HaiKhuu Daily Report - 02/11/2026

Good morning and happy Wednesday! Wow, this has been an interesting morning already, but the day and this report have just started. Doing a quick search, I am seeing a lot of volatility in the markets at the moment, with Solana and Cryptos dropping heavily, but watching as precious metals are ripping in price, all while $SPY is extremely neutral.

Silver is up roughly 5.5% at the time of writing this report, and I think that I may have timed out my silver long almost perfectly at the bottom. Congrats to anyone who went long silver with me at the bottom, as we got extremely lucky with our entry and timing.

But hey, this is going to be an interesting time for the overall markets, and hopefully, conditions only continue to strengthen from here. Yesterday was a tough time leading into close, but the markets are still looking alright, but are showing the initial signs of weakness at the moment. I am not necessarily saying that the markets are going to crash, but I will say that conditions don’t look the best, and overly optimistic going into open.

Make sure to tread lightly while attempting to trade today because there is a high likelihood of a directional move in the markets. We can easily break out or sell off, so make sure to follow the momentum in the markets and tread extremely lightly. This will be a lot of fun, so just make the most out of these conditions, and let’s have an amazing time!

The updated $SPY daily levels are as follows:

Previous All-Time High: $697.84

Psychological Support: $680

Daily Cloud Support: $676.16

Thoughts & Comments from Yesterday - 02/10/2026

Yesterday was an absolutely insane time for the markets with volatility, confusion, and many opportunities to realize a significant amount of gains. I hope you all had a wonderful time despite the confusing general market momentum and were able to realize a significant amount of gains in the process. Traders were consistently presented with opportunities to trade in either direction, and everyone had opportunities presented, so I hope you all survived and were able to make the most out of yesterday!

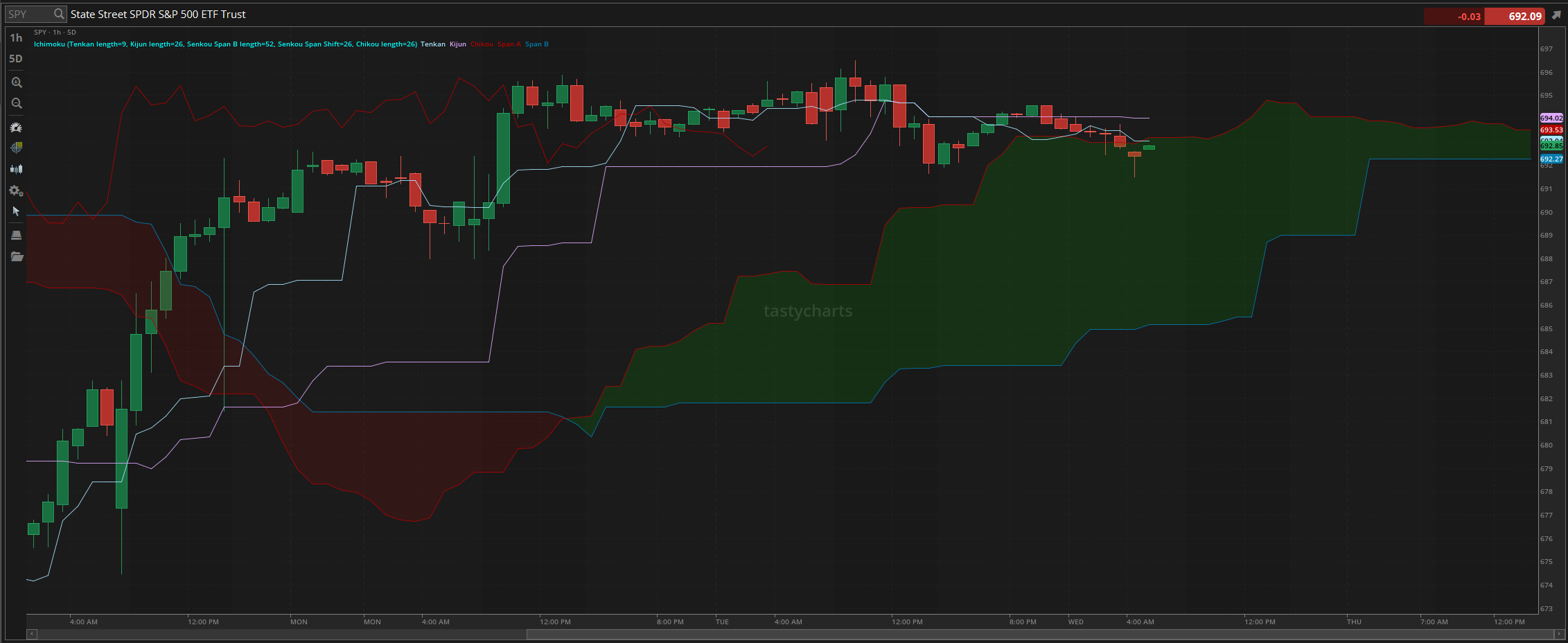

We started the day with $SPY looking alright, opening the day at $694.92, market conditions were alright as $SPY was slightly green, but watched as $SPY quickly sold off after open, officially going black for the day within the first half hour. Conditions were sketchy towards the bottom, but I watched as $SPY broke out beautifully and went on to make the official high of the day, trading at $696.54, about a dollar shy of the previous all-time high. We hovered testing tha t high for about an hour or so, before watching as the markets sold off leading into the lunchtime lull, only to continue to sell off and fall in the afternoon.

