HaiKhuu Daily Report - 01/22/2026

Good morning, and happy THURSDAY! WOW, I don’t know about you, but I think that this is an absolutely INSANE recovery for the markets, and I genuinely hope that you all are having a lot of fun and have been able to realize a significant amount of gains in a short period of time!

Markets are looking amazing at the time of writing this report as $SPY has only continued to move up during the pre-market session and conditions are looking exceptionally strong going into today! Continue to enjoy this momentum, and continue to ride this wave. Traders have easily been able to realize a signficant amount in a short period of time, and it is on you to have made the most out of these conditions.

There is a realistic possibility that we go on and quickly make a NEW all-time high in the markets today, and recover the rest of this gap extremely quickly. There is general downside risk in the markets as everything is acting irrationally, and we can see news pop up at anytime, but with the confidence everyone is experiencing, go into today excited and make the most out of this strength and confidence.

Good luck trading today, and let’s watch $SPY continue to rip!

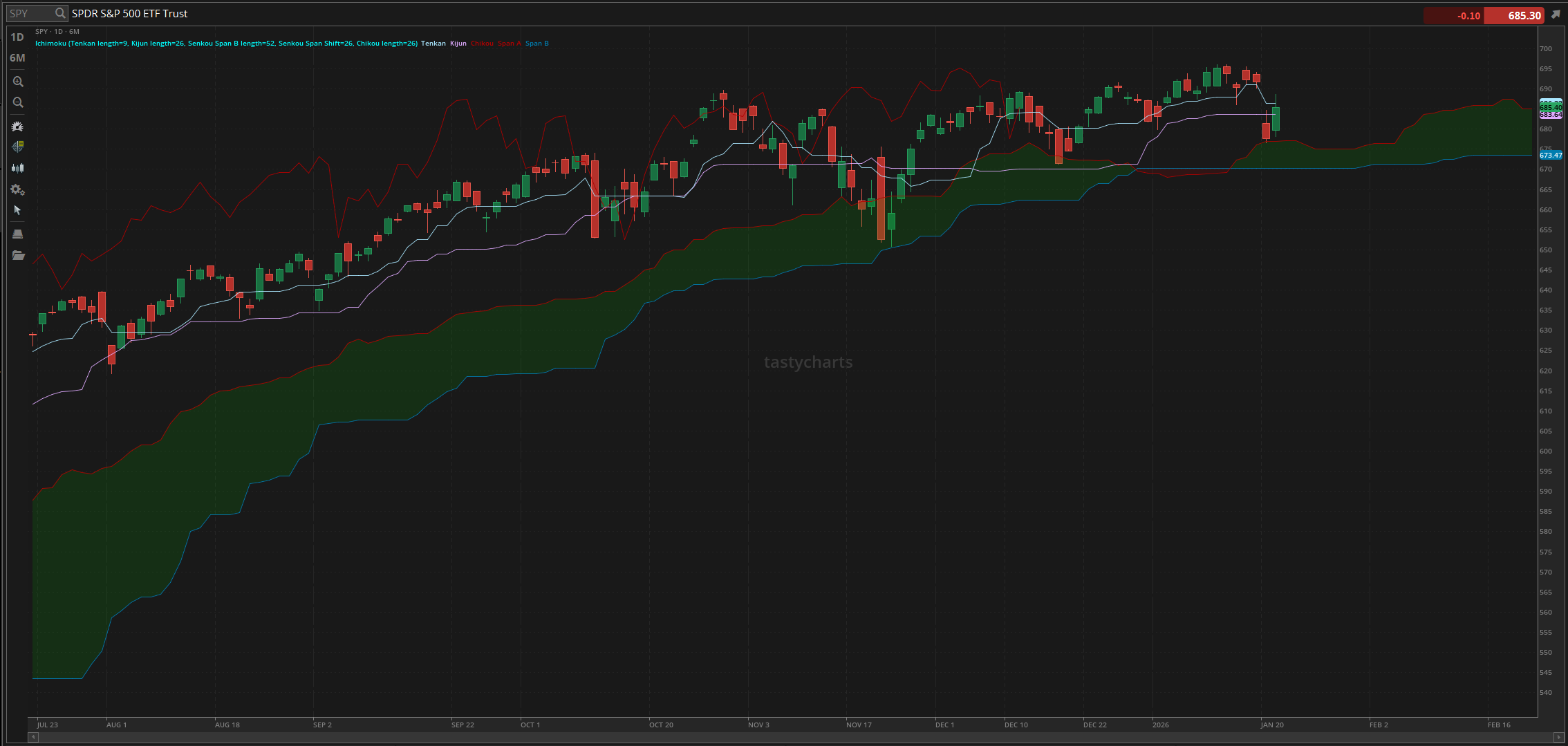

The updated $SPY daily levels are as follows:

Conversion Line Support: $686.33

Baseline Support: $683.64

Psychological Support: $680

Daily Cloud Support: $677.02

Thoughts & Comments from Yesterday - 01/21/2026

Yesterday was an absolutely INSANE time for the overall markets. We watched as there was opportunity, momentum, and irrationality, everything a great trader needs to realize a significant amount of gains in a short period of time! Hopefully, you all were able to generate a significant amount of both realized and unrealized gains in the process and had an amazing time! It was a great recovery effort we watched in real time, and hope you all printed in the process!

