HaiKhuu Daily Report - 01/27/2026

Good morning, and happy Tuesday! I hope you are all ready for a continuation of confusion and volatility as $SPY is edging closer and closer to testing a new all-time high! Market conditions are strong, traders are confused, and we are preparing to have another amazing time!

We have major economic news and earnings coming out tomorrow, so this will be the “final” day of normality throughout the rest of this week. Go into today with expectations of volatility, opportunity, and momentum.

The markets are looking great at the time of writing this report, and I highly doubt there are going to be any major changes by the time the markets open. We are less than $2 away from making an all-time high, and realistically, with the confidence we all are experiencing, it is hard not to be optimistic going into today.

Go on and make the most out of the momentum that is being provided to us, and continue to remain rational with your allocations today. Do not take on too much risk, but make sure that you are still capitalizing on these conditions with confidence. It will be almost impossible for traders to lose money while attempting to allocate today, but that all comes down to how you allocate, where you allocate, and what you decide to allocate into. But as long as you are rational, I do not see a reason why you cannot make the most of it.

Head into today excited, and prepare to make the most out of some beautiful market conditions.

Let’s realize some gains today and have a great time!

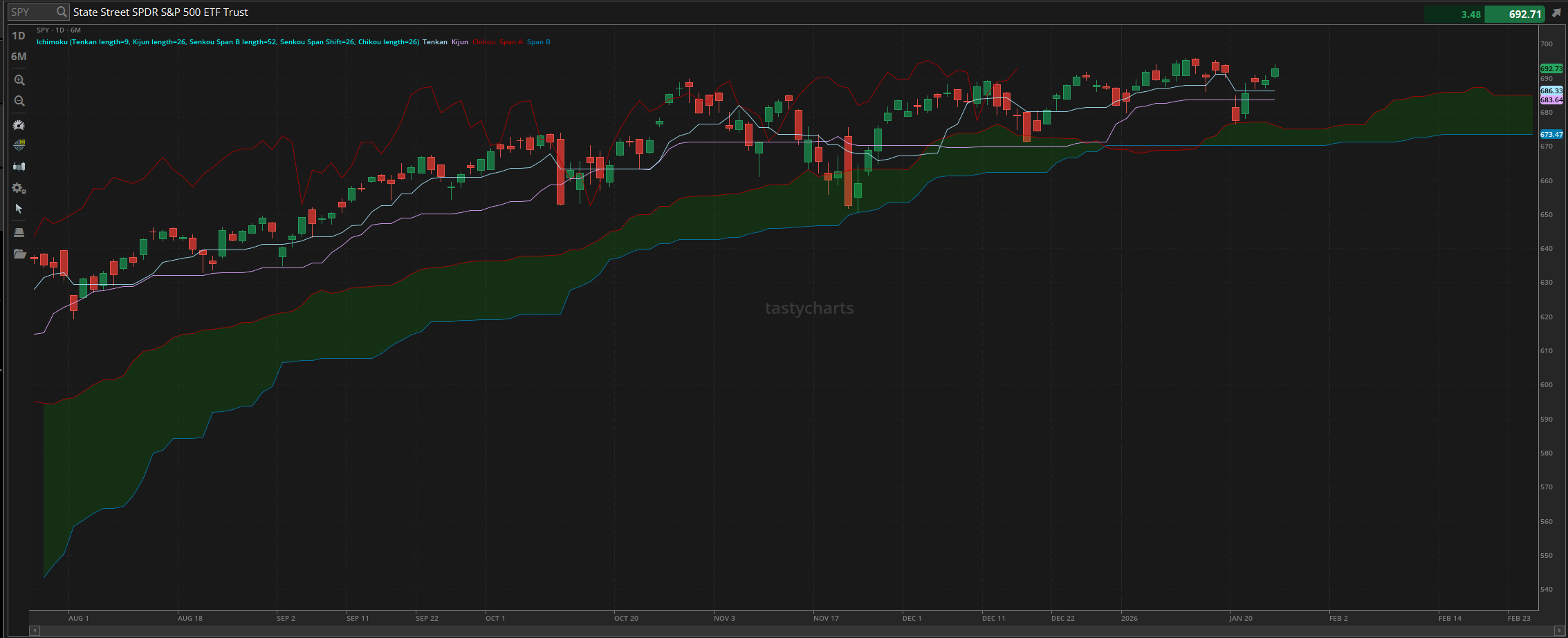

The updated $SPY daily levels are as follows:

Conversion Line Support: $686.33

Baseline Support: $683.64

Psychological Support: $680

Daily Cloud Support: $676.08

Thoughts & Comments from Yesterday - 01/26/2026

Yesterday was a beautiful yet difficult day for the overall markets. Traders should have had almost zero issues realizing a significant amount of gains as $SPY traded towards an all-time high. As long as you continued to hold and maintain your strong equities, you had an amazing day!