$SPY went and sold off around 1 pm EST, where $SPY officially went red again for the day, and watched as we only continued to sell off leading into close, where the markets dropped once again leading into close, where we officially made the low of the day in the final candle, trading at $691.66, before the markets officially ended the day with $SPY trading at $692.12, down approximately $2 for the day, or down roughly 0.25% overall.

I am not going to say that yesterday was a great day for the markets, as it wasn’t. There weren’t overly bullish market conditions that provided us with opportunities to blindly be bullish, but there were consistent opportunities to trade and realize some gains in a short period of time. I hope you all were able to ride the momentum and make the most out of the strength that was present in the markets yesterday, and had some bearish allocations that helped you capitalize on the weakness that was provided.

If you didn’t end up generating a significant amount of gains as a result of the conditions yesterday, that is not necessarily the worst thing in the world, but just make sure to do everything in your power at this point to realize some gains today, and make the most out of these volatile conditions!

S&P 500 Heat Map - 02/10/2026

Thoughts & Comments for Today - 02/11/2026

Today is going to be a relatively more difficult day for the markets. I am not trying to say this to discourage anyone, but it is just one of the realities of these current market conditions. With the way that everything is trending right now, it is almost hard not to be optimistic, yet extremely skeptical. The markets are chopping around heavily during the pre-market session, and we are seeing continued weakness coming out of the cryptocurrency markets. This is not necessarily a bad thing, as it will give us opportunities to allocate, but that weakness never brings confidence.

Please go into today with your fists up and prepare for another battle.

I genuinely believe that with the volatility in the markets, we are going to continue to see the markets experience irrationality and inconsistency. Many traders will have a difficult time while attempting to trade, while others are going to have some smooth sailing depending on how they are allocated in the markets.

The biggest thing that I will have to warn you about is not fight any trends. As I said before, I am expecting irrationality and inconsistencies in the markets. There is a high likelihood that the markets break out on mild confidence, and there is a high likelihood that the markets sell off with some mild weakness. So please, attempt to follow the general market momentum, and do not try to fight trends today.

I do believe that single names are going to be the best place to attempt to allocate today, mostly with the way the markets are setting up. If you are attempting to go long, then look to allocate accordingly towards some of these higher beta tech organizations that have sold off heavily, and if you are attempting to short the markets, look to short some of these major tech organizations that are heavily overpriced. General market momentum will be “easier” to navigate here in the short term, but those who are able to nail these single organizations and their trends are going to do great.

If you are looking for a couple of organizations, as always, I have my watch list below of the organizations I will be watching, but you should also check out some of these names:

Speculative Higher Beta: $RIVN, $UNH, $MSTR, $INTC, $AMD, $TSLA, $ORCL

Again, I am not saying that any of those organizations are going to move up or down today, nor am i promising any direction from any of those companies, but those are all organizations with relatively higher beta, where assuming that things work in your favor, should provide you with significantly more realized gains than attempting to scalp and day trade the markets.

Just please, make sure to practice safe risk management today because traders will consistently realize losses if they fight trends, or simply do not time their positions properly. Be smart, be safe, and have some fun while attempting to trade today!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 02/11/2026 (ET):

Consumer Price Index - 8:30 AM

Core CPI - 8:30 AM

Monthly U.S. Federal Budget - 2:00 PM

Notable Earnings for 02/11/2026:

Pre-Market Earnings:

Vertiv Holdings (VRT)

Shopify (SHOP)

Humana (HUM)

Unity (U)

Kraft Heinz Company (KCH)

T-Mobile US (TMUS)

McDonald’s (MCD)

Hilton Worldwide Holdings (HLT)

After Market Earnings:

AppLovin (APP)

Albemarien(ALB)

Cisco Systems (CISCO)

MGM Resorts (MGM)

Ameren (AEE)

Manulife Financial (MFC)

Motorola Solutions (MSI)

Wrap up

Prepare accordingly for a volatile and confusing time for the markets. Opportunities are going to be consistently presented to us, but the real question is where the markets take us. Are we going to break out? Are we going to sell off? Are we going to have an insane day? Who knows. All I know is that this is going to be an exceptionally volatile time, so make the most out of these conditions, have some fun, and realize some gains today!

Good luck trading, and let’s print today!