HaiKhuu Daily Report - 01/26/2026

Good morning, and happy Monday! I hope you all had a wonderful weekend and are ready for what should be a fun and hectic week for the markets! Things are looking spicy as markets are down slightly at the time of writing this report, displaying general weakness leading into the week. The mild bearish movement we are seeing at the moment is not overly significant, and honestly, the uncertainty created is great for those attempting to scalp and day trade.

Continue to tread lightly on these market conditions, as there is a lot of uncertainty in the markets right now, and there is the beginning of civilian unrest as a result of what happened over the weekend, so tread lightly, as that irrationality may translate into uncertainty in the general markets.

Just continue to follow the general market momentum, remain optimistic about where the markets might take us, and stay solvent in the short term.

Those who know how to capitalize on these conditions and are confident in their abilities should have no issues trading this week. Only those taking on bad trades and overleveraging their portfolios will have the most difficulty in the short term.

Just make sure to prepare accordingly for this week, as this is going to be a HUGE week for earnings, with organizations like $MSFT, $META, and $TSLA coming up on Wednesday, and $AAPL coming on Thursday! On top of that, we have Jerome Powell speaking on Wednesday! So if you’ve not checked out the WEEKLY PREVIEW, check it out to prepare for the week!

Let’s make the most out of this week, and have a great time!

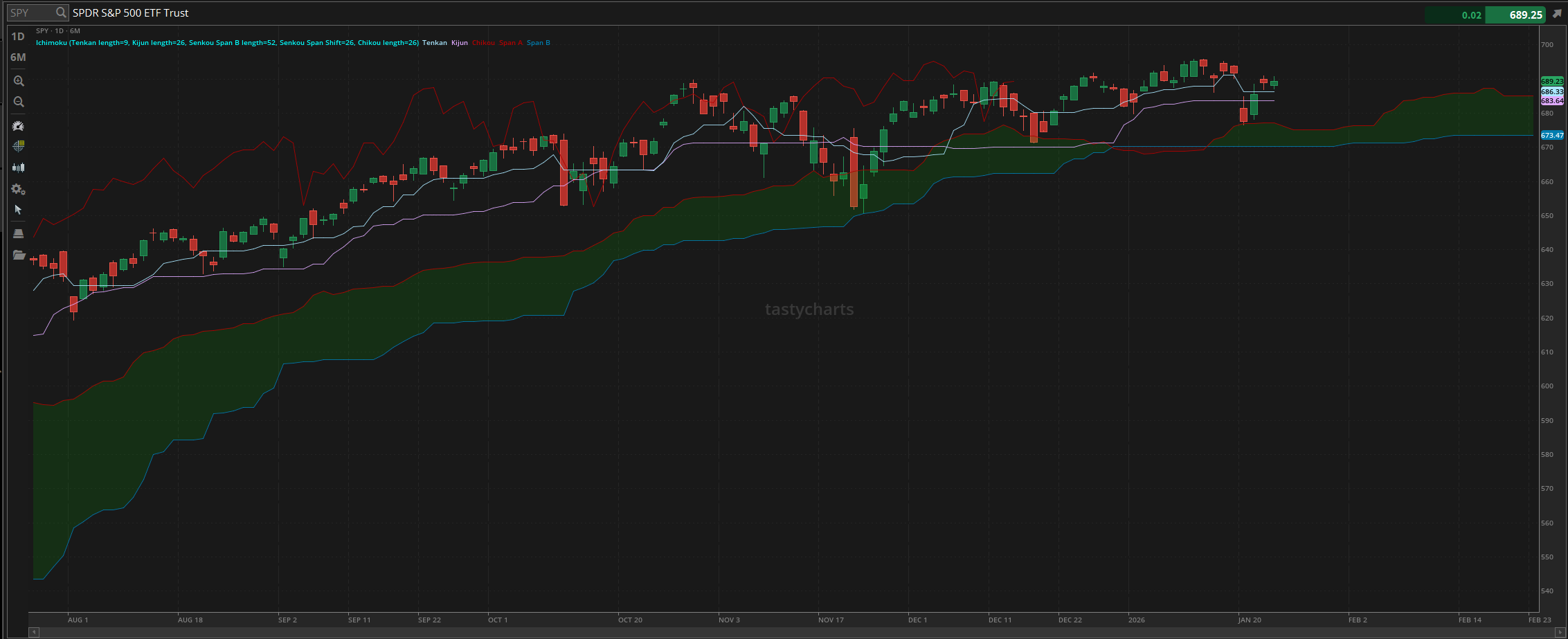

The updated $SPY daily levels are as follows:

Conversion Line Support: $686.33

Baseline Support: $683.64

Psychological Support: $680

Daily Cloud Support: $677.13

Thoughts & Comments from Last Week

Last week was a relatively gross time for the markets, but it provided traders with some absolutely insane opportunities to trade and realize a significant amount of gains regardless of the direction you attempted to trade, assuming you simply followed the general market momentum and took advantage of everything that was presented to you. Life is great, and so were the markets, so i hope you all printed and enjoyed last week!

