HaiKhuu Daily Report - 02/12/2026

Good morning and happy Thursday! Man, this week has been FLYING by with the insane volatility we are seeing in these market conditions! Markets are up slightly at the time of writing this report, and honestly, conditions look alright going into open! We are seeing neutrality coming from the Fear and Greed index, which is a great sign that traders are not overly optimistic despite the fact that we are less than 0.5% away from making a new all-time high.

I am not saying we are going to make a new all-time high today, nor am I attempting to tell you that I am going to be hyper bullish, but with the way the markets have continued to look, it would not surprise me to see another day full of neutrality, but at the same time, it would not surprise me if we went on and saw a directional move.

If there is a directional move, I am more bullish and optimistic than bearish and pessimistic, but just know that, in reality, we are at risk of a possible sell-off from the top, and that you should all tread extremely lightly. I do believe the reality of a selling event is low leading into today, but anything can genuinely happen, so tread lightly today and make sure to practice safe risk management.

This will be a fun day, so make the most of it!

The updated $SPY daily levels are as follows:

Previous All-Time High: $697.84

Psychological Support: $680

Daily Cloud Support: $676.16

Thoughts & Comments from Yesterday - 02/11/2026

Yesterday was a kind of gross day for the overall markets. Conditions remained extremely neutral for $SPY, but we watched as there was volatility and momentum in single-name stocks. Hopefully you listened to our recommendations and absolutely killed it yesterday!

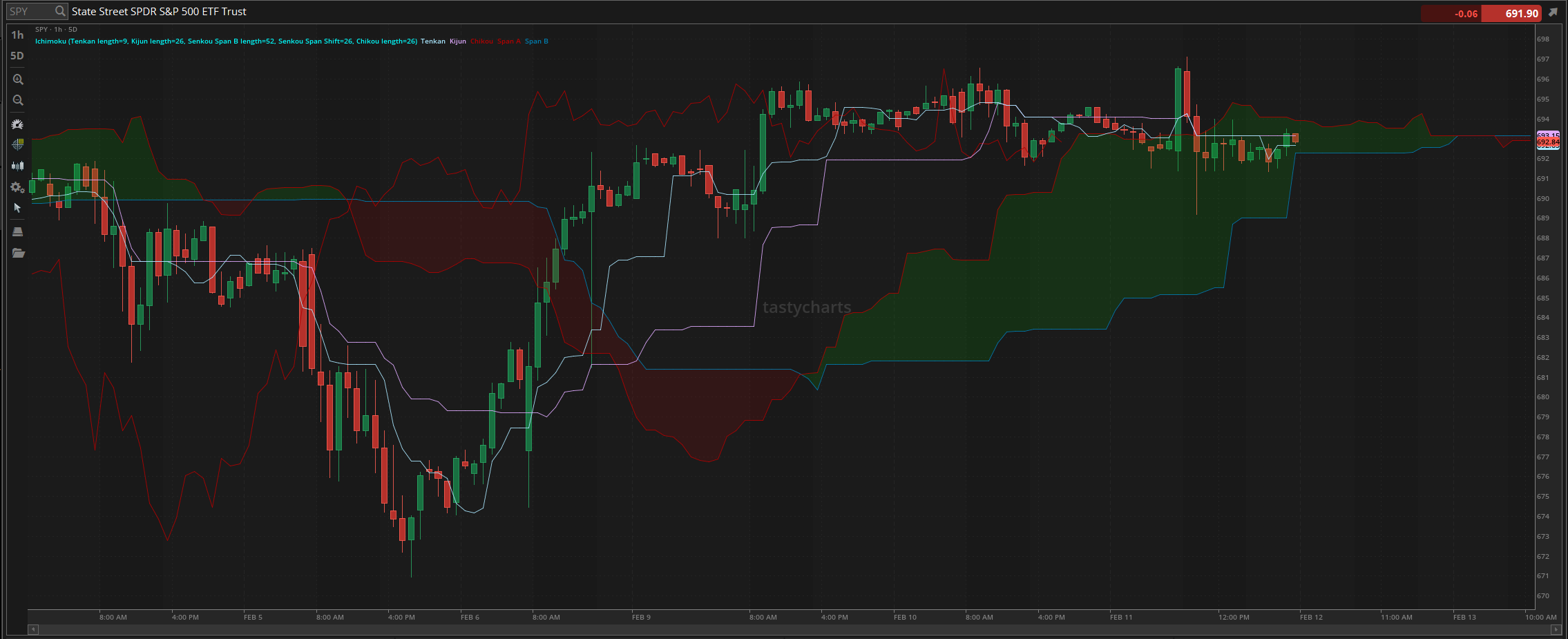

We started the day with $SPY honestly looking alright, moving up beautifully during the pre-market session on economic data. $SPY opened the day trading at $696.47, and watched as we made the official high early in the morning, trading at $689.18, and then watched as $SPY continued to drop throughout the morning.

