HaiKhuu Daily Report - 01/23/2026

Good morning, and happy Friday! Wow, this week has gone by in an instant, and I hope you all are ready for what is going to be an interesting day for the markets! $INTC dropped heavily on earnings last night, resulting in slightly weaker than expected market conditions leading into today! This is not necessarily a bad thing, as opportunities will present themselves through the bloodshed, but finding those plays and landing those trades will be an interesting time.

Markets are down slightly at the time of writing this report, so go into today treading lightly because there is mild uncertainty and confusion at this point. Follow the general market momentum, practice safe risk management, and end this week strong.

Expect some irrationality and inconsistencies in the markets that will make trading more difficult, but know that some people genuinely will PRINT while attempting to trade today.

This will be an extremely interesting time, so have some fun, realize some gains, and let’s end this week STRONG!

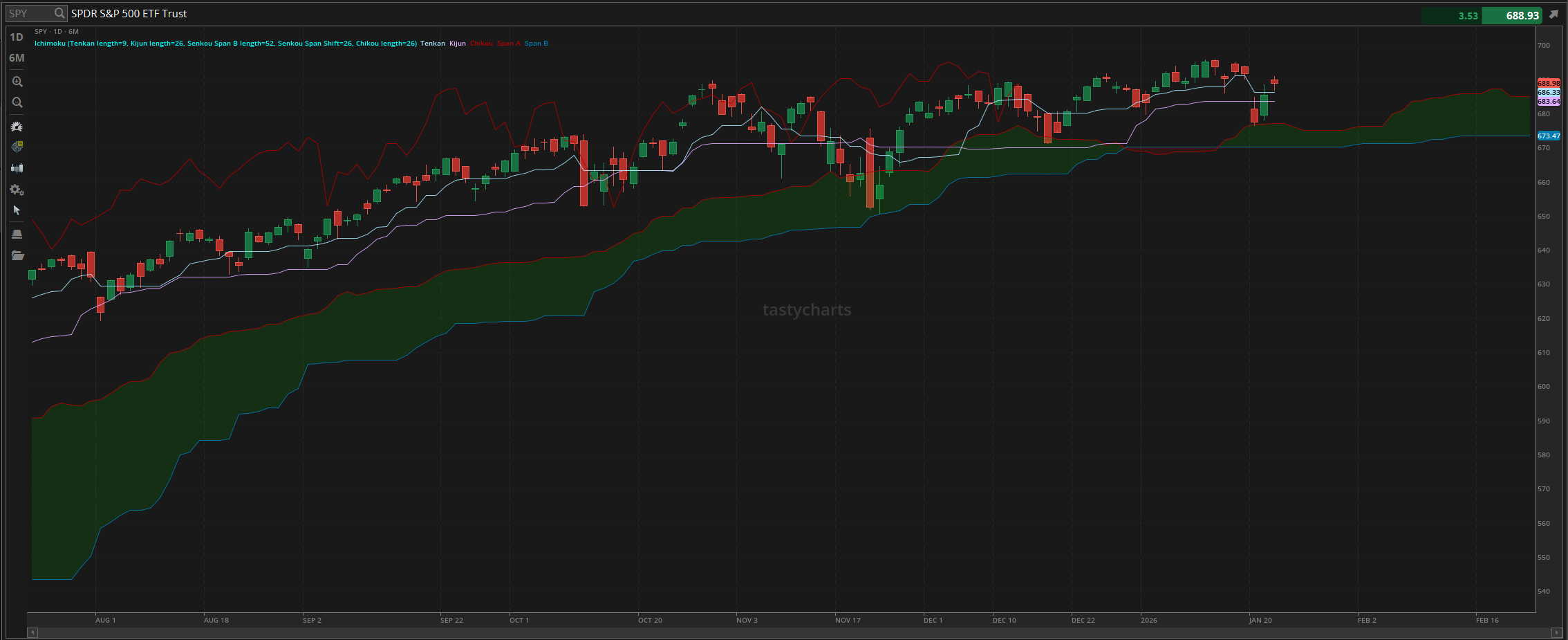

The updated $SPY daily levels are as follows:

Conversion Line Support: $686.33

Baseline Support: $683.64

Psychological Support: $680

Daily Cloud Support: $677.13

Thoughts & Comments from Yesterday - 01/22/2026

Yesterday was a tough day for the markets, but there was beautiful bullish momentum, so hopefully everyone was able to realize a significant amount of gains. Markets showed strength, there was opportunity to trade both directions, and everyone shouold have had some fun.