We started the day with $SPY moving up slightly, opening the day at $679.73. Market conditions at open were strong as we were in the process of recovering, watching as $SPY broke out and went on to make the official high of the day, trading at $685. Conditions at the top were beautiful, and everyone had an opportunity to realize a significant amount of gains from the open momentum.

Everything did slow down leading into the lunchtime lull, and we watched as $SPY went on to make the official low of the day during the lull, trading at $678.13.

Market conditions at the time were relatively slow, gross, and really did not display much confidence in the process, but we watched as $SPY thankfully moved up and displayed more confidence as there was news regarding Trump and these “tariffs” revolving around Greenland.

Markets then rallied, going on to make the official high of the day, trading at $688.73, before coming back down and remaining relatively neutral until close, where we officially ended the day with $SPY trading at $685.40, up approximately $8 for the day, or up 1.2% overall.

I will say, the momentum on an intraday basis was tough to navigate, but provided opportunities to scalp in both directions. If you held long positions or attempted to buy the dip on an intraday basis, that was absolutely the move, and traders across the board should have generated a significant amount of gains in a short period of time. This has been one of the best trading days I’ve personally had all year, and it’s funny that it’s happening now out of all times, so congrats again to anyone who was able to make the most out of these market conditions and realized some gains in the process. We will enjoy what the markets have in store for us today and make the most of it!

S&P 500 Heat Map - 01/21/2026

Thoughts & Comments for Today - 01/22/2026

Today is setting up to be another great day for the markets. If that remains true or not is another question, but with the way the markets are trending, I will say it is almost hard not to be excited and optimistic leading into the day. At the time of writing this report, $SPY is actively testing the $690 resistance. There is a very real possibility that we break above that level by open, and watch as $SPY goes on and makes a new all-time high. Market conditions are strong, traders should remain optimistic, and we should all be excited about today.

The one warning I do have for you all, is despite the strength and confidence we are seeing in the markets, look to tread lightly. I am not expecting any real downside in the markets today, mostly with the movement we have seen in the pre-market session, but you all understand how volatile these market conditions are. There is a very real possibility that the markets do not ultimately end up moving, and a very real possibility of a sell-off.

I am not expecting a major sell-off to happen from this point, but again, anything is possible, so make sure to tread lightly and keep your fists up, but do everything in your power to remain solvent and as profitable as possible. The only thing that would realistically cause the markets to sell off heavily at this point is some random unexpected news regarding the tariffs, but at the same time, if we ease the tension that is built at the moment, the inverse will happen, where the markets just continue to rally, and we have an amazing time.

One of the most difficult things to do in these conditions is entering into long positions. With the confusion that traders are experiencing right now, we are primed to have another directional move in the near future, the question is, where does that reversal happen, how long will there be strength, and realistically, how large of a movement will happen.

I wish that I had the answers to spoon-feed you all exactly everything perfectly, but with the conditions we are seeing in the markets and the irrationality we are experiencing, any prediction I provide is as valid as anyone else's.

But, with that said, I can say that, in my opinion, the easiest way to capitalize on these conditions is by simply holding strong equities. But equities are expensive now, and it is difficult to allocate towards these trending organizations that have rallied over the previous couple of months.

If that is your issue, either find opportunities to buy into weakness, as traders will consistently see great organizations trading at a relative discount, or look to simply allocate into strong equities here at the top, and simply ride some short-term momentum. Over night risks and attempting to swing trade takes on additional risks at this point, but again, buying the dip and retaining confidence in your positions ultimately is the risk that you have to take at this level, we are going to have an amazing time.

Just continue to retain your long exposure in the markets, remain optimistic about these conditions, and just continue to do everything in your power to generate as many realized gains as you can possibly in the shortest amount of time. Many traders are going to have zero issues doing this today, the question is, are you going to be able to retain your composure during this confusion. Those who remain comfortable, are those who are going to realize the most, in the shortest period of time. So continue to make the most out of this strength, and let’s have a lot of fun trading today!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $PLTR, $ORCL, $NVDA, $TSLA, $AMD, $INTC

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 01/22/2026 (ET):

Initial Jobless Claims - 8:30 AM

GDP (first revision) - 8:30 AM

Notable Earnings for 01/22/2026:

Pre-Market Earnings:

Procter & Gamble (PG)

Freeport-McMoRan Copper (FCX)

GE Aerospace (GE)

Huntington Bancshares (HBAN)

Abbott (ABT)

McCormick & Company (MKC)

Northern Trust (NTRS)

Old Republic International (ORI)

After Market Earnings:

Intel (INTC)

Intuitive Surgical (ISRG)

Alcoa (AA)

Capital One Financial (COF)

CSX (CSX)

Alaska Air Group (ALK)

Sallie Mae (SLM)

Wrap up

This is going to be an absolutely amazing day for the general markets and I hope that you all are excited and ready for a new all-time high in the markets. Continue to remain realistic with your expectations, but continue to be optimistic. Market conditions are strong, traders should print today, and we should all have an absolutely amazing time!

Good luck trading, and let’s see where $SPY takes us today!