We started last week with the markets being CLOSED on Monday, and started everything with $SPY gapping down on Tuesday. We started the week with $SPY opening at $681.49, before chopping around and making the official low of the week, trading at $676.57, bouncing off the daily cloud support, scaring many traders in the process. Those who attempted to scalp the dip on Tuesday had an absolutely terrible time, but buying organizations heavily discounted at the bottom was the move.

Markets at least moved up early in the morning on Wednesday and continued to rally as we went on to make the official high of the day trading at $688, coming back into the general range of support levels, bouncing and choppying around, leading into Thursday, where $SPY really did not do much at least on an intraday basis, but the positioning of the markets at least provided us with more confidence. $SPY retained it’s level above the daily conversion line support, despite having a red intraday, remained beautifully green from Wednesday, and then we essentially watched as the markets chopped and remained relatively neutral through Friday.

We ended the week with $SPY trading at $689.25, up about $8 from open on Tuesday, and provided everyone with some beautiful opportunities to trade and realize some gains! Hopefully, you all had a lot of fun and took advantage of the momentum in the markets, and were able to make the most of last week, and I hope you all are excited to see where the markets take us this week!

S&P 500 Heat Map - 01/23/2026

Thoughts & Comments for Today - 01/26/2026

Today is setting up to be another interesting time for the general markets. We are seeing mild weakness coming from the markets at the time of writing this report, but with the confusion and opportunity presented to us, those who are comfortable with their abilities to trade should continue to remain confident.

Before I get into anything, I do have to continue to warn you all about the risks in attempting to allocate in these market conditions.

Market conditions are beautiful at the moment, but there is a significant amount of confusion being generated at the moment, and we are seeing civilian unrest as a result of the Minnesota headlines. This is not going to be a political statement, but just continue to tread lightly as this uncertainty can easily translate into the equity markets, bringing inconsistency, irrational selling, and confusion across the board.

But, for those who understand what happens every time there is uncertainty, you know that there will be a mispricing of assets, and as a result of that, opportunities will be born.

So, if you are attempting to trade today, look for an opportunity to take advantage of this discount that is being presented to us. The short-term weakness we will experience will be exactly that, short-term weakness. Find where there are opportunities to take advantage of the momentum, allocate where you have confidence, and trade with comfort. There will be discounts presented to us, and now it is just a matter of realizing gains from those opportunities.

Many will have difficulties attempting to trade, but as long as you understand the timeframe and gameplan of every position you attempt to enter, then you will be in a great spot. This is why I always warn people against blindly following anyone, myself included, into any position. It is one thing if a fisherman helps you fish; it’s another if you are sitting there waiting for a fisherman to hand you fish daily, and praying that one of these times the fisherman doesn’t accidentally poison you. I do not know about you, but if I die, I am going out with my own dumb decisions, not because I blindly followed someone else into theirs.

One play that I want you all to keep your eyes out for is $INTC. I am not saying that $INTC is a buy, and I am specifically saying that $INTC is not a blind purchase today, but look for an opportunity to purchase $INTC in the near future. With the bearish momentum we are seeing in the organization right now, I do believe we will see a beautiful buy-the-dip opportunity. I do not believe that this bearish momentum is over yet, and I do believe that $INTC at the current evaluation is heavily overpriced. But under the assumption that they continue to come back down to “Fair value,” then I would look to take advantage of that opportunity. High 20’s is where I personally want $INTC to go ($27-29), but realistically, I do believe that $INTC will at least break back into the high 30’s range before starting to bounce back up.

Just make sure you all are practicing safe risk management in these conditions, though, and many traders are going to have a difficult time as a result of this general market weakness and confusion.

Do not get swept up in the literal politics going on right now, and have an amazing time. Much love, and let’s see what this week has in store for us!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $PLTR, $ORCL, $NVDA, $TSLA, $AMD, $INTC

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 01/26/2026 (ET):

Durable-goods orders (delayed report) - 8:30 AM

Notable Earnings for 01/26/2026:

Pre-Market Earnings:

Steel Dynamics (STLD)

Baker Hughes (BKR)

Bank of Marin Bancorp (BMRC)

Bank of Hawaii (BOH)

HBT Financial (HBT)

Lakeland Financial (LKFN)

After Market Earnings:

Brown & Brown (BRO)

Nucor (NUE)

W.R Berkley (WRB)

Sanmina Corporation (SANM)

Western Alliance (WAL)

Alexandria Real Estate (ARE)

Wrap up

This is going to be a hectic week with earnings and economic news. I hope you all are excited to see where the markets take us from this point, and I hope you all are ready for what should be a beautiful time. Please make sure that you are practicing safe risk management, and do everything in your power to have a great time. Do not fight any trends, realize some gains, and have an amazing time!

Good luck trading, and let’s see where $SPY takes us this week!