Conditions at the top were nice, but it was short-lived as $SPY quickly sold off and went on to make the official low of the day, trading at $689.18 within the first hour of the day, and then watched as $SPY recovered, and remained relatively neutral trading around $692 from betweem the beginning of the lunchtime lull and close. As bad as it sounds, that is how neutral the back half of the afternoon was, but that is again just part of the markets and the volatility that we get to experience.

We officially ended the day with $SPY trading at $691.96, down $0.16 for the day, or down 0.0023% overall. The slow momentum made trading extremely tough and inconsistent in the back half of the day, and I hope that you listened to our warnings yesterday and dodged accordingly. It will be fun to see where the markets take us today!

S&P 500 Heat Map - 02/11/2026

Thoughts & Comments for Today - 02/12/2026

Today is going to be another hectic and exciting day for the markets that provide us with opportunities to trade and realize some gains. The real question is, are you going to be able to remain consistent during this time? Many traders are going to find difficulties in these market conditions due to the inconsistencies of the markets and the irrationality that we are seeing. This is not necessarily a bad thing, but at the same time, any time losses are generated, it is a bad time. So please, if you are attempting to trade today, understand what you are getting yourself into, and what you can do to prepare accordingly to allocate.

As I said before, we are neutral on the fear and greed index, which is not a bad sign, and honestly allows us to have more bullish confidence going into today. In the case that the markets want to break out, traders' sentiment says that we can easily continue much higher, and watch as $SPY breaks above the previous all-time high, and $700. Obviously, this is an extremely optimistic sentiment, and as I warned before, I am expecting a directional move today. We can very easily come down, but that is not going to be ideal, so tread lightly, but be optimistic leading into today.

Just make sure that you are practicing risk management leading into today. One of the fears that I have leading into today is not the fear of us selling off, but the fear that we will continue to see neutrality. In the case there is neutrality in the markets, my same advice stands, where I do not recommend that the large majority of you attempt to scalp and trade in the short term, nor attempt to allocate into any 0-DTE or new expiration option contracts, as you will watch as theta or chop just slowly steal your money.

One of the recommendations I have today will be the same as yesterday, where I highly recommend that the large majority of you look to trade volatile single names. Look for the trend in single-name organizations, and allocate accordingly. I believe that traders genuinely are going to have an easier time attempting to catch a trend on a higher beta tech organization. They will move up more directionally in the case of a breakout, and they will provide a lot more consistent realized gains throughout the day.

If you are able to catch an organization that is trending or is undervalued, you will be able to capitalize on the conditions with relative ease.

I have brought up a couple of single-name organizations I am interested in over the previous couple of trading days, but two to make sure you keep your eyes on here in the short term are $MSTR and $ORCL. I am not allocated into $MSTR, but I do have a position in $ORCL, so I will be biased when I say this, but I genuinely believe that both organizations have an insane runway that they can use and take advantage of.

Again, this is not a signal or endorsement to buy either of these organizations. I am not a financial advisor, and this should not be considered financial advice, but I do believe both have a high likelihood of moving up in the short term, and these organizations are higher beta, resulting in significantly larger movements in the case of a general breakout. $ORCL will move heavily with tech, and $MSTR will move heavily with BTC. So if you are bullish on BTC or the Saylor pyramid scheme, this is not the worst opportunity, and just keep your eyes on Larry Ellison, as $ORCL can very easily break out again from this point.

Just protect your bottom line today, and do everything in your power to realize a significant amount of gains and have an amazing time!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 02/12/2026 (ET):

Initial Jobless Claims - 8:30 AM

Existing Home Sales - 10:00 AM

Notable Earnings for 02/12/2026:

Pre-Market Earnings:

Brookfield Corporation (BN)

Howmet Aerospace (HWM)

PG&E (PCG)

American Electric Power (AEP)

Anheuser-Busch InBev (BUD)

Fortis (FTS)

Exelon (EXC)

After Market Earnings:

Coinbase Global (COIN)

Pinterest (PINS)

Arista Networks (ANET)

Rivian Automotive (RIVN)

Applied Materials (AMAT)

Agnico-Eagle Lines (AEM)

Wynn Resorts (WYNN)

Wrap up

Just tread lightly on these market conditions and be wary of the general market volume and volatility. Some traders are going to have continued difficulties as a result of this ongoing market momentum. Please just tread lightly, practice risk management, and continue to have an amazing time!

Good luck trading, and let’s kill it today!