We started the day with $SPY trading at $689.94, market conditions looked alright at open as $SPY rallied up and made a relative high before quickly coming back down within the first hour of the day, going on to make the official low of the day trading at $686.92.

Things were alright at the bottom as $SPY was still up roughly $1.50 for the day, and thankfully we watched as the markets reversed from the bottom, and continued to rally into the early afternoon, making the official high of the day trading at $691.12.

Conditions at the top, the same way conditions were at the bottom, were not absolutely insane, but opportunities were presented to us to scalp a slight reversal in the markets, as in the back half of the afternoon, $SPY went on and sold off slightly.

We ended the day with $SPY officially closing at $688.98, up just shy of $4 overall or up about 0.5%.

I will say that it was an absolutely beautiful day for the markets that provided us with opportunities to trade and realize a significant amount of gains. Hopefully everyone was able to print in the process and had an amazing time, because again, opportunities were consistently presented to anyone, regardless of your trading style. Let’s see what the markets have in store for us today, and be excited to see what happens!

S&P 500 Heat Map - 01/22/2026

Thoughts & Comments for Today - 01/23/2026

Today is going to be a confusing time for the markets. With the fact that we are down slightly at the time of writing this report, I feel that a lot of uncertainty in the air is coming as a result of $INTC earnings last night. Due to their softer-than-expected quarter, we are seeing slightly less confidence coming from other semiconductor names like $NVDA and $AMD, resulting in weakness in the broader market. This is not necessarily a bad thing, but that is not the best thing if you are attempting to be hyper bullish going into today.

Markets can break out, and realistically can move to a new all-time high, but I do believe the likelihood of an irrational breakout is slowing down, and becoming less likely as the volatility in the markets is also calming. If you are attempting to trade today, be careful and cautious if you are attempting to actively scalp. With the inconsistencies we are seeing in the markets, many scalpers on an intraday basis are going to get stopped out, chopped out, or faked out for their plays.

Just remember that solvency and conviction are keys to your success in the markets.

If you cannot remain consistent and understand your own psychology behind a play, you are most likely going to lose, because you are blindly following and praying, versus watching traders allocate accordingly.

I don’t see a reason why the traders cannot continue to realize gains in these conditions, and honestly, the least consistent traders are going to be the loudest about how much of a “scam” the current markets are, not because the markets truely are terrible right now, but because they are failing as a trader during one of the easiest times to trade in the markets.

So please, make some smart decisions, make some good allocations, and have faith in your allocations.

One play that does interest me at this level, as a result of the selling that occurred yesterday, is looking to sell some cash-secured puts on $INTC.

With the way the markets have been moving over the previous couple of months, there have not been any great opportunities to sell cash-secured puts that have provided me with confidence, but with the fact that $INTC is down about 15%, I do believe that this will be an interesting play that provides us with opportunities to trade.

This is obviously not a signal to buy or sell any positions and I cannot guarentee that I am correct on my thesis, but I personally will be looking at selling some slijghtly OTM 0-DTE contracts around open as option prices are going to be grossly mispriced at the time, and continue to hold that play for approximately the first hour or two of the day.

There is obviously risks involved while attempting to do this, and I would only look at the contracts that provide enough premium where it is worth considering these positions.

I will be looking to cover the play as soon as possible and collect as much reasonable premium as I can. This won’t necessarily be sexy, but I would be more than happy collecting 20-30-50% of the premium available on the position and cutting it to limit exposure. Again, not the sexiest play, but here is a play spoon-fed on a silver platter. Again, I cannot guarentee anything, nor promise you that your version of my play will work, but boom. That should be a fun play for the day, and the first CSP shout I’ve made in a while!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $PLTR, $ORCL, $NVDA, $TSLA, $AMD, $INTC

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 01/23/2026 (ET):

Personal Income (delayed report) - 8:30 AM

Personal Spending (delayed report) - 8:30 AM

PCE Index (delayed report) - 8:30 AM

Consumer Sentiment (final) - 10:00 AM

Notable Earnings for 01/23/2026:

Pre-Market Earnings:

SLB (SLB)

Booz Allen Hamilton (BAH)

Ericsson (ERIC)

Comerica (CMA)

Wrap up

Just continue to remain rational while attempting to trade today because those who are irrational, over-leverage, and take on bad plays will have the toughest time, while those who simply sit back, enjoy the markets, and relax get to have the most fun and realize the most gains.

Go into today excited, and do everything you can to realize some gains and end this week strong!

Good luck trading, and wrap this week up!