding that any of those three scenarios is a very real possibility, and know that many individuals will experience a lot of volatility and confusion when attempting to allocate today. Some will generate a significant amount of gains, while, unfortunately, others will generate a significant amount of losses. As long as you are practicing safe risk management, I do not see a reason why we all cannot have a great time today.

We are back in the back half of neutral on the Fear & Greed Index, meaning that people are starting to become more fearful of these conditions, but at the same time, that should provide us with more confidence, as these dips are providing us with upside potential.

Just remember how slow the markets were moving when we were chopping back at the previous all-time highs, not seeing a significant amount of upside potential; now that is back. $SPY can easily move up another $20 without making a new all-time high, leaving us with a beautiful opportunity to attempt to capitalize on these conditions.

I will vocalize the fact that I am still fearful yet optimistic, leading into today. With the way the markets are set up, it will be extremely difficult for the markets to get irrational purchasing at this level unless we see some news or a general sentiment shift, so tread lightly.

In the case that we do get a directional move in the markets, don’t fight the momentum and simply follow the trend.

I personally got caught up in attempting to fight the trend yesterday, and those who watched those trades in real time know the reality of what happens when you trade 0-DTE’s while conditions are less than ideal. Don’t get caught in an irrational position, remain rational with your logic, and again, practice safe risk management.

Hopefully, we do not see a continuation of selling, but in the case that the markets do continue to sell off from here, my next bearish PT is going to be $660.

Just be optimistic going into today and hope that this is all one massive buy-the-dip opportunity that provides us with some beautiful bullish momentum. Tread lightly, hope for the best, but prepare for the worst, and just simply follow the trend. We will have a lot of fun today, the only question is, will you be able to realize gains or not?

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $PLTR, $ORCL, $NVDA, $TSLA, $AMD, $INTC

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 01/21/2026 (ET):

Construction Spending (delayed report) - 10:00 AM

Pending Home Sales - 10:00 AM

Notable Earnings for 01/21/2026:

Pre-Market Earnings:

Johnson & Johnson (JNJ)

Ally Financial (ALLY)

Halliburton (HAL)

Charles Schwab (SCHW)

TE Connectivity (TEL)

Citizens Financial (CFG)

Prologis (PLD)

Travelers (TRV)

After Market Earnings:

Kinder Morgan (KMI)

CACI International (CACI)

Knight-Swift Transportation (KNX)

Pinnacle Financial (PNFP)

FB Financial (FBK)

Fulton Financial (FULT)

Wrap up

This will be an interesting day for the markets. Hopefully, we recover and provide us with a great opportunity to trade, but at the same time, with the general confusion and fear that many are experiencing, just know there will be many skeptics. Just tread lightly, follow the momentum, practice safe risk management, and make the most out of these conditions. Let’s have some fun and realize some gains.

Good luck trading, and let’s see where $SPY takes us!