We started the day by watching as $SPY moved up during the pre-market session despite showing weakness during the futures open. $SPY started the week trading at $690.52, and honestly, traders could not complain as there was a continuation of bullish momentum from open, which only continued to rally throughout the day. Opportunities were amongst us to trade and allocate, and those who took advantage of the momentum had a great time.

Markets continued to rally through the morning and only started to slow down leading into the lunchtime lull, despite going on and making the official high of the day, trading at $694.13. Everything was beautiful at the top, but the markets did start to display general weakness leading into the end of the trading day. Momentum was slow, and there was mild selling into close.

We officially ended the day with $SPY trading at $692.73, up $3.50 for the day, or up roughly 0.5%. I won’t say that it necessarily was a bad day, because it wasn’t. $SPY traded towards a new all-time high, and traders had constant opportunities to realize a significant amount of gains on an intraday basis. So, I hope you all had a lot of fun and rode the beautiful momentum of yesterday!

S&P 500 Heat Map - 01/26/2026

Thoughts & Comments for Today - 01/27/2026

Today should be an interesting time for the markets. We are treading closer and closer to a new all-time high as traders are becoming more comfortable and confident in these conditions. There is a lot of uncertainty in the markets at the moment, but that does not matter as long as the markets continue to move up.

Please tread lightly if you are attempting to trade today, and take advantage of the momentum that is building as the confidence is coming back extremely quickly in the markets, and we are treading towards a new all-time high.

I am not attempting to be overly bullish or blindly confident in these market conditions, but with the strength that we are seeing across the board right now, I genuinely do believe that comfortable traders who simply follow basic risk management and technical analysis should realize a significant amount of gains today. Obviously, this is all very speculative and optimistic about these market conditions, but genuinely, I do believe that we are going to have some fun going into today.

We have major earnings and economic news coming out tomorrow, so for some, this is going to be kind of the “final hurrah” before the markets experience elevated volatility. We can easily go on and make a new all-time high today, but all that matters is simply following the market momentum. If the markets remain strong, retain your long-term strong positions and make the most out of this momentum.

Those who practice risk management, follow the general market momentum, and actively attempt to scalp or day trade today should be met with some beautiful opportunities to realize some gains.

You won’t hear me say this often, but in the case that markets remain strong, look to trade higher beta stocks to capitalize on these conditions, and it is a perk if they are down heavily over the previous couple of days. If you understand how to trade, a couple of great higher beta organizations that have taken a tumble over the previous couple of days to keep an eye on are: $TSLA, $NVDA, $AMD, $PLTR, and $NVDA.

I am not saying that any of those five organizations are guaranteed to go up today, but realistically, with the way those organizations are priced and are moving, I am expecting to see a larger directional move out of these organizations, prospectively, compared to $SPY. As long as you are confident in both the way the markets are moving and these independent organizations, you should be able to generate significantly more by attempting to trade these companies than if you attempted to trade $SPY or any lower beta play.

Again, just please remember to practice safe risk management. The increased volatility we are seeing at these prices will result in quicker losses being generated in the case that you are wrong, and don’t forget to not let your day trades & scalps become swing trades. This is not a comment on what is going to happen tomorrow, but just remember that we have both FOMC, as well as major market-moving earnings, so things will become more volatile and irrational going into the end of the week.

Just tread lightly today, and make the most out of the strength and confidence we all are experiencing!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 01/27/2026 (ET):

Consumer Confidence - 10:00 AM

Notable Earnings for 01/27/2026:

Pre-Market Earnings:

UnitedHealth Group (UNH)

Boeing (BA)

United Parcel Service (UPS)

General Motors (GM)

Synchrony Financial (SYF)

American Airlines Group (AAL)

NextEra Energy (NEE)

After Market Earnings:

Texas Instruments (TXN)

Seagate Technology (STX)

PPG Industries (PPG)

Logitech International (LOGI)

Nextracker (NXT)

Qorvo (QRVO)

Wrap up

This should be a fun time for the general markets with confidence and momentum on our side. Just please, make sure to tread lightly, practice safe risk management, and do what you can to realize as many gains as possible. Traders are going to have a great time, so enjoy today, and let’s have some fun!

Good luck trading, and let’s see where $SPY takes us today!